South Carolina Disclaimer of Inheritance Rights for Stepchildren

Description

How to fill out Disclaimer Of Inheritance Rights For Stepchildren?

Have you been in the place the place you need to have paperwork for either company or person reasons nearly every working day? There are a lot of authorized file web templates accessible on the Internet, but finding ones you can rely isn`t straightforward. US Legal Forms provides a large number of form web templates, much like the South Carolina Disclaimer of Inheritance Rights for Stepchildren, which can be published in order to meet state and federal requirements.

When you are already knowledgeable about US Legal Forms internet site and have a merchant account, merely log in. After that, you can acquire the South Carolina Disclaimer of Inheritance Rights for Stepchildren design.

If you do not provide an accounts and would like to begin using US Legal Forms, adopt these measures:

- Find the form you want and make sure it is for your correct area/area.

- Make use of the Preview option to examine the form.

- Browse the explanation to actually have chosen the correct form.

- If the form isn`t what you`re searching for, utilize the Look for discipline to obtain the form that meets your requirements and requirements.

- Once you find the correct form, simply click Purchase now.

- Opt for the prices prepare you want, fill out the specified info to create your money, and buy the transaction using your PayPal or Visa or Mastercard.

- Pick a convenient file file format and acquire your copy.

Discover every one of the file web templates you have bought in the My Forms menus. You can get a more copy of South Carolina Disclaimer of Inheritance Rights for Stepchildren at any time, if required. Just click on the necessary form to acquire or printing the file design.

Use US Legal Forms, the most considerable collection of authorized forms, to save some time and prevent faults. The services provides professionally produced authorized file web templates that can be used for a range of reasons. Generate a merchant account on US Legal Forms and start generating your lifestyle easier.

Form popularity

FAQ

The spousal elective share statute in South Carolina provides that the surviving spouse has the right to claim one-third of the estate even it they are completely disinherited in the decedent's last will and testament. Often, due to unhappy circumstances, someone will want to completely disinherit their spouse.

If you leave a spouse and no children, your spouse takes all. If you leave no spouse, but children, then your children take your property. Generally, if a child of yours does not survive you their children take the share your child would have taken if they had survived you.

Often, due to unhappy circumstances, someone will want to completely disinherit their spouse. While you can disinherit your children, in South Carolina you cannot completely disinherit your spouse. This is to protect the surviving spouse from being left destitute and a burden on the state.

If you have a spouse and no children, your spouse will inherit your entire estate. If you have a spouse and children, your spouse gets half and the remaining estate is split equally amongst the children. If you have no spouse or children, your parents would receive your estate.

While many people assume surviving spouses automatically inherit everything, this is not the case in California. If your deceased spouse dies with a will, their share of community property and their separate property will be distributed ing to the terms of that will, with some exceptions.

SECTION 62-2-101. Intestate estate. Any part of the estate of a decedent not effectively disposed of by his will passes to his heirs as prescribed in the following sections of this Code.

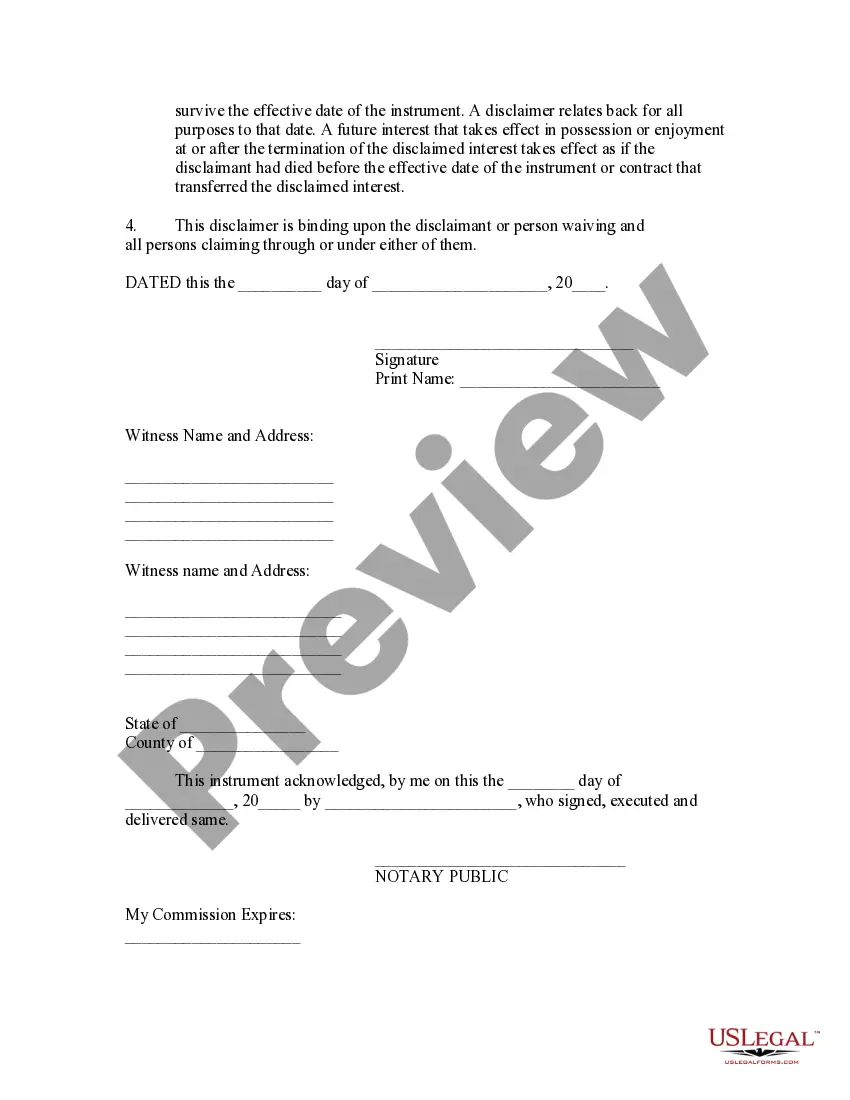

The disclaimer must be in writing and include a description of the interest, a declaration of intent to disclaim all or a defined portion of the interest, and be signed by the disclaimant (S.C. Code Ann. 62-2-801 (c) (3)).

Your assets, by law, will pass to your family even if you don't have a Will. However, writing a Will usually makes the probate process easier and less expensive for your family. Will or no Will, most estates will need to be administered through the South Carolina Probate Court.