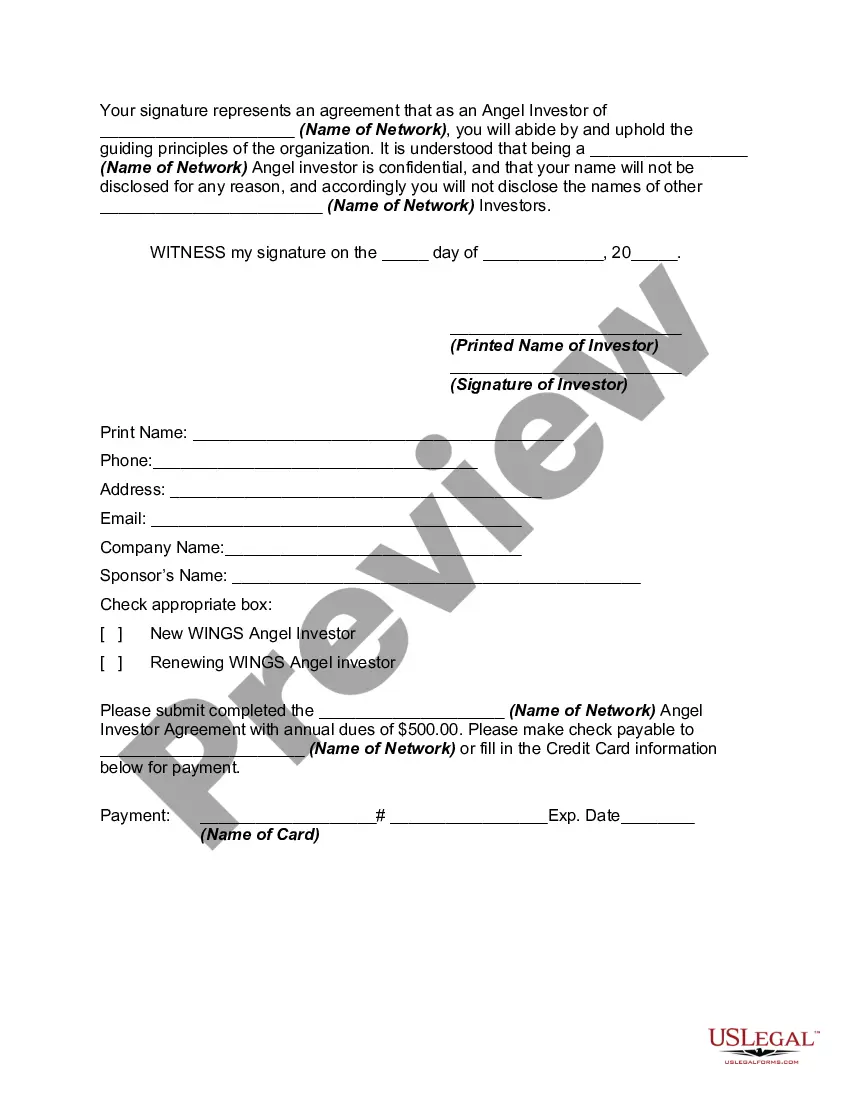

South Carolina Angel Investor Agreement is a legal document that outlines the terms and conditions agreed upon by an angel investor and a startup seeking funding in South Carolina. This agreement serves to protect the interests and rights of both parties involved in the investment process and provides a framework for their collaboration. The South Carolina Angel Investor Agreement typically includes the following key elements and relevant keywords: 1. Definitions and Parties: The agreement starts with a section defining the terms used throughout the document, such as "Investor" (referring to the angel investor), "Company" (referring to the startup), and any other relevant parties or terms. 2. Investment Details: This section outlines the specific details of the investment itself, including the amount of funding the investor is providing and the equity stake or ownership percentage they will receive in return. Keywords: investment, funding, equity stake. 3. Representations and Warranties: Both the investor and the startup make certain statements and guarantees about themselves, their businesses, and the investment process. This section covers various aspects such as legal compliance, intellectual property ownership, financial status, and non-disclosure agreements. Keywords: representations, warranties, legal compliance, intellectual property. 4. Rights and Obligations: This part details the rights and obligations of each party in the agreement. It may cover the investor's right to information, voting rights, board representation, liquidity preference, and exit strategies. The startup's obligations could include financial reporting, maintaining insurance, and adherence to agreed-upon business plans. Keywords: rights, obligations, information rights, voting rights, liquidity preference. 5. Confidentiality and Non-Disclosure: Here, the parties agree to keep confidential information shared during the investment process confidential, protecting trade secrets and sensitive data. Keywords: confidentiality, non-disclosure, trade secrets. 6. Termination and Default: This section outlines the circumstances that could lead to the termination or default of the agreement, including breaches of contract, insolvency, or material misrepresentations. Keywords: termination, default, breaches of contract. 7. Governing Law and Dispute Resolution: This part establishes the jurisdiction, typically South Carolina law, under which the agreement will be interpreted, and outlines the preferred method of dispute resolution, such as arbitration or mediation. Keywords: governing law, dispute resolution, arbitration, mediation. Different types or variations of South Carolina Angel Investor Agreements may exist depending on individual preferences, specific industry considerations, or unique circumstances. Examples of these variations include convertible note agreements, equity purchase agreements, or revenue-based financing agreements. These types determine the structure of the investment and the conditions under which it converts into equity or is repaid.

South Carolina Angel Investor Agreement

Description

How to fill out South Carolina Angel Investor Agreement?

Choosing the right lawful file format can be a have difficulties. Of course, there are tons of templates accessible on the Internet, but how do you find the lawful kind you want? Use the US Legal Forms web site. The assistance gives thousands of templates, for example the South Carolina Angel Investor Agreement, that can be used for company and personal requirements. All the varieties are inspected by specialists and meet state and federal demands.

In case you are previously authorized, log in to your profile and click on the Download button to get the South Carolina Angel Investor Agreement. Utilize your profile to appear throughout the lawful varieties you might have ordered formerly. Check out the My Forms tab of your own profile and acquire an additional duplicate of the file you want.

In case you are a brand new user of US Legal Forms, allow me to share basic recommendations so that you can follow:

- Initially, make sure you have chosen the right kind for your area/area. You can look over the form utilizing the Preview button and study the form outline to make certain it is the best for you.

- If the kind is not going to meet your needs, make use of the Seach industry to obtain the proper kind.

- Once you are certain that the form is acceptable, go through the Get now button to get the kind.

- Choose the costs program you want and enter the essential info. Make your profile and pay money for the order utilizing your PayPal profile or Visa or Mastercard.

- Choose the document structure and down load the lawful file format to your gadget.

- Complete, edit and print and sign the acquired South Carolina Angel Investor Agreement.

US Legal Forms may be the largest library of lawful varieties that you will find a variety of file templates. Use the company to down load skillfully-manufactured documents that follow express demands.

Form popularity

FAQ

Someone qualifies as an angel investor when they invest their personal funds directly into early-stage companies and startups. It's not just the financial aspect; having a background in business or entrepreneurship also plays a significant role. A South Carolina Angel Investor Agreement can provide clarity on the investment process and help define your rights and responsibilities, ensuring a smooth partnership with the entrepreneurs you choose to support.

Requirements for being an angel investor often include having sufficient financial resources and a keen interest in supporting startups. In South Carolina, an angel investor often needs to provide expertise along with capital to help a new business grow. The South Carolina Angel Investor Agreement can simplify this process, guiding you through necessary legal frameworks to protect your investment.

To qualify as an angel investor, you typically need to meet certain financial criteria, such as having a net worth over $1 million, excluding your primary residence. You may also need to demonstrate significant income, generally exceeding $200,000 annually. With a South Carolina Angel Investor Agreement, you can formalize investments while ensuring compliance with state regulations, making your status as an investor legitimate.

Most angel investors have a net worth of at least $1 million, excluding their primary residence. This financial cushion helps ensure they can absorb potential losses and invest with confidence. By utilizing a South Carolina Angel Investor Agreement, you can clearly outline your investment terms and negotiate accordingly in your financial engagements.

You typically need at least $25,000 to make a significant impact as an angel investor. However, the exact amount can depend on the business and investment opportunity. A South Carolina Angel Investor Agreement can guide you in assessing how much capital you should allocate for a particular investment.

The minimum investment amount for angel investors often starts around $10,000, but many opt for higher amounts to diversify their portfolios. While the minimum might vary based on the specific deal or investor group, using a South Carolina Angel Investor Agreement can streamline your investment process and make your contributions more effective.

Finding an angel investor can be challenging, especially if you do not have a strong business plan or network. Building relationships and showcasing the potential of your business are essential steps to attract these investors. Utilizing a South Carolina Angel Investor Agreement can help clarify your proposal and improve your chances of securing funding.

The amount of capital needed to be an angel investor varies widely, usually ranging from $25,000 to $100,000 for an initial investment. However, your total commitment can be higher, depending on your investment strategy. Engaging with a South Carolina Angel Investor Agreement allows you to make informed investments while managing your risks.

To qualify as an angel investor, you typically need to meet certain income thresholds. In general, the income requirement is at least $200,000 for the last two years, or $300,000 when combined with a spouse. This ensures you have the financial stability to participate in investment opportunities, such as those involving a South Carolina Angel Investor Agreement.

In most cases, you do not need a specific license to be an angel investor, although regulations can vary by state. It is important to understand the legal implications of your investments and ensure compliance with local laws. Utilizing a South Carolina Angel Investor Agreement can help clarify roles and responsibilities for both investors and entrepreneurs. Consulting resources from platforms like uslegalforms can guide you in navigating these requirements.