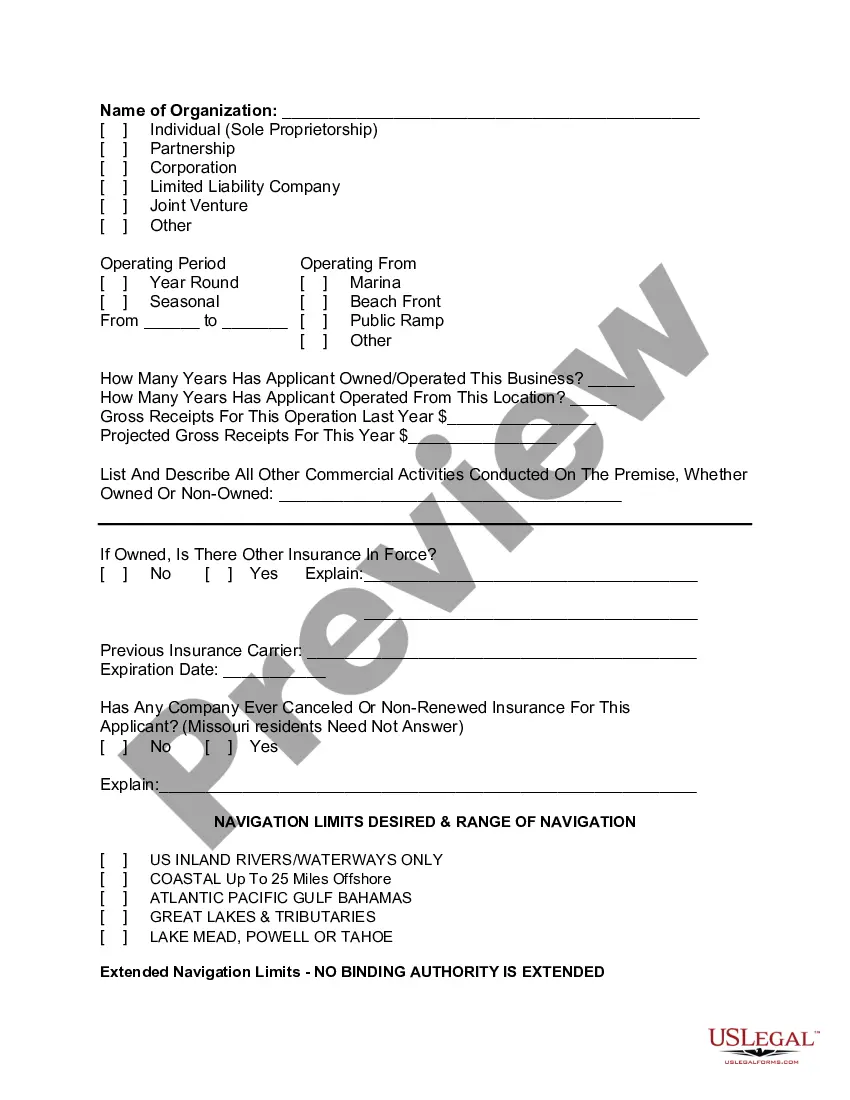

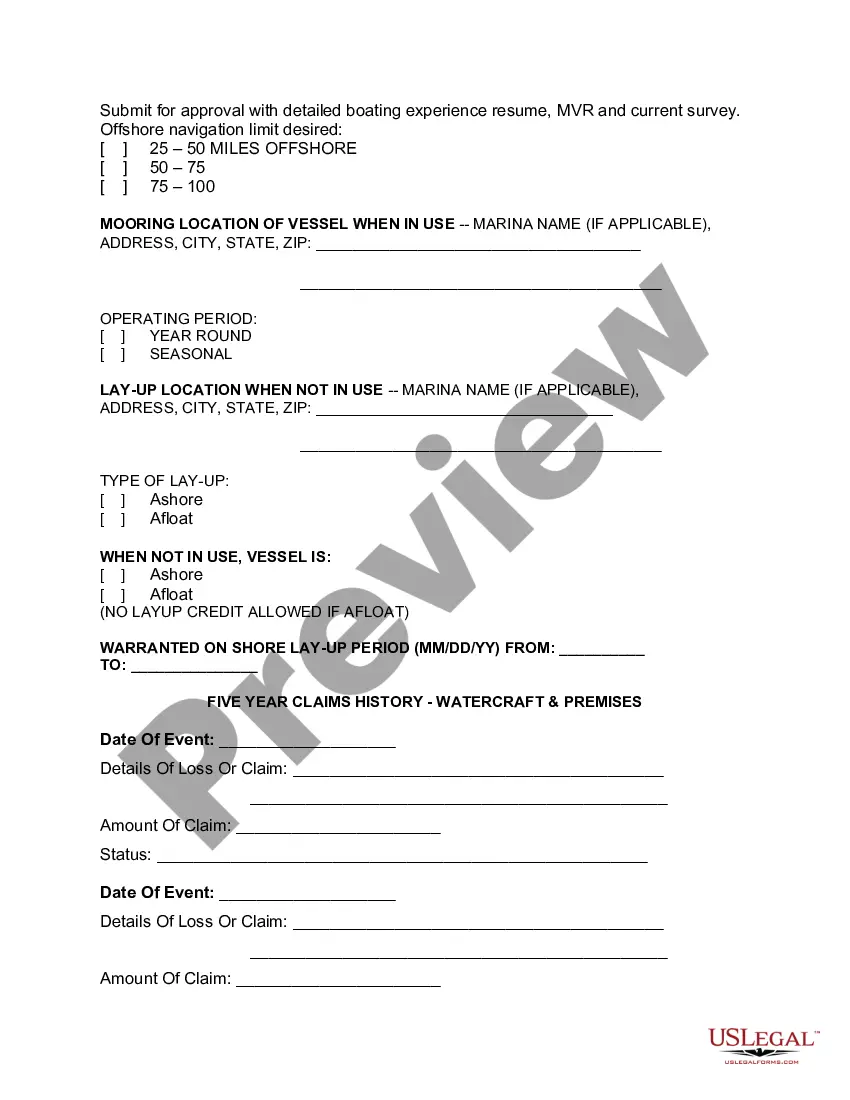

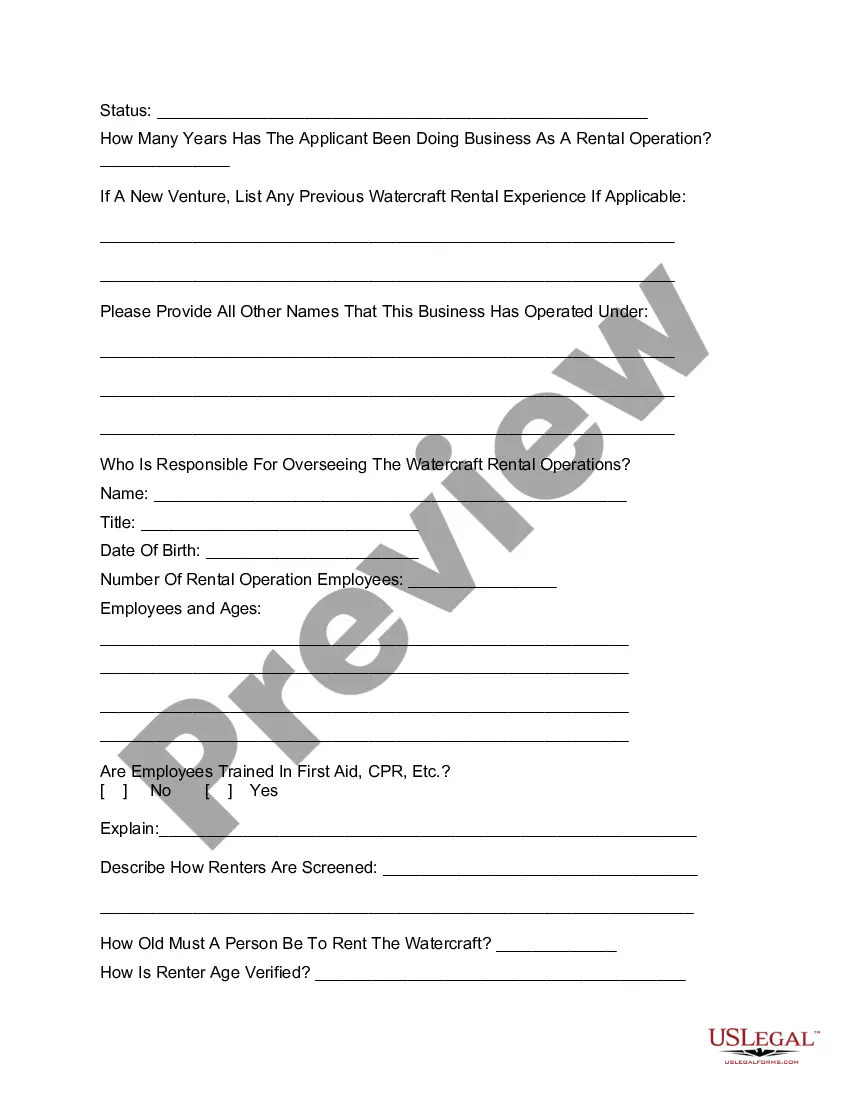

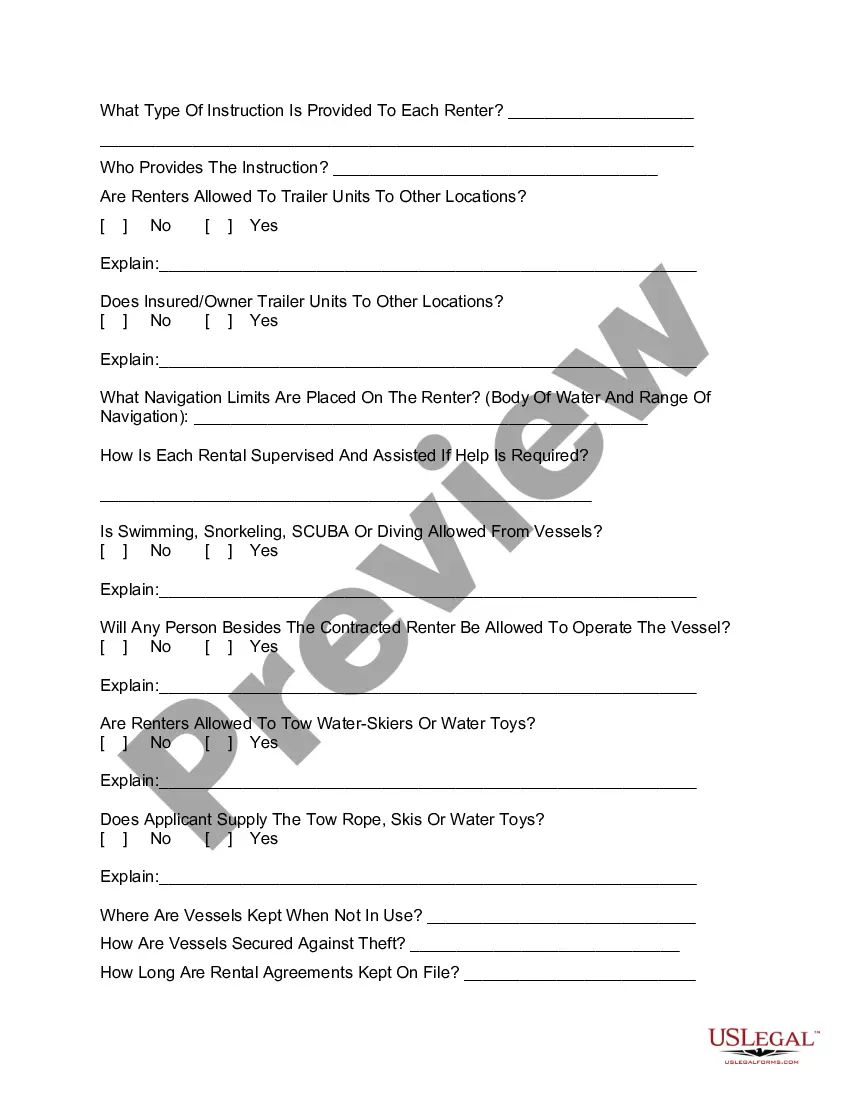

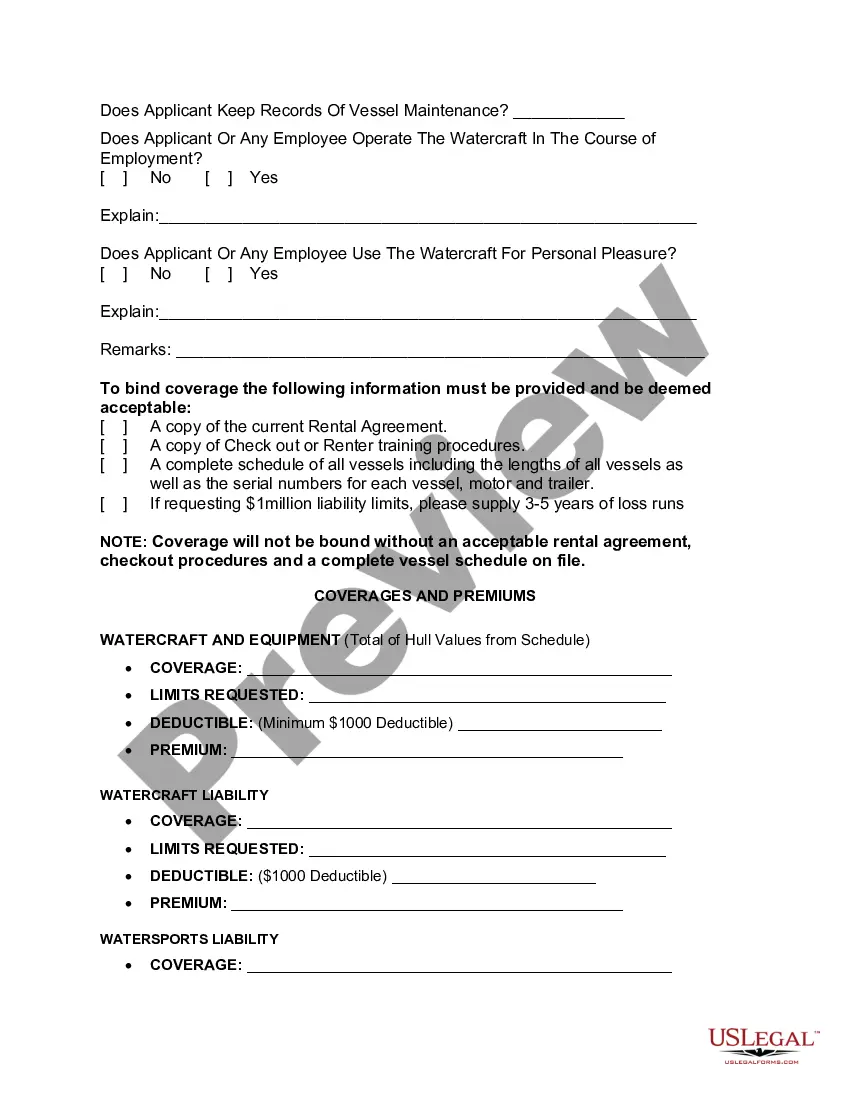

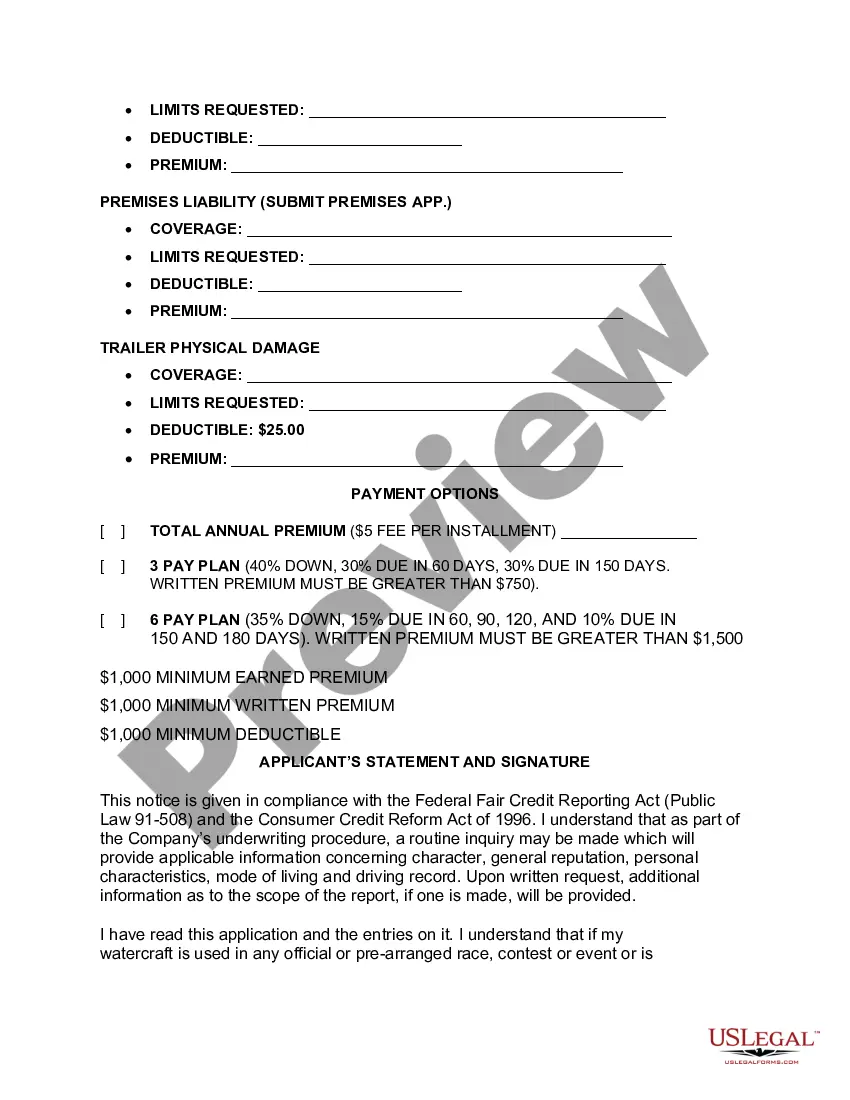

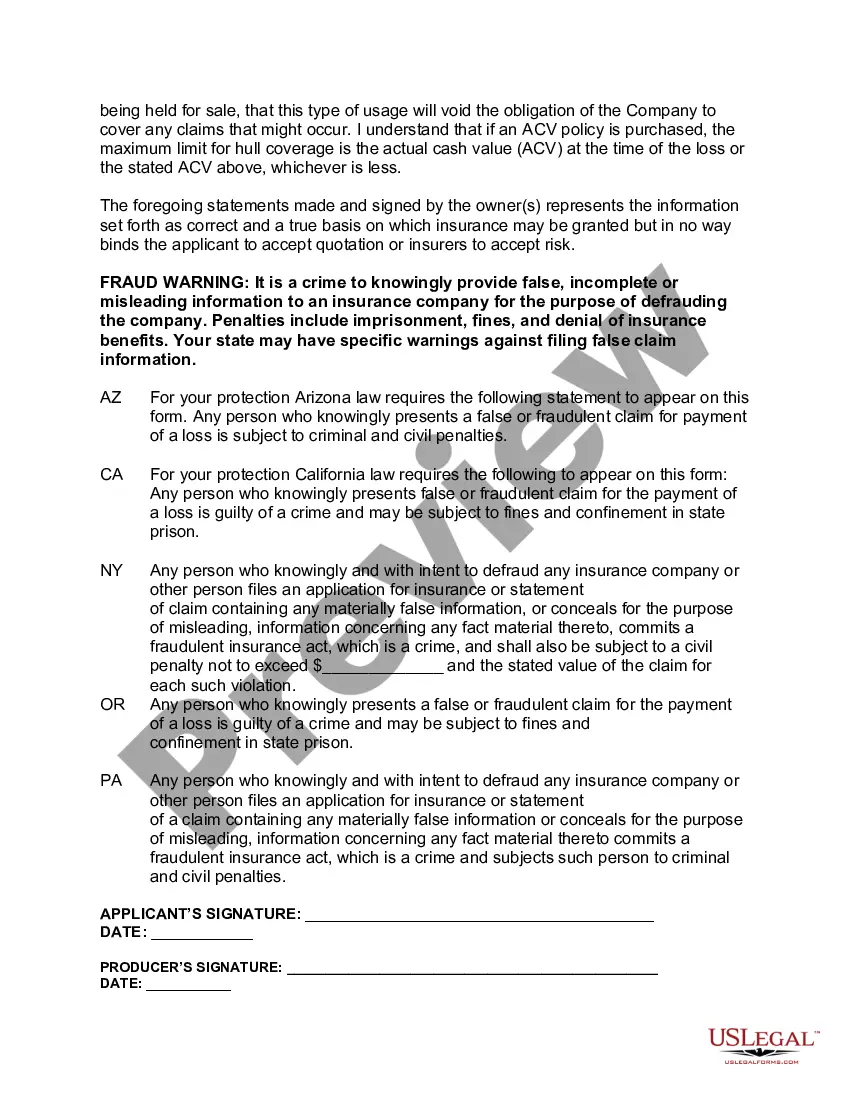

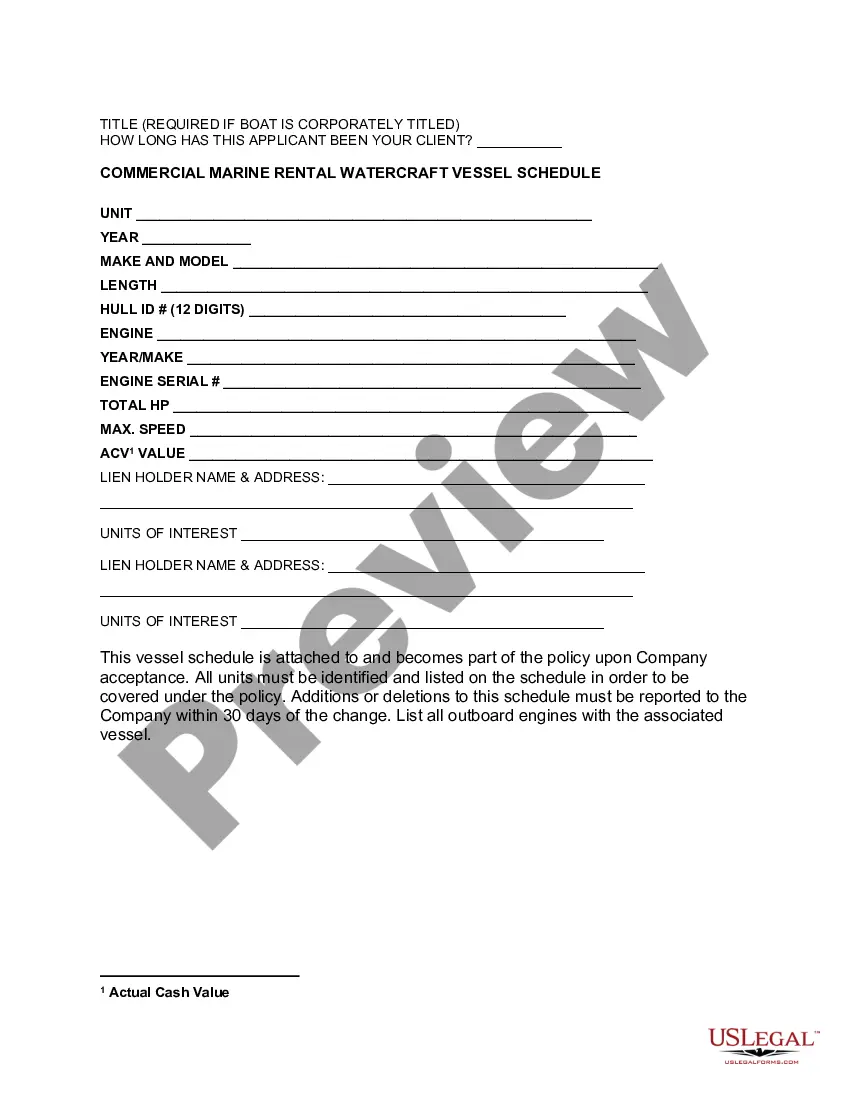

South Carolina Commercial Watercraft Rental Insurance Application is a comprehensive form specifically designed for businesses involved in the rental of watercraft, such as boats, jet skis, and other similar recreational vehicles, in the state of South Carolina. This application is crucial for companies seeking insurance coverage to protect their assets, customers, and themselves from potential risks and liabilities associated with commercial watercraft rentals. Key phrases: South Carolina, commercial watercraft rental insurance, application, rental businesses, watercraft, boats, jet skis, recreational vehicles, insurance coverage, risks, liabilities. Different types of South Carolina Commercial Watercraft Rental Insurance Applications may include: 1. General Liability Insurance Application: This type of application provides coverage for bodily injury, property damage, and personal/advertising injury claims arising out of the rental activities. It protects businesses from potential lawsuits and medical expenses associated with accidents and injuries occurring on or off the water. 2. Property Insurance Application: This application focuses on coverage for physical damage to the watercraft rented out by the business. It safeguards against damages caused by accidents, natural disasters, theft, vandalism, and other perils that may result in substantial financial losses. 3. Watercraft Liability Insurance Application: This application specifically addresses the liability risks associated with operating and renting out watercraft. It provides protection against bodily injury, property damage, and pollution liability claims resulting from accidents or incidents involving the rented watercraft. 4. Personal Injury Protection (PIP) Insurance Application: PIP insurance application covers medical expenses, lost wages, and other related costs for injuries sustained by renters or passengers of the rented watercraft. It ensures that individuals involved in accidents during the rental period receive appropriate medical care and compensation. 5. Umbrella/Excess Liability Insurance Application: This application offers additional liability coverage above the limits provided by underlying general liability and watercraft liability policies. It acts as a supplement to protect businesses against higher-value claims that may exceed their primary insurance coverage. By accurately completing a South Carolina Commercial Watercraft Rental Insurance Application, businesses can ensure appropriate coverage and financial protection against potential liabilities arising from their rental operations. It is essential to provide detailed information about the watercraft fleet, rental agreements, safety protocols, and previous claims history to help insurance providers assess the risks and determine appropriate coverage limits and premiums.

South Carolina Commercial Watercraft Rental Insurance Application

Description

How to fill out South Carolina Commercial Watercraft Rental Insurance Application?

If you need to full, download, or produce legitimate document themes, use US Legal Forms, the biggest variety of legitimate kinds, that can be found on-line. Take advantage of the site`s simple and hassle-free lookup to obtain the files you want. Numerous themes for business and individual uses are categorized by classes and suggests, or keywords. Use US Legal Forms to obtain the South Carolina Commercial Watercraft Rental Insurance Application within a handful of mouse clicks.

When you are currently a US Legal Forms buyer, log in to the profile and click the Down load key to find the South Carolina Commercial Watercraft Rental Insurance Application. Also you can entry kinds you formerly acquired within the My Forms tab of your own profile.

If you are using US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Make sure you have selected the form to the right area/nation.

- Step 2. Use the Preview solution to look over the form`s information. Do not neglect to see the information.

- Step 3. When you are unhappy using the type, make use of the Lookup industry on top of the screen to get other models of the legitimate type format.

- Step 4. Upon having discovered the form you want, select the Purchase now key. Pick the rates prepare you like and add your references to sign up on an profile.

- Step 5. Process the transaction. You may use your bank card or PayPal profile to complete the transaction.

- Step 6. Choose the format of the legitimate type and download it in your device.

- Step 7. Comprehensive, change and produce or indication the South Carolina Commercial Watercraft Rental Insurance Application.

Each legitimate document format you purchase is the one you have eternally. You might have acces to every type you acquired inside your acccount. Select the My Forms area and decide on a type to produce or download yet again.

Contend and download, and produce the South Carolina Commercial Watercraft Rental Insurance Application with US Legal Forms. There are thousands of professional and state-certain kinds you can utilize for your business or individual demands.