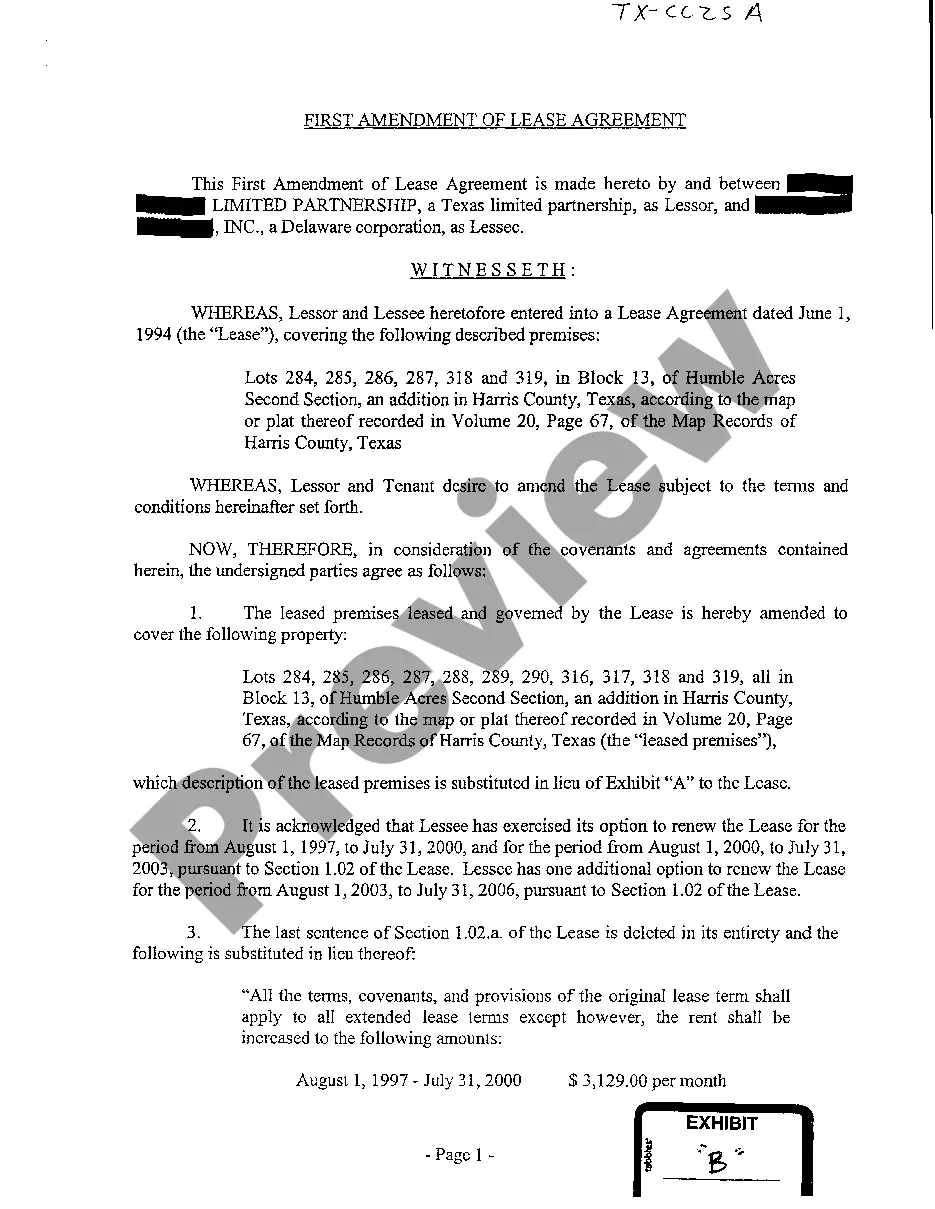

The South Carolina General Form of Factoring Agreement — Assignment of Accounts Receivable is a legally binding document that outlines the terms and conditions between a company (the "Factor") and a business (the "Seller") for the sale and assignment of accounts receivable. This agreement is commonly used in South Carolina by businesses that provide goods or services on credit and want to convert their outstanding invoices into immediate cash. The Factor, typically a financing company, agrees to purchase the Seller's accounts receivable at a discounted rate, providing the Seller with immediate funds to meet its cash flow needs. The agreement includes essential elements such as the effective date, parties involved, definitions of terms, representation and warranties of the Seller, purchase and assignment of accounts receivable, rights and obligations of both parties, pricing and fees, payment terms, confidentiality, dispute resolution, termination, and various other provisions to protect both parties' interests. Some relevant keywords related to the South Carolina General Form of Factoring Agreement — Assignment of Accounts Receivable include: 1. Factoring Agreement: The legal contract outlining the terms of the arrangement between the Factor and the Seller. 2. Accounts Receivable: The outstanding invoices owed to the Seller by its customers. 3. Assignment: The transfer of ownership or rights from the Seller to the Factor. 4. Financing Company: A financial institution or entity that provides funding to businesses by purchasing their accounts receivable. 5. Cash Flow: The movement of money in and out of a business, vital for its day-to-day operations. 6. Discounts: The reduced payment received by the Seller from the Factor, often a percentage of the face value of the accounts receivable. 7. Effective Date: The date on which the agreement becomes enforceable. 8. Termination: The conditions and procedures for ending the agreement between the Factor and the Seller. 9. Representation and warranties: Statements made by the Seller regarding the accuracy and legitimacy of the accounts receivable being sold. 10. Dispute resolution: The process followed to resolve any conflicts or disagreements that may arise between the parties. Though the question does not specify different types of South Carolina General Form of Factoring Agreement — Assignment of Accounts Receivable, it is important to note that there can be variations or customized forms of the agreement depending on the specific requirements or preferences of the parties involved. These may include specific clauses to address unique terms, industries, or contractual arrangements tailored to the distinct needs of the Seller and the Factor.

Factoring Ar In Sc

Description

How to fill out South Carolina General Form Of Factoring Agreement - Assignment Of Accounts Receivable?

If you want to full, down load, or produce legitimate record web templates, use US Legal Forms, the most important selection of legitimate types, which can be found on the Internet. Use the site`s simple and hassle-free look for to find the documents you require. Different web templates for business and personal uses are sorted by classes and states, or keywords and phrases. Use US Legal Forms to find the South Carolina General Form of Factoring Agreement - Assignment of Accounts Receivable within a handful of mouse clicks.

If you are presently a US Legal Forms consumer, log in in your accounts and click on the Down load key to find the South Carolina General Form of Factoring Agreement - Assignment of Accounts Receivable. Also you can entry types you formerly saved in the My Forms tab of your accounts.

If you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Make sure you have chosen the shape for your right metropolis/land.

- Step 2. Take advantage of the Review choice to look through the form`s content. Don`t forget to read the description.

- Step 3. If you are not satisfied using the type, use the Search discipline on top of the display to locate other types from the legitimate type design.

- Step 4. Upon having identified the shape you require, go through the Acquire now key. Select the rates strategy you like and put your accreditations to sign up to have an accounts.

- Step 5. Approach the purchase. You should use your credit card or PayPal accounts to perform the purchase.

- Step 6. Pick the structure from the legitimate type and down load it on your product.

- Step 7. Comprehensive, edit and produce or indication the South Carolina General Form of Factoring Agreement - Assignment of Accounts Receivable.

Every legitimate record design you purchase is your own property for a long time. You might have acces to each type you saved in your acccount. Click the My Forms segment and decide on a type to produce or down load once again.

Be competitive and down load, and produce the South Carolina General Form of Factoring Agreement - Assignment of Accounts Receivable with US Legal Forms. There are many professional and status-certain types you may use for the business or personal demands.

Form popularity

FAQ

The four main types of factoring are the Greatest common factor (GCF), the Grouping method, the difference in two squares, and the sum or difference in cubes.

Accounts receivable factoring companies will buy your receivables for 50% to 90% of the total invoice value. Then, your customers will pay their invoices, in full, directly to the factoring company. Lenders will typically take a processing fee, usually around 3%, on the invoice amount.

Factoring companies set prices based on the value of the accounts receivable. Sometimes factoring companies charge flat rates regardless of how long it takes them to recoup payment on the invoice. Others charge variable rates: The longer your customers take to pay the invoice, the more you'll owe.

Debt factoring arrangements take place when a business sells its accounts receivables to a factor at a discount. The factor then collects the receivables from the customers. This arrangement is used to improve cash flow for a business. Factoring begins when a factor evaluates a business and its receivables.

Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable (i.e., invoices) to a third party (called a factor) at a discount. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.

Valuing Receivables: Receivables are recorded at net realizable value. Business owners know that some customers who receive credit will never pay their account balances. These uncollectible accounts are called bad debts.

You can also calculate average accounts receivable by adding up the beginning and ending amount of your accounts receivable over a period of time and dividing by two.

In algebra, 'factoring' (UK: factorising) is the process of finding a number's factors. For example, in the equation 2 x 3 = 6, the numbers two and three are factors.

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

A factoring contract is an agreement where a small business sells outstanding invoices to third parties known as factors in exchange for upfront cash. When these invoices, or accounts receivable, are paid by clients, the money will go to the factor, rather than the small business itself.