Title: South Carolina Installment Sale and Security Agreement Regarding Sale of Automobile: A Comprehensive Guide Keywords: South Carolina, Installment Sale, Security Agreement, Sale of Automobile, One Individual to Another Introduction: In South Carolina, an installment sale and security agreement are commonly used when an individual intends to sell their automobile to another individual in a deferred payment structure. This detailed description aims to provide an overview of the process, legal requirements, and various types of South Carolina installment sale and security agreements regarding the sale of automobiles between individuals. Types of South Carolina Installment Sale and Security Agreements: 1. Traditional Installment Sale Agreement: A traditional installment sale agreement is a legally binding contract that outlines the terms and conditions of the sale and financing of the automobile between two individuals in South Carolina. Under this type of agreement, the buyer typically makes regular payments, including principal and interest, over a specified period until the total purchase price is paid in full. 2. Balloon Payment Installment Agreement: A balloon payment installment agreement is an alternative type of installment sale agreement. In this arrangement, the buyer pays reduced installment payments over the loan term, with a larger "balloon" payment due at the end. This type of installment sale often suits borrowers who anticipate an increase in income or plan to refinance the balloon payment in the future. Key Elements of a South Carolina Installment Sale and Security Agreement: 1. Identification of Parties: The agreement should clearly identify the buyer/seller of the automobile, including their legal names, addresses, and contact information. Additionally, include the vehicle's make, model, year, and identification number for accurate identification. 2. Purchase Price and Payment Terms: Provide a detailed breakdown of the total purchase price, indicating the down payment, interest rate (if applicable), installment amount, term duration, and any late payment penalties or fees. 3. Security Interest: The agreement should create a lien or security interest in favor of the seller on the automobile being sold. This ensures that the seller has legal protection until the buyer fulfills their payment obligations. The security interest will be officially recorded on the vehicle's title and can be enforced in case of default. 4. Default and Remedies: Define the events that constitute default, such as missed payments or breach of contract terms. Outline the remedies available to the seller if such default occurs, including repossession and recovery of the vehicle, as well as any associated costs or fees. 5. Condition of the Automobile and Warranties: Include sections regarding the automobile's condition at the time of sale and any warranties provided by the seller. Disclose any known defects or issues, and specify any responsibilities or disclaimers related to repairs, maintenance, or future damages. Conclusion: When engaging in an installment sale and security agreement regarding the sale of an automobile in South Carolina, it is crucial to create a detailed contract that protects the interests of both the buyer and seller. By understanding and adhering to the legal requirements and various types of installment sales, individuals can navigate these transactions confidently and mitigate potential risks.

South Carolina Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another

Description

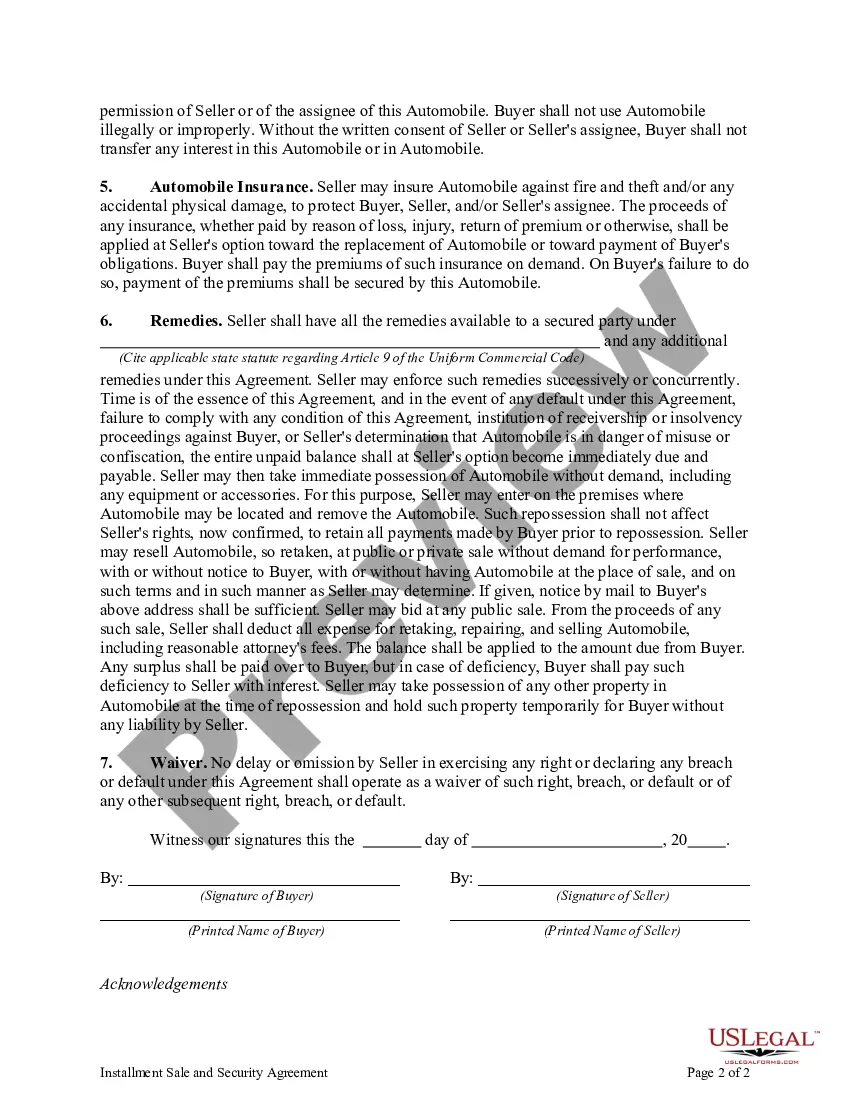

How to fill out South Carolina Installment Sale And Security Agreement Regarding Sale Of Automobile From One Individual To Another?

Are you in a place in which you need to have papers for possibly business or person functions just about every day time? There are tons of legal file themes available on the Internet, but finding types you can trust is not simple. US Legal Forms gives 1000s of kind themes, much like the South Carolina Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another, which are created to fulfill federal and state needs.

If you are already knowledgeable about US Legal Forms site and get an account, basically log in. Following that, it is possible to acquire the South Carolina Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another format.

If you do not have an accounts and want to begin to use US Legal Forms, abide by these steps:

- Find the kind you require and make sure it is for the proper metropolis/area.

- Utilize the Review button to review the shape.

- See the explanation to actually have chosen the right kind.

- If the kind is not what you`re trying to find, make use of the Search area to find the kind that meets your needs and needs.

- Whenever you find the proper kind, just click Acquire now.

- Opt for the costs plan you desire, complete the desired details to produce your bank account, and pay money for your order with your PayPal or bank card.

- Choose a handy paper file format and acquire your backup.

Find each of the file themes you have purchased in the My Forms menu. You can get a additional backup of South Carolina Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another whenever, if necessary. Just click on the required kind to acquire or produce the file format.

Use US Legal Forms, one of the most substantial selection of legal types, to save efforts and stay away from blunders. The assistance gives professionally made legal file themes that you can use for a variety of functions. Generate an account on US Legal Forms and commence making your life easier.