South Carolina Assignment and Transfer of Stock

Description

How to fill out Assignment And Transfer Of Stock?

If you need to obtain, acquire, or print valid document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Utilize the site's straightforward and practical search features to locate the documents you require.

Various templates for business and personal applications are organized by categories and suggestions, or keywords.

Every legal document template you obtain is yours permanently. You have access to every form you saved in your account. Click on the My documents section and select a form to print or download again.

Compete and acquire, and print the South Carolina Assignment and Transfer of Stock with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal requirements.

- Use US Legal Forms to easily find the South Carolina Assignment and Transfer of Stock.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the South Carolina Assignment and Transfer of Stock.

- You can also find forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to browse through the form's content. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal form style.

- Step 4. After you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the transaction. You may use your Visa or Mastercard, or PayPal account to finalize the payment.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the South Carolina Assignment and Transfer of Stock.

Form popularity

FAQ

Yes, the assignment of a contract is legal in South Carolina, provided that the original contract does not prohibit assignment. Understanding the legality of this process is crucial for individuals looking to transfer their rights and obligations to another party. For those involved in South Carolina Assignment and Transfer of Stock, knowing the rules around contract assignment can facilitate smoother transactions and legal compliance.

Section 44 33 34 pertains to the regulations governing certain investment companies and is essential for those navigating the investment landscape in South Carolina. This section ensures that investment practices align with state laws and that all transactions, including South Carolina Assignment and Transfer of Stock, adhere to legal standards. Staying informed about such codes can enhance investment strategies and compliance.

To record a deed in South Carolina, the document must be signed by the grantor, notarized, and then submitted to the county register of deeds. This process is essential for ensuring legal recognition and protection of property interests. Understanding these requirements is beneficial not only for real estate transactions but also for guiding related transactions in South Carolina Assignment and Transfer of Stock. A platform like uslegalforms can assist with the necessary paperwork.

Section 12 24 70 in South Carolina primarily deals with taxation codes related to stocks and bonds. This legal framework specifies how transactions involving stock transfers are taxed. For individuals engaged in South Carolina Assignment and Transfer of Stock, being aware of this section can guide them in understanding potential tax liabilities, ensuring that they remain compliant with state regulations.

The assignment of shares involves the process where a shareholder assigns their rights and benefits to another party, while the transfer of shares typically refers to the complete change of ownership from one individual or entity to another. This distinction is important in matters of South Carolina Assignment and Transfer of Stock, as the legal implications can vary depending on the method used. Understanding these differences helps individuals make informed decisions when managing their investments.

Code 12 24 70 refers to specific tax regulations in South Carolina that impact stock transfers and assignments. This code is crucial for understanding the tax implications associated with the sale and transfer of stock. Proper knowledge of this regulation helps individuals navigate the complexities of South Carolina Assignment and Transfer of Stock efficiently. Familiarity with these codes ensures compliance and minimizes legal issues.

The S.C. Code of Laws for disturbing schools addresses behavior that disrupts educational environments. It outlines the legal consequences for individuals who engage in actions that interfere with the operation of schools. Understanding this law is essential for those involved in educational administration and community engagement. By ensuring a respectful school environment, everyone benefits, including those involved in South Carolina Assignment and Transfer of Stock.

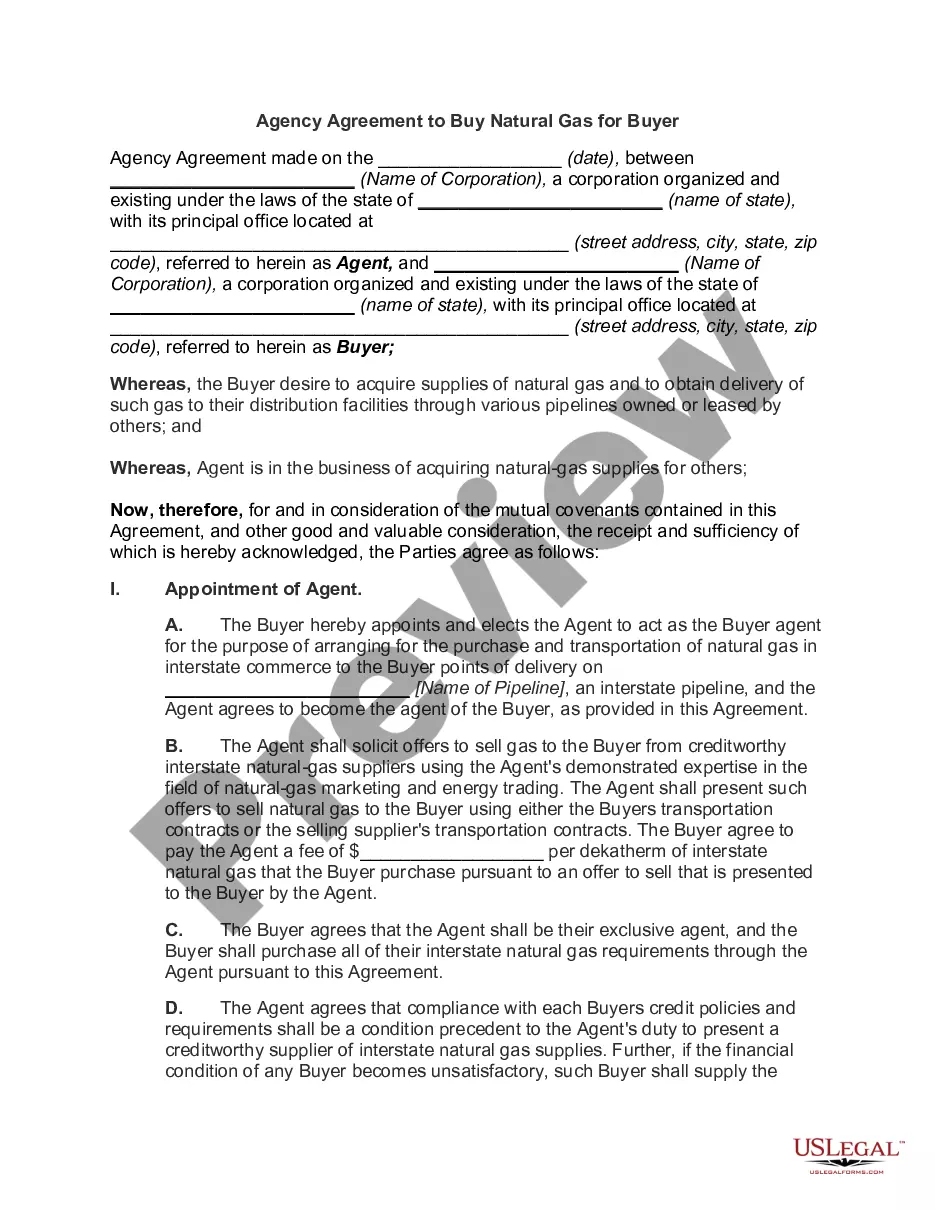

To complete a stock transfer, you typically need a stock assignment form, a deed of Assignment, and any supporting documentation required by the issuing company. In addition, personal identification and potentially the original stock certificates may also be necessary. Utilizing US Legal Forms can simplify gathering these documents and executing the South Carolina Assignment and Transfer of Stock efficiently.

A deed of assignment and transfer of shares combines the functions of both a deed of Assignment and a transfer process into one document. This dual-purpose deed simplifies the South Carolina Assignment and Transfer of Stock process by outlining the specific shares being transferred and ensuring both parties’ rights are clearly defined. It provides a comprehensive approach to stock ownership changes.

A deed of Assignment is a legal document that outlines the terms under which one party assigns their rights or interests in an asset to another party. Within South Carolina Assignment and Transfer of Stock, this deed serves as a formal declaration of the transfer of shares, making it crucial for clear ownership records. It typically outlines the rights that are being assigned and the parties involved.