A Bill of Sale with encumbrances means that whatever product is being sold has some sort of lien, mortgage, or monies owing, and the Buyer is agreeing that they will take on these obligations upon purchase.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

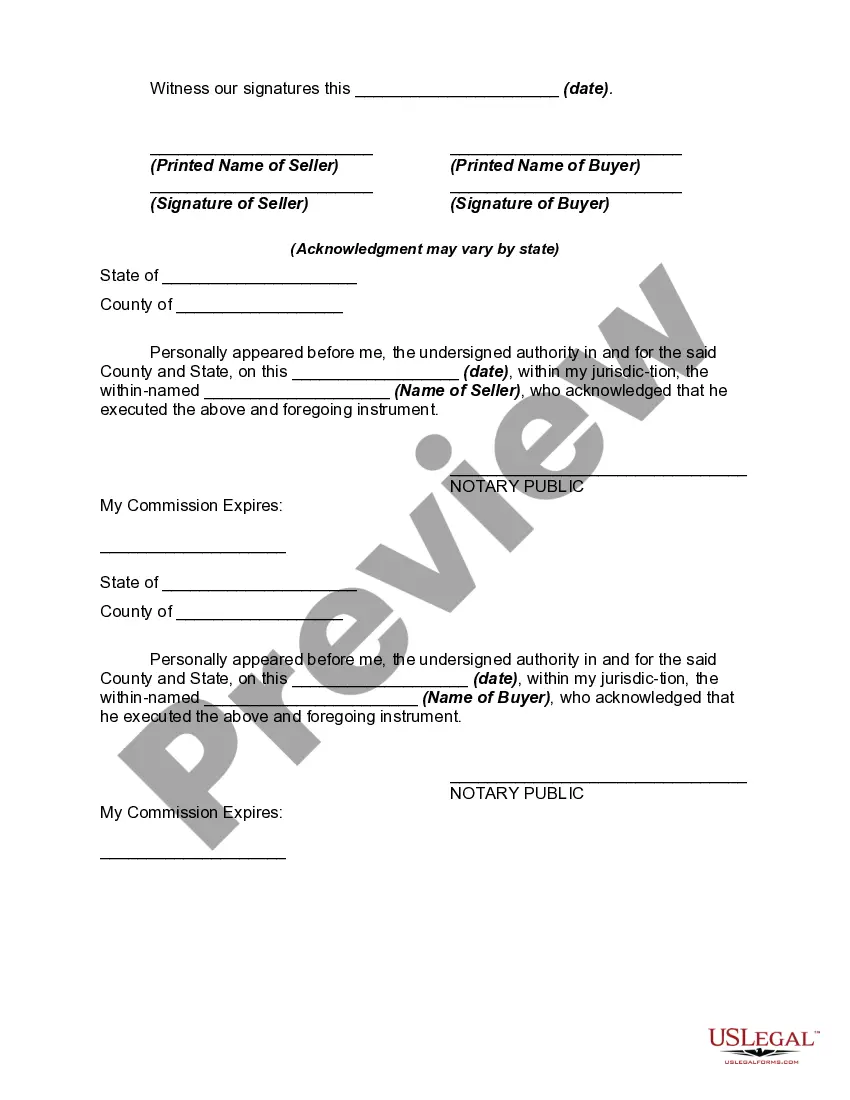

Title: A Comprehensive Guide to South Carolina Bill of Sale of Motor Vehicle — With Encumbrances Introduction: The South Carolina Bill of Sale of Motor Vehicle — With Encumbrances is a legally binding document that facilitates the transfer of ownership of a motor vehicle along with any existing encumbrances. This article will provide detailed information about this document, its importance, and any additional types of bills of sale available in South Carolina. Overview: A South Carolina Bill of Sale of Motor Vehicle — With Encumbrances acts as a record of the transaction between a seller and buyer when transferring ownership of a vehicle. It not only signifies the transfer of title but also outlines any encumbrances (liens, outstanding debts, or legal claims) against the vehicle. By disclosing these encumbrances, both parties are aware of any financial obligations associated with the vehicle. Key Features: 1. Identification Details: The bill of sale includes the names, addresses, and contact information of both the seller and the buyer, along with their driver's license numbers. 2. Vehicle Information: It specifies the vehicle's year, make, model, vehicle identification number (VIN), and license plate number. 3. Encumbrance Disclosure: This document highlights existing liens or encumbrances on the vehicle, such as outstanding loans, unpaid taxes, or pending legal claims. 4. Purchase Price and Payment Terms: The agreed-upon purchase price, payment method, and any installment plans should be clearly mentioned. 5. Signatures and Notarization: Both parties involved in the sale must sign and date the bill of sale. Some transactions may require notarization for added legal validity. Types of South Carolina Bill of Sale of Motor Vehicle — With Encumbrances: 1. Standard Used Vehicle Bill of Sale — With Encumbrances: This form is used for the sale of a used vehicle that has existing liens, loans, or other encumbrances. 2. Repossessed Vehicle Bill of Sale — With Encumbrances: Designed specifically for vehicles that have been repossessed, this form outlines the details of the repossession, the current encumbrances, and the new buyer's information. 3. Salvage Title Vehicle Bill of Sale — With Encumbrances: Used primarily when selling a vehicle with a salvage title, this bill of sale covers encumbrances related to the vehicle's condition and any ongoing insurance claims. Conclusion: The South Carolina Bill of Sale of Motor Vehicle — With Encumbrances is a crucial legal document when transferring ownership of a vehicle while disclosing any existing liens, loans, or claims against the vehicle. Understanding the importance of this document and its various types will ensure a smooth and secure transaction for both buyers and sellers in South Carolina.Title: A Comprehensive Guide to South Carolina Bill of Sale of Motor Vehicle — With Encumbrances Introduction: The South Carolina Bill of Sale of Motor Vehicle — With Encumbrances is a legally binding document that facilitates the transfer of ownership of a motor vehicle along with any existing encumbrances. This article will provide detailed information about this document, its importance, and any additional types of bills of sale available in South Carolina. Overview: A South Carolina Bill of Sale of Motor Vehicle — With Encumbrances acts as a record of the transaction between a seller and buyer when transferring ownership of a vehicle. It not only signifies the transfer of title but also outlines any encumbrances (liens, outstanding debts, or legal claims) against the vehicle. By disclosing these encumbrances, both parties are aware of any financial obligations associated with the vehicle. Key Features: 1. Identification Details: The bill of sale includes the names, addresses, and contact information of both the seller and the buyer, along with their driver's license numbers. 2. Vehicle Information: It specifies the vehicle's year, make, model, vehicle identification number (VIN), and license plate number. 3. Encumbrance Disclosure: This document highlights existing liens or encumbrances on the vehicle, such as outstanding loans, unpaid taxes, or pending legal claims. 4. Purchase Price and Payment Terms: The agreed-upon purchase price, payment method, and any installment plans should be clearly mentioned. 5. Signatures and Notarization: Both parties involved in the sale must sign and date the bill of sale. Some transactions may require notarization for added legal validity. Types of South Carolina Bill of Sale of Motor Vehicle — With Encumbrances: 1. Standard Used Vehicle Bill of Sale — With Encumbrances: This form is used for the sale of a used vehicle that has existing liens, loans, or other encumbrances. 2. Repossessed Vehicle Bill of Sale — With Encumbrances: Designed specifically for vehicles that have been repossessed, this form outlines the details of the repossession, the current encumbrances, and the new buyer's information. 3. Salvage Title Vehicle Bill of Sale — With Encumbrances: Used primarily when selling a vehicle with a salvage title, this bill of sale covers encumbrances related to the vehicle's condition and any ongoing insurance claims. Conclusion: The South Carolina Bill of Sale of Motor Vehicle — With Encumbrances is a crucial legal document when transferring ownership of a vehicle while disclosing any existing liens, loans, or claims against the vehicle. Understanding the importance of this document and its various types will ensure a smooth and secure transaction for both buyers and sellers in South Carolina.