A Bill of Sale with encumbrances means that whatever product is being sold has some sort of lien, mortgage, or monies owing, and the Buyer is agreeing that they will take on these obligations upon purchase.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

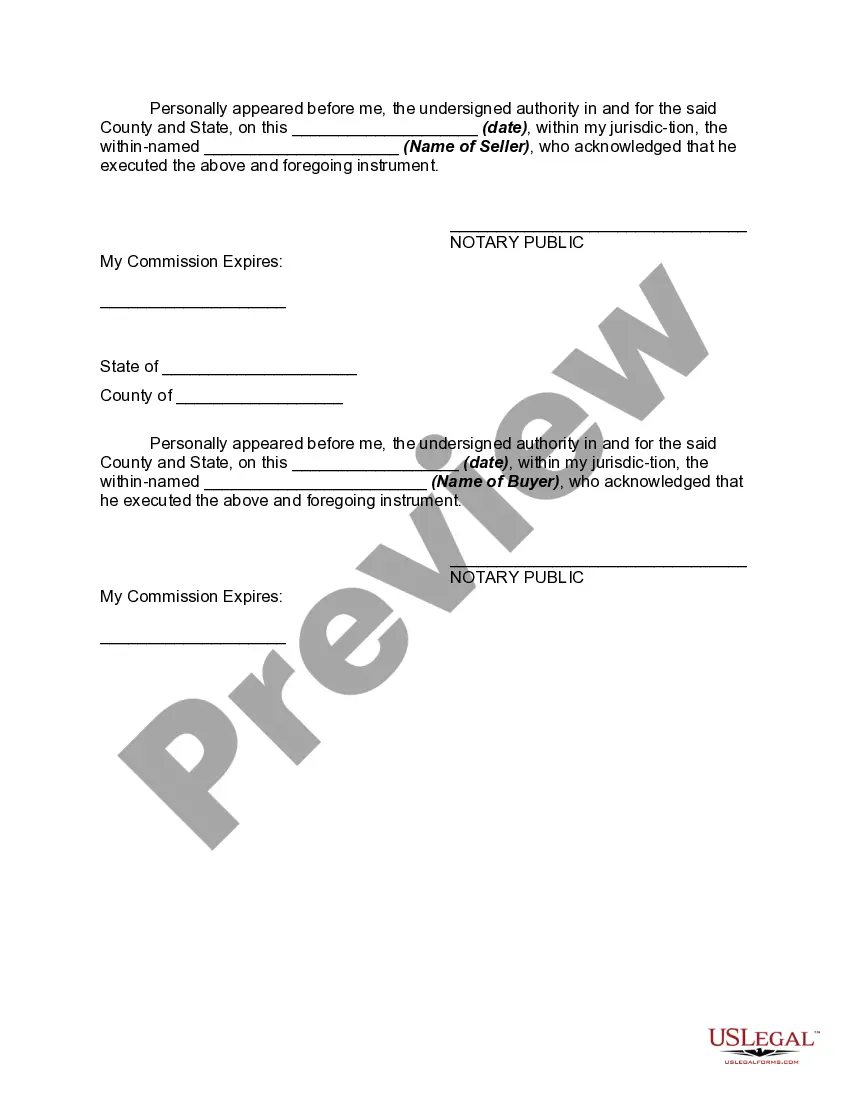

South Carolina Bill of Sale with Encumbrances is a legal document that proves the transfer of ownership of a particular item or property from one party to another. This document is often used in sales transactions where the seller wants to disclose any encumbrances or liens that exist on the property being sold. Here are some relevant keywords associated with the South Carolina Bill of Sale with Encumbrances: 1. South Carolina Bill of Sale: A legal document that establishes the transfer of ownership of a property or item from one party to another within the state of South Carolina. 2. Encumbrances: Refers to any claims, liens, mortgages, debts, or other legal obligations that may exist on the property being sold. These encumbrances can limit the ownership rights of the buyer. 3. Liens: A type of encumbrance that gives a creditor the right to possess the property until a debt is repaid. This could include a mortgage lien or a lien due to unpaid taxes. 4. Types of South Carolina Bill of Sale with Encumbrances: There are various types of bills of sale in South Carolina that can be used when selling a property with encumbrances. Some common types include: — Real Estate Bill of Sale with Encumbrances: Used when transferring ownership of real estate properties like land, houses, or commercial buildings, along with disclosing any existing encumbrances. — Vehicle Bill of Sale with Encumbrances: Used when transferring ownership of vehicles such as cars, motorcycles, boats, or recreational vehicles, while disclosing any liens or outstanding loans on the vehicle. — Personal Property Bill of Sale with Encumbrances: Used when selling personal items like furniture, equipment, or electronics, along with disclosing any existing liens or debts associated with the items. It is important to note that the South Carolina Bill of Sale with Encumbrances must include accurate details of the item or property being sold, the parties involved, specific terms, and conditions, as well as a clear disclosure of any encumbrances or liens. By having a comprehensive and accurately filled out bill of sale, both the buyer and seller can protect their interests and ensure a smooth transfer of ownership.South Carolina Bill of Sale with Encumbrances is a legal document that proves the transfer of ownership of a particular item or property from one party to another. This document is often used in sales transactions where the seller wants to disclose any encumbrances or liens that exist on the property being sold. Here are some relevant keywords associated with the South Carolina Bill of Sale with Encumbrances: 1. South Carolina Bill of Sale: A legal document that establishes the transfer of ownership of a property or item from one party to another within the state of South Carolina. 2. Encumbrances: Refers to any claims, liens, mortgages, debts, or other legal obligations that may exist on the property being sold. These encumbrances can limit the ownership rights of the buyer. 3. Liens: A type of encumbrance that gives a creditor the right to possess the property until a debt is repaid. This could include a mortgage lien or a lien due to unpaid taxes. 4. Types of South Carolina Bill of Sale with Encumbrances: There are various types of bills of sale in South Carolina that can be used when selling a property with encumbrances. Some common types include: — Real Estate Bill of Sale with Encumbrances: Used when transferring ownership of real estate properties like land, houses, or commercial buildings, along with disclosing any existing encumbrances. — Vehicle Bill of Sale with Encumbrances: Used when transferring ownership of vehicles such as cars, motorcycles, boats, or recreational vehicles, while disclosing any liens or outstanding loans on the vehicle. — Personal Property Bill of Sale with Encumbrances: Used when selling personal items like furniture, equipment, or electronics, along with disclosing any existing liens or debts associated with the items. It is important to note that the South Carolina Bill of Sale with Encumbrances must include accurate details of the item or property being sold, the parties involved, specific terms, and conditions, as well as a clear disclosure of any encumbrances or liens. By having a comprehensive and accurately filled out bill of sale, both the buyer and seller can protect their interests and ensure a smooth transfer of ownership.