South Carolina Bill of Sale by Corporation of all or Substantially all of its Assets

Description

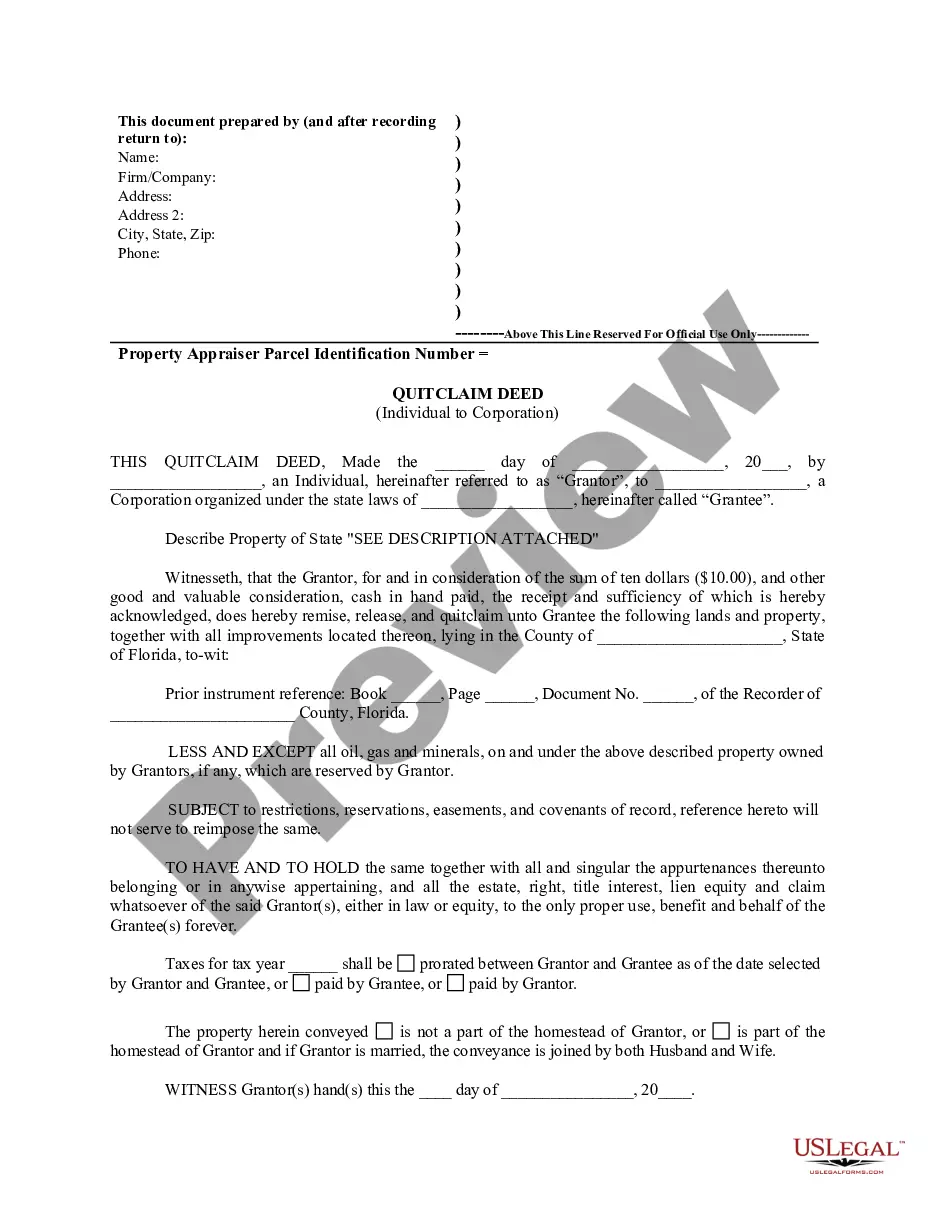

How to fill out Bill Of Sale By Corporation Of All Or Substantially All Of Its Assets?

Are you in a location where you need documentation for either business or personal reasons nearly every day.

There are many legal document templates available online, but finding reliable ones is challenging.

US Legal Forms offers a vast selection of form templates, including the South Carolina Bill of Sale by Corporation of all or substantially all of its Assets, which can be tailored to meet state and federal requirements.

Once you find the correct form, simply click Buy now.

Select the pricing plan you prefer, provide the necessary information to process your payment, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Carolina Bill of Sale by Corporation of all or substantially all of its Assets template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

- Use the Review button to examine the document.

- Check the details to confirm you have chosen the correct form.

- If the form isn’t what you are looking for, use the Search field to find the form that meets your requirements.

Form popularity

FAQ

The sale of all or substantially all of the assets refers to a transaction where a corporation conveys most of its property and valuable resources to another party. This type of sale, documented through the South Carolina Bill of Sale by Corporation of all or Substantially all of its Assets, is critical for maintaining legal clarity about the transfer. It often requires careful consideration of asset value and operational impact on the selling corporation. Utilizing legal forms through platforms like USLegalForms can simplify the process and ensure that all legal requirements are met.

The phrase 'all or substantially all' typically refers to the majority of a corporation's assets instead of every single asset. In legal terms, this means that while not every asset must be included in the sale, the majority must be significant enough to conduct business effectively. The South Carolina Bill of Sale by Corporation of all or Substantially all of its Assets captures this idea, ensuring clarity around what is being sold. This language allows for flexibility and can accommodate varying circumstances during sales.

A sale of substantially all assets typically involves transferring key assets that are crucial for business operations, such as equipment, inventory, and customer lists. In the context of the South Carolina Bill of Sale by Corporation of all or Substantially all of its Assets, this documentation specifies which assets are included in the sale. Consistently, the determination of 'substantiality' can vary, but generally, it indicates a strong majority of the corporation's valuable assets. Understanding these nuances helps guide sellers and buyers during negotiations.

A sale of substantially all assets occurs when a corporation transfers most, if not all, of its operational assets to another entity. In this scenario, the South Carolina Bill of Sale by Corporation of all or Substantially all of its Assets serves as a legal document that formalizes the transaction. This bill of sale protects both the seller and buyer by detailing the assets involved and clarifying the terms of the agreement. It's crucial to understand that this type of sale can impact the corporation's ongoing business operations.

Writing a bill of sale in South Carolina involves capturing essential details such as the date of sale, parties involved, and a clear description of the asset. Ensure both the buyer and seller review and sign the document for validation. For those dealing with a South Carolina Bill of Sale by Corporation of all or Substantially all of its Assets, using online services like USLegalForms can streamline this process and ensure that your document meets all legal requirements.

Section 33-1-103 of the SC Code of Laws provides definitions applicable to various statutory terms found within the Business Corporation Act. This section clarifies concepts crucial for corporate governance and legal compliance. For those looking into the intricacies of a South Carolina Bill of Sale by Corporation of all or Substantially all of its Assets, these definitions play an important role in ensuring clear communication and understanding.

The purpose of the Corporation Act is to facilitate the growth and stability of businesses within South Carolina. It lays down clear guidelines and protections for businesses and their stakeholders. Corporations planning to engage in a South Carolina Bill of Sale by Corporation of all or Substantially all of its Assets will find this act integral to their operations.

The Corporation Act in South Carolina provides the essential legal framework for corporations. This act governs corporate structure, operation, and regulation, ensuring compliance with state laws. For many corporations, understanding this act is vital when preparing documentation for a South Carolina Bill of Sale by Corporation of all or Substantially all of its Assets.

The Corporations Act covers a wide range of topics, including formation, governance, and dissolution of corporations. It sets rules for corporate officers, board members, and shareholder rights. By familiarizing themselves with this act, corporations can effectively manage processes like the South Carolina Bill of Sale by Corporation of all or Substantially all of its Assets.

SC Code Ann 33-44-504 relates to the rights and obligations of shareholders in a corporation. This section details how corporations should handle dividend distributions and asset sales. For corporations engaged in a South Carolina Bill of Sale by Corporation of all or Substantially all of its Assets, understanding these rights ensures fair treatment of shareholders throughout the transaction.