A South Carolina Term Loan Agreement between a business or corporate borrower and a bank is a legally binding contract that outlines the terms and conditions under which the borrower can access a specific amount of funds from the bank for a defined period. This type of agreement is commonly used for financing projects, expanding operations, or meeting working capital needs. The agreement typically begins with an introductory section that identifies the parties involved, their legal names, and their respective roles. It also includes the effective date of the agreement. Next, the agreement highlights the loan amount provided by the bank to the business borrower. Any interest rate applicable to the loan should be clearly stated along with the frequency of interest calculations and payments. In South Carolina, banks may offer multiple types of term loans, including fixed-rate loans, adjustable-rate loans, or variable-rate loans. These distinctions depend on the agreement negotiated between the parties. The agreement further specifies the loan term, which refers to the duration within which the borrower must repay the loan. Terms commonly range from one to ten years, but this can vary depending on the agreement. The agreement also outlines any repayment schedule, including monthly, quarterly, or annual installments, and highlights any grace periods or penalties for late payment. Collateral is an important aspect of term loan agreements. The agreement should state whether the loan requires specific assets or personal guarantees to secure the loan. Collateral may include real estate, equipment, inventory, or other valuable business assets. The agreement may also specify any applicable lien or security interest granted by the borrower to the bank to guarantee repayment. In addition to collateral, covenants and restrictions may be included in the agreement to protect the bank's interests. These may include financial reporting requirements, limitations on debt levels, restrictions on asset sales, or maintenance of certain financial ratios. Breaching these covenants can trigger default provisions outlined in the agreement, giving the bank the right to accelerate the loan or exercise other remedies available under South Carolina law. It is crucial to acknowledge the role of laws and regulations governing South Carolina loans. The agreement should specify that it is subject to and interpreted according to the laws of South Carolina. Additionally, the agreement may outline a dispute resolution process, such as arbitration or mediation, to address any disagreements that may arise between the parties. Different types of South Carolina Term Loan Agreements between business or corporate borrowers and banks may exist, including construction loans, equipment financing loans, acquisition loans, or working capital loans. Each agreement is tailored to the specific needs and goals of the borrower, addressing different aspects of the loan arrangement. Overall, a South Carolina Term Loan Agreement between a business or corporate borrower and a bank creates a legally binding framework that governs the loan transaction. It ensures clarity and protection for both parties involved, highlighting the loan amount, interest rate, repayment terms, collateral, covenants, and applicable laws.

South Carolina Term Loan Agreement between Business or Corporate Borrower and Bank

Description

How to fill out South Carolina Term Loan Agreement Between Business Or Corporate Borrower And Bank?

Are you currently in the place where you need to have paperwork for sometimes company or individual functions virtually every time? There are plenty of legal papers layouts accessible on the Internet, but locating kinds you can rely on is not easy. US Legal Forms delivers 1000s of develop layouts, much like the South Carolina Term Loan Agreement between Business or Corporate Borrower and Bank, that are composed to satisfy state and federal requirements.

In case you are currently informed about US Legal Forms internet site and get a free account, simply log in. Next, you are able to acquire the South Carolina Term Loan Agreement between Business or Corporate Borrower and Bank template.

Should you not offer an bank account and need to start using US Legal Forms, abide by these steps:

- Discover the develop you require and make sure it is for your right city/state.

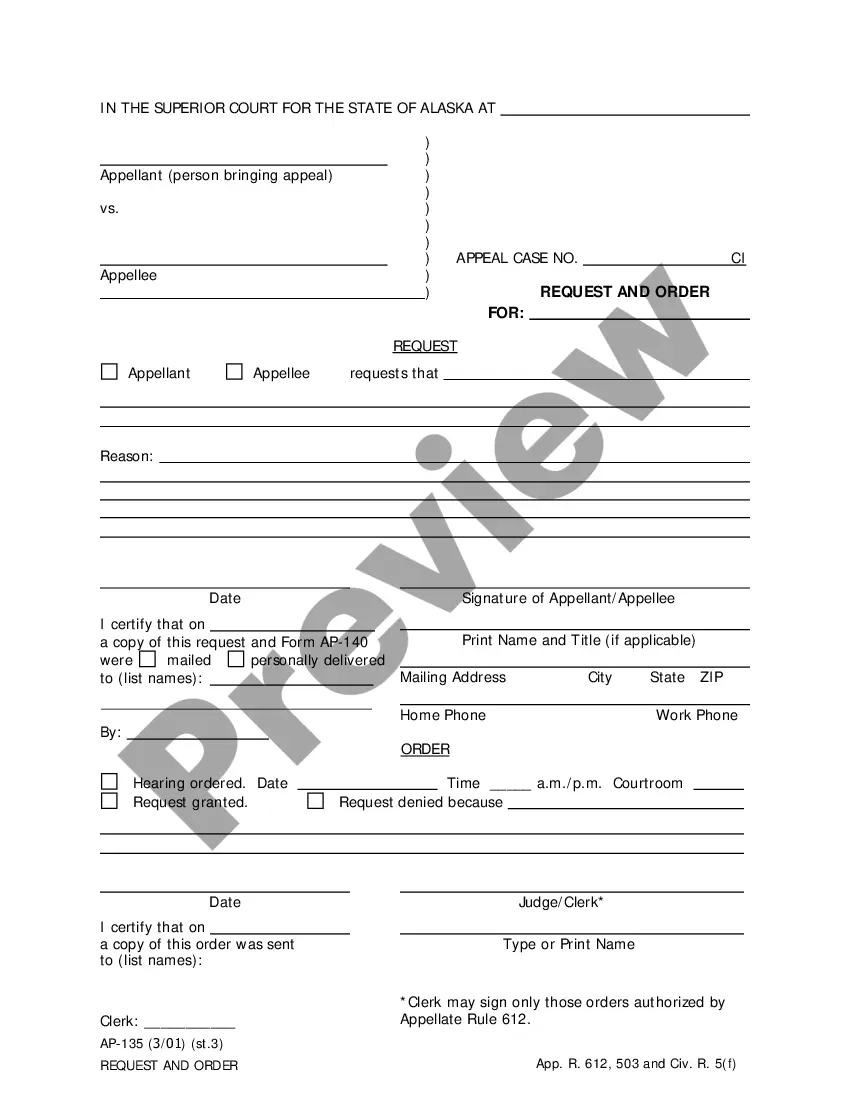

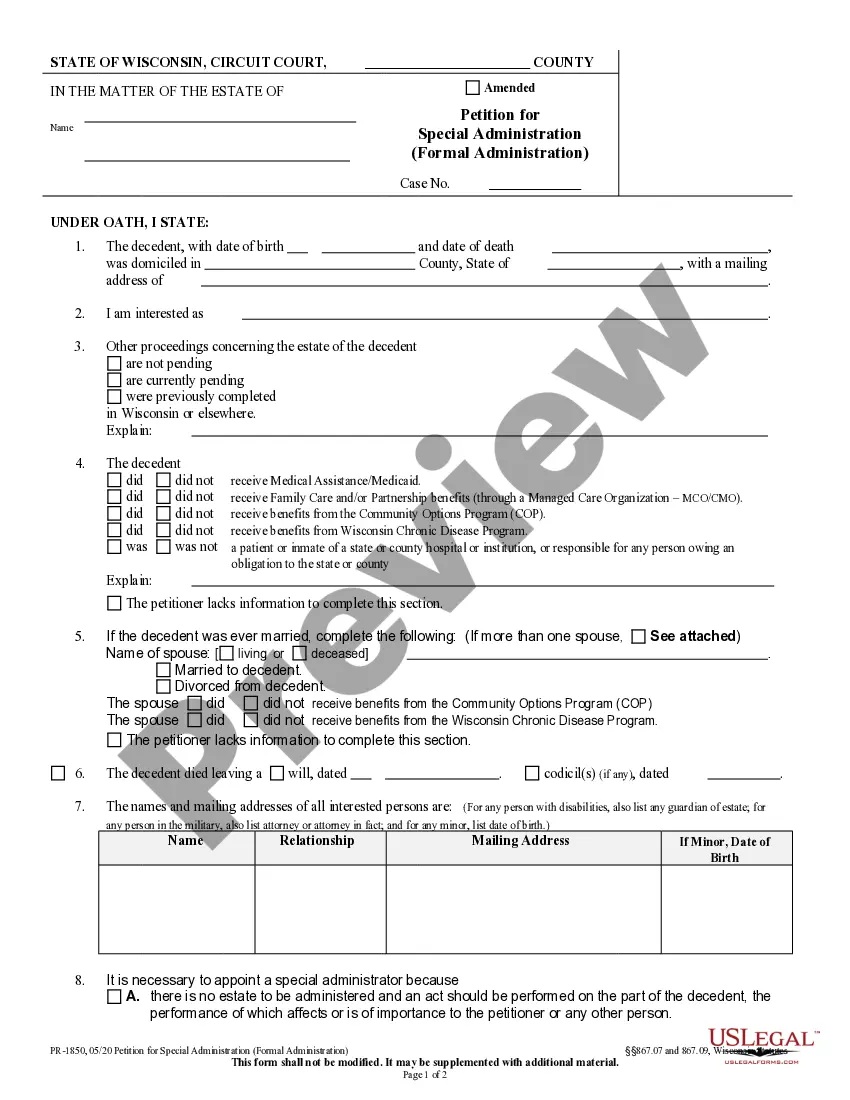

- Utilize the Review button to analyze the form.

- Look at the outline to ensure that you have selected the right develop.

- If the develop is not what you are searching for, make use of the Research discipline to find the develop that fits your needs and requirements.

- When you discover the right develop, click on Purchase now.

- Choose the rates prepare you need, submit the desired information to make your bank account, and pay money for an order utilizing your PayPal or bank card.

- Decide on a convenient file structure and acquire your copy.

Locate all of the papers layouts you have purchased in the My Forms food selection. You can aquire a more copy of South Carolina Term Loan Agreement between Business or Corporate Borrower and Bank at any time, if needed. Just go through the necessary develop to acquire or print out the papers template.

Use US Legal Forms, by far the most considerable selection of legal types, to save time and avoid mistakes. The service delivers professionally manufactured legal papers layouts that you can use for a variety of functions. Create a free account on US Legal Forms and initiate generating your life easier.