South Carolina Equipment Financing Agreement

Description

There is a large variety of financing techniques that businesses and consumers can use to receive financing; these techniques range from IPOs to bank loans. The use of financing is vital in any economic system as it allows consumers to purchase products out of their immediate reach, like houses, and businesses to finance large investment projects.

How to fill out Equipment Financing Agreement?

Are you presently inside a place the place you require paperwork for possibly company or individual functions almost every day? There are a variety of authorized papers templates available on the Internet, but discovering types you can trust is not straightforward. US Legal Forms provides thousands of type templates, much like the South Carolina Equipment Financing Agreement, that happen to be created in order to meet federal and state requirements.

If you are already acquainted with US Legal Forms website and get an account, basically log in. Following that, you can obtain the South Carolina Equipment Financing Agreement template.

Should you not come with an account and would like to begin to use US Legal Forms, adopt these measures:

- Obtain the type you want and make sure it is for your right area/area.

- Use the Review switch to examine the shape.

- Read the information to ensure that you have selected the correct type.

- In the event the type is not what you`re looking for, utilize the Search industry to discover the type that meets your requirements and requirements.

- If you discover the right type, simply click Get now.

- Choose the costs prepare you want, fill out the specified information to create your money, and pay money for the transaction making use of your PayPal or bank card.

- Choose a handy paper format and obtain your duplicate.

Discover every one of the papers templates you have bought in the My Forms food selection. You can obtain a more duplicate of South Carolina Equipment Financing Agreement any time, if needed. Just go through the necessary type to obtain or print out the papers template.

Use US Legal Forms, the most considerable variety of authorized types, to conserve time as well as avoid mistakes. The support provides skillfully made authorized papers templates which you can use for a variety of functions. Generate an account on US Legal Forms and initiate creating your life a little easier.

Form popularity

FAQ

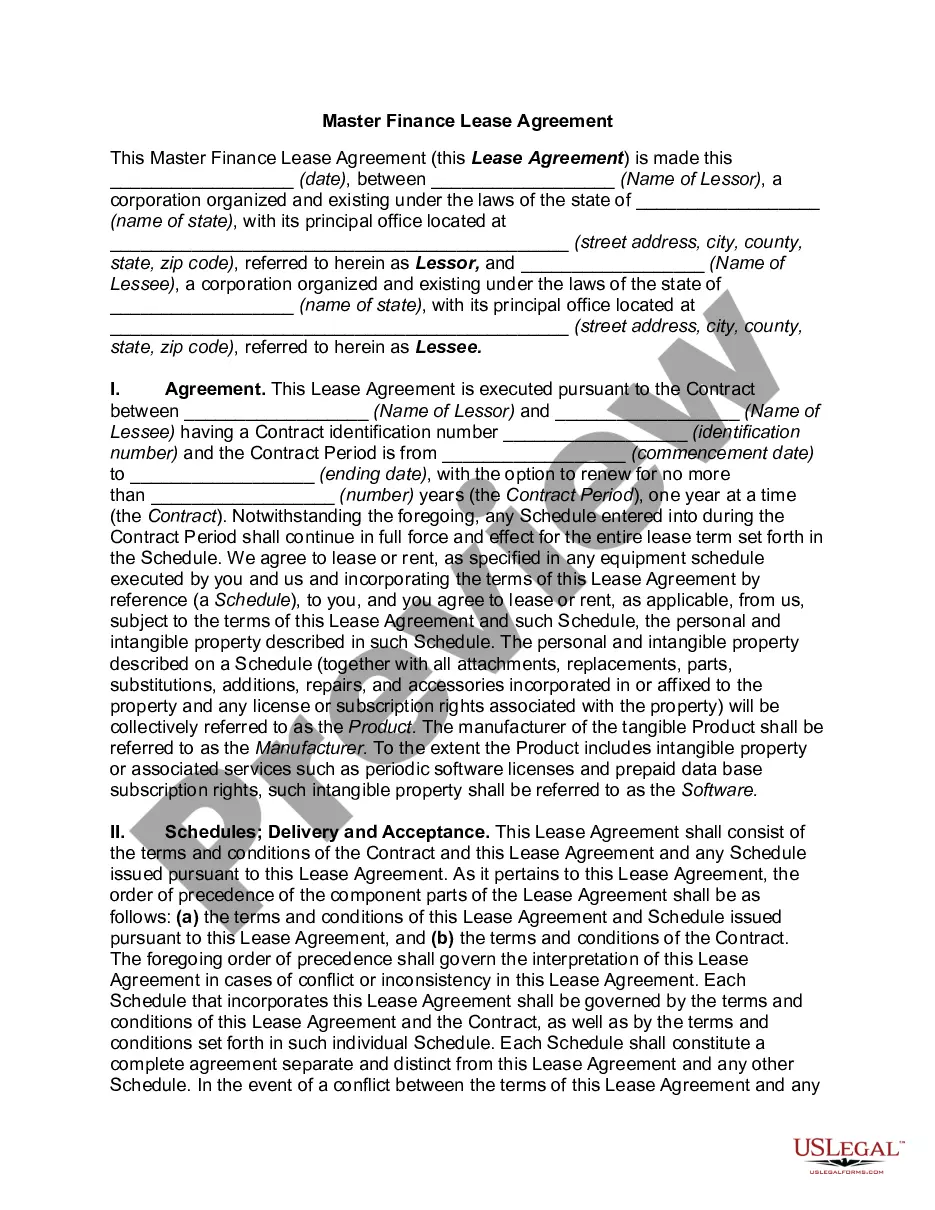

Lease? Loans and lease financing are both popular methods of funding, but there is a key distinction between the two. A loan is the borrowing of money while a lease is a term rental agreement for the use of specific equipment.

An operating lease allows you to only pay for the use of the equipment. On the other hand, a finance lease allows you to pay a set residual amount at the end of your lease term to own the equipment outright. In a finance lease, the finance company owns equipment until the buyer makes the residual payment.

In general, a loan is better if you have excess money for a down payment and you plan to keep the equipment for a long time. A lease is better if you don't have money to put down, the equipment is only needed for a particular project, or if there is a risk of it becoming outdated.

When you lease a vehicle, you do not own the car. Instead, you pay to use it for a specified period. Once your lease ends, you either renew the lease, return the car, or buy it. With financing, you own the vehicle outright.

A lease works as a rental agreement and generally has a lower month-to-month cost. Financing is a type of business loan that typically costs more each month but may result in paying less overall. This is because you own the equipment outright once the loan is paid off.

You are the lessee and the owner of the equipment, or the lender, is the lessor in a lease agreement. Once the lease period ends, the equipment is returned to the owner. In some cases, you may have the option to buy the equipment.

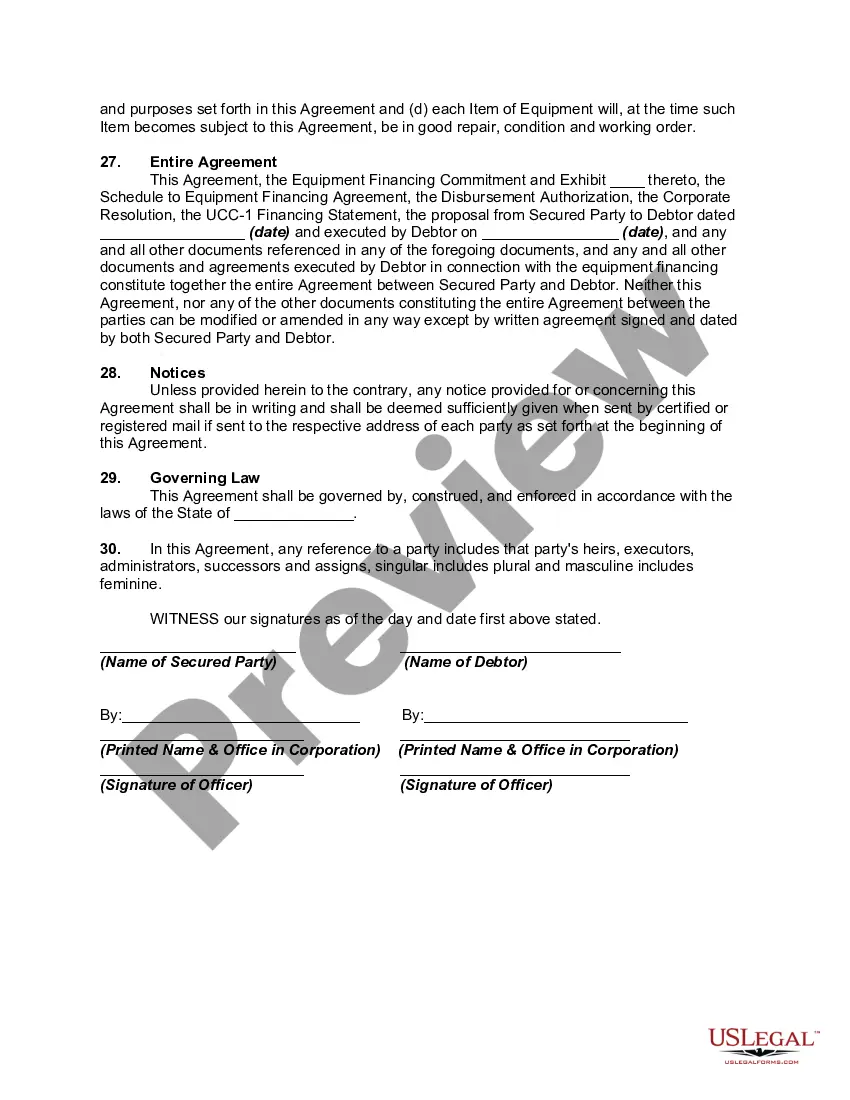

An equipment finance agreement (EFA) is like a loan, security agreement, and promissory note all packaged together into a single document. EFAs also contain some unique features that make them one of the most popular and versatile equipment financing options.