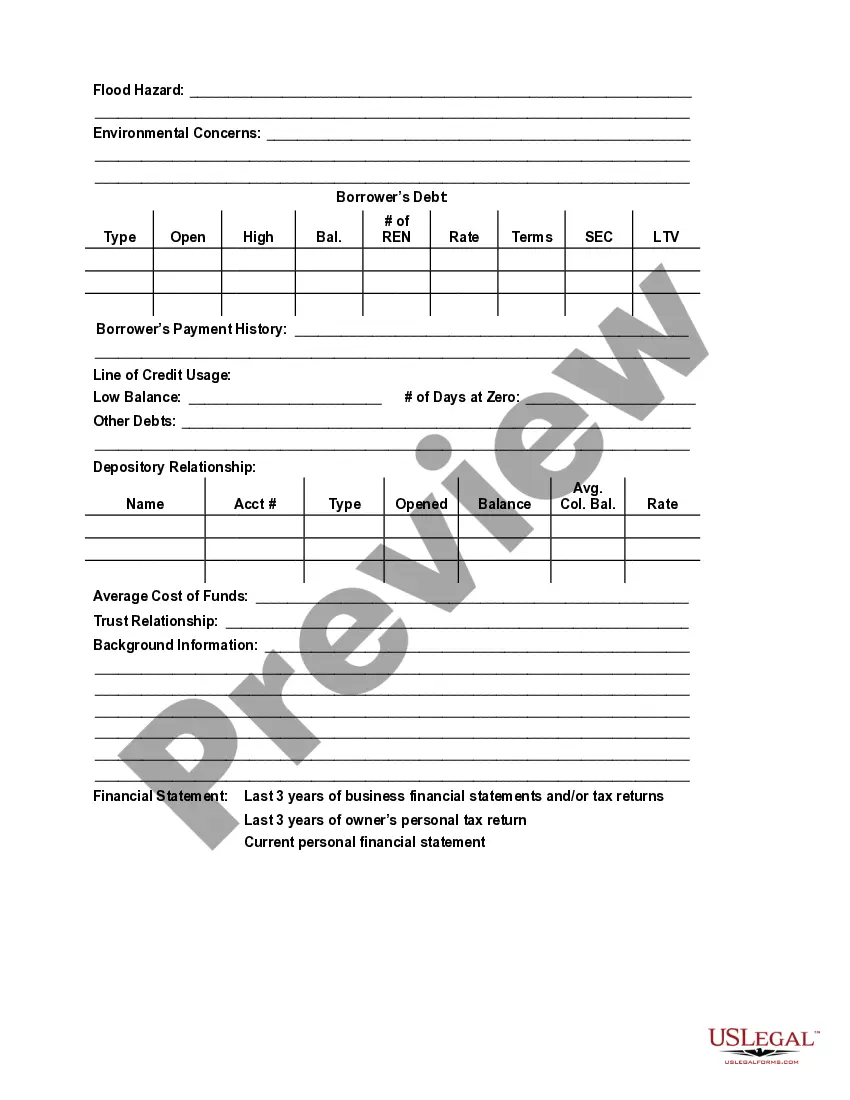

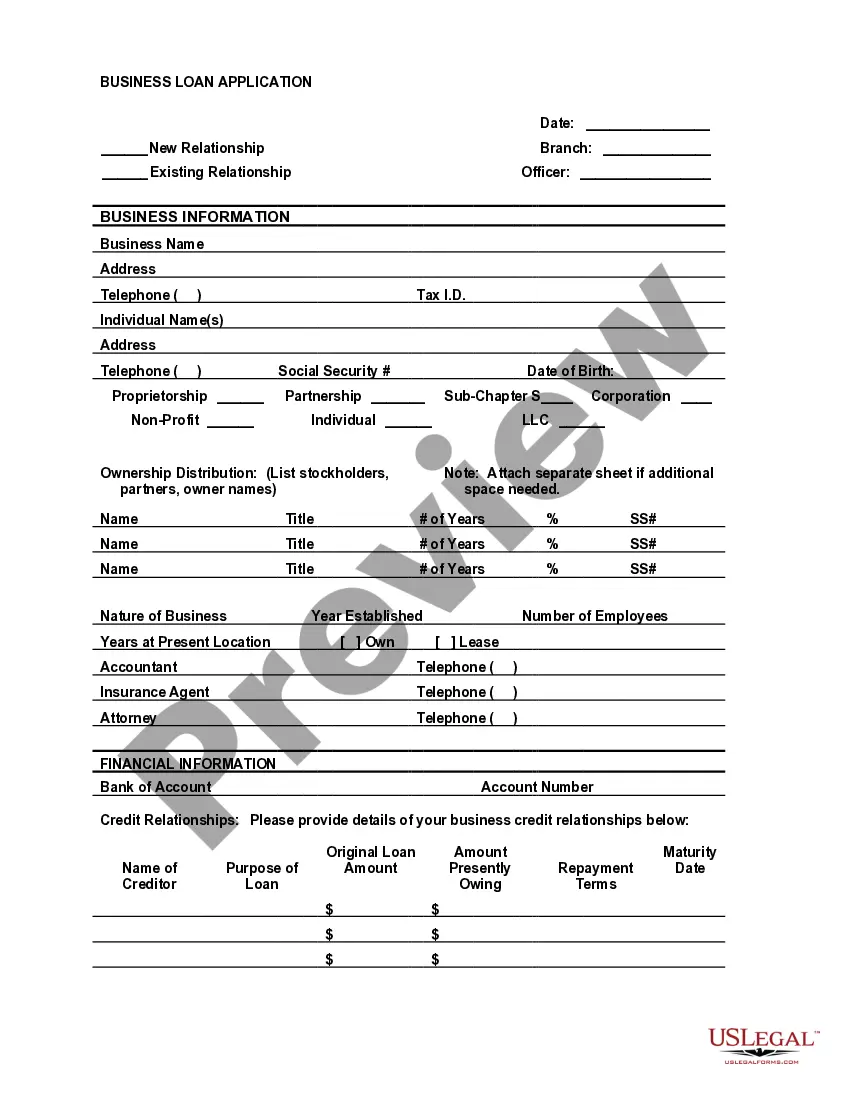

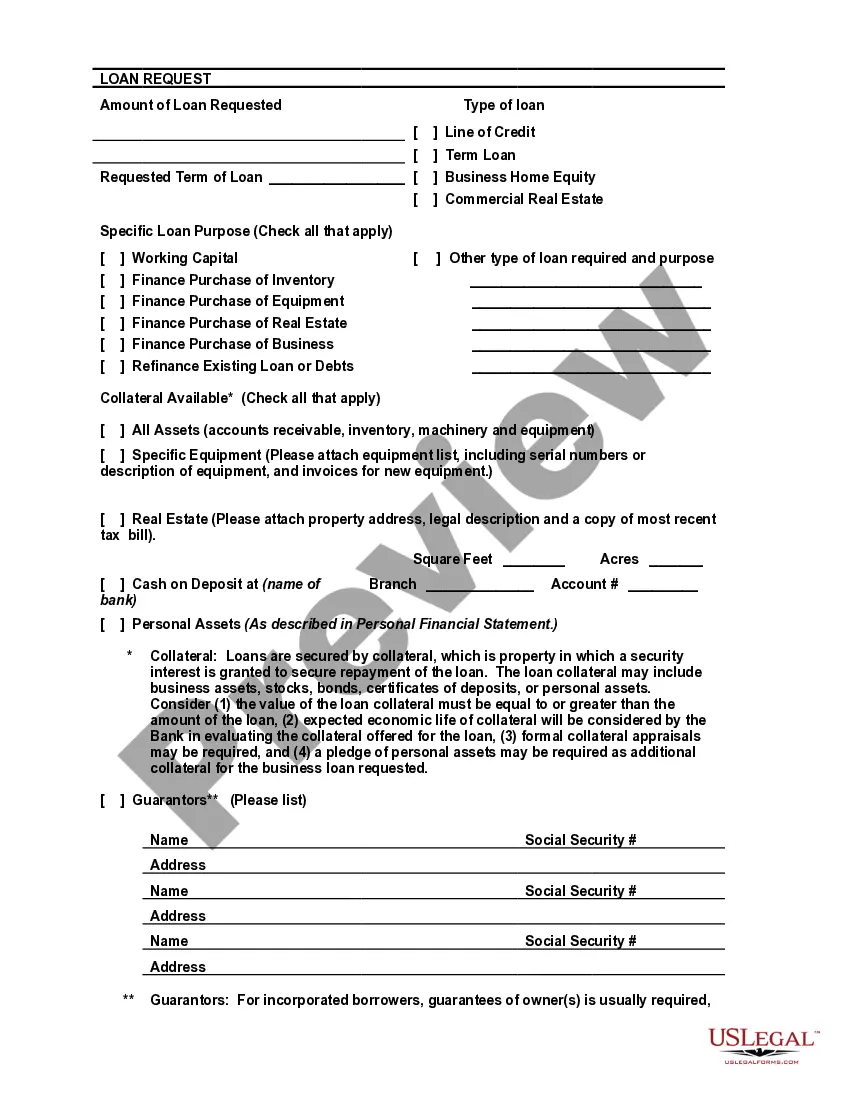

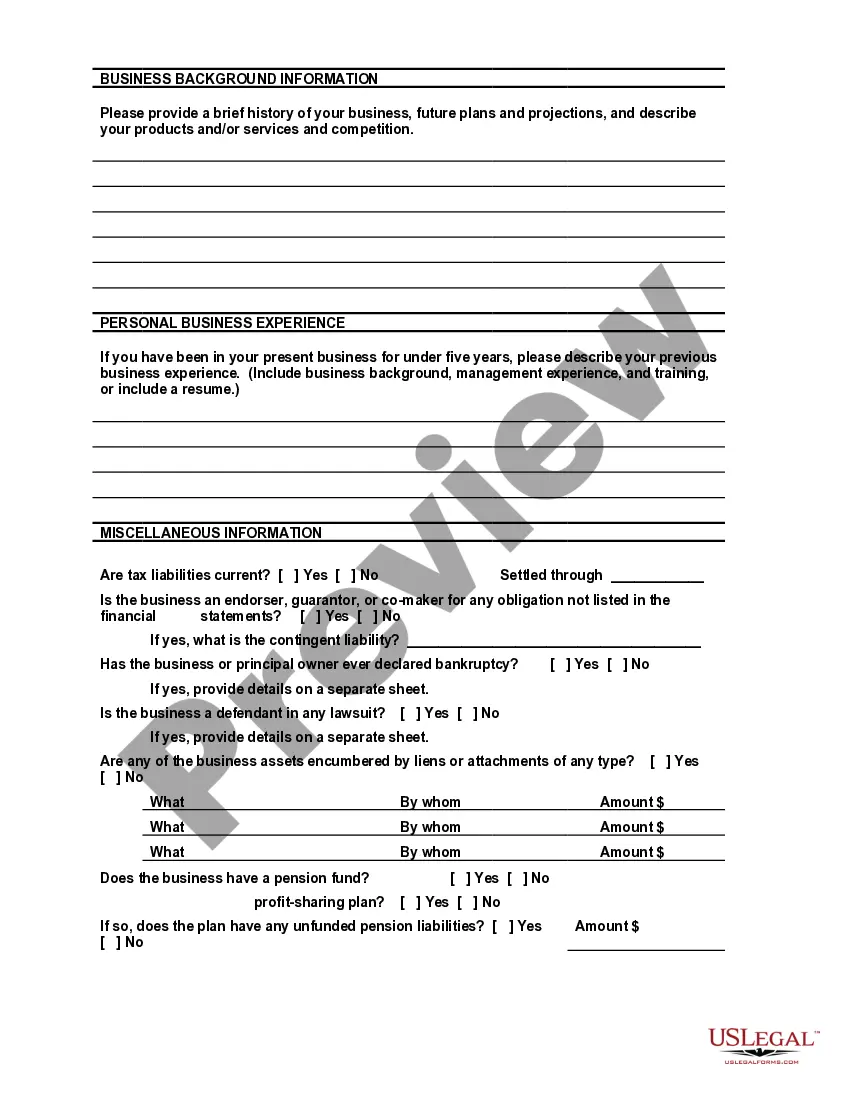

This document combines a representational bank loan application and the form used by a small community bank for an internal review of the application. Linking these two documents, may help you understand what information the bank wants from you as well as how the bank will use that information in making its decision on your business loan application.

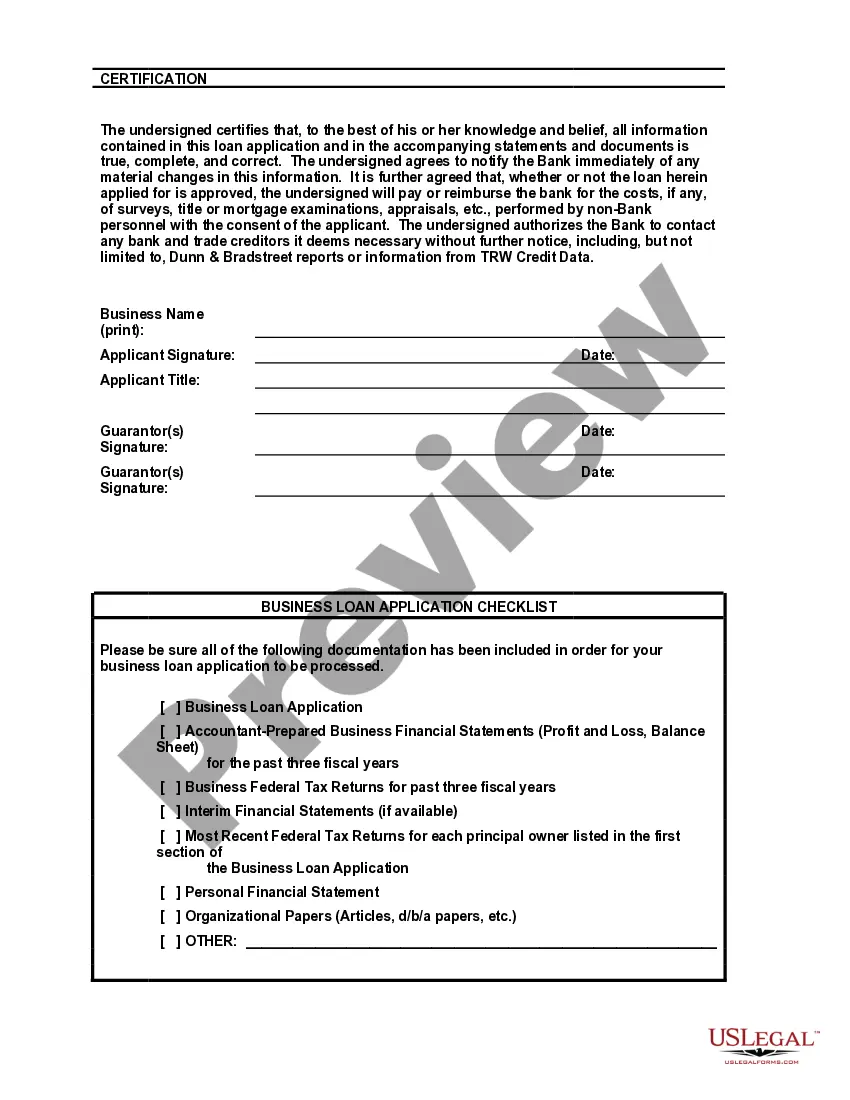

South Carolina Bank Loan Application Form and Checklist — Business Loan Are you a business owner in South Carolina looking to secure financing for your business? South Carolina Bank offers a simple and streamlined loan application process to help you achieve your financial goals. Our Bank Loan Application Form and Checklist for Business Loan are meticulously designed to ensure a hassle-free experience while applying for a loan. Our South Carolina Bank Loan Application Form for Business Loan is structured to gather all the necessary information about your business. The form includes sections such as personal and business details, loan purpose, financial statements, credit history, collateral, and more. By providing accurate and comprehensive information, you increase your chances of getting approved for a business loan. To make the application process even smoother, we have developed a detailed checklist that helps you organize and gather all the required documentation. Our checklist includes essential items such as: 1. Personal identification documents — Ensure you have a valid ID, driver's license, or passport ready. 2. Business registration documents — Provide copies of your business license, articles of incorporation, and any relevant permits. 3. Financial statements — Prepare your balance sheets, income statements, and cash flow statements for the past three years. 4. Tax returns — Submit your personal and business tax returns for the previous three years. 5. Bank statements — Gather your business bank statements to demonstrate your financial stability. 6. Business plan — Outline your business goals, marketing strategies, and financial projections to showcase your potential for success. 7. Collateral information — Identify and provide details about any assets you are willing to pledge as collateral for the loan. 8. Credit history — Collect your personal and business credit reports to assess your creditworthiness. By ensuring you have all the required documents listed in the checklist, you can avoid delays and speed up the loan application process. Our dedicated loan officers are always available to assist you and answer any questions you may have regarding the application and checklist. In addition to our standard business loan application form, we offer specialized loan programs tailored to specific business needs: 1. Startup Business Loan Application Form and Checklist — Designed for entrepreneurs initiating new business ventures, this application form focuses on evaluating the viability and potential of the business idea. 2. Expansion or Renovation Loan Application Form and Checklist — If you plan to expand your existing business or renovate your facilities, this application form helps assess the financial feasibility of your project. 3. Working Capital Loan Application Form and Checklist — For businesses in need of short-term financing to cover day-to-day operational expenses or seasonal fluctuations, this application form focuses on assessing cash flow and liquidity. Whatever your business loan requirements may be, South Carolina Bank is committed to providing you with the financial support you need. Our Bank Loan Application Form and Checklist for Business Loan ensure a smooth application process, increasing your chances of securing the funding necessary to take your business to new heights. Contact our loan department today to get started on your journey towards financial success.South Carolina Bank Loan Application Form and Checklist — Business Loan Are you a business owner in South Carolina looking to secure financing for your business? South Carolina Bank offers a simple and streamlined loan application process to help you achieve your financial goals. Our Bank Loan Application Form and Checklist for Business Loan are meticulously designed to ensure a hassle-free experience while applying for a loan. Our South Carolina Bank Loan Application Form for Business Loan is structured to gather all the necessary information about your business. The form includes sections such as personal and business details, loan purpose, financial statements, credit history, collateral, and more. By providing accurate and comprehensive information, you increase your chances of getting approved for a business loan. To make the application process even smoother, we have developed a detailed checklist that helps you organize and gather all the required documentation. Our checklist includes essential items such as: 1. Personal identification documents — Ensure you have a valid ID, driver's license, or passport ready. 2. Business registration documents — Provide copies of your business license, articles of incorporation, and any relevant permits. 3. Financial statements — Prepare your balance sheets, income statements, and cash flow statements for the past three years. 4. Tax returns — Submit your personal and business tax returns for the previous three years. 5. Bank statements — Gather your business bank statements to demonstrate your financial stability. 6. Business plan — Outline your business goals, marketing strategies, and financial projections to showcase your potential for success. 7. Collateral information — Identify and provide details about any assets you are willing to pledge as collateral for the loan. 8. Credit history — Collect your personal and business credit reports to assess your creditworthiness. By ensuring you have all the required documents listed in the checklist, you can avoid delays and speed up the loan application process. Our dedicated loan officers are always available to assist you and answer any questions you may have regarding the application and checklist. In addition to our standard business loan application form, we offer specialized loan programs tailored to specific business needs: 1. Startup Business Loan Application Form and Checklist — Designed for entrepreneurs initiating new business ventures, this application form focuses on evaluating the viability and potential of the business idea. 2. Expansion or Renovation Loan Application Form and Checklist — If you plan to expand your existing business or renovate your facilities, this application form helps assess the financial feasibility of your project. 3. Working Capital Loan Application Form and Checklist — For businesses in need of short-term financing to cover day-to-day operational expenses or seasonal fluctuations, this application form focuses on assessing cash flow and liquidity. Whatever your business loan requirements may be, South Carolina Bank is committed to providing you with the financial support you need. Our Bank Loan Application Form and Checklist for Business Loan ensure a smooth application process, increasing your chances of securing the funding necessary to take your business to new heights. Contact our loan department today to get started on your journey towards financial success.