Title: South Carolina Checklist — Action to Improve Collection of Accounts Introduction: The South Carolina Checklist — Action to Improve Collection of Accounts provides crucial guidelines and steps to enhance the process of account collection within the state of South Carolina. This comprehensive checklist aims to expedite and optimize the collection procedures, ensuring smooth financial transactions and adherence to legal requirements. Below, we will outline the various types of South Carolina Checklists related to the improvement of account collection processes. 1. South Carolina Checklist for Account Collection Process: This checklist outlines the primary actions and steps that should be followed to improve the collection of accounts within South Carolina. Key elements include: a. Gather Accurate Customer Information: Ensure proper customer information is collected and updated regularly. This involves verifying names, addresses, contact details, etc., to facilitate effective communication. b. Timely Invoicing and Statements: Promptly send invoices and account statements to customers, clearly outlining the due amounts, payment terms, and any additional charges or fees. c. Establishing an Efficient Collections Policy: Draft a comprehensive collections' policy that states the terms and conditions of payment, consequences of non-payment, escalation procedures, and compliance with relevant state and federal laws. d. Communication and Follow-Ups: Regularly communicate with customers to remind them of outstanding payments, notify them about upcoming dues, and address any concerns. Maintain a systematic follow-up schedule to ensure prompt payment while maintaining healthy customer relationships. e. Utilize Collection Agencies or Legal Assistance: Consider engaging professional collection agencies or legal support when necessary to recover overdue accounts. Ensure these agencies comply with South Carolina's collection laws and regulations. f. Document and Track Collection Efforts: Maintain accurate records of all communication with customers regarding payment collection attempts. This documentation serves as vital evidence if further legal action becomes necessary. g. Utilize Technology and Automation: Leverage appropriate accounting software or customer relationship management tools to automate invoice issuance, tracking, and payment reminders. This streamlines the entire account collection process while reducing errors and minimizing manual efforts. h. Compliance with Collection Laws: Familiarize yourself with South Carolina's collection laws and regulations, such as the Fair Debt Collection Practices Act, to ensure legal compliance throughout the entire collection process. 2. South Carolina Checklist for Small Business Account Collection: This checklist caters specifically to small businesses operating in South Carolina. It provides tailored action points and recommendations to help small businesses effectively manage their accounts receivable and improve their collection processes. 3. South Carolina Checklist for Government Agencies Account Collection: Designed for government agencies in South Carolina, this checklist outlines specific guidelines for optimizing the collection of outstanding accounts owed to government entities. It encompasses procedures that align with governmental regulations and fiscal requirements. Conclusion: The South Carolina Checklist — Action to Improve Collection of Accounts encompasses various types designed to meet the diverse needs of organizations and individuals operating in South Carolina. By following these comprehensive checklists, individuals and businesses can enhance their collection processes, minimize bad debts, and maintain financial stability. Remember to consult with legal professionals and stay updated on any changes to the relevant laws and regulations to ensure compliance.

South Carolina Checklist - Action to Improve Collection of Accounts

Description

How to fill out South Carolina Checklist - Action To Improve Collection Of Accounts?

If you need to complete, acquire, or printing legitimate file templates, use US Legal Forms, the most important selection of legitimate forms, which can be found online. Make use of the site`s simple and hassle-free lookup to obtain the papers you require. Numerous templates for business and individual reasons are sorted by types and suggests, or keywords and phrases. Use US Legal Forms to obtain the South Carolina Checklist - Action to Improve Collection of Accounts with a few mouse clicks.

In case you are previously a US Legal Forms client, log in to the profile and then click the Obtain key to find the South Carolina Checklist - Action to Improve Collection of Accounts. Also you can access forms you in the past delivered electronically within the My Forms tab of your own profile.

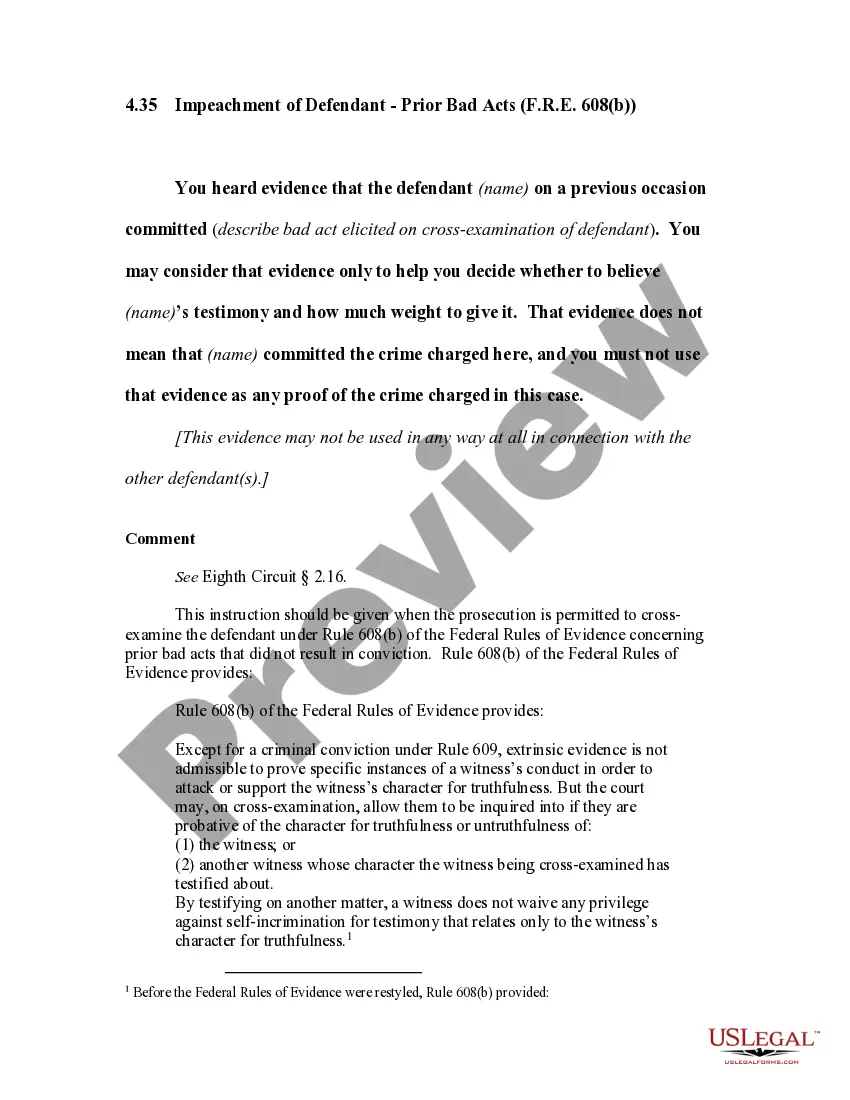

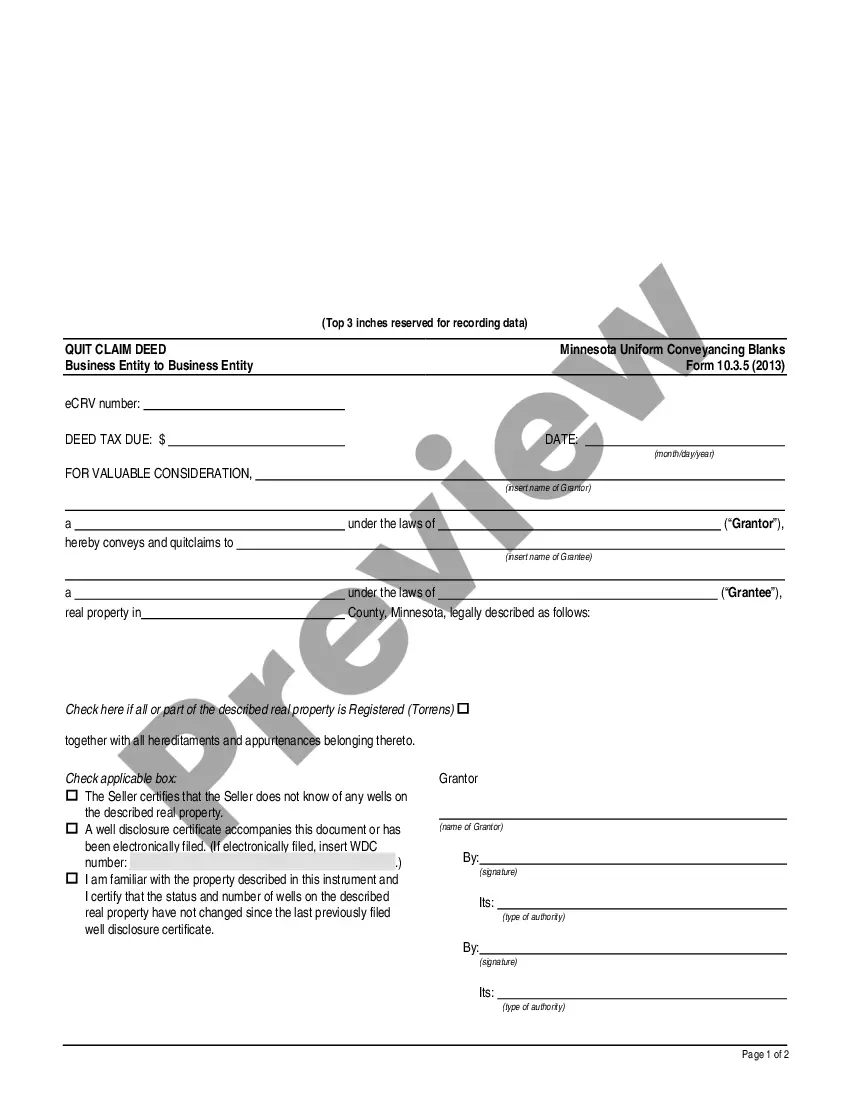

If you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Make sure you have selected the shape for the correct metropolis/region.

- Step 2. Make use of the Review option to look over the form`s content. Don`t forget about to learn the information.

- Step 3. In case you are not happy with all the type, take advantage of the Search industry towards the top of the display to locate other versions from the legitimate type design.

- Step 4. Once you have identified the shape you require, go through the Buy now key. Select the prices strategy you choose and add your qualifications to register for the profile.

- Step 5. Process the financial transaction. You can utilize your bank card or PayPal profile to complete the financial transaction.

- Step 6. Pick the format from the legitimate type and acquire it on the product.

- Step 7. Full, revise and printing or indicator the South Carolina Checklist - Action to Improve Collection of Accounts.

Every single legitimate file design you get is your own permanently. You possess acces to every single type you delivered electronically in your acccount. Select the My Forms segment and decide on a type to printing or acquire once more.

Remain competitive and acquire, and printing the South Carolina Checklist - Action to Improve Collection of Accounts with US Legal Forms. There are thousands of skilled and condition-certain forms you may use to your business or individual requires.