Title: The Ultimate South Carolina Business Deductions Checklist — Understand Its Benefits and Various Types Introduction: The South Carolina Business Deductions Checklist serves as a vital tool for businesses to streamline their tax-related expenses and maximize deductions. This comprehensive guide details the importance, benefits, and various types of South Carolina Business Deductions Checklists. --- Importance of South Carolina Business Deductions Checklist: 1. Efficient Expense Management: The checklist helps businesses track, categorize, and document eligible expenses, ensuring accurate reporting and maximizing deductions. 2. Minimizing Tax Liability: By identifying qualified deductions, businesses can minimize their state tax liabilities and effectively increase their bottom line. 3. Compliance with State Laws: South Carolina Business Deductions Checklist enables businesses to adhere to the state's tax laws, regulations, and requirements, reducing the risk of penalties or audits. --- Key Elements in a South Carolina Business Deductions Checklist: 1. Employee-Related Expenses: — Wages and Salaries: Track employee payments, bonuses, commissions, and benefits. — Insurance Premiums: Document expenses related to employee health, life, or workers' compensation insurance. — Retirement Contributions: Identify contributions made towards employee retirement plans. 2. Business Operating Expenses: — Advertising and Marketing: Record advertising, promotion, and marketing expenses. — Rent and Utilities: Document rental expenses and utilities associated with business premises. — Office Supplies: Track expenses related to stationery, equipment, software, internet, and other necessary supplies. 3. Travel and Transportation Expenses: — Vehicle-related Deductions: Track mileage, fuel, parking, and maintenance expenses for business-related journeys. — Lodging and Meals: Document expenses for overnight business trips, including hotel stays and meals incurred while conducting business. 4. Professional Services: — Accounting and Legal Expenses: Include professional fees paid to accountants, tax preparers, attorneys, and advisors. — Consulting or Outsourcing: Document fees paid for outsourced services or consulting for business improvement. --- Types of South Carolina Business Deductions Checklists: 1. General South Carolina Business Deductions Checklist: This type of checklist covers a wide range of common business deductions applicable to most industries operating in South Carolina, focusing on the key expense categories. 2. Industry-Specific South Carolina Business Deductions Checklists: These checklists cater to specific industries, such as healthcare, real estate, construction, or technology. They provide sector-specific insights and important deductions unique to the industry. 3. Start-up Business Deductions Checklist: Designed for newly established businesses, this checklist highlights deductions specifically relevant to start-ups, including organizing costs, research expenses, and costs related to acquiring new equipment or technology. Conclusion: The South Carolina Business Deductions Checklist is an invaluable resource for businesses operating in the state. By maintaining a comprehensive checklist and ensuring meticulous documentation, businesses can optimize deductions, minimize their tax liability, and stay compliant with state tax laws. Whether using a general checklist or exploring industry-specific options, businesses can efficiently manage their expenses, ultimately bolstering their financial health.

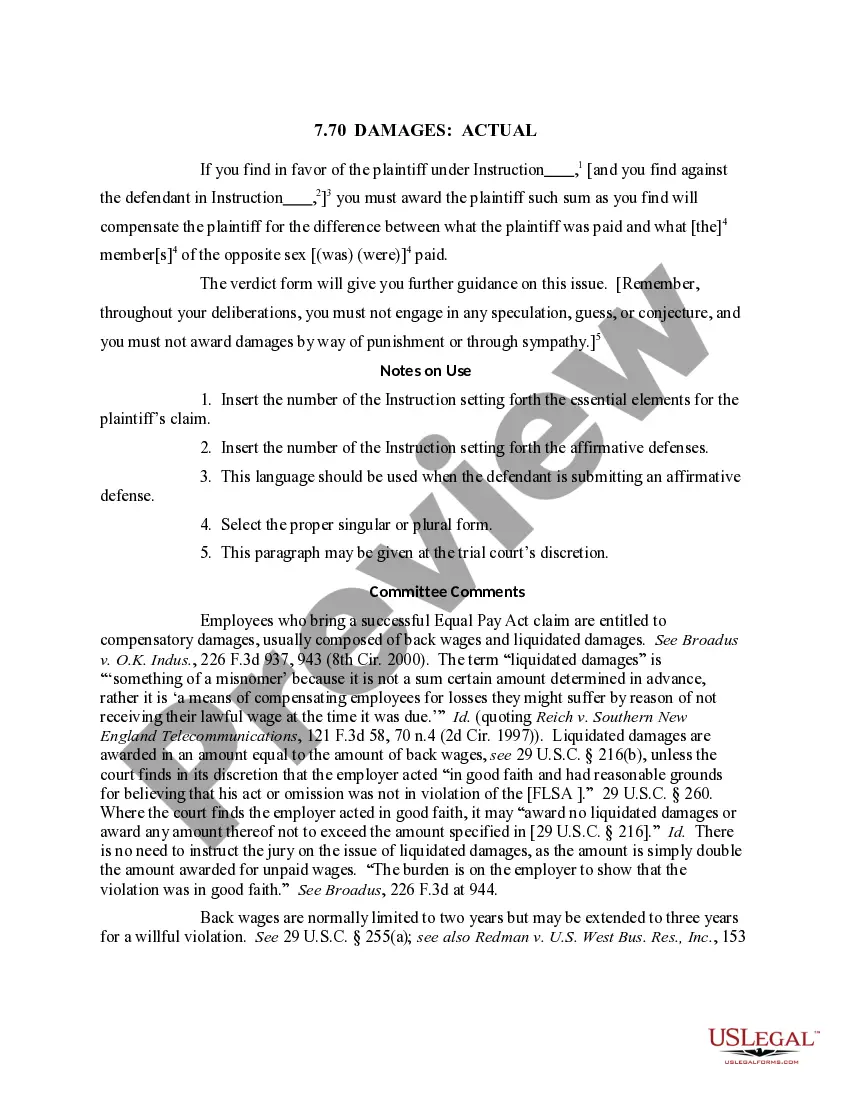

South Carolina Business Deductions Checklist

Description

How to fill out South Carolina Business Deductions Checklist?

Choosing the best legitimate papers design can be a have a problem. Needless to say, there are plenty of themes available online, but how can you discover the legitimate develop you want? Use the US Legal Forms site. The support provides a large number of themes, for example the South Carolina Business Deductions Checklist, which you can use for organization and private requires. All the kinds are checked out by experts and satisfy state and federal specifications.

When you are presently listed, log in for your bank account and click the Acquire button to get the South Carolina Business Deductions Checklist. Utilize your bank account to look with the legitimate kinds you have acquired in the past. Go to the My Forms tab of your own bank account and obtain another backup of the papers you want.

When you are a whole new user of US Legal Forms, here are easy recommendations so that you can stick to:

- Initial, be sure you have chosen the right develop for your personal metropolis/county. You can look over the shape while using Preview button and look at the shape explanation to make sure it will be the right one for you.

- If the develop is not going to satisfy your expectations, utilize the Seach field to find the correct develop.

- When you are sure that the shape is acceptable, select the Acquire now button to get the develop.

- Select the rates strategy you would like and enter the necessary info. Design your bank account and pay money for an order with your PayPal bank account or credit card.

- Opt for the document formatting and down load the legitimate papers design for your device.

- Complete, revise and produce and sign the acquired South Carolina Business Deductions Checklist.

US Legal Forms is definitely the biggest catalogue of legitimate kinds where you can see different papers themes. Use the company to down load skillfully-produced paperwork that stick to status specifications.