South Carolina Sample Term Sheet with Explanatory Annotations

Description

Term sheets are very similar to "letters of intent" (LOI) in that they are both preliminary, mostly non-binding documents meant to record two or more parties' intentions to enter into a future agreement based on specified (but incomplete or preliminary) terms. The difference between the two is slight and mostly a matter of style: an LOI is typically written in letter form and focuses on the parties' intentions; a term sheet skips most of the formalities and lists deal terms in bullet-point or similar format. There is an implication that an LOI only refers to the final form. A term sheet may be a proposal, not an agreed-to document.

How to fill out Sample Term Sheet With Explanatory Annotations?

If you desire to finalize, download, or print legitimate document templates, utilize US Legal Forms, the foremost collection of legal forms available online.

Utilize the site's straightforward and convenient search feature to find the documents you require.

Numerous templates for business and personal purposes are categorized by types and regions or keywords. Use US Legal Forms to locate the South Carolina Sample Term Sheet with Explanatory Annotations in just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every document you saved in your account. Click on the My documents section and choose a document to print or download again.

Complete and download, and print the South Carolina Sample Term Sheet with Explanatory Annotations with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal requirements.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to get the South Carolina Sample Term Sheet with Explanatory Annotations.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

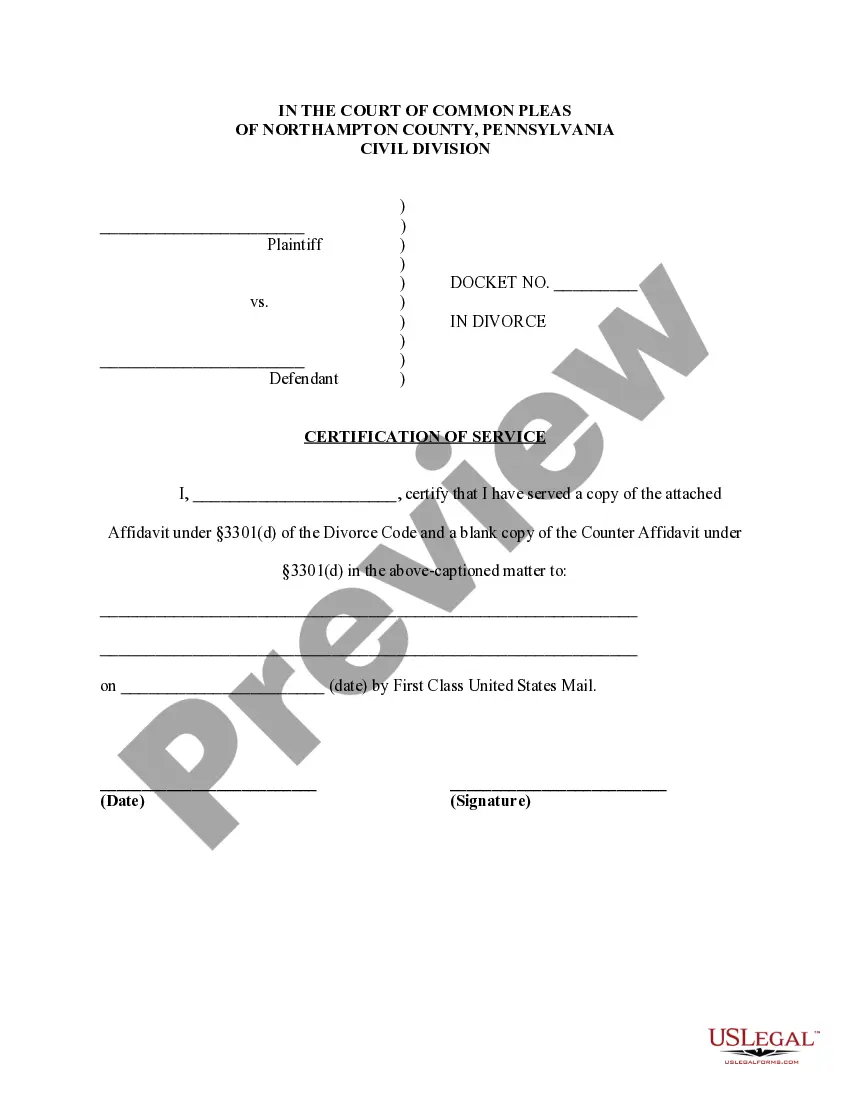

- Step 2. Utilize the Review option to examine the form’s content. Remember to read the details.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find alternative versions of the legal document format.

- Step 4. Once you have found the form you need, click on the Purchase now button. Choose the pricing plan you prefer and provide your details to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the South Carolina Sample Term Sheet with Explanatory Annotations.

Form popularity

FAQ

Key terms in a VC term sheet typically encompass investment valuation, ownership percentage, liquidation preferences, and voting rights. These terms are crucial for defining the relationship between investors and founders. Accessing a South Carolina Sample Term Sheet with Explanatory Annotations can give you valuable insight into these key terms.

Analyzing a term sheet involves carefully reviewing every section to ensure clarity and alignment with strategic goals. Focus on understanding financial terms, governance rights, and exit strategies. Utilizing a South Carolina Sample Term Sheet with Explanatory Annotations can provide a framework to help guide your analysis.

A key terms sheet summarizes the most critical components of a transaction in a concise format. It serves as an overview to help parties focus on main points without diving into full-fledged contracts. A South Carolina Sample Term Sheet with Explanatory Annotations can help you understand how to effectively compile these key terms.

Important aspects of a term sheet include clear definitions of financial terms, the responsibilities of each party, and the conditions for fulfilling the agreement. A well-crafted term sheet can serve as a foundational document for successful negotiations. For clarity and effectiveness, consider using a South Carolina Sample Term Sheet with Explanatory Annotations to guide your drafting.

Standard clauses of a term sheet include essential elements like confidentiality, exclusivity, and termination clauses. These clauses ensure parties understand their obligations and protect sensitive information during negotiations. You can refer to a South Carolina Sample Term Sheet with Explanatory Annotations for examples of how these clauses are typically drafted.

A term sheet generally comes before due diligence (DD) but is contingent upon the completion of DD. It outlines the fundamental terms while allowing the involved parties to investigate further into the opportunity. To understand this relationship better, reviewing a South Carolina Sample Term Sheet with Explanatory Annotations can highlight how the two processes interact.

Key clauses of a term sheet often include representations and warranties, covenants, and rights related to governance. Other significant clauses may cover non-compete agreements and dispute resolution processes. For detailed insights into these clauses, consider examining a South Carolina Sample Term Sheet with Explanatory Annotations to see how they are typically constructed.

The structure of a VC term sheet usually follows a standard outline that includes sections for investment details, valuation, and rights of investors. It often covers provisions related to exit plans, liquidation preferences, and conversion rights. By reviewing a South Carolina Sample Term Sheet with Explanatory Annotations, you can grasp the logical flow and arrangement of these critical elements.

A comprehensive term sheet should include information about the transaction type, financing terms, and the responsibilities of involved parties. It is also crucial to incorporate clauses regarding confidentiality, exclusivity, and timelines. Referencing a South Carolina Sample Term Sheet with Explanatory Annotations can help you ensure that all necessary elements are included.

A term sheet typically includes essential elements such as the parties involved, financial terms, and conditions of the agreement. Key components often involve valuation, investment amounts, equity distribution, and any rights or obligations of each party. Utilizing a South Carolina Sample Term Sheet with Explanatory Annotations can provide you with context and clarity on these essential components.