South Carolina Prenuptial Property Agreement

Description

How to fill out Prenuptial Property Agreement?

Are you in a position in which you need files for possibly enterprise or specific reasons almost every day? There are tons of legitimate document themes available online, but finding versions you can trust is not simple. US Legal Forms gives 1000s of type themes, much like the South Carolina Prenuptial Property Agreement, that are published to fulfill federal and state needs.

In case you are currently acquainted with US Legal Forms site and possess a free account, simply log in. Next, you may down load the South Carolina Prenuptial Property Agreement template.

Should you not have an account and want to start using US Legal Forms, adopt these measures:

- Obtain the type you want and ensure it is for your appropriate town/region.

- Take advantage of the Preview option to review the form.

- See the description to actually have selected the right type.

- In the event the type is not what you`re trying to find, make use of the Look for industry to find the type that meets your requirements and needs.

- If you discover the appropriate type, just click Get now.

- Select the prices strategy you want, fill out the required details to create your account, and purchase an order using your PayPal or bank card.

- Select a practical file file format and down load your version.

Get all the document themes you possess bought in the My Forms food selection. You can obtain a further version of South Carolina Prenuptial Property Agreement anytime, if needed. Just select the required type to down load or print the document template.

Use US Legal Forms, the most comprehensive variety of legitimate kinds, to save efforts and stay away from faults. The service gives skillfully made legitimate document themes which can be used for a variety of reasons. Produce a free account on US Legal Forms and initiate generating your way of life easier.

Form popularity

FAQ

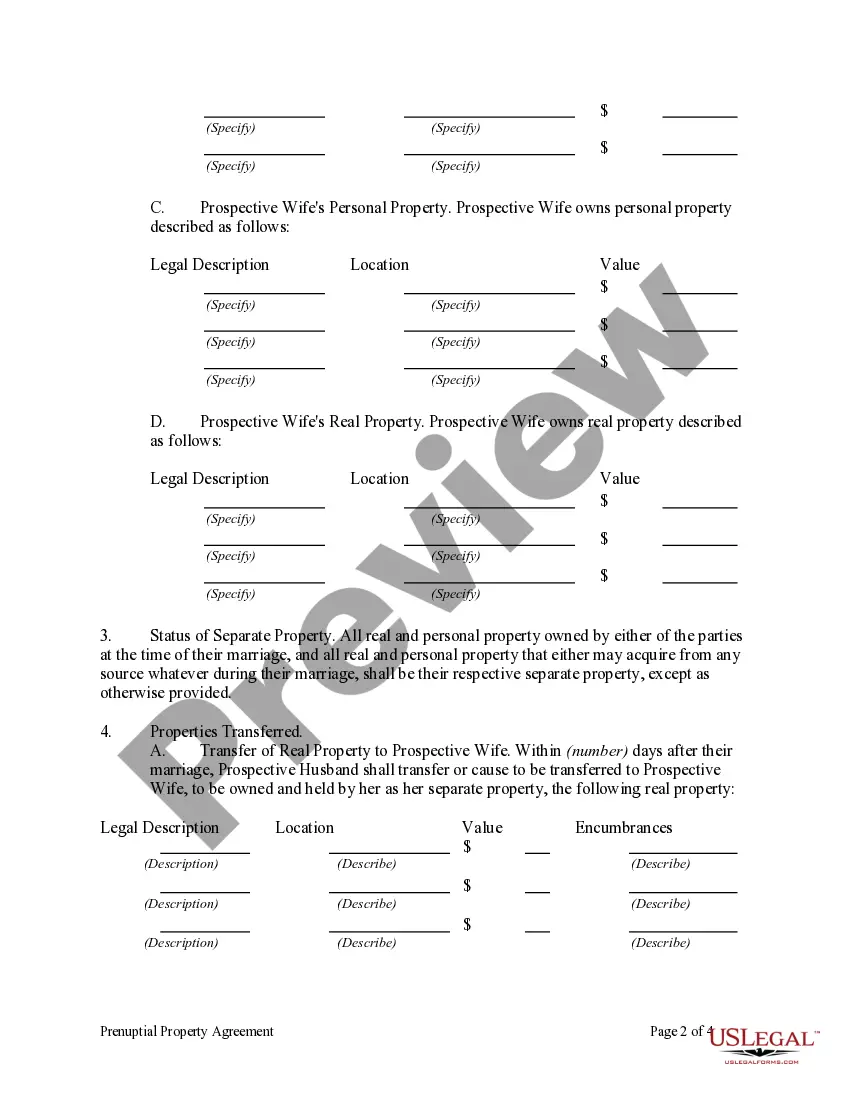

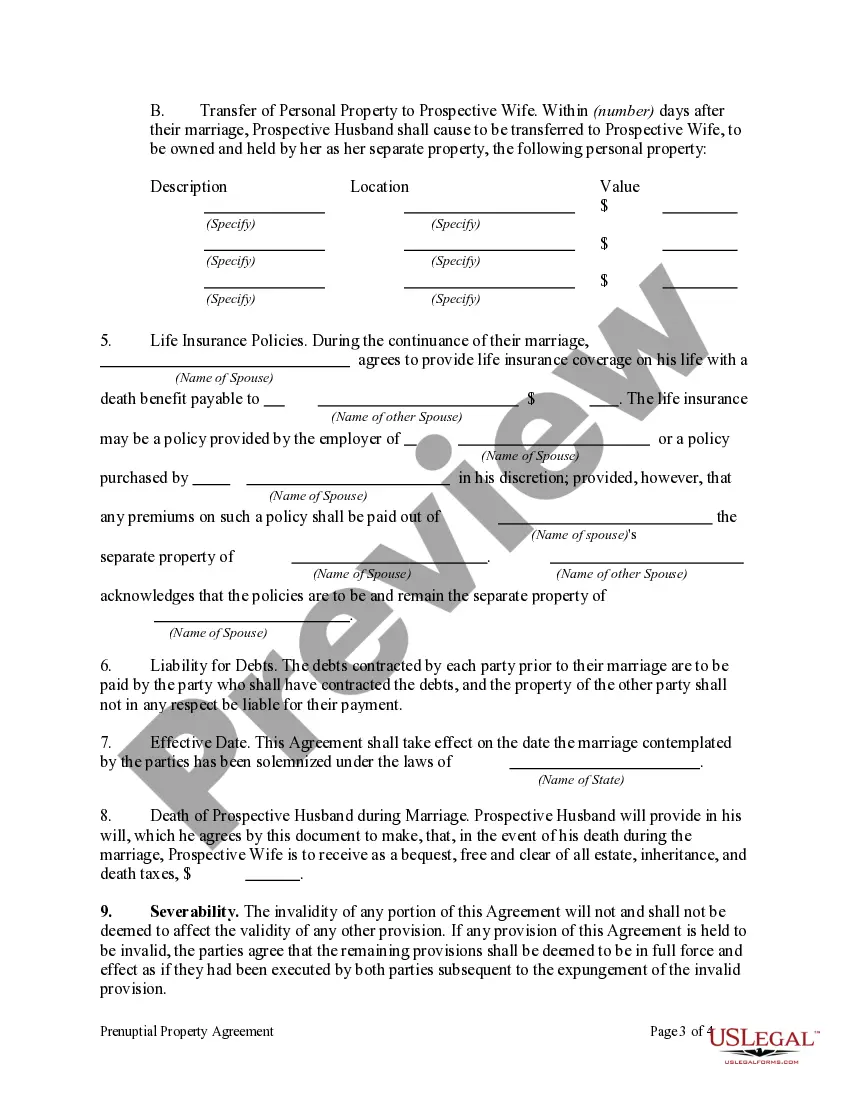

South Carolina Antenuptial Agreement Statute and Case Law The prenup must be in writing. The terms must be fair and equitable. The terms must be lawful or immoral. The terms must be financial in nature (not relating to personal business, such as weight gain or in-laws)

What is Non-Marital Property in South Carolina? Property acquired before the marriage is generally considered non-marital property, subject to exceptions as discussed below.

How Does a Couple Enter an Enforceable Prenup? South Carolina courts will generally uphold a prenuptial agreement if both parties execute it knowingly and voluntarily. Both parties should be represented and advised by independent legal counsel to understand the agreement they are signing.

A prenuptial agreement is a contract, and it needs to be fair under the circumstances. South Carolina law holds that a prenuptial agreement will be presumed to be equitable if both parties entering into it are represented by separate independent counsel and both parties make full and complete financial disclosures.

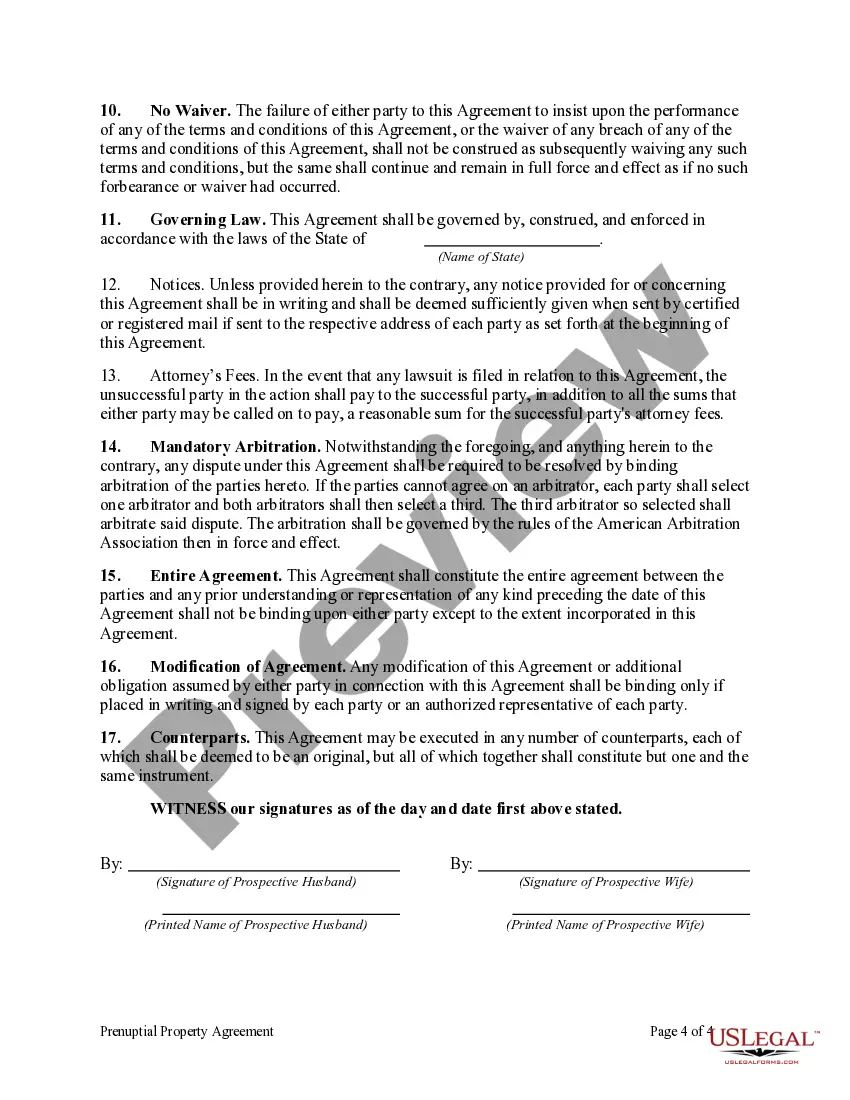

No, South Carolina isn't a community property state. Marital property is divided by the court in an equitable manner as described above. Dower and curtesy are common law legal concepts that have generally been abolished in the U.S. today.

While all 50 states recognize prenups, they may have different rules. For example, some states have their own sunset provision laws that phase out or end a prenuptial agreement after a certain period of time or life event, such as a child's birth.

South Carolina courts will generally uphold a prenuptial agreement if both parties execute it knowingly and voluntarily. Both parties should be represented and advised by independent legal counsel to understand the agreement they are signing.

South Carolina courts will generally uphold a postnuptial agreement if both parties execute it knowingly and voluntarily.