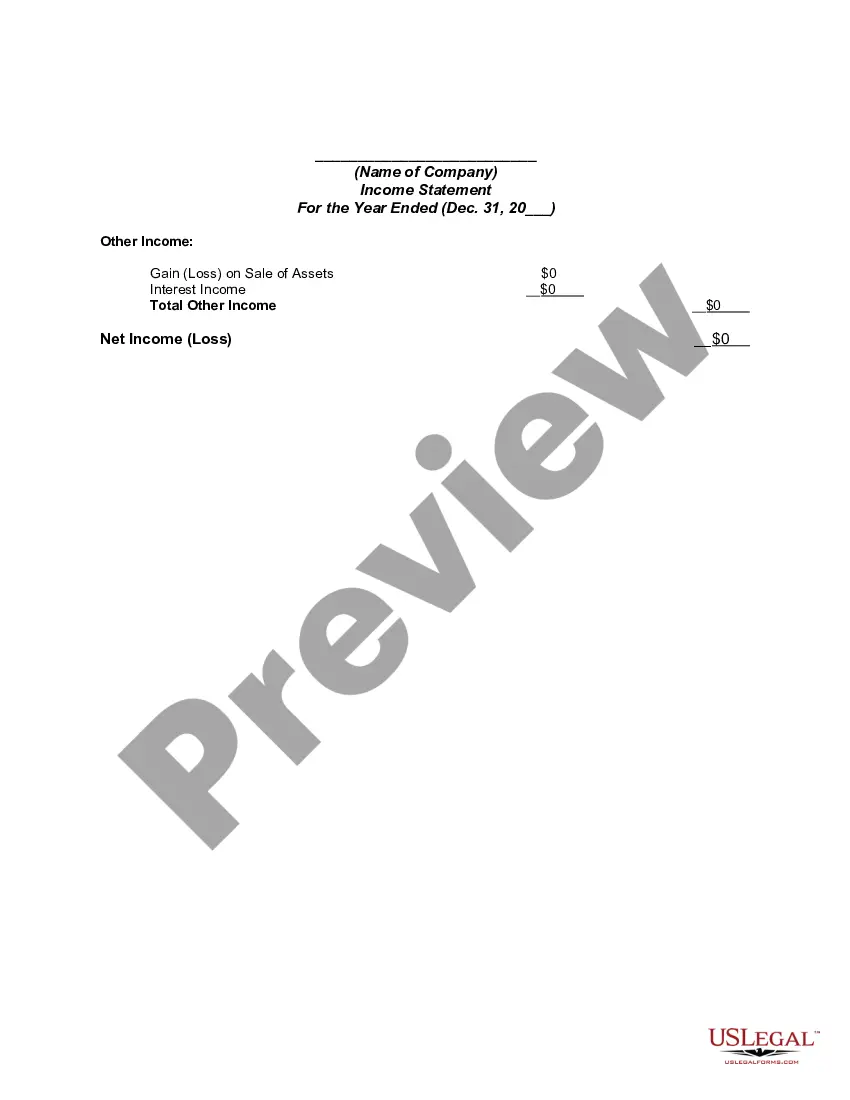

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

South Carolina Income Statement

Description

How to fill out Income Statement?

Finding the correct official document format can be a challenge. Of course, there are numerous templates accessible online, but how can you acquire the official form you require.

Utilize the US Legal Forms website. The service offers a vast array of templates, including the South Carolina Income Statement, which can be utilized for both business and personal purposes.

All forms are verified by experts and conform to state and federal regulations.

If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are certain that the form is suitable, click the Get now button to download the form. Select the pricing plan you prefer and enter the required information. Create your account and complete your purchase using your PayPal account or credit card. Choose the file format and download the official document format to your device. Complete, modify, print, and sign the downloaded South Carolina Income Statement. US Legal Forms is the largest repository of official forms where you can find various document templates. Utilize the service to download professionally crafted documents that conform to state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the South Carolina Income Statement.

- Use your account to search for the official forms you may have purchased previously.

- Navigate to the My documents tab in your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions you can follow.

- First, ensure you have selected the correct form for your city/state.

- You can browse the form using the Preview button and review the form description to ensure this is the right one for you.

Form popularity

FAQ

Filing an annual report in South Carolina is necessary for many business entities to maintain good standing. This requirement helps ensure that your business remains compliant with state laws. Consider using UsLegalForms to streamline filing your annual report and managing your South Carolina Income Statement.

Yes, if you operate a corporation or an LLC in South Carolina, you typically need to file annual reports. These reports inform the state of your business’s status and activities. Using resources from UsLegalForms can simplify the process and ensure your South Carolina Income Statement is prepared correctly.

To file an income tax statement in South Carolina, gather your financial documents and use the appropriate forms available from the South Carolina Department of Revenue. You can file electronically or by mail. This process will help you accurately complete your South Carolina Income Statement and fulfill your tax obligations.

Several states do not require an annual report, but the rules can vary widely. States like Nevada and Delaware have specific guidelines that exempt some businesses. It’s crucial to check your state’s regulations and ensure your South Carolina Income Statement complies with local standards.

In South Carolina, some businesses must file an annual report to remain in good standing. This requirement primarily applies to corporations and certain LLCs. By filing an annual report, you keep your South Carolina Income Statement and business status updated in the eyes of the law.

You will mail your South Carolina income tax return to the South Carolina Department of Revenue. The address varies based on whether you are expecting a refund or are sending a payment. Always refer to the latest guidelines to ensure your South Carolina Income Statement reaches the correct location.

Yes, you must file a state income tax return if you reside or earn income in South Carolina. This requirement applies unless your income falls below the state’s minimum threshold for tax liability. Remember, submitting your South Carolina Income Statement accurately helps you avoid penalties and ensures compliance.

Yes, South Carolina requires businesses to file an annual report. This report summarizes the company's financial performance, including the income statement. U.S. Legal Forms offers valuable templates and advice to help you prepare your South Carolina income statement and annual report accurately.

You can find a company's income statement through various financial reporting sites or by directly visiting the company’s investor relations page. Additionally, for public records in South Carolina, U.S. Legal Forms can assist you in obtaining necessary business income statements swiftly and efficiently.

Currently, South Carolina has not announced any plans to eliminate state income tax. However, discussions around taxation are ongoing, so it's crucial to stay informed. Utilizing resources like U.S. Legal Forms can help you understand how state policies affect your South Carolina income statement and tax obligations.