South Carolina Sample Letter for Letter Requesting Extension to File Business Tax Forms

Description

How to fill out Sample Letter For Letter Requesting Extension To File Business Tax Forms?

Have you ever been in a situation where you need documents for either organizational tasks or specific purposes almost every day.

There are numerous legal document templates accessible online, but obtaining versions you can depend on isn't easy.

US Legal Forms offers thousands of form templates, including the South Carolina Sample Letter for Letter Requesting Extension to File Business Tax Forms, designed to fulfill state and federal requirements.

Once you find the correct form, simply click Acquire now.

Select the pricing plan you desire, fill in the required information to create your account, and pay for your order using your PayPal or credit card. Choose a convenient document format and download your copy. Access all the form templates you have purchased in the My documents section. You can download an additional copy of the South Carolina Sample Letter for Letter Requesting Extension to File Business Tax Forms at any time if needed. Just click the necessary form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Carolina Sample Letter for Letter Requesting Extension to File Business Tax Forms template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

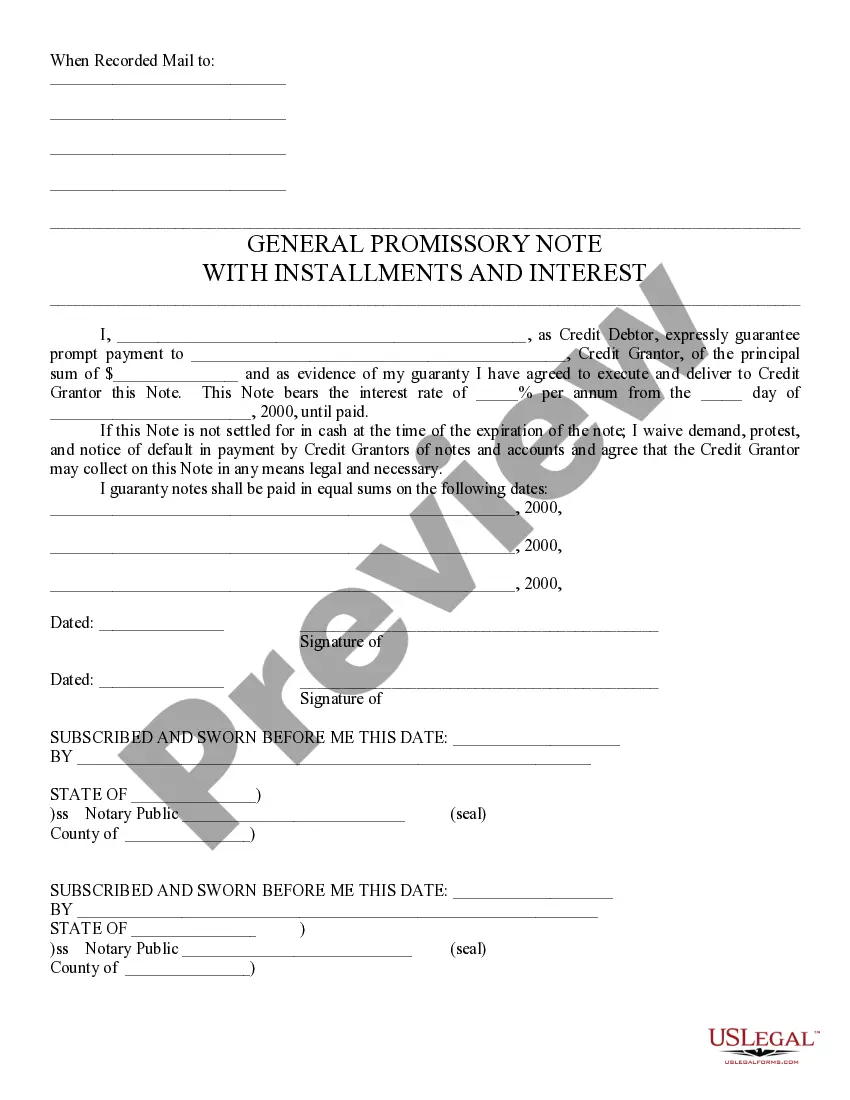

- Use the Preview option to inspect the document.

- Review the description to be sure you have selected the right form.

- If the form isn't what you're after, utilize the Search field to locate the form that meets your needs.

Form popularity

FAQ

Yes, South Carolina does accept federal extensions for corporations. However, corporations must still file their South Carolina state tax returns by the extended deadline, even if they have received a federal extension. Using a South Carolina Sample Letter for Letter Requesting Extension to File Business Tax Forms can help you communicate the request effectively. Always ensure that you check the specific requirements and follow the guidelines to avoid any issues.

While a Federal tax extension can provide additional time to file federal returns, it does not automatically extend state filing deadlines. South Carolina requires its businesses to request a separate extension using a designated form. Including a South Carolina Sample Letter for Letter Requesting Extension to File Business Tax Forms with your application helps ensure you meet state requirements. Consult US Legal Forms for additional guidance on ensuring compliance.

Yes, the IRS extension applies to corporations, granting them extra time to submit their federal tax returns. Corporations must file their extension requests on time to avoid any potential penalties. For those needing a South Carolina Sample Letter for Letter Requesting Extension to File Business Tax Forms, resources at US Legal Forms can help streamline this process. It’s crucial to understand both federal and state provisions for a smooth filing experience.

In South Carolina, the tax extension form allows businesses to request additional time to file their tax returns. This state-specific form must be filled out and submitted with a proper South Carolina Sample Letter for Letter Requesting Extension to File Business Tax Forms. Using this form ensures that taxpayers avoid penalties for late submissions. You can find the necessary resources to help you navigate this process at US Legal Forms.

Yes, South Carolina generally follows federal guidelines regarding extensions for corporations. Businesses can use the same extension periods as the IRS, which allows them to file their federal return later than the original due date. However, it is essential to submit the required South Carolina Sample Letter for Letter Requesting Extension to File Business Tax Forms to ensure compliance with state regulations. For tailored assistance, consider utilizing US Legal Forms.

Yes, South Carolina does accept the federal extension for corporations; however, it's crucial to file the appropriate state extension form, SC4868, to ensure compliance. By submitting this form, corporations can receive additional time to file their state business tax returns. For assistance, refer to the South Carolina Sample Letter for Letter Requesting Extension to File Business Tax Forms, which can help you navigate the requirements.

You can obtain a tax extension form from your state’s revenue department website or the IRS website, where Form 4868 is available for download. If you prefer to file directly online, many states, including South Carolina, allow you to submit your extension electronically. Using the South Carolina Sample Letter for Letter Requesting Extension to File Business Tax Forms can simplify the process if you're unsure what to include in your submission.

The IRS does not provide a physical letter as proof of your tax extension. Instead, once you file Form 4868, your extension is automatically granted, and you can verify it through the IRS website. To stay organized, consider utilizing the South Carolina Sample Letter for Letter Requesting Extension to File Business Tax Forms as a template to track your communications.

To get a tax extension letter, start by completing the relevant extension form, such as Form 4868 for federal taxes or SC4868 for South Carolina taxes. After submitting your request, it's important to keep a copy for your records. If you're unsure about the process, the South Carolina Sample Letter for Letter Requesting Extension to File Business Tax Forms can guide you in formatting your request properly.

To obtain a letter of extension from the IRS, you should file Form 4868 before the tax deadline, which grants you an automatic six-month extension. After processing, the IRS will not send a letter, but you can verify your extension status online. Utilizing the South Carolina Sample Letter for Letter Requesting Extension to File Business Tax Forms can assist you in drafting a formal request if needed.