South Carolina Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage

Description

How to fill out Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage?

Are you presently in the position that you require papers for either organization or personal functions almost every time? There are a lot of legal record templates accessible on the Internet, but discovering versions you can depend on is not effortless. US Legal Forms provides a large number of kind templates, such as the South Carolina Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage, which can be published to satisfy federal and state requirements.

If you are currently acquainted with US Legal Forms website and also have a free account, basically log in. Next, you can acquire the South Carolina Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage design.

If you do not offer an account and wish to begin using US Legal Forms, follow these steps:

- Obtain the kind you need and make sure it is for that appropriate city/region.

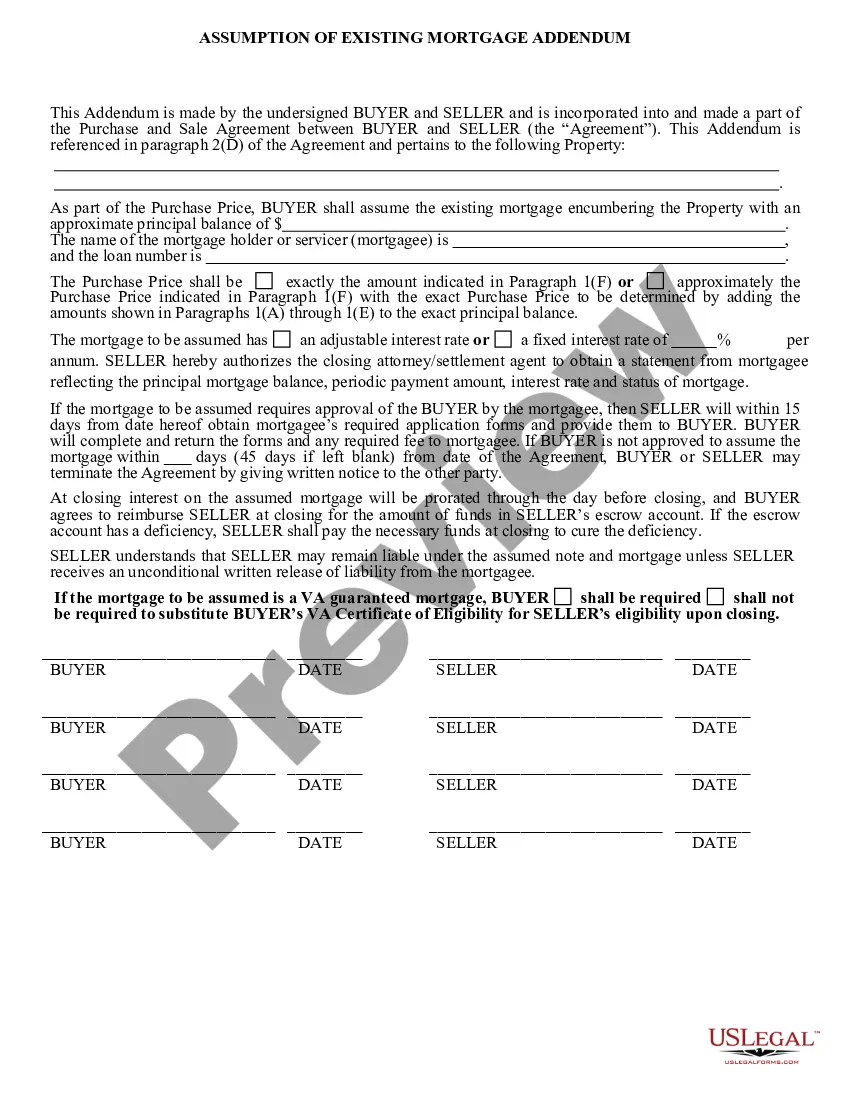

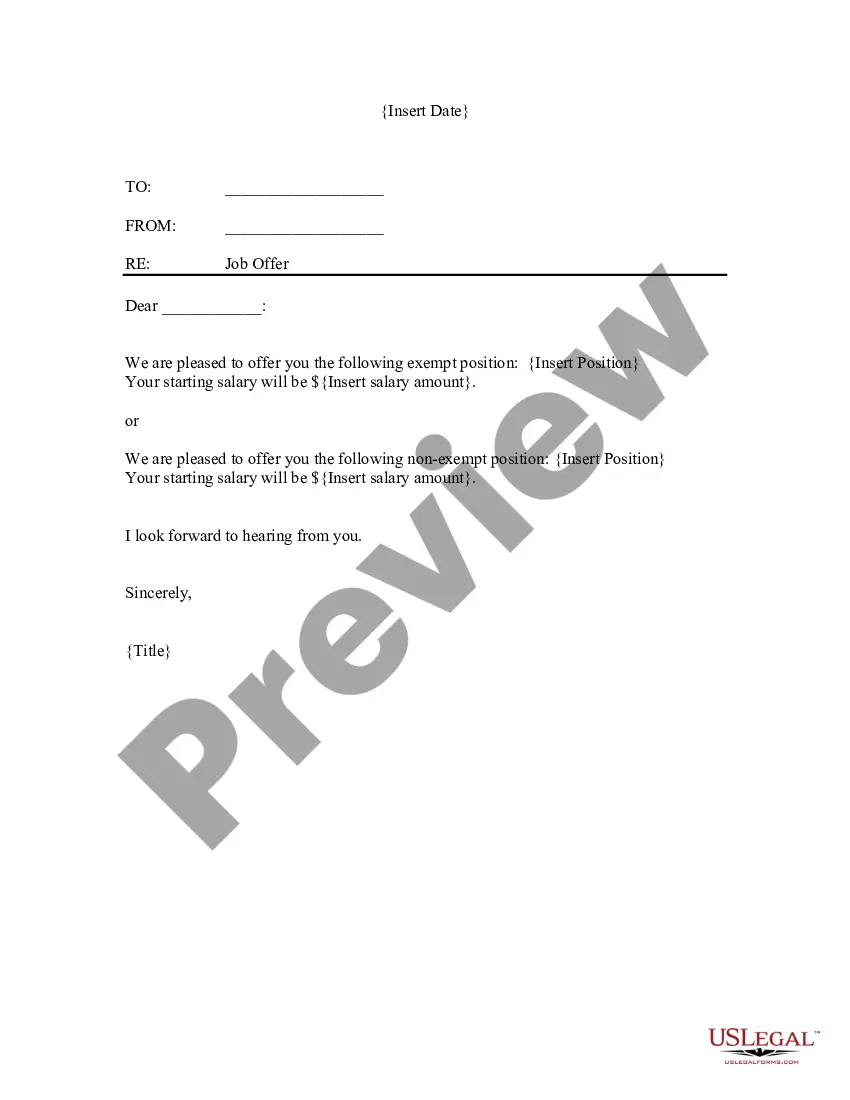

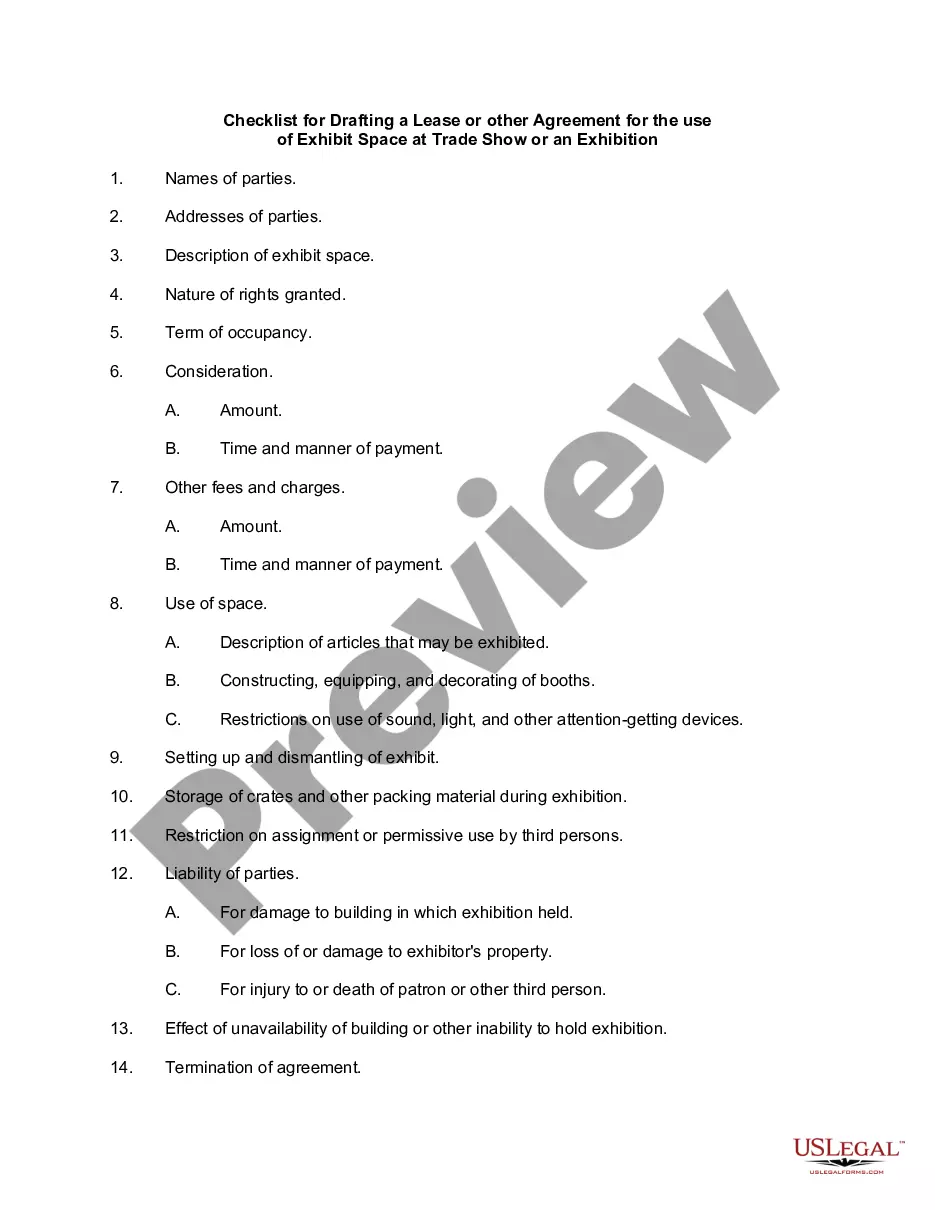

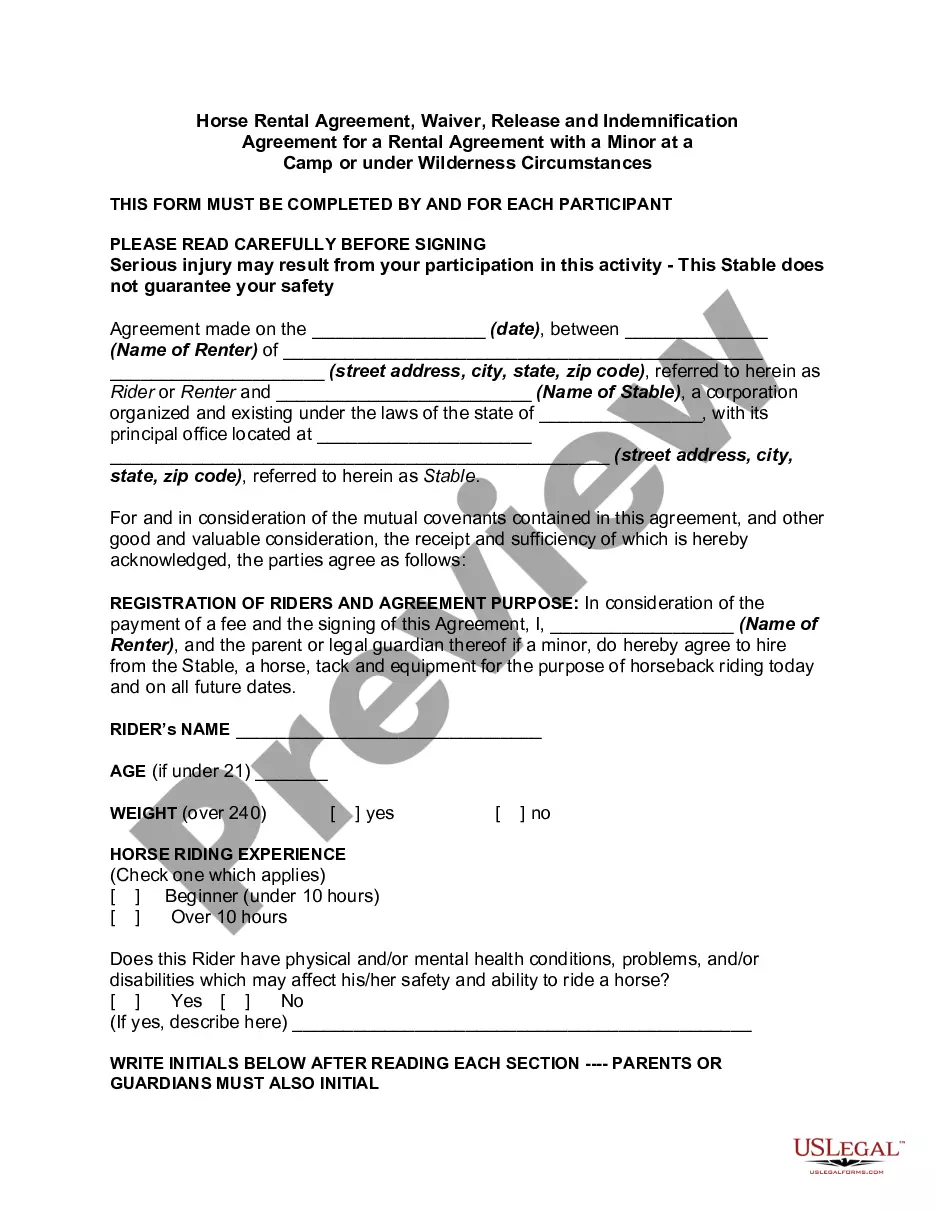

- Make use of the Review key to examine the form.

- Browse the outline to ensure that you have chosen the appropriate kind.

- In case the kind is not what you are trying to find, utilize the Lookup discipline to find the kind that meets your needs and requirements.

- If you get the appropriate kind, just click Acquire now.

- Select the pricing program you need, submit the specified info to generate your account, and purchase the transaction utilizing your PayPal or credit card.

- Decide on a hassle-free file format and acquire your backup.

Get all the record templates you may have bought in the My Forms food list. You can get a further backup of South Carolina Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage any time, if possible. Just go through the required kind to acquire or printing the record design.

Use US Legal Forms, probably the most extensive assortment of legal kinds, to save lots of time and avoid errors. The support provides professionally produced legal record templates that you can use for a range of functions. Produce a free account on US Legal Forms and begin making your way of life easier.

Form popularity

FAQ

SECTION 29-1-10. Lien on real estate of no force after twenty years; exception for acknowledged debt or payment on account; lien on property interest held by gas or electric utility or electric cooperative.

A second mortgage is a second loan that you take on your home. You can borrow up to 80% of the appraised value of your home, minus the balance on your first mortgage. The loan is secured against your home equity. While you pay off your second mortgage, you also need continue to pay off your first mortgage.

They asked for damages under section 29-3-320 of the South Carolina Code, which says that banks that don't satisfy a mortgage within 90 days are subject to damages of the lesser of $25,000 or one-half of the secured debt, plus attorneys' fees, costs and actual damages.

To be approved for a second mortgage, you'll likely need a credit score of at least 620, though individual lender requirements may be higher. Plus, remember that higher scores correlate with better rates. You'll also probably need to have a debt-to-income ratio (DTI) that's lower than 43%.

Second mortgages are called that because they are secondary to the main, primary mortgage used for the home purchase. In the event of a foreclosure, the primary mortgage gets fully paid off before any second mortgages get a dime. They are second liens, behind the first lien of the primary mortgage.

You might also need to get an appraisal to confirm the current value of your home. Equity requirements vary, but many lenders prefer that you have at least 15 percent to 20 percent equity in your home. You can typically borrow up to 85 percent of your home's value, minus your current mortgage debts.

You could lose your home if you don't pay back a second mortgage. Interest rates can be higher than refinancing. You might not qualify if you don't have enough equity or appraisal value. Second mortgages can be costly with appraisal fees, credit checks and closing costs.

? You'll need a higher credit score than first mortgage programs. A 620 credit score is the minimum for many second mortgage lenders, while others set the bar as high as 680. ? You must qualify with two mortgage payments. A second mortgage means you'll make two house payments.