Subject: South Carolina Sample Letters for Corporation Taxes Dear [Corporation Name], We are pleased to provide you with detailed information regarding South Carolina sample letters for corporation taxes. South Carolina imposes several types of taxes on corporations, and it is crucial for businesses operating in the state to understand and fulfill their tax obligations correctly. 1. Income Tax Letters: South Carolina imposes income taxes on corporations based on their net income. To comply with the state's income tax regulations, corporations are often required to submit various types of letters, including: — Income Tax Return Letter: This letter is used to file the corporation's annual income tax return, reporting its taxable income and calculating the tax due. — Estimated Tax Payment Letter: If a corporation anticipates owing more than $500 in tax for the year, it must make estimated tax payments. A letter is required to accompany each payment, stating the corporation's name, address, federal employer identification number (VEIN), and the tax year to which the payment applies. — Income Tax Refund Letter: In case a corporation believes it has overpaid its income tax liability, it may file a letter requesting a refund. 2. Sales and Use Tax Letters: Corporations in South Carolina are required to collect and remit sales and use taxes on taxable sales. Relevant sample letters include: — Sales and Use Tax Registration Letter: A letter used to apply for a sales and use tax license, allowing a corporation to conduct taxable sales in South Carolina. — Sales Tax Return Letter: This letter is submitted monthly, quarterly, or annually (based on the corporation's gross sales), reporting the taxable sales made during that period and calculating the sales tax due. 3. Withholding Tax Letters: If a corporation has employees in South Carolina, it must withhold and remit state income taxes from their wages, and the related sample letters are: — Withholding Tax Return Letter: This letter is used to report the total wages paid to employees and the corresponding withheld state income tax amount. — Withholding Tax Penalty Abatement Letter: If a corporation seeks relief from penalties related to its withholding tax obligations due to reasonable cause, it may submit a letter requesting penalty abatement. It is important to note that these are just a few examples of South Carolina sample letters for corporation taxes. Depending on the specific circumstances of your corporation, additional correspondence may be required, especially when dealing with tax audits, adjustments, exemptions, or any other related matters. We strongly recommend consulting with a qualified tax professional or referring to the South Carolina Department of Revenue's official website for the most accurate and up-to-date information regarding sample letters for corporation taxes in South Carolina. Should you need any further assistance or have any specific questions regarding your corporation's tax obligations, please feel free to contact our office, and our knowledgeable team will be more than happy to guide you through the process. Sincerely, [Your Name] [Your Title/Position] [Company Name] [Contact Information]

South Carolina Sample Letter for Corporation Taxes

Description

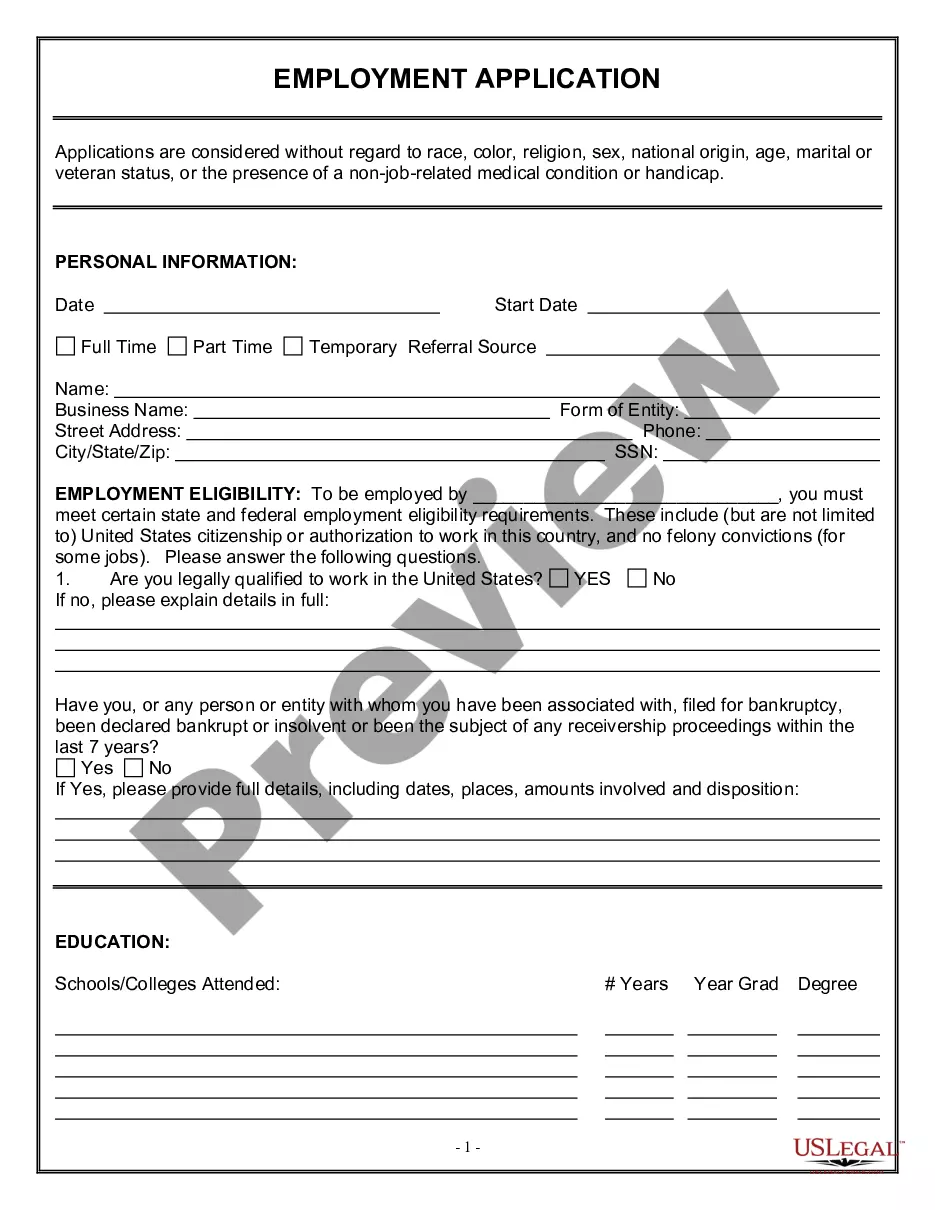

How to fill out South Carolina Sample Letter For Corporation Taxes?

US Legal Forms - one of many greatest libraries of lawful forms in America - gives a variety of lawful file templates you are able to obtain or produce. Utilizing the site, you may get a large number of forms for organization and personal purposes, sorted by groups, suggests, or keywords and phrases.You can get the newest versions of forms like the South Carolina Sample Letter for Corporation Taxes within minutes.

If you have a membership, log in and obtain South Carolina Sample Letter for Corporation Taxes from your US Legal Forms collection. The Download switch can look on every type you view. You gain access to all previously downloaded forms from the My Forms tab of your respective profile.

In order to use US Legal Forms the very first time, allow me to share basic instructions to help you started:

- Ensure you have chosen the proper type for your city/area. Click the Review switch to examine the form`s content. Browse the type description to actually have chosen the appropriate type.

- When the type does not satisfy your specifications, take advantage of the Search field at the top of the display to find the one which does.

- If you are content with the form, confirm your selection by clicking the Acquire now switch. Then, choose the rates strategy you prefer and supply your references to register for an profile.

- Approach the purchase. Make use of charge card or PayPal profile to finish the purchase.

- Select the file format and obtain the form in your device.

- Make alterations. Fill up, modify and produce and indication the downloaded South Carolina Sample Letter for Corporation Taxes.

Every single format you included with your account lacks an expiry time and it is your own eternally. So, if you would like obtain or produce an additional backup, just go to the My Forms area and click on in the type you want.

Get access to the South Carolina Sample Letter for Corporation Taxes with US Legal Forms, by far the most considerable collection of lawful file templates. Use a large number of expert and state-particular templates that meet up with your organization or personal demands and specifications.