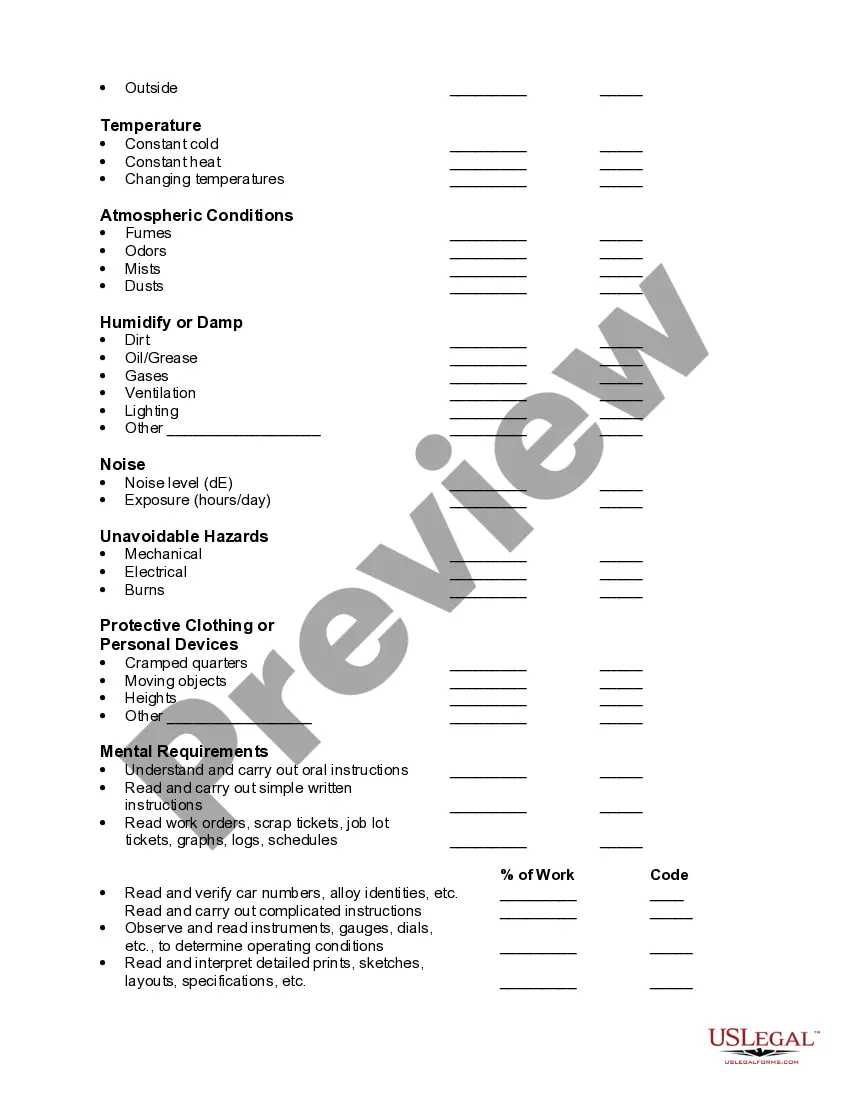

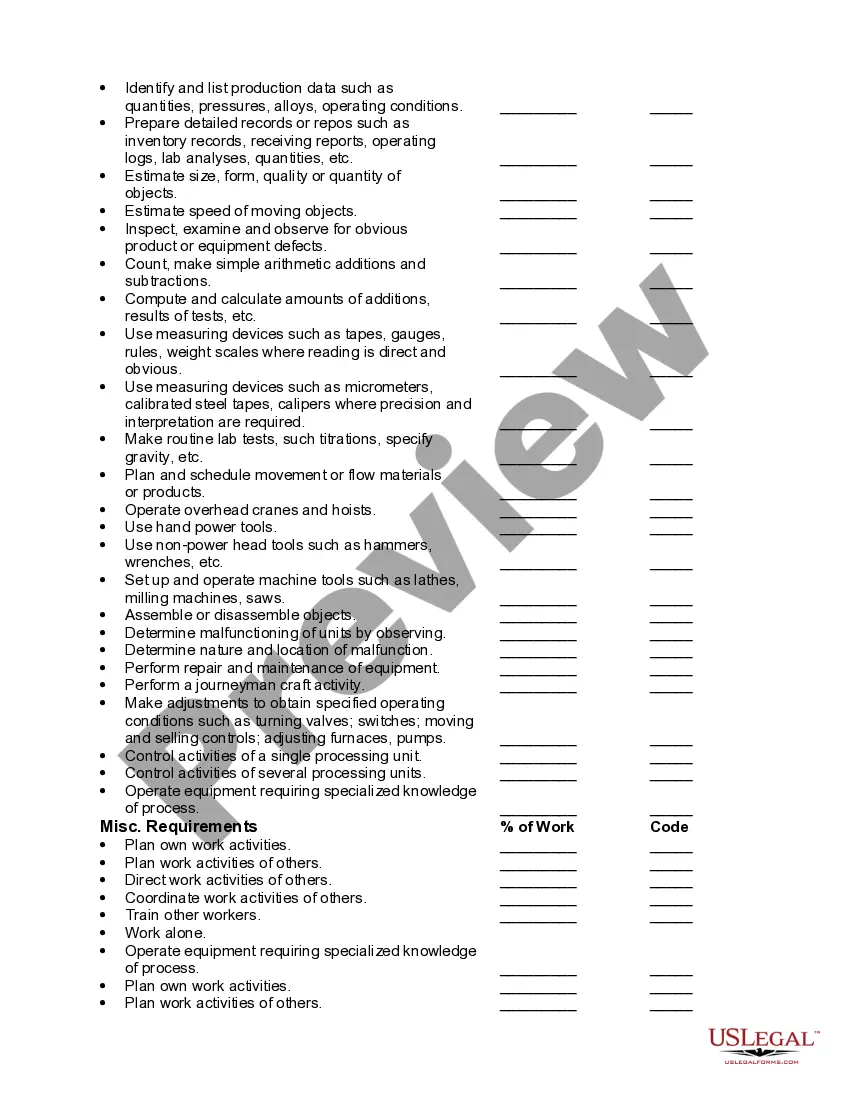

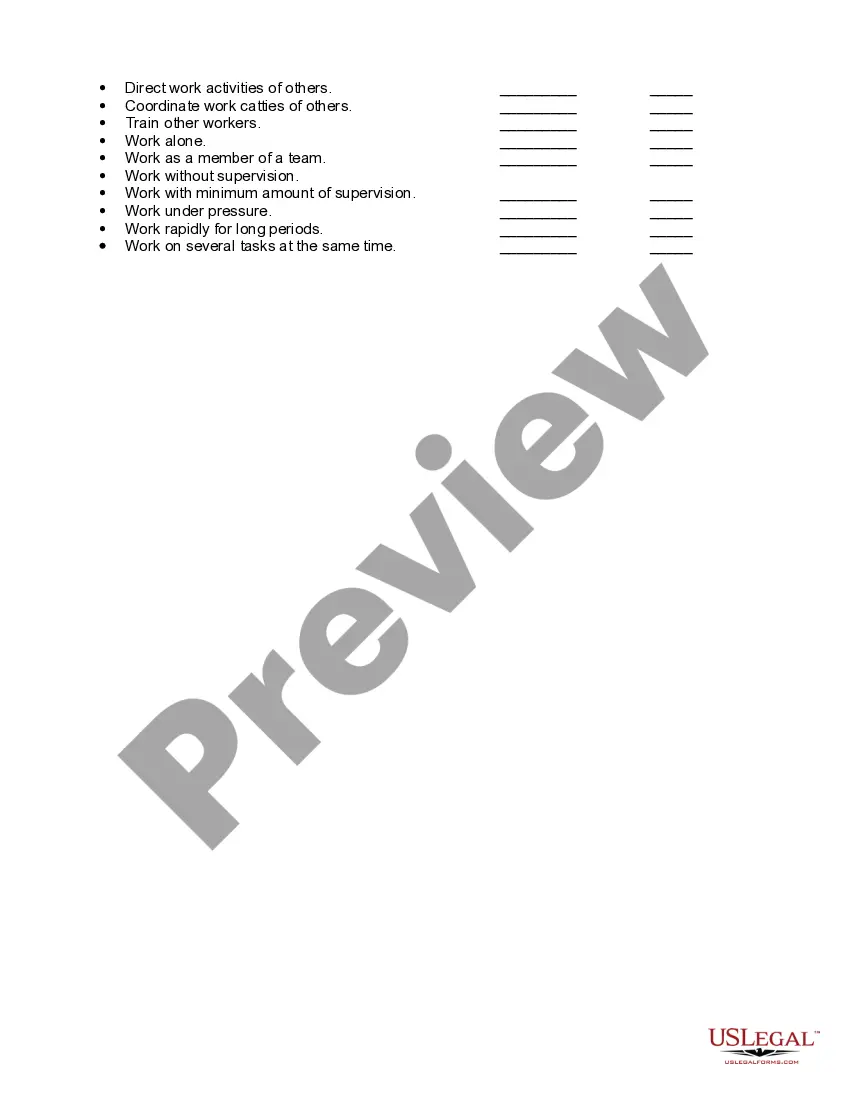

South Carolina Sample Job Requirements Worksheet

Description

How to fill out Sample Job Requirements Worksheet?

You might spend hours online trying to locate the official document template that meets the state and federal criteria you need.

US Legal Forms offers a vast array of official forms that have been vetted by professionals.

You can effortlessly download or print the South Carolina Sample Job Requirements Worksheet from our service.

If available, utilize the Review option to verify the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download option.

- Afterward, you can complete, modify, print, or sign the South Carolina Sample Job Requirements Worksheet.

- Every official document template you acquire is yours indefinitely.

- To obtain another copy of a purchased form, visit the My documents tab and select the appropriate option.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, confirm that you have selected the correct document template for your desired state/city.

- Review the form information to ensure you have chosen the correct document.

Form popularity

FAQ

Line 7 on the W-4 form refers to the total number of allowances you are claiming. This line impacts how much tax is withheld from your paycheck. Claiming the correct number of allowances is important for your financial planning, and the South Carolina sample job requirements worksheet can help clarify how to determine the appropriate number for your situation.

When you start a job, you fill out a W-4 form, not a W-2. The W-4 establishes your federal income tax withholding, while the W-2 is provided by your employer at the end of the year to report your earnings and the taxes withheld. Completing your W-4 correctly is essential for proper tax withholding, and the South Carolina sample job requirements worksheet can guide you through this process.

How Many Allowances Should I Claim if I'm Single? If you are single and have one job, you can claim 1 allowance. There's also the option of requesting 2 allowances if you are single and have one job. That allows you to get close to your break-even amount.

The following states opted to create their own state W-4 forms: Delaware, Idaho, Nebraska, Oregon, South Carolina, and Wisconsin whereas Colorado, New Mexico, North Dakota, and Utah will adopt the new inputs that the 2020 Federal W-4 put forth.

Employee instructionsComplete the SC W-4 so your employer can withhold the correct South Carolina Income Tax from your pay. If you have too much tax withheld, you will receive a refund when you file your tax return.

How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet) for 2019. As you may know, Form W-4 is used to determine your withholding allowances based on your unique situation so that your employer can withhold the correct federal income tax from your pay.

It is better to claim 1 if you are good with your money and 0 if you aren't. This is because if you claim 1 you'll get taxed less, but you may have to pay more taxes later.

The IRS has released an updated Tax Withholding Estimator and a FAQ page to assist in filling out the Form W-4. You may also visit the SC Department of Revenue website for information regarding the SC W-4. The university cannot offer tax advice but we may be able to assist with general questions on the form.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

Here's your rule of thumb: the more allowances you claim, the less federal income tax your employer will withhold from your paycheck (the bigger your take home pay). The fewer allowances you claim, the more federal income tax your employer will withhold from your paycheck (the smaller your take home pay).