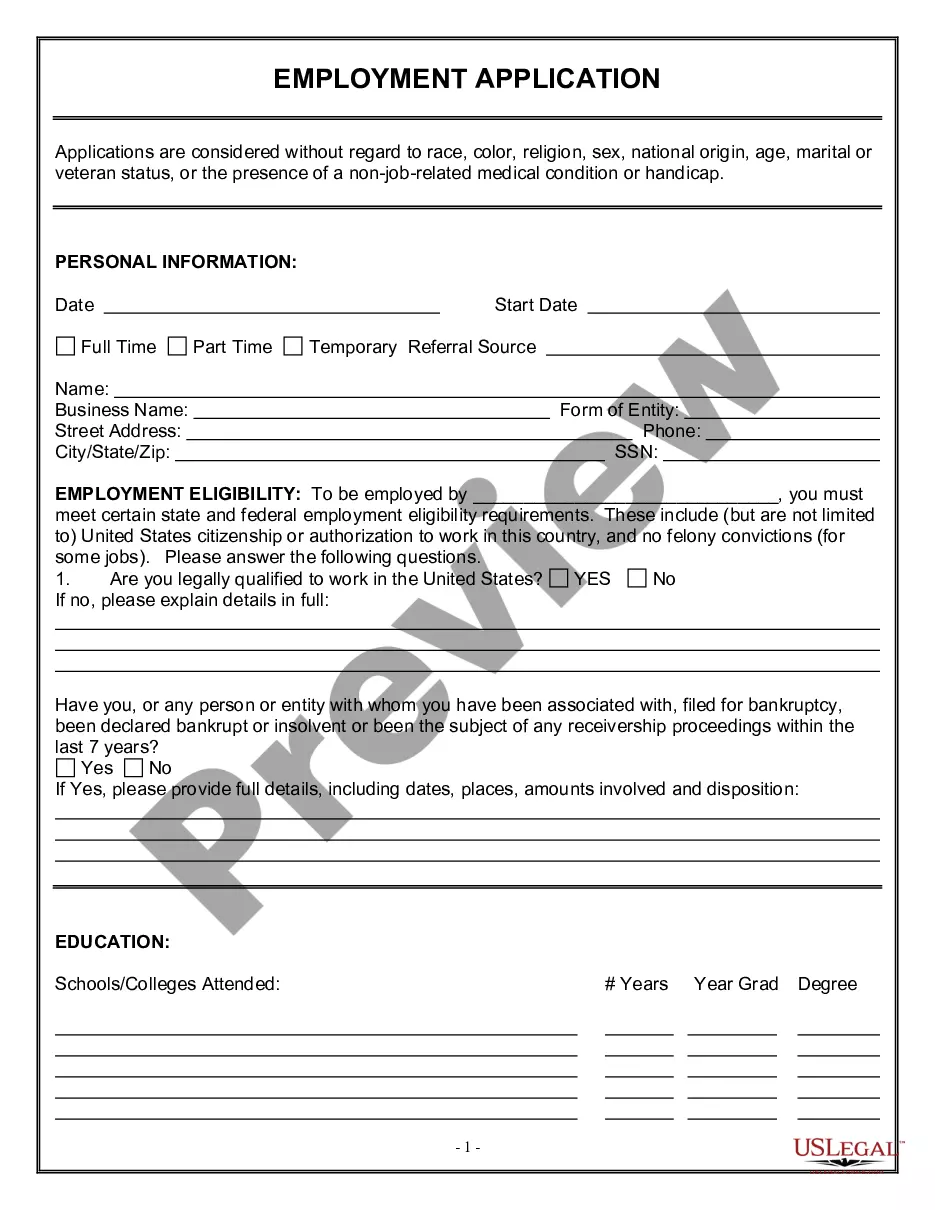

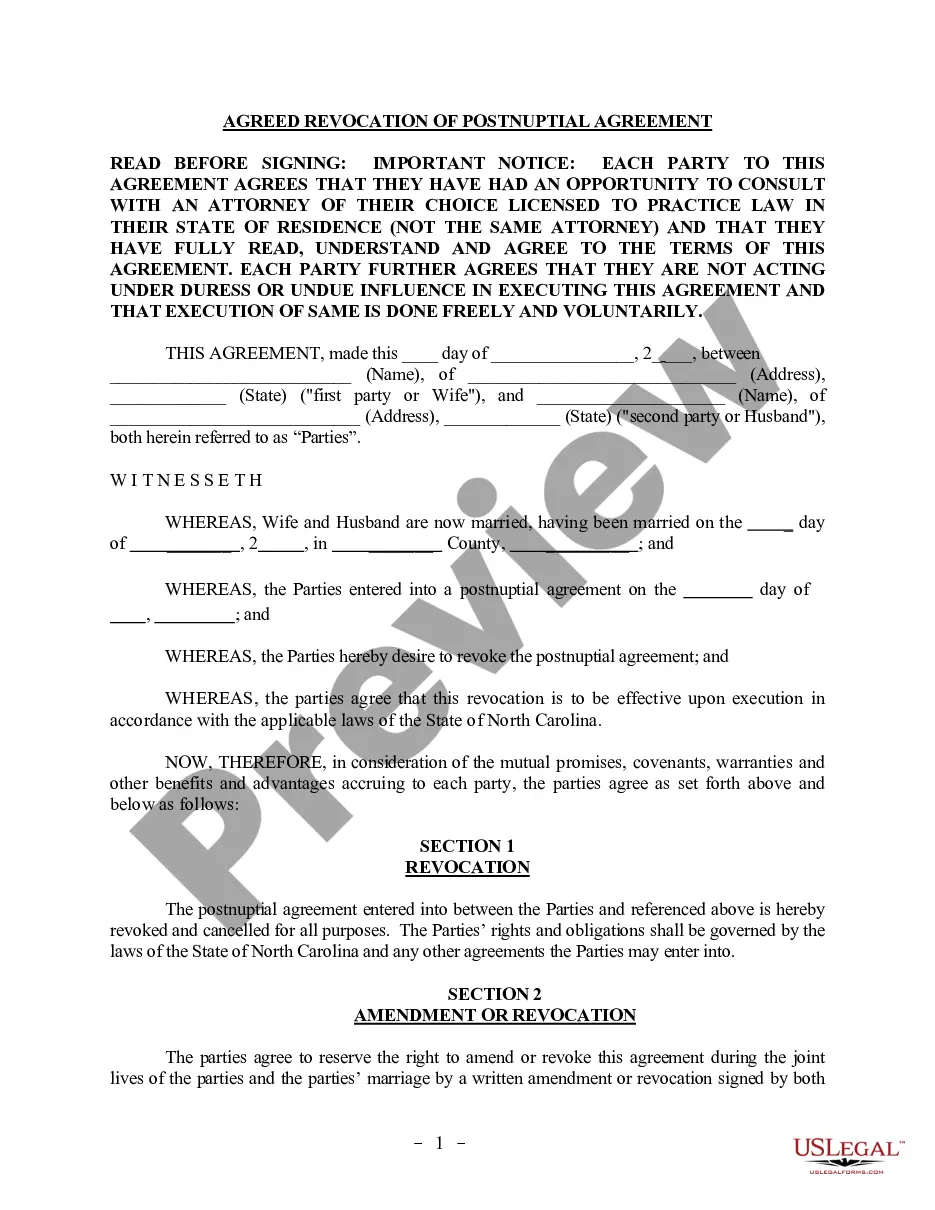

Title: South Carolina Checklist — Sale of a Business: A Comprehensive Guide for Smooth Transactions Keywords: South Carolina, checklist, sale of a business, business transaction, legal obligations, documentation, due diligence, transfer of assets, licensing, taxes, contracts, employment agreements, agreements, negotiations, closing process, industry-specific regulations Introduction: The South Carolina Checklist — Sale of a Business is an essential guide designed to ensure a successful and legally compliant transfer of ownership. This comprehensive checklist outlines the necessary steps and considerations for both buyers and sellers involved in a business transaction in South Carolina. It covers various aspects such as legal obligations, due diligence, documentation, licenses, taxation, and industry-specific regulations. Types of South Carolina Checklists — Sale of a Business: 1. General Checklist: This checklist offers a step-by-step guide for all types of businesses in South Carolina. It covers the fundamental aspects of a business sale, including legal requirements, financial considerations, and compliance with state regulations. 2. Industry-Specific Checklist: Several industries in South Carolina have unique regulations and considerations that need to be addressed during a business sale. Industry-specific checklists cater to businesses operating in specific sectors, such as healthcare, hospitality, manufacturing, retail, or professional services. These checklists take into account the distinct licensing, compliance, and operational requirements of each industry. Key Elements of a South Carolina Checklist — Sale of a Business: I. Preparing Documents: — Obtain and review financial records, including profit and loss statements, balance sheets, tax returns, and existing agreements. — Compile legal documentation such as articles of incorporation, contracts, lease agreements, and permits. — Ensure the accuracy of business and asset valuation reports. II. Due Diligence: — Conduct a comprehensive analysis of the business's financial, legal, and operational aspects. — Assess the business's liabilities, pending litigation, outstanding debts, contracts, and intellectual property rights. — Verify the accuracy of financial records, inventory, and customer databases. III. Licensing and Permits: — Review and transfer necessary licenses and permits to the buyer's name. — Confirm compliance with local, state, and federal regulations governing the business's operations. — Obtain any industry-specific certifications required for the business. IV. Taxes and Financials: — Assess the business's tax obligations and liabilities, including sales tax, payroll tax, and income tax. — Coordinate with an accountant to ensure accurate financial statements and tax filings. — Address any outstanding tax issues to avoid future disputes. V. Contracts and Agreements: — Review and transfer contracts, leases, supplier agreements, and customer contracts to the buyer. — Address any potential issues related to non-compete agreements, confidentiality agreements, or employee agreements. — Negotiate terms and conditions with the buyer to ensure a smooth transition. VI. Employment Considerations: — Review employment agreements to determine their transferability and obligations to employees. — Provide required notices to employees regarding the change in ownership. — Consider implications of employee benefits, retirement plans, and unemployment compensation. VII. Closing Process: — Coordinate with attorneys, accountants, and other professionals involved in the sale. — Prepare and execute a definitive purchase agreement. — Complete all necessary government filings and registrations. Conclusion: The South Carolina Checklist — Sale of a Business is an indispensable tool that ensures a seamless and legally compliant transfer of business ownership. It covers various essential elements, including due diligence, licensing, taxation, contracts, and employment considerations. By following this checklist, both buyers and sellers can navigate the complexities of a business sale in South Carolina successfully.

South Carolina Checklist - Sale of a Business

Description

How to fill out Checklist - Sale Of A Business?

Are you currently in a circumstance where you require documents for both business or personal reasons almost every weekday.

There are numerous legal document templates available on the internet, but finding reliable forms can be challenging.

US Legal Forms offers a wide selection of document templates, including the South Carolina Checklist - Sale of a Business, designed to meet federal and state requirements.

When you locate the appropriate form, click Download now.

Select the payment plan you prefer, fill in the necessary details to create your account, and pay for the order using your PayPal or Visa or Mastercard. Choose a convenient file format and download your copy. You can view all the document templates you have purchased in the My documents section. You can get an additional copy of the South Carolina Checklist - Sale of a Business anytime as desired. Just click on the required template to download or print the document design. Use US Legal Forms, the largest collection of legal forms, to save time and avoid errors. The service offers properly crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the South Carolina Checklist - Sale of a Business template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Utilize the Preview feature to review the document.

- Check the details to confirm that you have selected the right form.

- If the form is not what you are seeking, use the Search field to find the template that meets your requirements.

Form popularity

FAQ

The bottom line. Almost all businesses will need one or multiple licenses to start and operate their businesses legally, whether at the local, state, or federal level.

Do Business the Right WayThe state of South Carolina requires all corporations to file a South Carolina Corporation Income Tax Return which includes an annual report. Most LLCs won't need to file a tax return unless they're taxed as a C or S corp.

Business Licenses The state of South Carolina doesn't have a general business license; however, many cities require local licenses in order to operate. Retail License Businesses selling products and certain services will need to register for a Retail License from the South Carolina Department of Revenue.

A: No. Lexington County does not require or issue business licenses. Zoning permits are required for all land use activities. If the business is located in a municipality, check with that City/Town Hall to see if they require a business license and to inquire about their zoning requirements.

Any time a person or business is (1) physically located in or (2) conducts business in the unincorporated areas of Richland County, i.e., outside a city limits, regardless of where the business is located, an annual business license fee is required. A business license is required even if no income has been generated.

You must submit a CL-1 and a $25 minimum License Fee to the SCSOS if you are 2022 a domestic corporation filing your initial Articles of Incorporation, or 2022 a foreign corporation filing an Application for Certificate of Authority to Transact Business in South Carolina.

Close your businessDecide to close. Sole proprietors can decide on their own, but any type of partnership requires the co-owners to agree.File dissolution documents.Cancel registrations, permits, licenses, and business names.Comply with employment and labor laws.Resolve financial obligations.Maintain records.

The state of South Carolina requires all corporations to file a South Carolina Corporation Income Tax Return which includes an annual report.

Each city in SC and nine counties (Beaufort, Charleston, Dorchester, Horry, Jasper, Marion, Orangeburg, Richland, and Sumter counties) in SC require a business license to be obtained for any business that is located in or doing business in their jurisdiction.

South Carolina does not require LLCs to file an annual report. Taxes. For complete details on state taxes for South Carolina LLCs, visit Business Owner's Toolkit or the State of South Carolina . Federal tax identification number (EIN).