A South Carolina Sublease Agreement for Commercial Property is a legal document that outlines the terms and conditions for subleasing a commercial space in South Carolina. A sublease occurs when the original tenant (sublessor) rents out the property to a third party (sublessee) for a specified period, while still remaining responsible to the original landlord (lessor) for the lease terms. This agreement serves as a legally binding contract that protects the interests of all parties involved in the sublease transaction. It provides clarity on key aspects such as rent, duration, maintenance responsibilities, and any additional terms specific to the sublease. There are different types of South Carolina Sublease Agreements for Commercial Property, including: 1. Gross Sublease Agreement: This type of sublease agreement requires the sublessee to pay a fixed monthly rent which encompasses all costs, including utilities, insurance, and property taxes. The sublessor remains responsible for these expenses. 2. Percentage Sublease Agreement: In this agreement, the sublessee pays a percentage of their monthly income as rent. This type of sublease often applies to businesses that are largely dependent on sales revenue. 3. Fixed Sublease Agreement: This agreement stipulates a set monthly rent that remains constant throughout the sublease duration. It is the most straightforward type of agreement, providing a clear financial commitment for both parties. 4. Modified Net Sublease Agreement: In this arrangement, the sublessee pays a base rent along with a portion of the additional costs associated with the property, such as maintenance, property taxes, and insurance. The specific allocation of these additional costs is outlined in the agreement. The South Carolina Sublease Agreement for Commercial Property typically includes the following essential elements: — Parties involved: The names, addresses, and contact information of the sublessor, sublessee, and original lessor. — Property details: A description of the commercial property being subleased, including its location and any specific terms or restrictions. — Term: The start and end dates of the sublease period, along with any provisions for renewal or termination. — Rent and payments: The amount of rent the sublessee is obligated to pay, the frequency of payments, and any penalties for late payments or returned checks. — Maintenance responsibilities: Clearly delineates the maintenance obligations of both the sublessor and sublessee, including who is responsible for repairs, utilities, and common area expenses. — Additional terms: Any specific provisions or conditions unique to the sublease, such as assignment rights, alterations, subletting, or dispute resolution methods. In conclusion, a South Carolina Sublease Agreement for Commercial Property is a vital legal document that establishes the rights and obligations of all parties involved in a commercial sublease. Whether it's a gross, percentage, fixed, or modified net sublease agreement, it is crucial for all terms and conditions to be clearly defined to avoid potential disputes and ensure a smooth subleasing experience.

South Carolina Sublease Agreement for Commercial Property

Description

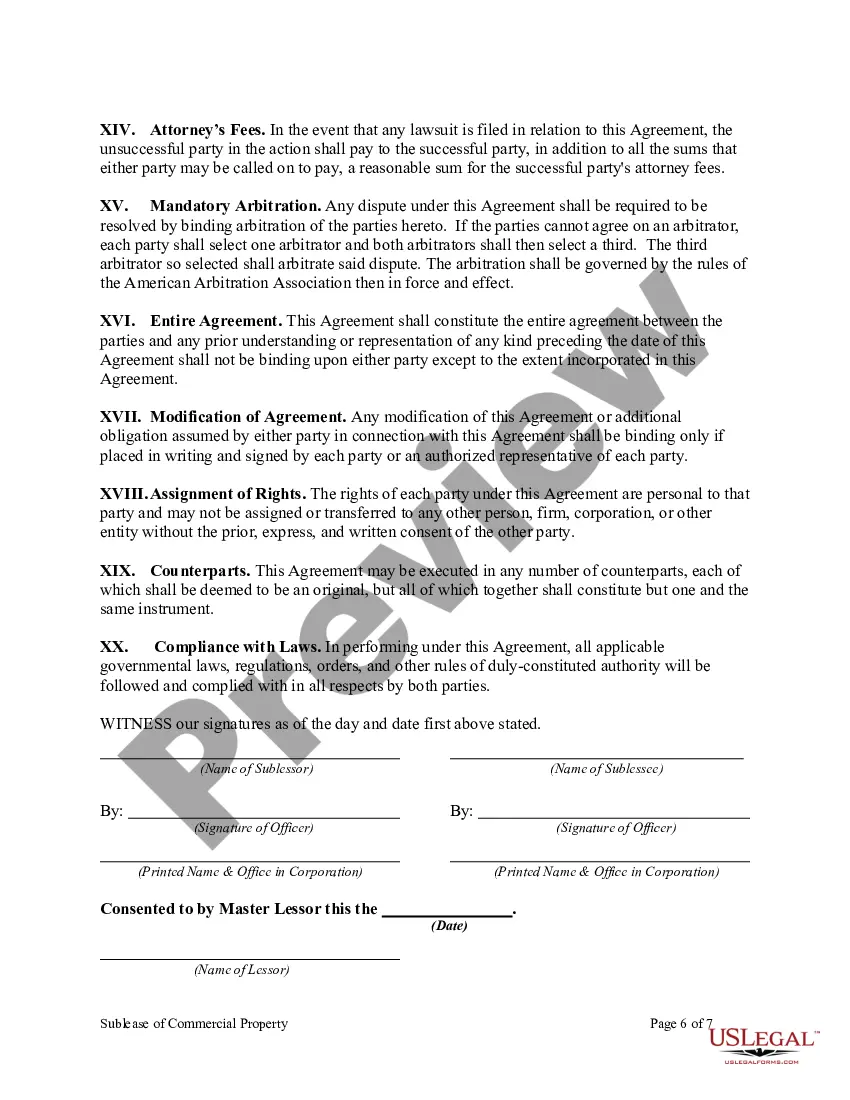

How to fill out South Carolina Sublease Agreement For Commercial Property?

Choosing the right authorized document web template can be a have difficulties. Obviously, there are a lot of themes available online, but how will you find the authorized type you need? Use the US Legal Forms internet site. The assistance gives 1000s of themes, for example the South Carolina Sublease Agreement for Commercial Property, which can be used for company and private demands. All of the forms are inspected by experts and meet federal and state specifications.

When you are presently signed up, log in to your accounts and click the Download key to find the South Carolina Sublease Agreement for Commercial Property. Make use of your accounts to look through the authorized forms you may have purchased formerly. Proceed to the My Forms tab of your respective accounts and get one more copy in the document you need.

When you are a whole new customer of US Legal Forms, allow me to share straightforward recommendations that you can adhere to:

- Initial, make sure you have chosen the right type for the area/state. You may look through the shape utilizing the Review key and browse the shape outline to ensure this is the right one for you.

- In case the type is not going to meet your preferences, make use of the Seach area to get the appropriate type.

- When you are certain the shape is suitable, select the Buy now key to find the type.

- Select the costs strategy you need and enter the needed information and facts. Create your accounts and purchase an order with your PayPal accounts or charge card.

- Select the submit structure and down load the authorized document web template to your system.

- Total, edit and produce and indicator the acquired South Carolina Sublease Agreement for Commercial Property.

US Legal Forms is definitely the biggest local library of authorized forms in which you can discover different document themes. Use the company to down load expertly-manufactured files that adhere to status specifications.