South Carolina Sample Letter for Decedent's Real Estate Transaction

Description

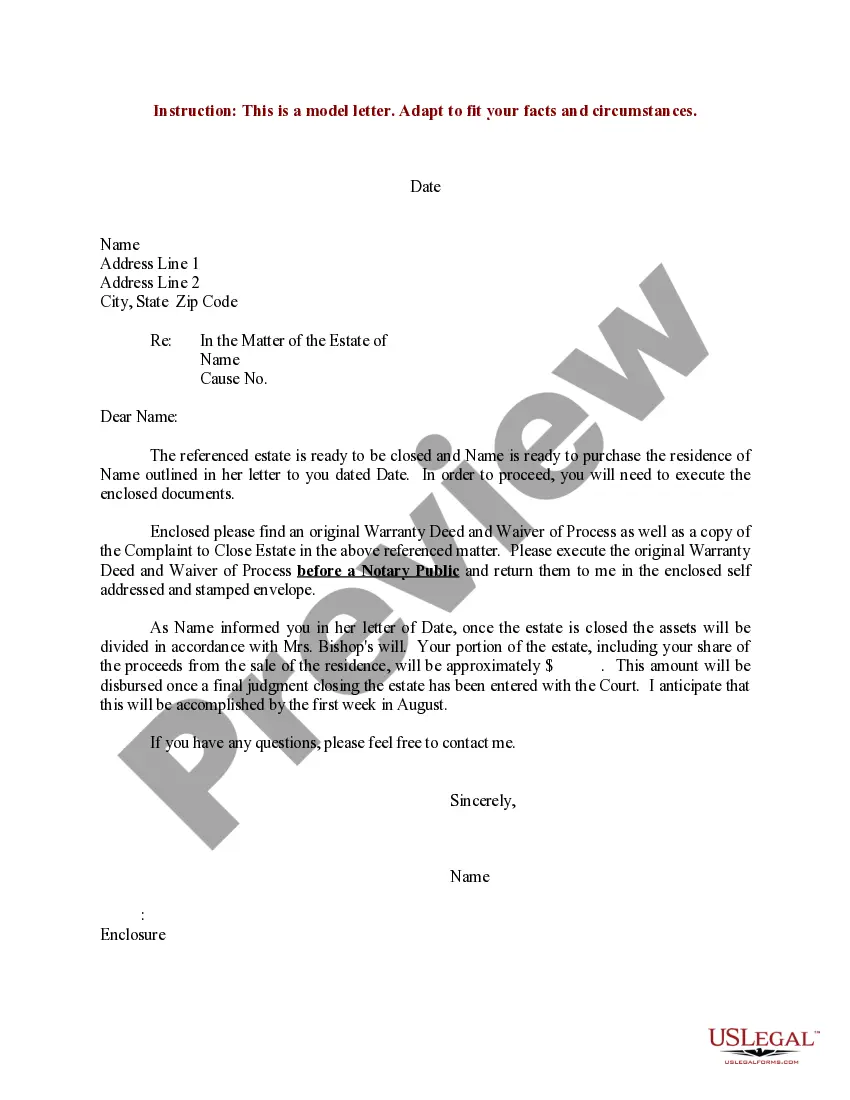

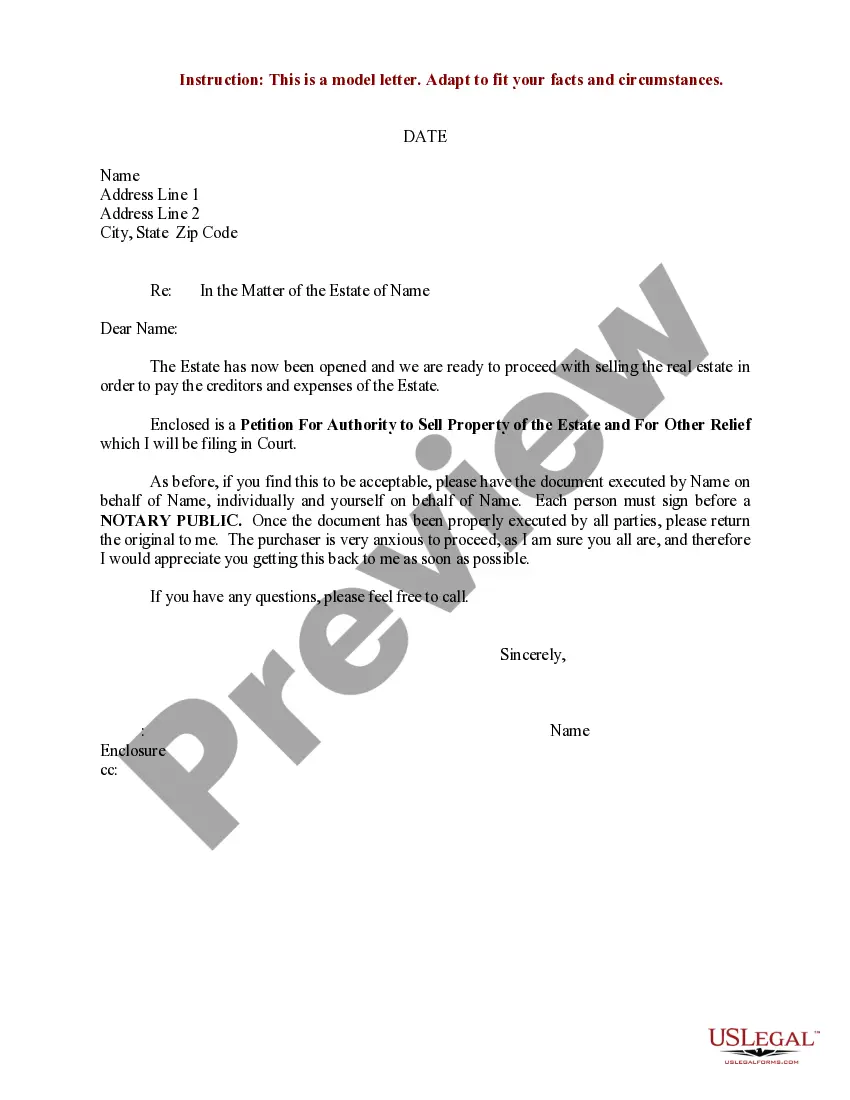

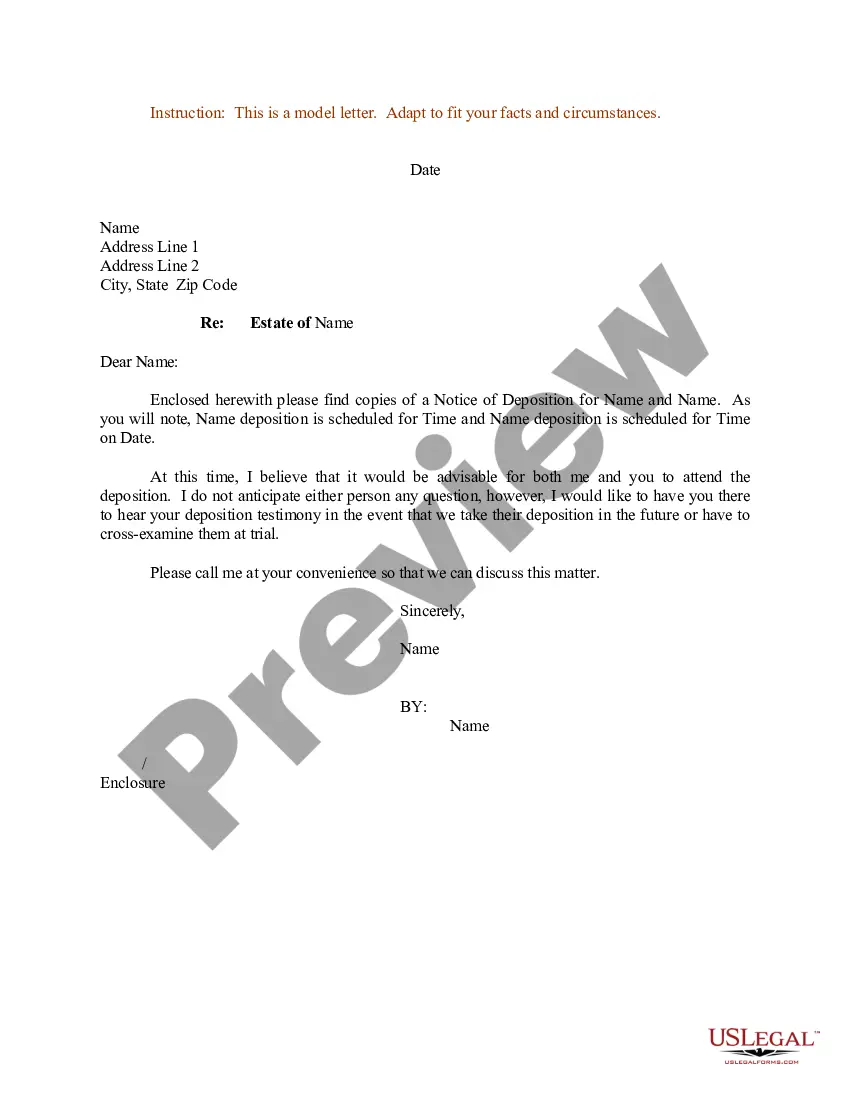

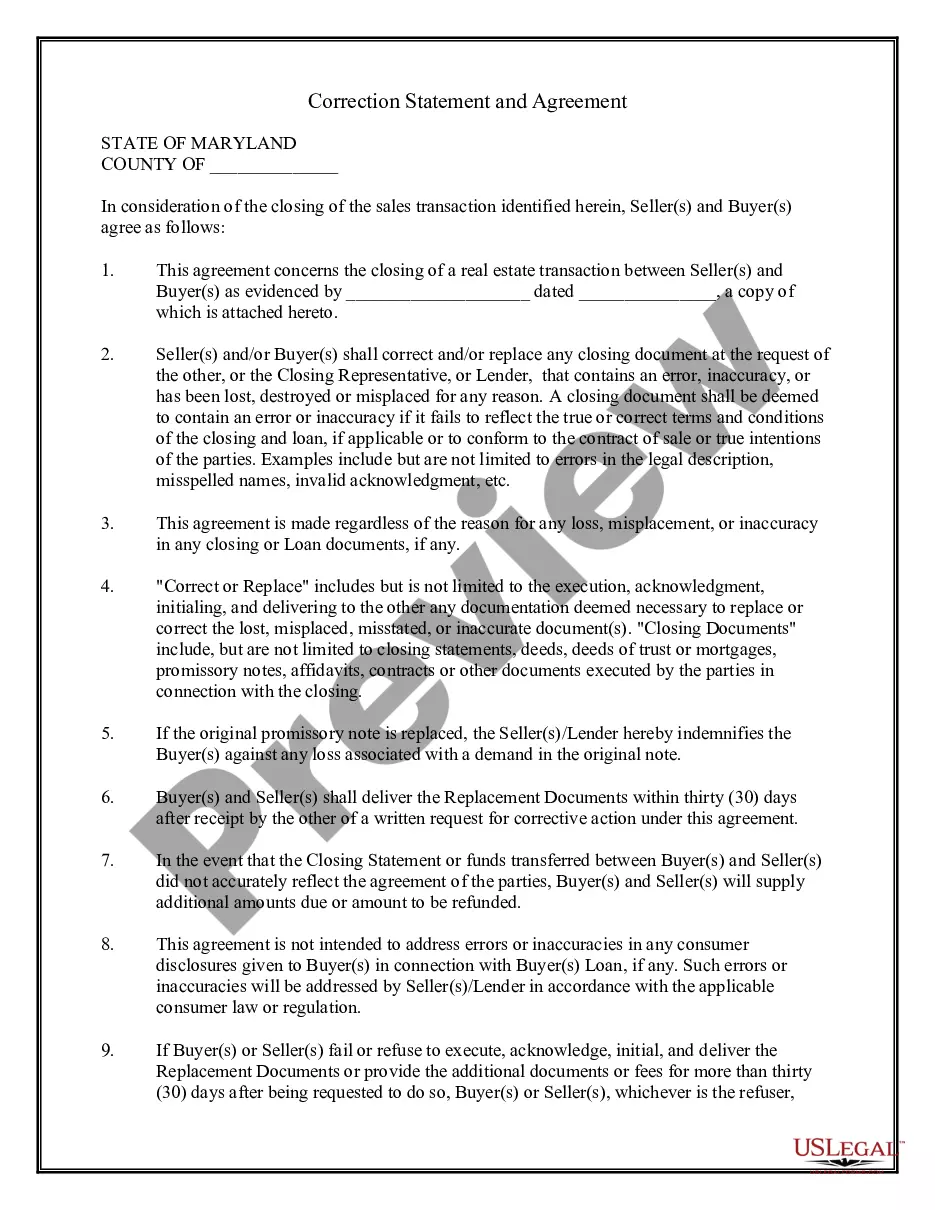

How to fill out Sample Letter For Decedent's Real Estate Transaction?

Have you been in the place where you will need documents for possibly enterprise or specific functions nearly every working day? There are plenty of legal record themes available on the net, but getting versions you can rely on is not easy. US Legal Forms offers thousands of kind themes, like the South Carolina Sample Letter for Decedent's Real Estate Transaction, that happen to be created to satisfy state and federal demands.

If you are previously familiar with US Legal Forms site and possess an account, just log in. Following that, you may obtain the South Carolina Sample Letter for Decedent's Real Estate Transaction web template.

Should you not come with an accounts and need to begin using US Legal Forms, adopt these measures:

- Get the kind you want and ensure it is for your appropriate metropolis/area.

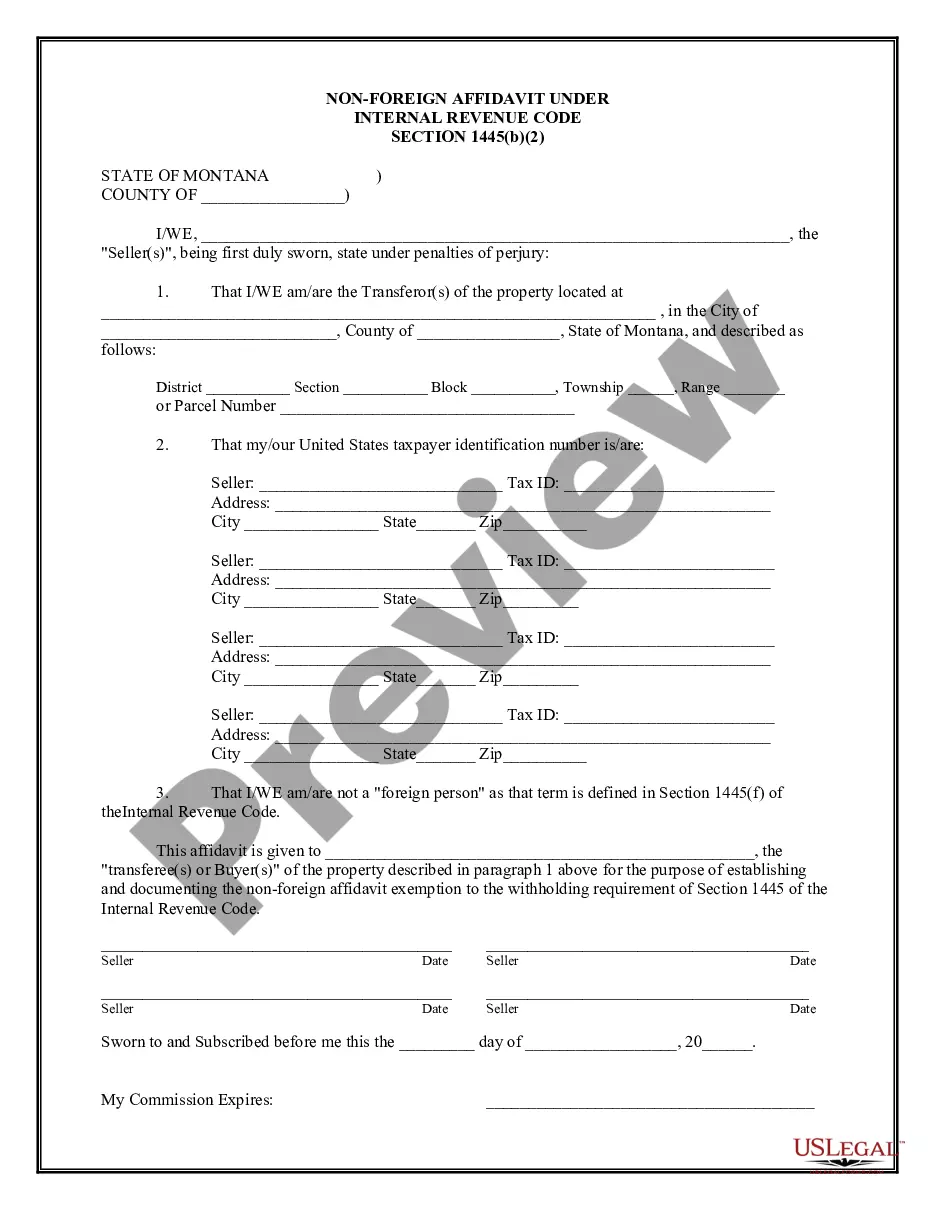

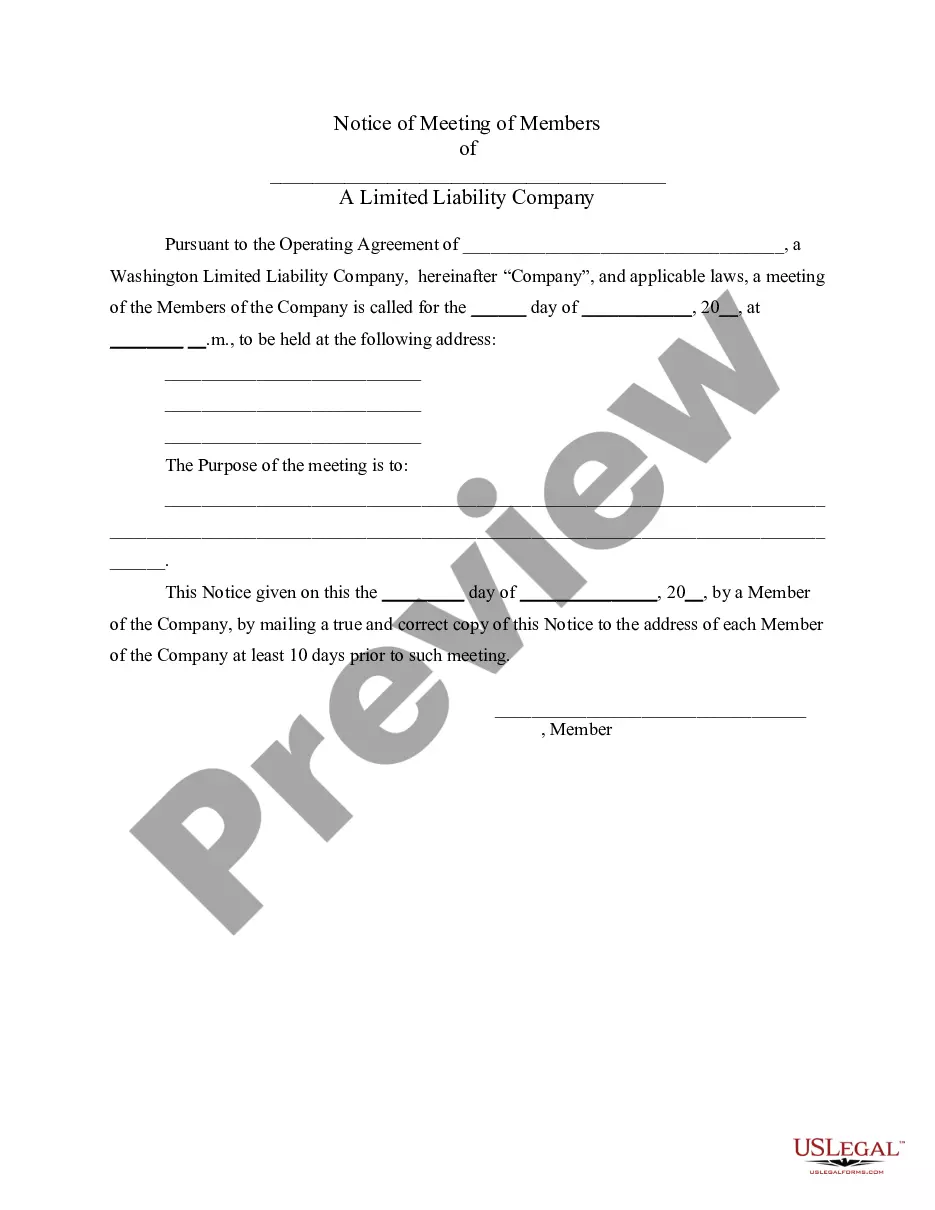

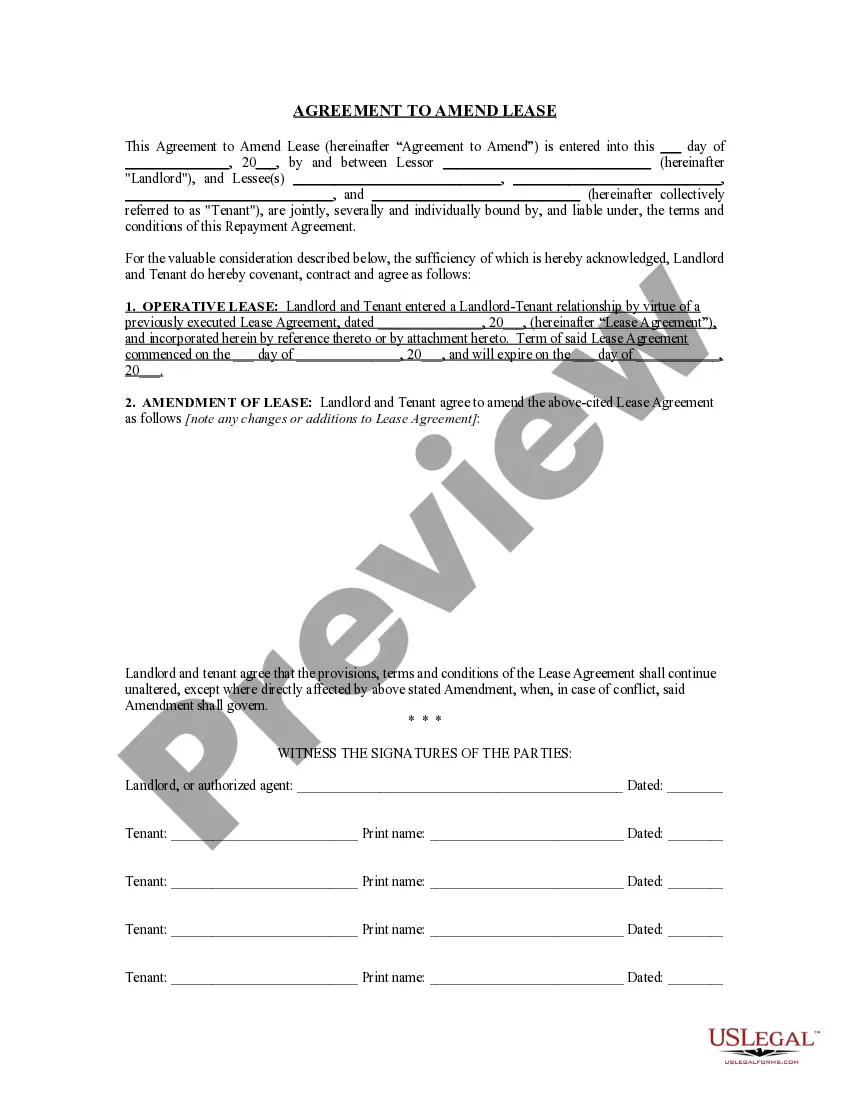

- Take advantage of the Review key to examine the form.

- Read the information to actually have chosen the right kind.

- In case the kind is not what you`re searching for, utilize the Look for industry to discover the kind that meets your needs and demands.

- When you find the appropriate kind, click Purchase now.

- Select the rates prepare you desire, fill in the desired details to generate your bank account, and pay for your order with your PayPal or charge card.

- Decide on a practical paper file format and obtain your copy.

Get each of the record themes you might have bought in the My Forms food selection. You may get a extra copy of South Carolina Sample Letter for Decedent's Real Estate Transaction at any time, if necessary. Just select the necessary kind to obtain or print out the record web template.

Use US Legal Forms, the most considerable assortment of legal types, to conserve some time and stay away from mistakes. The service offers professionally produced legal record themes which can be used for an array of functions. Generate an account on US Legal Forms and commence creating your daily life a little easier.

Form popularity

FAQ

If you live in South Carolina and die without a valid will and have only a surviving spouse (but no children), your spouse gets everything. If you have children and you die intestate in South Carolina, your spouse inherits half of your estate while your children get the other half evenly.

If one sibling is living in an inherited property and refuses to sell, a partition action can potentially be brought by the other siblings or co-owners of the property in order to force the sale of the property. In general, no one can be forced to own property they don't want, but they can be forced to sell.

As of now, South Carolina law does not permit the use of TOD deeds to transfer ownership of real estate. Instead, other estate planning tools, such as joint tenancy or a living trust, can be used to avoid probate for real estate.

If you leave a spouse and no children, your spouse takes all. If you leave no spouse, but children, then your children take your property. Generally, if a child of yours does not survive you their children take the share your child would have taken if they had survived you.

When heirs' property is created, the heirs own all the property together (in legal terms, they own the property as ?tenants in common?). In other words, they each own an interest in the undivided land rather than each heir owning an individual lot or piece of the land.

While there is no specific deadline for this in South Carolina law, it is generally best to do so within a month to prevent unnecessary delays in the probate process.

If all inheritors do not agree then the property cannot be sold. Chill! If majority of the inheritors are willing to sell the property they need to go through a probate court. The inheritors can file a 'partition action' lawsuit in the probate court.

In South Carolina, the personal representative must execute a deed of distribution with respect to real estate owned by a deceased person in order to transfer or release the estate's ownership or control over the property.