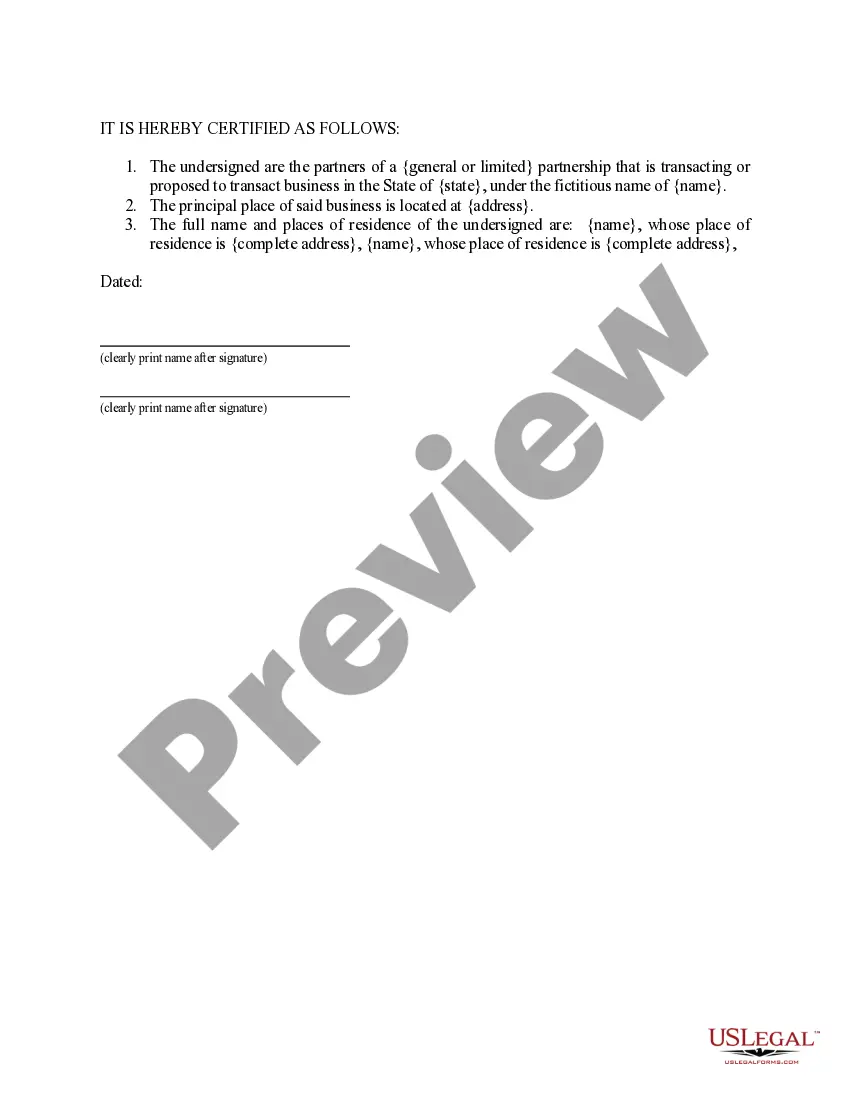

South Carolina Sample Letter for Certificate of Transaction of Business under Fictitious Name - By Partnership

Description

How to fill out Sample Letter For Certificate Of Transaction Of Business Under Fictitious Name - By Partnership?

Choosing the best legitimate document format can be a have difficulties. Naturally, there are a variety of templates available on the net, but how would you find the legitimate develop you require? Make use of the US Legal Forms website. The assistance provides a large number of templates, like the South Carolina Sample Letter for Certificate of Transaction of Business under Fictitious Name - By Partnership, that you can use for enterprise and personal requires. All the kinds are checked out by experts and fulfill state and federal specifications.

In case you are presently authorized, log in to the accounts and click the Obtain option to have the South Carolina Sample Letter for Certificate of Transaction of Business under Fictitious Name - By Partnership. Make use of your accounts to search throughout the legitimate kinds you possess purchased earlier. Proceed to the My Forms tab of your respective accounts and get another duplicate of the document you require.

In case you are a brand new user of US Legal Forms, listed here are simple recommendations that you should comply with:

- Initial, make certain you have chosen the proper develop to your area/area. You can check out the form utilizing the Preview option and read the form description to make certain it is the right one for you.

- In the event the develop is not going to fulfill your preferences, use the Seach area to find the proper develop.

- Once you are certain that the form is acceptable, click the Buy now option to have the develop.

- Pick the costs prepare you need and type in the necessary information. Create your accounts and buy your order making use of your PayPal accounts or bank card.

- Pick the document structure and acquire the legitimate document format to the gadget.

- Total, modify and produce and signal the acquired South Carolina Sample Letter for Certificate of Transaction of Business under Fictitious Name - By Partnership.

US Legal Forms may be the greatest local library of legitimate kinds where you will find a variety of document templates. Make use of the company to acquire skillfully-produced files that comply with state specifications.

Form popularity

FAQ

South Carolina Annual Report Information. Businesses and nonprofits are required to file annual reports to stay in good standing with the secretary of state. Annual reports are required in most states. Due dates and fees vary by state and type of entity.

How long does it take the South Carolina Secretary of State to issue a Certificate of Existence? Normal processing: 2-3 business days, plus additional time for mailing. Counter Service: while you wait (in person only).

To register a foreign corporation in South Carolina, you must file a South Carolina Application for Certificate of Authority with the South Carolina Secretary of State, Business Filings Division. You can submit this document by mail, in person, or online.

So for most people who own an LLC in South Carolina, there are no state-required annual South Carolina LLC fees. If you hired a Registered Agent service, you'll have an annual subscription fee to pay each year. This is usually about $125 per year. Some LLCs may need a business license in South Carolina.

CL-1 The Initial Annual Report of Corporations. This form is filed with the South Carolina Department of Revenue. $25.00.

LLC taxes and fees The following are taxation requirements and ongoing fees for South Carolina LLCs: Annual report. South Carolina does not require LLCs to file an annual report.

Businesses that are incorporated in another state will typically apply for a South Carolina certificate of authority. Doing so registers the business as a foreign entity and eliminates the need to incorporate a new entity. Operating without a certificate of authority may result in penalties or fines.