South Carolina Amended Loan Agreement

Description

How to fill out Amended Loan Agreement?

Are you presently in the place where you will need documents for both organization or person reasons almost every day time? There are a lot of authorized file themes accessible on the Internet, but getting kinds you can depend on is not easy. US Legal Forms gives a huge number of kind themes, such as the South Carolina Amended Loan Agreement, that happen to be published to satisfy federal and state needs.

In case you are presently familiar with US Legal Forms web site and get a free account, basically log in. Afterward, you are able to obtain the South Carolina Amended Loan Agreement template.

Unless you provide an profile and need to start using US Legal Forms, adopt these measures:

- Find the kind you need and make sure it is for the appropriate town/state.

- Make use of the Preview option to check the form.

- Look at the information to ensure that you have chosen the correct kind.

- In case the kind is not what you are seeking, use the Look for discipline to discover the kind that suits you and needs.

- Once you get the appropriate kind, simply click Buy now.

- Select the pricing prepare you want, submit the required info to generate your bank account, and buy the order using your PayPal or charge card.

- Choose a handy file structure and obtain your duplicate.

Get each of the file themes you may have bought in the My Forms food list. You can aquire a further duplicate of South Carolina Amended Loan Agreement anytime, if possible. Just click on the needed kind to obtain or print the file template.

Use US Legal Forms, by far the most extensive collection of authorized forms, in order to save time as well as steer clear of faults. The service gives professionally manufactured authorized file themes which can be used for a range of reasons. Create a free account on US Legal Forms and initiate making your way of life a little easier.

Form popularity

FAQ

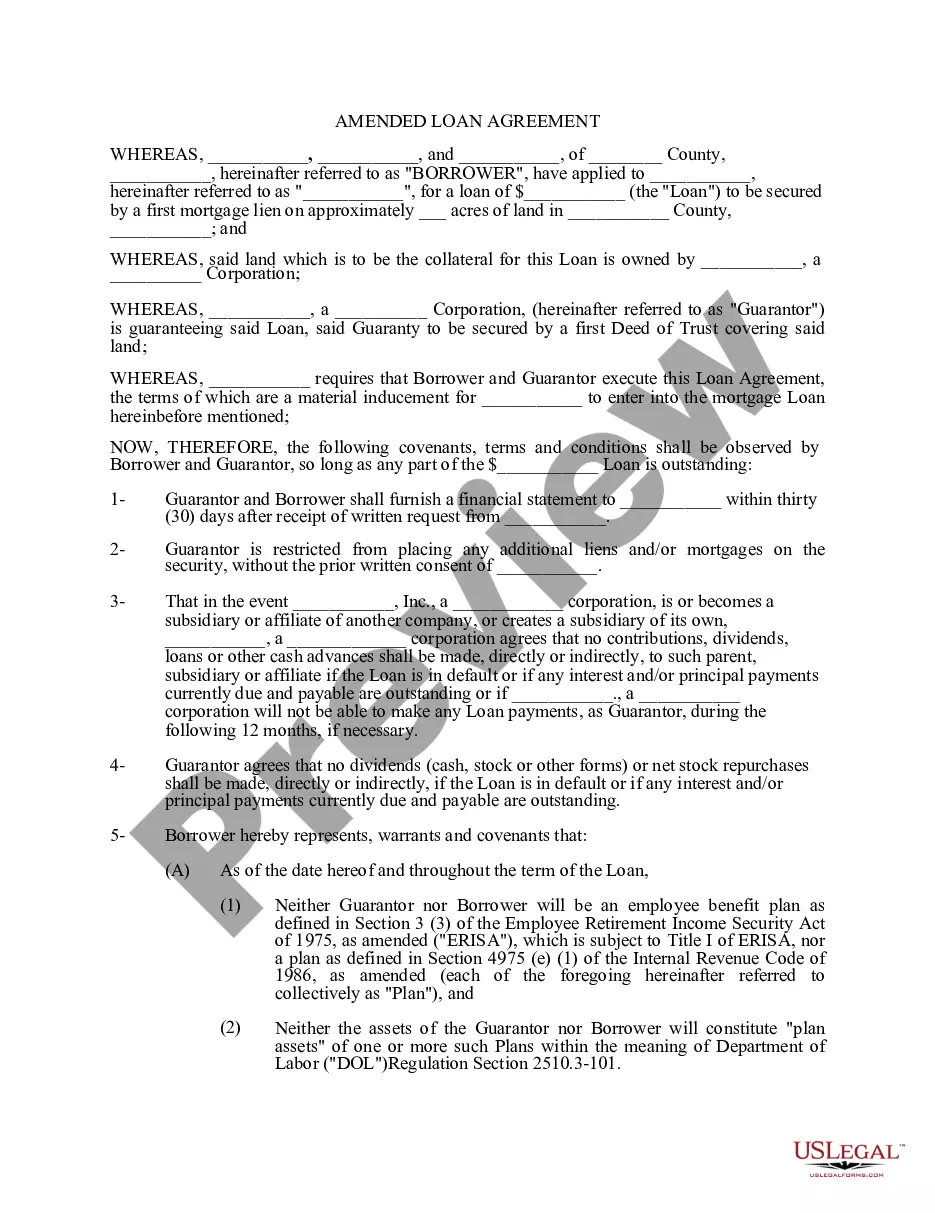

By Practical Law Finance. This is a standard form of amendment agreement for use where a borrower and its lenders have agreed to modify their loan agreement by adding, changing or removing provisions and defined terms.

Chapter 23 - High-cost And Consumer Home Loans. Section 37-23-70. Prohibited acts; complaints; penalties; statute of limitations; enforcement; costs. (A) A lender may not engage knowingly or intentionally in the unfair act or practice of "flipping" a consumer home loan.

No mortgage or deed having the effect of a mortgage or other lien shall constitute a lien upon any real estate after the lapse of twenty years from the date for the maturity of the lien.

(B) As used in this section "continuous breach of the peace" means a pattern of repeated acts or conduct which either (1) directly disturbs the public peace or (2) disturbs the public peace by inciting or tending to incite violence.

Terms can change before closing under certain circumstances. Lenders cannot control all closing costs.

37-23-80: Prohibits prepayment penalties for loans less than $150,000.

An addendum is an attachment to a contract that modifies the terms and conditions of the original contract. Addendums are used to efficiently update the terms or conditions of many types of contracts.

?There is no statute of limitation on the foreclosure of a mortgage. It is only when the mortgage debt has been due after maturity for a time sufficient to raise a presumption that the same has been satisfied that mere delay will furnish a defense to foreclosure.