South Carolina Assignment of Partnership Interest to a Corporation with Consent of Remaining Partners

Description

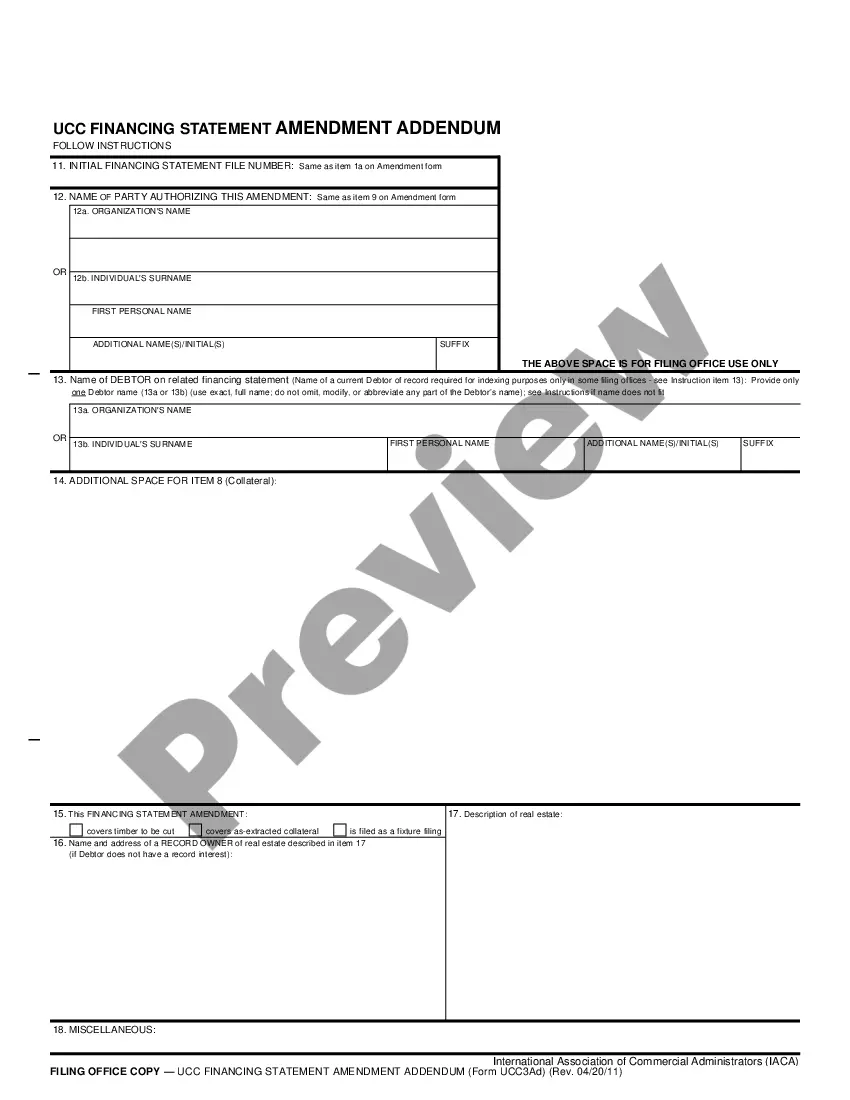

How to fill out Assignment Of Partnership Interest To A Corporation With Consent Of Remaining Partners?

Are you within a place the place you will need documents for possibly business or specific reasons virtually every time? There are plenty of lawful file layouts available online, but finding types you can rely on is not easy. US Legal Forms delivers a large number of form layouts, much like the South Carolina Assignment of Partnership Interest to a Corporation with Consent of Remaining Partners, that happen to be created in order to meet state and federal needs.

In case you are previously informed about US Legal Forms web site and have your account, just log in. Next, it is possible to obtain the South Carolina Assignment of Partnership Interest to a Corporation with Consent of Remaining Partners format.

Unless you have an bank account and need to begin using US Legal Forms, follow these steps:

- Find the form you want and make sure it is to the appropriate area/region.

- Take advantage of the Preview key to check the shape.

- See the description to actually have chosen the correct form.

- When the form is not what you are looking for, take advantage of the Look for field to discover the form that suits you and needs.

- When you discover the appropriate form, click Purchase now.

- Choose the rates plan you desire, complete the desired information to create your bank account, and pay for your order utilizing your PayPal or credit card.

- Decide on a hassle-free document format and obtain your duplicate.

Find all the file layouts you might have purchased in the My Forms food list. You can aquire a further duplicate of South Carolina Assignment of Partnership Interest to a Corporation with Consent of Remaining Partners at any time, if required. Just go through the required form to obtain or produce the file format.

Use US Legal Forms, one of the most extensive variety of lawful kinds, to save time and avoid blunders. The assistance delivers expertly created lawful file layouts that can be used for a range of reasons. Create your account on US Legal Forms and initiate generating your life a little easier.

Form popularity

FAQ

The Secretary of State may commence a proceeding to dissolve a limited liability company administratively if the company does not pay a fee, tax, or penalty imposed by this chapter or other law within sixty days after it is due.

SECTION 33-44-202. Organization. (a) One or more persons may organize a limited liability company, consisting of one or more members, by delivering articles of organization to the office of the Secretary of State for filing.

S.C. Code Ann. § 33-44-504(e) provides that Section is the exclusive remedy by which a judgment creditor may satisfy a judgment out of the distributional interests in an LLC.

Title 33 - Corporations, Partnerships and Associations. Chapter 44 - UNIFORM LIMITED LIABILITY COMPANY ACT OF 1996. Section 33-44-1002 - Application for certificate of authority. (8) whether the members of the company are to be liable for its debts and obligations under a provision similar to Section 33-44-303(c).

Most state and local bar ethics opinions on this topic state that a lawyer can be a partner in more than one firm, but that the firms in which he is a partner become essentially one firm for the purposes of imputed disqualification and conflicts of interest.

Partners can act like partnerships and corporations at the same time. Partnership wherein some or all are the same. A partnership was formed for a single transaction. This is how partnerships work under the law.

South Carolina Code of Laws Sections 33-44-108 through 33-44-111 contain the state law governing registered agents for limited liability companies. This includes the need to have an agent and office for service of process, the procedures for changing the agent or office, and what an agent must do to resign.

Corporations can act as partners in a partnership because states allow corporations to perform many of the same activities as individuals, such as entering into contracts, owning property, and hiring employees.

SECTION 33-44-303. Liability of members and managers. (a) Except as otherwise provided in subsection (c), the debts, obligations, and liabilities of a limited liability company, whether arising in contract, tort, or otherwise, are solely the debts, obligations, and liabilities of the company.

Corporations establish a separate legal entity, limiting owners' personal liability, while partnerships mean owners personally represent the business. Partnerships are pass-through entities so they don't pay corporate taxes; some types of corporations (namely, C-corps) are subject to the corporate tax rate.