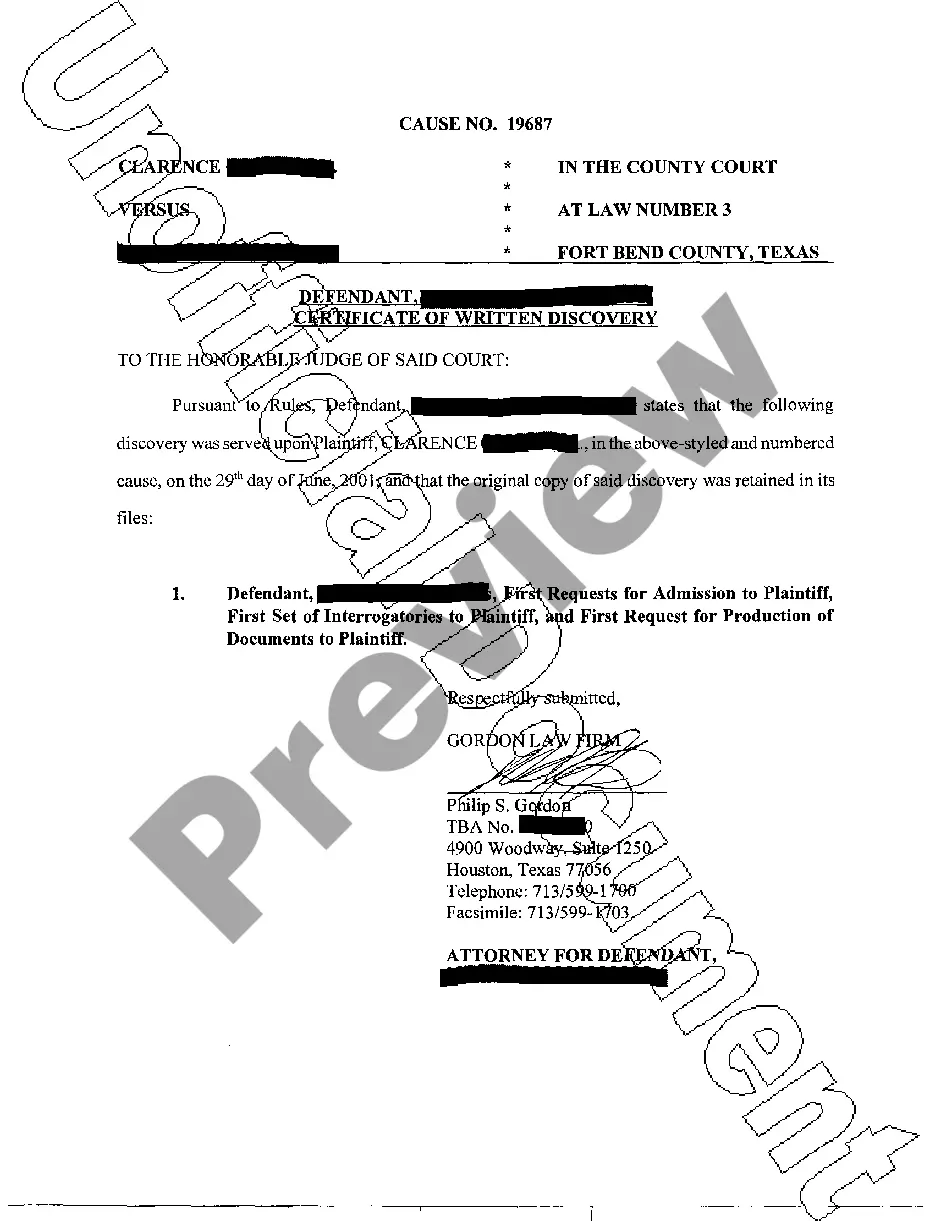

South Carolina Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act

Description

How to fill out Sample Letter To Debt Collector Re Fair Debt Collection And Practices Act?

If you need to complete, obtain, or produce authorized papers web templates, use US Legal Forms, the most important assortment of authorized varieties, which can be found on-line. Use the site`s simple and practical lookup to get the documents you require. Numerous web templates for company and personal functions are sorted by classes and claims, or keywords. Use US Legal Forms to get the South Carolina Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act in just a handful of clicks.

When you are currently a US Legal Forms buyer, log in to the profile and then click the Obtain button to find the South Carolina Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act. You can even entry varieties you formerly delivered electronically in the My Forms tab of the profile.

If you work with US Legal Forms for the first time, refer to the instructions below:

- Step 1. Ensure you have chosen the form for the right city/country.

- Step 2. Make use of the Preview solution to check out the form`s content. Don`t forget about to see the information.

- Step 3. When you are not satisfied together with the form, use the Search area towards the top of the screen to discover other models in the authorized form template.

- Step 4. Upon having found the form you require, go through the Acquire now button. Select the pricing plan you choose and include your references to sign up on an profile.

- Step 5. Process the purchase. You can use your Мisa or Ьastercard or PayPal profile to complete the purchase.

- Step 6. Pick the file format in the authorized form and obtain it on the gadget.

- Step 7. Comprehensive, revise and produce or indicator the South Carolina Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act.

Every single authorized papers template you acquire is your own property permanently. You have acces to every form you delivered electronically inside your acccount. Click on the My Forms section and choose a form to produce or obtain again.

Compete and obtain, and produce the South Carolina Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act with US Legal Forms. There are millions of expert and condition-certain varieties you may use for your company or personal demands.

Form popularity

FAQ

Under this Act (Title VIII of the Consumer Credit Protection Act), third-party debt collectors are prohibited from using deceptive or abusive conduct in the collection of consumer debts incurred for personal, family, or household purposes.

Harassment of the debtor by the creditor ? More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

The FDCPA also provides, for example, that debt collectors may not harass or annoy debtors, may not threaten debtors with arrest, and may not threaten legal action unless litigation actually is being contemplated. 15 U.S.C.

Reporting of Medical Debt: The three major credit bureaus (Equifax, Transunion, and Experian) will institute a new policy by March 30, 2023, to no longer include medical debt under a dollar threshold (the threshold will be at least $500) on credit reports.

The amended FDCPA allows debt collectors to use newer technologies, such as email and text messages, to communicate with consumers regarding their debts, subject to certain limitations, which protect consumers against harassment or abuse.

Collectors are required by Fair Debt Collection Practices Act (FDCPA) to send you a written debt validation notice with information about the debt they're trying to collect. It must be sent within five days of the first contact. The debt validation letter includes: The amount owed.

An effective debt collection letter should include all of the following: The total amount the client owes you. The original date the balance was due. Instructions detailing how to make the overdue payment. The new due date, whether a specific date or as soon as possible.