A Sample Letter of Credit (LC) is a crucial financial instrument used in international trade to provide a guarantee of payment to the seller by the buyer's bank. This document involves the commitment of the issuing bank to make payments on behalf of its customer, known as the applicant, to the beneficiary (seller/exporter) upon the fulfillment of specified conditions. When it comes to South Carolina, there are various types of Sample Letters of Credit applicable. Let's explore some of them: 1. Irrevocable LC: This type of LC cannot be amended or canceled without the consent of all parties involved. It provides a higher level of security for both the buyer and the seller. 2. Revocable LC: Unlike the irrevocable LC, this LC type can be modified or revoked by the issuing bank or the applicant without the agreement of the beneficiary. 3. Standby LC: This LC acts as a performance guarantee, assuring the beneficiary that payment will be made if the applicant fails to fulfill their contractual obligations. 4. Confirmed LC: In this LC, an additional confirming bank, usually a local bank in the beneficiary's country, adds its confirmation to the LC, especially when dealing with unfamiliar foreign banks. 5. Transferable LC: A transferable LC allows the beneficiary to transfer a part or the entire LC amount to a third party, often used when there is an intermediary involved in the transaction. 6. Back-to-Back LC: This type of LC involves two separate LC's. The first LC is issued in favor of an intermediary who acts as both the beneficiary and the applicant, while the second LC is issued by the intermediary to the main beneficiary (seller). South Carolina, a southeastern U.S. state known for its vibrant economy and bustling international trade activity, utilizes these different types of Sample Letters of Credit to facilitate secure trade transactions. Exporters and importers alike in South Carolina can rely on these LC's to mitigate risk, foster trust, and ensure timely payments in cross-border transactions. Whether businesses in South Carolina opt for an irrevocable, revocable, standby, confirmed, transferable, or back-to-back LC, these instruments play a pivotal role in promoting smooth international trade and enhancing the financial security of both buyers and sellers. The versatility of Sample Letters of Credit enables South Carolina businesses to participate actively in the global marketplace.

South Carolina Sample Letter of Credit

Description

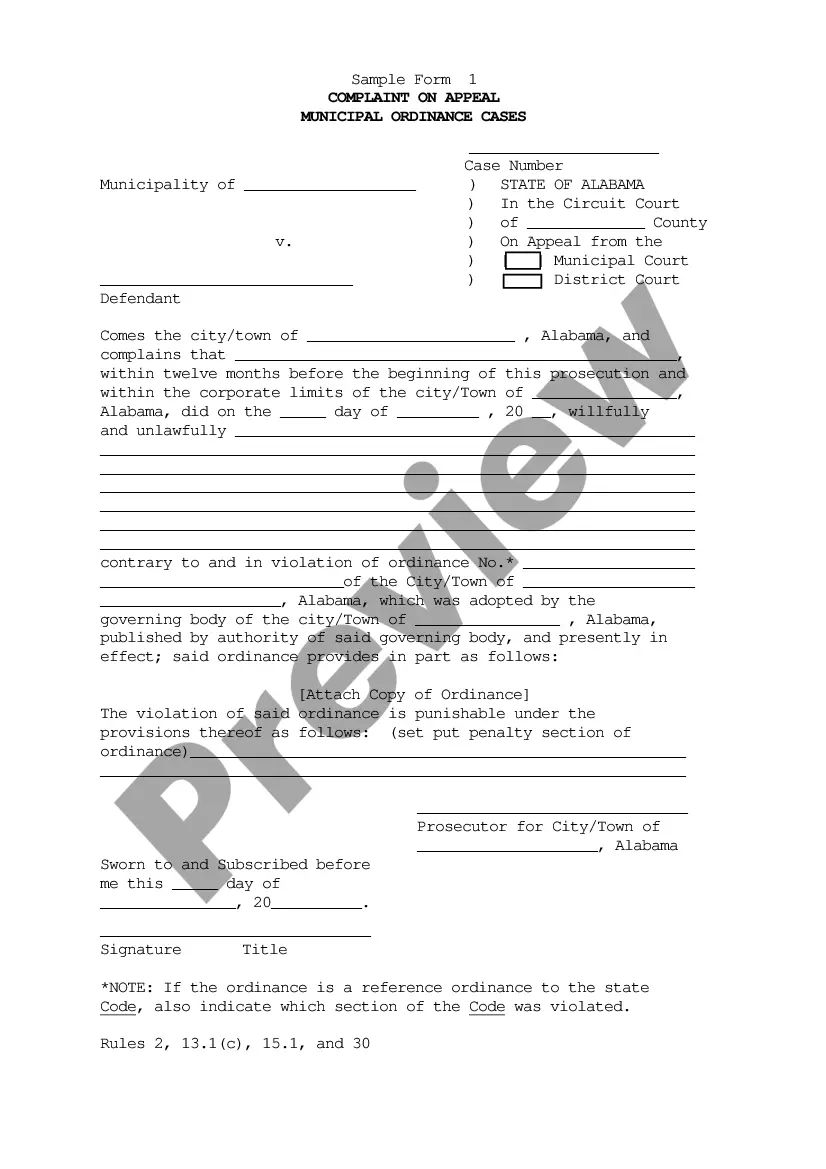

How to fill out South Carolina Sample Letter Of Credit?

If you want to full, down load, or produce legal document layouts, use US Legal Forms, the most important collection of legal forms, which can be found on-line. Utilize the site`s simple and easy practical look for to get the paperwork you want. Different layouts for business and personal functions are sorted by categories and says, or key phrases. Use US Legal Forms to get the South Carolina Sample Letter of Credit in a handful of clicks.

Should you be previously a US Legal Forms customer, log in to the accounts and then click the Obtain switch to have the South Carolina Sample Letter of Credit. You may also access forms you in the past downloaded within the My Forms tab of your accounts.

Should you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape for the appropriate area/land.

- Step 2. Take advantage of the Preview choice to examine the form`s content material. Don`t overlook to read the description.

- Step 3. Should you be unhappy using the form, utilize the Look for discipline towards the top of the monitor to get other versions in the legal form design.

- Step 4. Upon having found the shape you want, go through the Buy now switch. Choose the rates prepare you prefer and include your references to sign up to have an accounts.

- Step 5. Method the purchase. You can utilize your Мisa or Ьastercard or PayPal accounts to perform the purchase.

- Step 6. Choose the formatting in the legal form and down load it in your device.

- Step 7. Total, edit and produce or indicator the South Carolina Sample Letter of Credit.

Each and every legal document design you get is yours for a long time. You have acces to every single form you downloaded within your acccount. Click the My Forms area and decide on a form to produce or down load again.

Contend and down load, and produce the South Carolina Sample Letter of Credit with US Legal Forms. There are millions of specialist and state-certain forms you may use to your business or personal needs.

Form popularity

FAQ

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.

How To Get a Letter of Credit. To get a letter of credit, contact your bank. You'll most likely need to work with an international trade department or commercial division. Not every institution offers letters of credit, but small banks and credit unions can often refer you to somebody who can accommodate your needs.

Documents Required For LC Opening A signed copy of the proforma invoice or SPA of your trade deal. Company's Registration / Trade License Copy and MOU between partners (if any) Authorized Signatory's Passport photocopy. Utility Bills proving the Authorized Signatory's Residence & Company Address.

The types of letters of credit include a commercial letter of credit, a revolving letter of credit, a traveler's letter of credit, and a confirmed letter of credit.

Main types of LC Irrevocable LC. This LC cannot be cancelled or modified without consent of the beneficiary (Seller). ... Revocable LC. ... Stand-by LC. ... Confirmed LC. ... Unconfirmed LC. ... Transferable LC. ... Back-to-Back LC. ... Payment at Sight LC.

A letter of credit, or a credit letter, is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. If the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase.

A Letter of Credit is an arrangement whereby Bank acting at the request of a customer (Importer / Buyer), undertakes to pay for the goods / services, to a third party (Exporter / Beneficiary) by a given date, on documents being presented in compliance with the conditions laid down.

A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason. An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees.