South Carolina Subrogation Agreement between Insurer and Insured

Description

How to fill out Subrogation Agreement Between Insurer And Insured?

You may commit several hours on-line searching for the lawful file design that suits the state and federal needs you will need. US Legal Forms provides a huge number of lawful varieties which can be reviewed by experts. It is possible to obtain or print out the South Carolina Subrogation Agreement between Insurer and Insured from the services.

If you have a US Legal Forms bank account, you can log in and click the Obtain key. Following that, you can full, revise, print out, or sign the South Carolina Subrogation Agreement between Insurer and Insured. Each and every lawful file design you buy is yours forever. To have another version of the bought kind, check out the My Forms tab and click the corresponding key.

If you use the US Legal Forms site for the first time, follow the basic directions beneath:

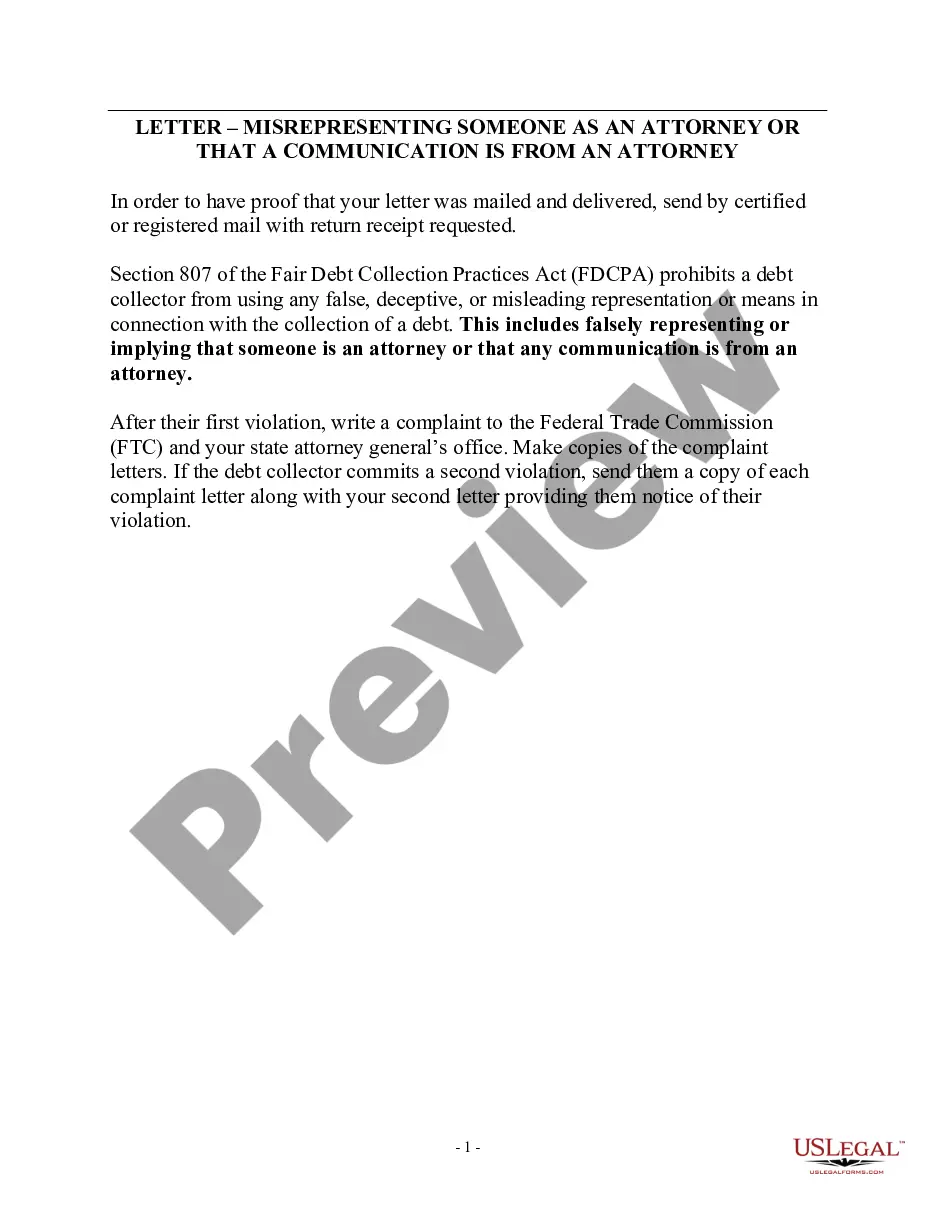

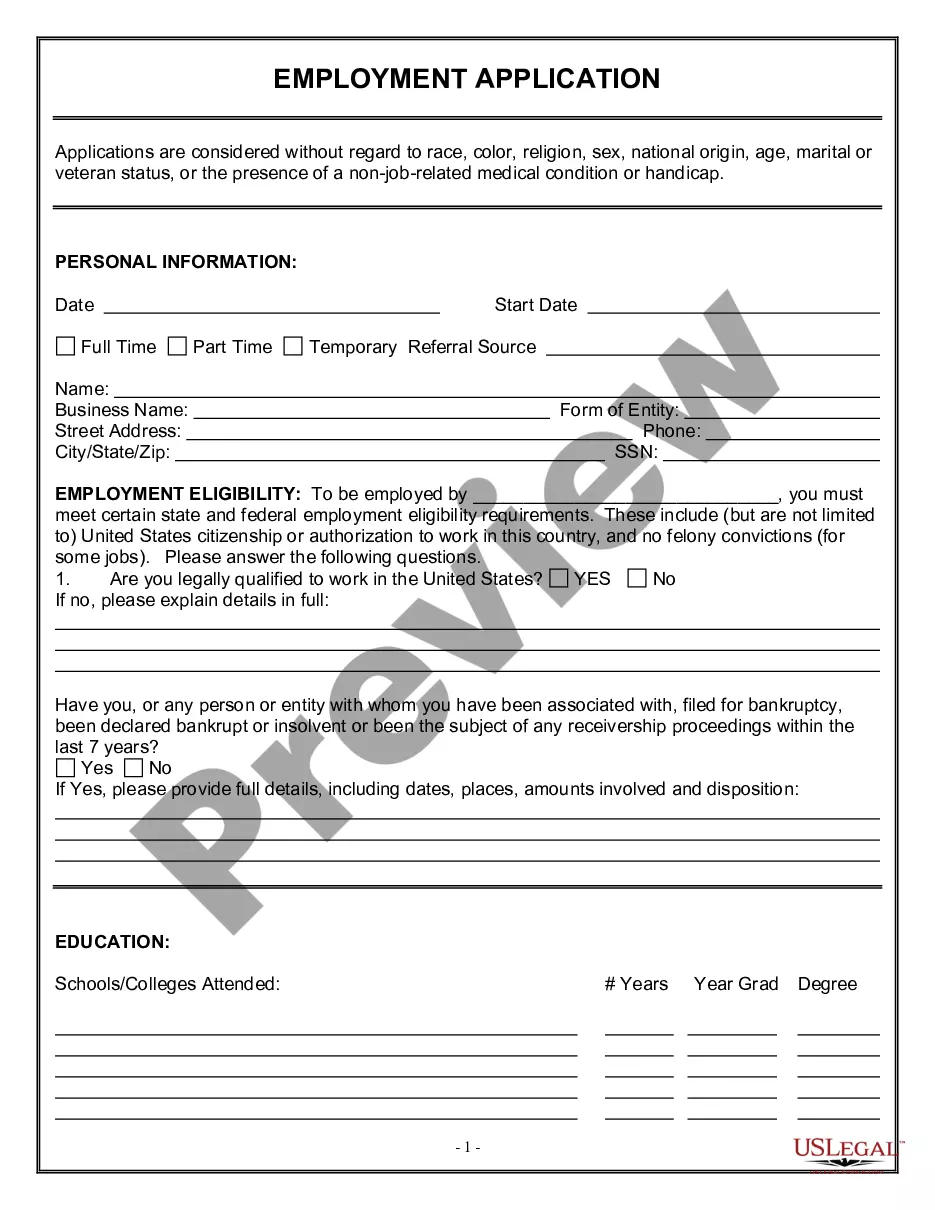

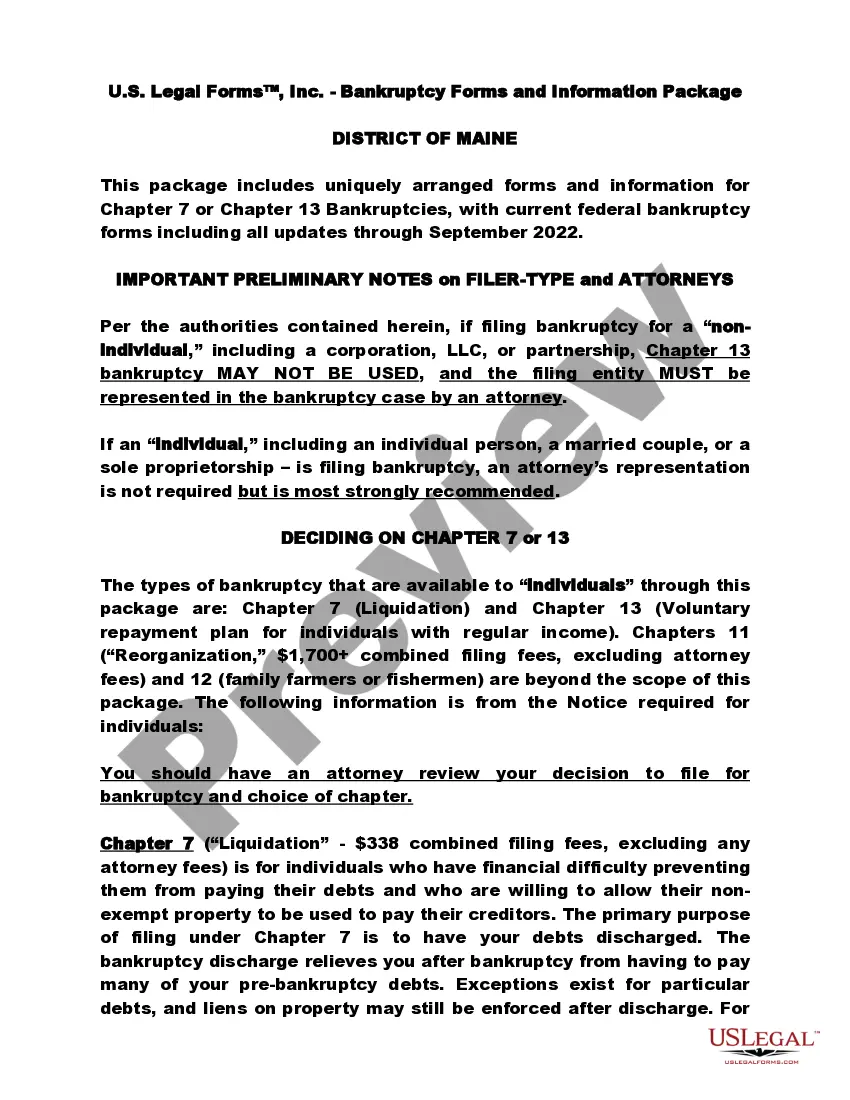

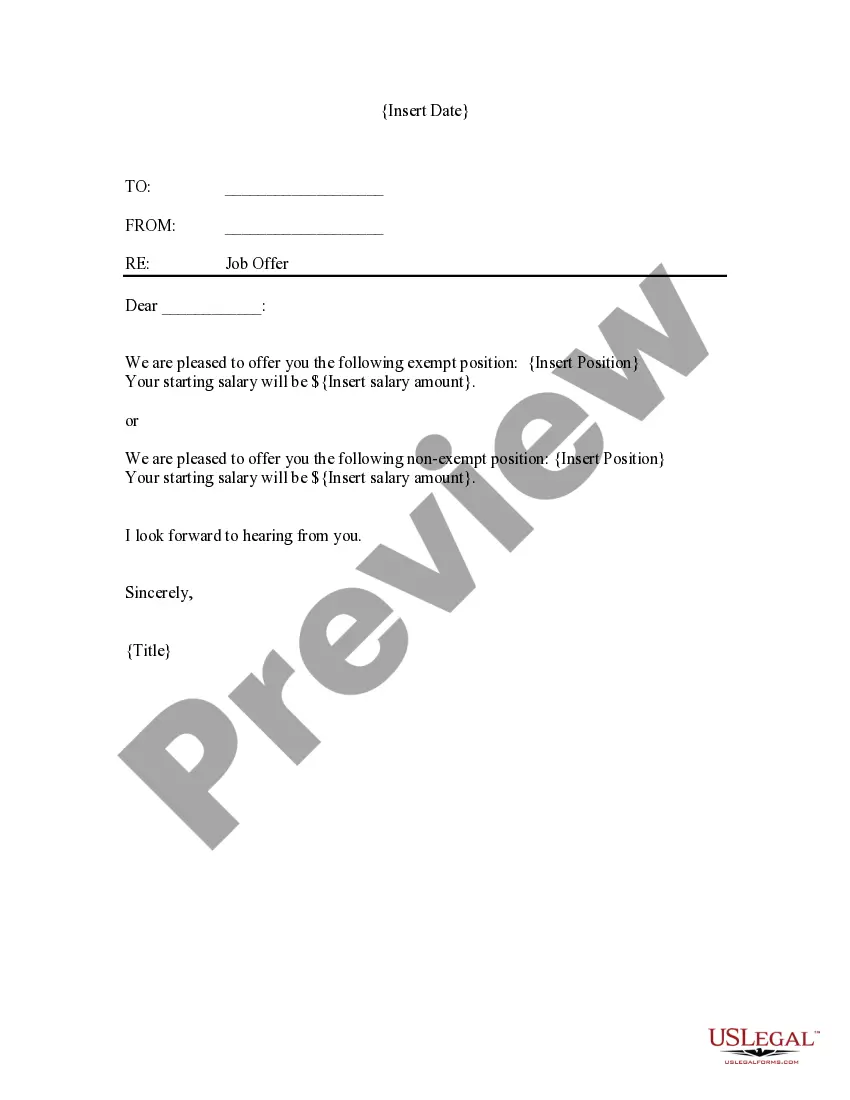

- Very first, make certain you have chosen the best file design for the region/metropolis that you pick. Look at the kind explanation to make sure you have picked the correct kind. If offered, make use of the Preview key to check from the file design at the same time.

- In order to discover another edition of the kind, make use of the Lookup discipline to discover the design that meets your requirements and needs.

- Upon having discovered the design you want, click Buy now to proceed.

- Pick the costs plan you want, type in your accreditations, and sign up for an account on US Legal Forms.

- Complete the deal. You should use your bank card or PayPal bank account to pay for the lawful kind.

- Pick the file format of the file and obtain it in your gadget.

- Make adjustments in your file if possible. You may full, revise and sign and print out South Carolina Subrogation Agreement between Insurer and Insured.

Obtain and print out a huge number of file templates while using US Legal Forms Internet site, that provides the largest variety of lawful varieties. Use skilled and condition-certain templates to handle your small business or specific requires.

Form popularity

FAQ

Title 38, Chapter 70 of the South Carolina Code of Laws defines the regulations and requirements for utilization reviews and private review agents.

The Made Whole Doctrine (sometimes referred to as the Made Whole Rule), is a common law doctrine that states a subrogee/insurer is not entitled to recover from an at-fault party unless and until the subrogor/insured has been, or can be, ?made whole.? The doctrine is an equitable defense that an insured can utilize to ...

An insurance company may not subrogate against its own insured or a co-insured. However, when a party claiming to be a co-insured is merely a loss payee to which no liability coverage is afforded, subrogation is permissible.

Section 38-71-190 states that "the director [i.e., the Director of the Department of Insurance] or his designee, upon being petitioned by the insured, determines that the exercise of subrogation is inequitable and commits an injustice to the insured..." This determination by the director or his designee may be appealed ...

Section 38-71-190 states that "the director [i.e., the Director of the Department of Insurance] or his designee, upon being petitioned by the insured, determines that the exercise of subrogation is inequitable and commits an injustice to the insured..." This determination by the director or his designee may be appealed ...

A time of payment of claims provision states the number of days that the insurance company has to pay or deny a submitted claim. This provision is included to minimize the amount of time that a policyholder has to wait for his/her payment or for a decision about his/her claim.

Section 38-71-190 of the South Carolina Code grants the insured the right to petition the Director of Insurance for a hearing on the fairness of subrogation by an insurer.

"Subrogation," or "subro" for short, refers to the right your insurance company holds under your policy ? after they've paid a covered claim ? to request reimbursement from the at-fault party. This reimbursement often comes from the at-fault party's insurance company.