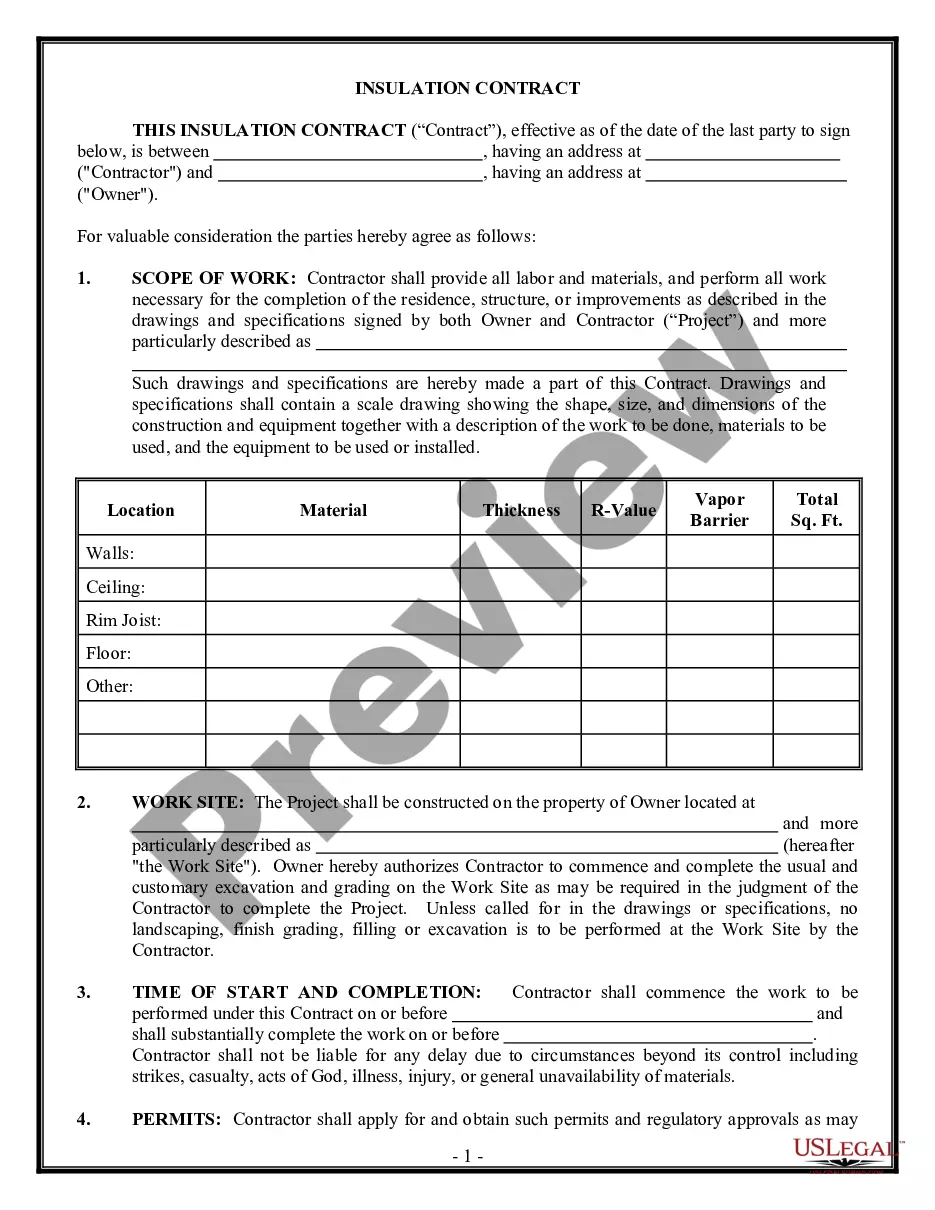

A South Carolina credit support agreement is a legal contract designed to provide financial security and assurance to lenders or creditors when extending credit to borrowers in the state of South Carolina. This agreement acts as a form of collateral or guarantee, ensuring that lenders will be repaid in case the borrower defaults on their obligations. Key aspects of a South Carolina credit support agreement include terms and conditions agreed upon by both parties, outlining the agreed-upon credit amount, interest rates, repayment schedules, and consequences of default. This agreement helps protect lenders from financial losses and encourages them to make credit available to borrowers, even those who may have limited creditworthiness. There are several types of credit support agreements that can be used in South Carolina, depending on the specific needs and circumstances of the parties involved. Some common types include: 1. Collateral Agreement: This agreement involves the borrower pledging assets such as property, equipment, or accounts receivable as collateral for the loan. In case of default, the lender can seize and sell these assets to recover their funds. 2. Personal Guarantee Agreement: In this type of agreement, an individual (typically the borrower or a third party) agrees to personally guarantee the repayment of the loan. If the borrower defaults, the guarantor becomes responsible for repaying the debt. 3. Letters of Credit: A letter of credit is a credit support agreement issued by a financial institution, serving as a promise to pay the lender in the event of non-payment by the borrower. This provides an additional level of security for the lender. 4. Surety Bond: This type of credit support agreement involves a third-party (the surety) assuming responsibility for the debt if the borrower defaults. The surety agrees to pay the lender a predetermined amount to cover any losses incurred. It is essential for both borrowers and lenders in South Carolina to carefully review and understand the terms and obligations outlined in a credit support agreement before signing. Seeking legal advice is highly recommended ensuring compliance with South Carolina laws and to protect the rights and interests of all parties involved.

South Carolina Credit support agreement

Description

How to fill out South Carolina Credit Support Agreement?

Choosing the best authorized file web template can be quite a have a problem. Of course, there are tons of web templates available on the net, but how do you find the authorized kind you want? Take advantage of the US Legal Forms web site. The services gives a huge number of web templates, for example the South Carolina Credit support agreement, that can be used for enterprise and personal demands. All the forms are checked out by professionals and fulfill state and federal requirements.

If you are already listed, log in for your account and click the Down load switch to get the South Carolina Credit support agreement. Utilize your account to check from the authorized forms you possess bought earlier. Check out the My Forms tab of the account and acquire another backup in the file you want.

If you are a fresh end user of US Legal Forms, here are straightforward recommendations that you can adhere to:

- Initial, make sure you have chosen the appropriate kind for the area/state. You can look through the shape using the Preview switch and study the shape explanation to make certain this is the right one for you.

- If the kind will not fulfill your preferences, take advantage of the Seach field to obtain the correct kind.

- When you are certain that the shape is suitable, click on the Acquire now switch to get the kind.

- Pick the pricing prepare you desire and type in the needed information. Design your account and pay for an order making use of your PayPal account or credit card.

- Pick the submit file format and acquire the authorized file web template for your product.

- Total, revise and produce and signal the acquired South Carolina Credit support agreement.

US Legal Forms is the biggest collection of authorized forms in which you will find various file web templates. Take advantage of the service to acquire professionally-created files that adhere to status requirements.

Form popularity

FAQ

Statutes of limitations exist for many different legal issues, including consumer and business debt. Under South Carolina law (S.C. Code § 15-3-530), the statute of limitations for most types of consumer and business debt is three (3) years. Creditors Should Know Time-Barred Debt Columbia, SC crawfordvk.com ? creditors-know-time-barr... crawfordvk.com ? creditors-know-time-barr...

Each state has different laws when it comes to the statute of limitations on debt. In South Carolina mortgage debt has a statute of limitations of 20 years. This is quite long compared to consumer debt such as credit card debt, which has a statute of limitations of 3 years.

Summary Court in South Carolina is also known as Magistrate Court - the Judge is called a Magistrate. Credit card companies, finance companies and other debt collectors (called "creditors") can file lawsuits to collect debt from you in these courts if the amount is less than $7500.

Credit Repair Licensing in South Carolina Yes, South Carolina requires a license specifically for credit repair. Start a Credit Repair Business in the state of South Carolina creditrepaircloud.com ? south-carolina-credi... creditrepaircloud.com ? south-carolina-credi...

The state of South Carolina is one of four states that does not permit wage garnishment. However, state law does permit creditors to pursue garnishment against your bank account, effectively freezing your assets.

Setoff Debt & GEAR? South Carolina law requires the SCDOR to assist qualifying entities in collecting debts through two collection programs: Setoff Debt and GEAR. Setoff Debt allows the SCDOR to assist in collecting debts owed to claimant agencies by garnishing South Carolina Individual Income Tax refunds.

Debt Collection Laws in South Carolina Residents of South Carolina fall under the Federal Debt Collections Protection Act, which prohibits collection agencies from harassing borrowers or using unfair or misleading tactics to collect debts. South Carolina Debt Relief, Statute of Limitations & Debt Collection Laws debt.org ? faqs ? consumer-south-carolina debt.org ? faqs ? consumer-south-carolina

Keep in mind: In South Carolina, a creditor's ability to collect under a judgment lien will be affected by a number of factors -- including a fixed amount of value that won't be touchable if the property is the debtor's primary residence (called a homestead exemption), other liens that may be in place, and any ... Judgment Liens on Property in South Carolina - Nolo nolo.com ? legal-encyclopedia ? judgment-l... nolo.com ? legal-encyclopedia ? judgment-l...