A South Carolina Assignment of LLC Company Interest to Living Trust is a legal document that allows an individual or an entity to transfer ownership or membership interests in a limited liability company (LLC) to a living trust. This assignment enables the LLC member to transfer their rights, duties, and benefits associated with the company to a trust, while still maintaining the asset protection, estate planning benefits, and management control over the LLC. In South Carolina, there are several types of South Carolina Assignment of LLC Company Interest to Living Trust, each with its particular characteristics and purposes. Some of these types include: 1. Revocable Living Trust Assignment: This type of assignment allows an LLC member to transfer their company interest to a revocable living trust, which can be modified, altered, or revoked during the granter's lifetime. The trust assets and income remain under the control of the granter until their death or incapacity. 2. Irrevocable Living Trust Assignment: Unlike a revocable living trust, an irrevocable living trust assignment transfers the LLC membership interests permanently, relinquishing the granter's control over the assets and income. It provides asset protection, helps reduce estate taxes, and ensures the seamless transfer of wealth to beneficiaries upon the granter's death. 3. Testamentary Living Trust Assignment: This assignment takes effect upon the death of the LLC member, transferring the membership interests to a living trust specified in the individual's will or estate plan. It allows for the smooth transition of the company interest while bypassing probate. 4. Family Limited Partnership (FLP) Assignment: This type of assignment involves transferring the LLC membership interests to a family limited partnership that is governed by a living trust. Alps are often utilized for estate planning purposes to retain family control over assets, protect them from creditors, and facilitate efficient wealth transfer between generations. Key elements and considerations in a South Carolina Assignment of LLC Company Interest to Living Trust may include: — Identification of the assignor (LLC member transferring the interest) and the assignee (living trust receiving the interest). — Details of the LLC, including its name, address, and any relevant identifying information. — Specific percentage or units of ownership being assigned, along with any rights, dividends, or profits associated with the interest. — A statement indicating the assignment is unconditional, voluntary, and without any encumbrances or claims. — Provisions outlining the governing law and jurisdiction for resolving any disputes related to the assignment. — Execution and notarization of the assignment document, accompanied by the LLC's consent (if required) and any necessary filing with the South Carolina Secretary of State or other relevant authorities. It is crucial to consult with a qualified attorney or legal professional familiar with the intricacies of South Carolina law when considering an Assignment of LLC Company Interest to Living Trust. This ensures compliance with state regulations and an accurate representation of the parties' intentions while achieving their desired estate planning or asset protection objectives.

South Carolina Assignment of LLC Company Interest to Living Trust

Description

How to fill out South Carolina Assignment Of LLC Company Interest To Living Trust?

Have you been in a place in which you need to have documents for possibly business or specific functions nearly every day time? There are plenty of authorized document templates accessible on the Internet, but locating kinds you can trust isn`t easy. US Legal Forms delivers a huge number of form templates, just like the South Carolina Assignment of LLC Company Interest to Living Trust, which can be created to meet state and federal requirements.

In case you are previously informed about US Legal Forms site and have a free account, simply log in. Afterward, you may down load the South Carolina Assignment of LLC Company Interest to Living Trust template.

Unless you offer an accounts and would like to begin to use US Legal Forms, adopt these measures:

- Discover the form you will need and ensure it is for your correct city/area.

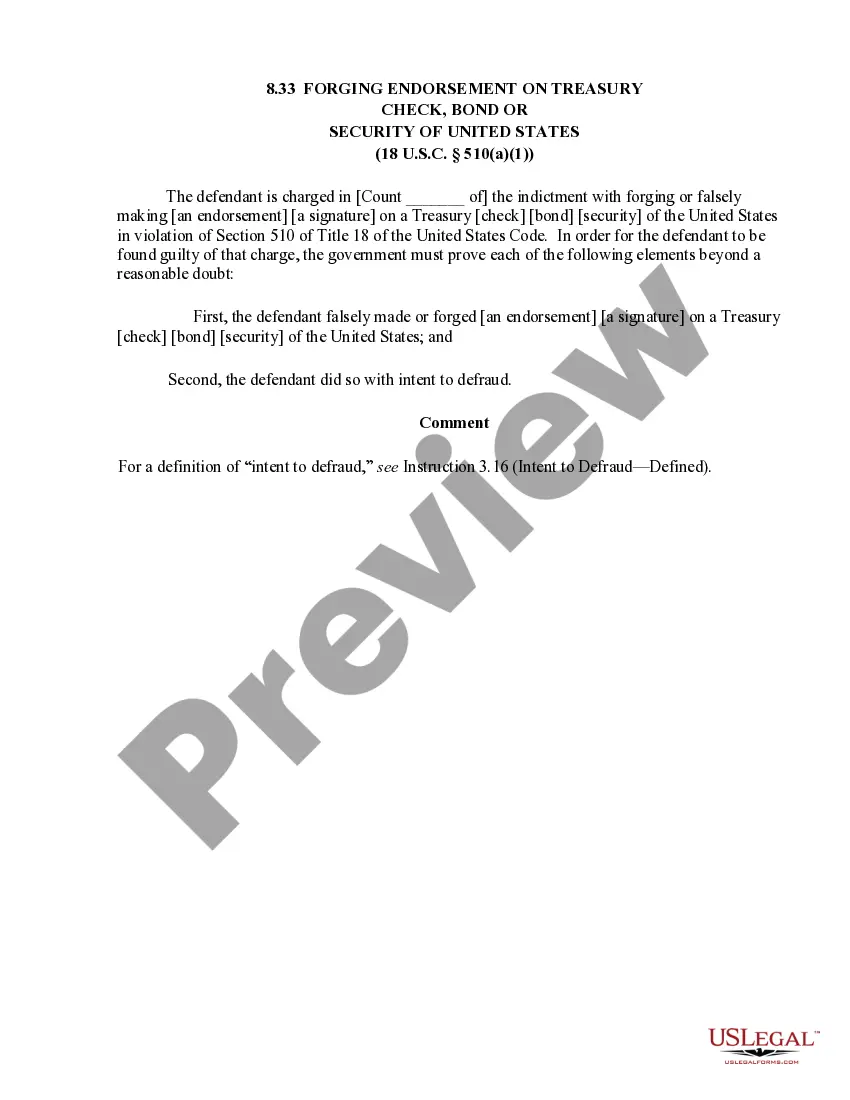

- Use the Review button to examine the form.

- Look at the outline to ensure that you have chosen the right form.

- In case the form isn`t what you are looking for, make use of the Lookup discipline to obtain the form that suits you and requirements.

- Once you find the correct form, click on Get now.

- Choose the costs program you desire, fill out the desired details to make your bank account, and buy your order making use of your PayPal or bank card.

- Select a hassle-free file structure and down load your version.

Find each of the document templates you may have purchased in the My Forms food selection. You may get a extra version of South Carolina Assignment of LLC Company Interest to Living Trust whenever, if required. Just click the needed form to down load or print out the document template.

Use US Legal Forms, by far the most comprehensive variety of authorized kinds, to conserve time as well as avoid blunders. The services delivers skillfully made authorized document templates which you can use for a range of functions. Make a free account on US Legal Forms and commence creating your life a little easier.