A South Carolina Security Interest Subordination Agreement is a legally binding document that determines the priority of security interests in a borrower's assets. It is commonly used in commercial transactions where multiple lenders or creditors have claims to the same collateral. The purpose of a security interest subordination agreement is to establish the order in which creditors will be repaid in the event of a borrower's default or bankruptcy. By entering into this agreement, lenders voluntarily subordinate their security interest, allowing another lender to have a higher priority in collecting the collateral proceeds. There are several types of South Carolina Security Interest Subordination Agreements, each serving a specific purpose. Some of these include: 1. Intercreditor Agreement: This type of subordination agreement is typically entered into by two or more creditors who have security interests in the same collateral. It establishes the priority of each creditor's claims and defines how proceeds will be distributed in case of default. 2. Subordination Agreement with a Debtor: This agreement is made between a debtor and a creditor, where the debtor agrees to subordinate their security interest in certain collateral to another creditor. This is often done to secure additional financing or to restructure existing debt. 3. Subordination Agreement with a Junior Creditor: In this scenario, a junior creditor agrees to subordinate their security interest to a senior creditor. By accepting a lower priority, the junior creditor may gain other benefits such as higher interest rates or extended loan terms. 4. Subordination Agreement with a Third Party: This type of subordination agreement involves a third-party lender who agrees to subordinate their security interest to another lender. This is typically done when a borrower seeks additional financing or refinancing options. In South Carolina, the terms and conditions of a Security Interest Subordination Agreement must comply with the state's Uniform Commercial Code (UCC) and other applicable laws. It is crucial for all parties involved to carefully review and negotiate the terms of the agreement to protect their interests and ensure compliance with legal requirements. Overall, a South Carolina Security Interest Subordination Agreement is an important tool that allows lenders and creditors to establish the priority of their security interests in a borrower's assets. It provides clarity and protection for all parties involved in commercial transactions, ensuring a fair distribution of collateral proceeds in case of default or bankruptcy.

South Carolina Security Interest Subordination Agreement

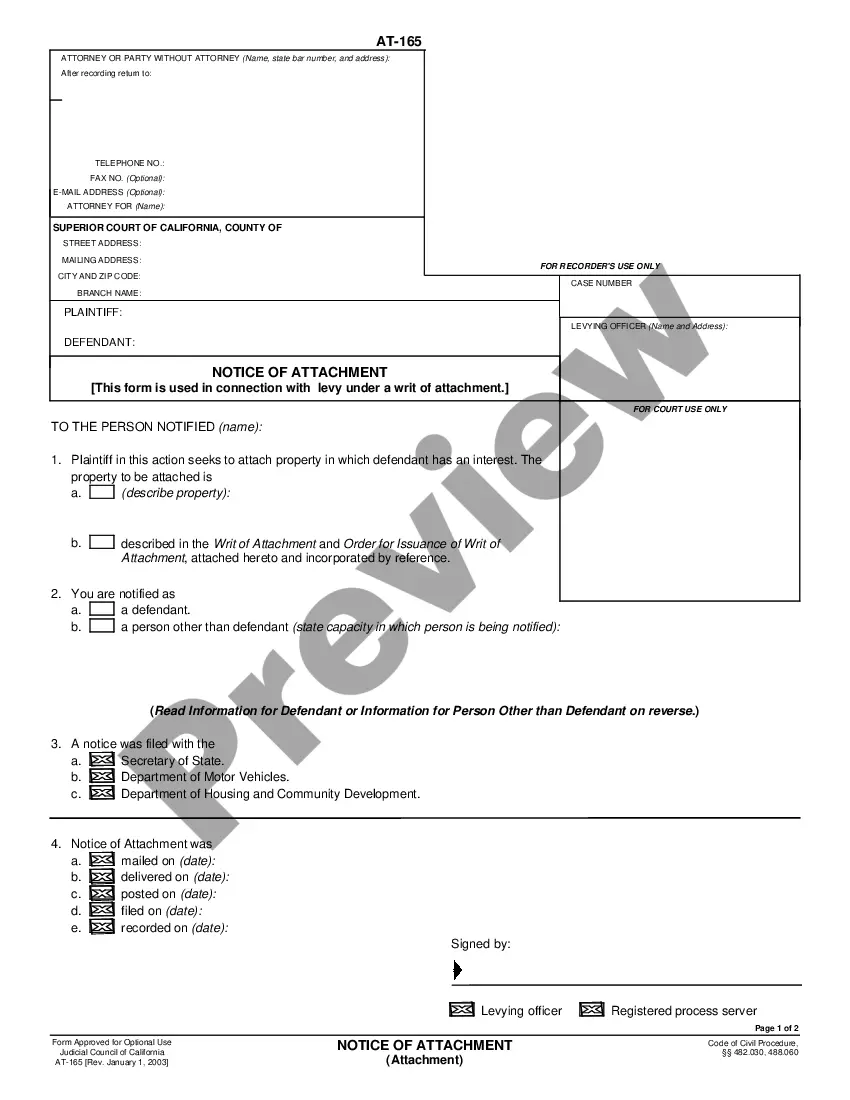

Description

How to fill out South Carolina Security Interest Subordination Agreement?

If you need to complete, obtain, or print out lawful record themes, use US Legal Forms, the largest variety of lawful forms, which can be found on the Internet. Use the site`s easy and practical search to get the documents you want. A variety of themes for organization and specific reasons are categorized by classes and suggests, or search phrases. Use US Legal Forms to get the South Carolina Security Interest Subordination Agreement within a couple of mouse clicks.

In case you are currently a US Legal Forms client, log in in your bank account and click on the Obtain button to get the South Carolina Security Interest Subordination Agreement. You can even accessibility forms you formerly saved within the My Forms tab of your respective bank account.

If you use US Legal Forms initially, follow the instructions below:

- Step 1. Make sure you have selected the form for your correct town/region.

- Step 2. Take advantage of the Review method to examine the form`s information. Don`t overlook to see the information.

- Step 3. In case you are not happy with the develop, take advantage of the Look for industry at the top of the display to locate other types of the lawful develop format.

- Step 4. Once you have discovered the form you want, go through the Buy now button. Choose the pricing strategy you prefer and add your qualifications to sign up for an bank account.

- Step 5. Approach the purchase. You can utilize your Мisa or Ьastercard or PayPal bank account to finish the purchase.

- Step 6. Find the formatting of the lawful develop and obtain it on your own product.

- Step 7. Full, modify and print out or sign the South Carolina Security Interest Subordination Agreement.

Every lawful record format you get is the one you have for a long time. You might have acces to each develop you saved in your acccount. Click the My Forms area and decide on a develop to print out or obtain once more.

Remain competitive and obtain, and print out the South Carolina Security Interest Subordination Agreement with US Legal Forms. There are thousands of professional and state-certain forms you can use to your organization or specific requirements.