South Carolina Covenant Not to Sue by Widow of Deceased Stockholder

Description

How to fill out Covenant Not To Sue By Widow Of Deceased Stockholder?

You might spend numerous hours online searching for the legal document template that complies with the state and national requirements you need.

US Legal Forms offers thousands of legal forms that are evaluated by experts.

You can download or print the South Carolina Covenant Not to Sue by Widow of Deceased Stockholder from the service.

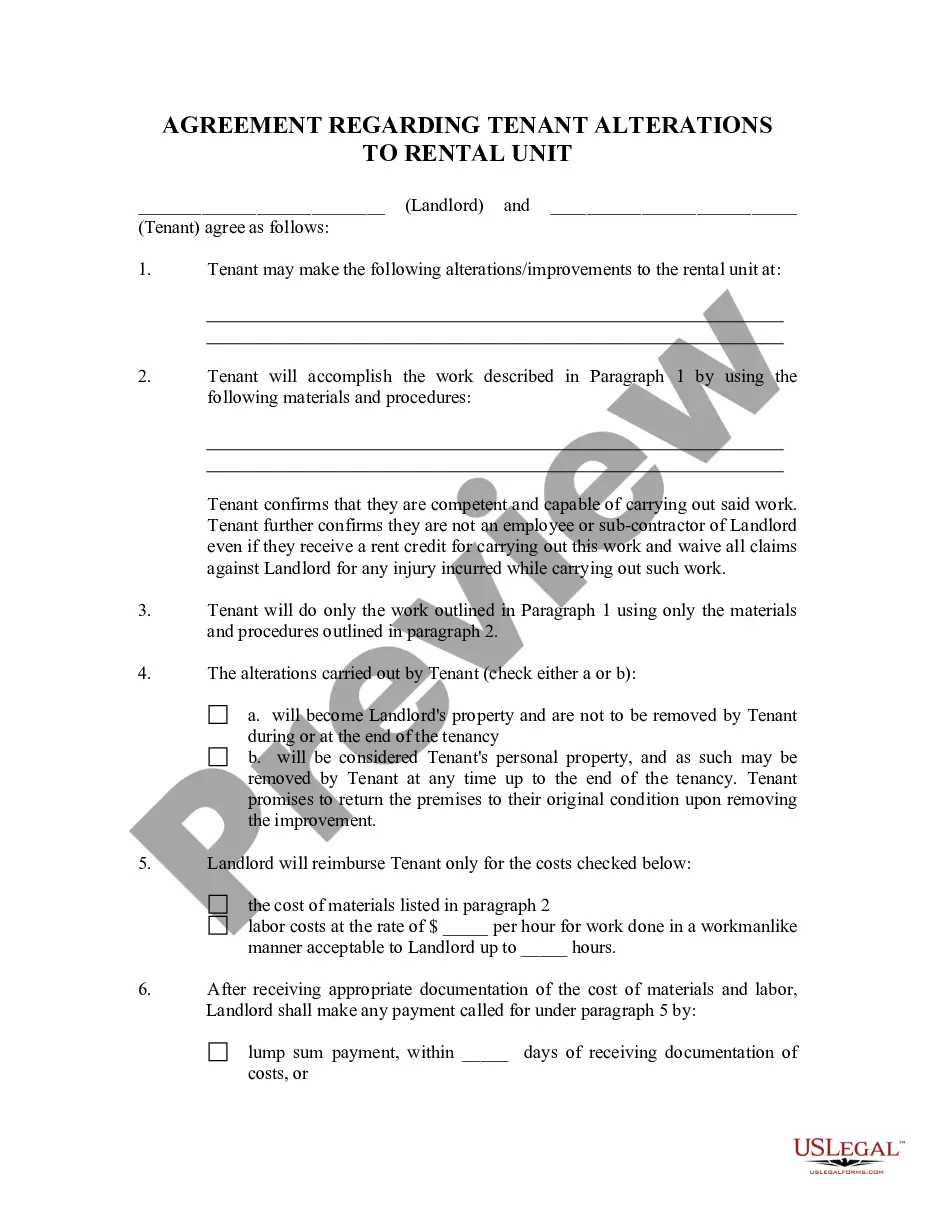

Review the form description to confirm that you have selected the right document. If available, utilize the Preview feature to browse through the document template as well.

- If you already have a US Legal Forms account, you can sign in and click the Obtain button.

- Subsequently, you can fill out, modify, print, or sign the South Carolina Covenant Not to Sue by Widow of Deceased Stockholder.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of a purchased form, go to the My documents section and click the appropriate option.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/area of your choice.

Form popularity

FAQ

The Uniform Law Commissioners approved a revised Uniform Principal and Income Act in the Summer of 1997, and the Act is currently in different stages of the adoption process in various states. It has now been adopted in Arkansas, California, Connecticut, Iowa, North Dakota, Oklahoma, Virginia and West Virginia.

Living Trusts In South Carolina, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

In South Carolina, if you are married and you die without a will, what your spouse gets depends on whether or not you have living descendants -- children, grandchildren, or great grandchildren. If you don't, then your spouse inherits everything. If you do, then your spouse inherits 1/2 of your intestate property.

Article 996 of the New Civil Code provides that If a widow or widower and legitimate children or descendants are left, the surviving spouse has in the succession the same share as that of each of the children.

If you live in South Carolina and die without a valid will and have only a surviving spouse (but no children), your spouse gets everything. If you have children and you die intestate in South Carolina, your spouse inherits half of your estate while your children get the other half evenly.

If your spouse dies, you usually become the sole owner of any money or property that you both owned jointly. This is true for both married and common-law couples.

The states that have enacted a version of the Uniform Trust Code are Alabama, Arizona, Arkansas, Florida, Kansas, Kentucky, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Jersey, New Hampshire, New Mexico, North Carolina, North Dakota, Ohio, Oregon, Pennsylvania,

Simply put, if you have a legally binding will when you pass away then the dictates of that document will determine what happens to your assets- so if you have listed your spouse as sole beneficiary, they will receive everything, or exactly how much you have given to them in the will.

Which States Allow Dynasty Trusts? Some states have maintained the 21-year Rule Against Perpetuities, and therefore do not allow dynasty trusts. The top tier states for dynasty trusts are Alaska, Delaware, Nevada, and South Dakota because they allow dynasty trusts and do not impose state income tax on trusts.