A South Carolina Qualified Domestic Trust Agreement, also known as a DOT Agreement, is a legal instrument designed to provide tax benefits and financial protection for non-U.S. citizen surviving spouses inheriting property from their U.S. citizen spouses. This arrangement allows the non-U.S. citizen spouse to take advantage of the marital deduction provisions provided by the Internal Revenue Code (IRC) while ensuring that the assets placed in the trust remain subject to certain conditions. Under South Carolina law, a DOT Agreement helps to alleviate the potential estate tax burden that could be triggered upon the death of the U.S. citizen spouse. Without a DOT, the unlimited marital deduction typically available to U.S. citizen spouses would not apply to non-U.S. citizen spouses, resulting in substantial estate tax liabilities. By establishing a DOT Agreement, the non-U.S. citizen surviving spouse can receive income from the trust assets while deferring any estate tax obligations until distribution from the trust or their subsequent passing. This provides financial security for the surviving spouse while ensuring that the assets remain subject to U.S. estate tax regulations. It is important to note that South Carolina does not have any specific laws governing Qualified Domestic Trust Agreements. However, the state generally follows the provisions of the federal tax code regarding Dots. The DOT Agreement must comply with the federal requirements to receive the desired tax benefits. Though there are no distinct types of South Carolina Qualified Domestic Trust Agreements specific to the state, they can be tailored to fit the unique circumstances of each individual couple. The terms of the agreement and the assets placed within the trust can vary based on factors such as the size of the estate, the financial needs of the surviving spouse, and the objectives for the disposition of the assets. In summary, a South Carolina Qualified Domestic Trust Agreement is a valuable estate planning tool that allows non-U.S. citizen surviving spouses to receive financial protection and tax benefits when inheriting assets from their U.S. citizen spouses. While the state has no separate legal framework, complying with the federal rules ensures eligibility for the desired tax advantages.

South Carolina Qualified Domestic Trust Agreement

Description

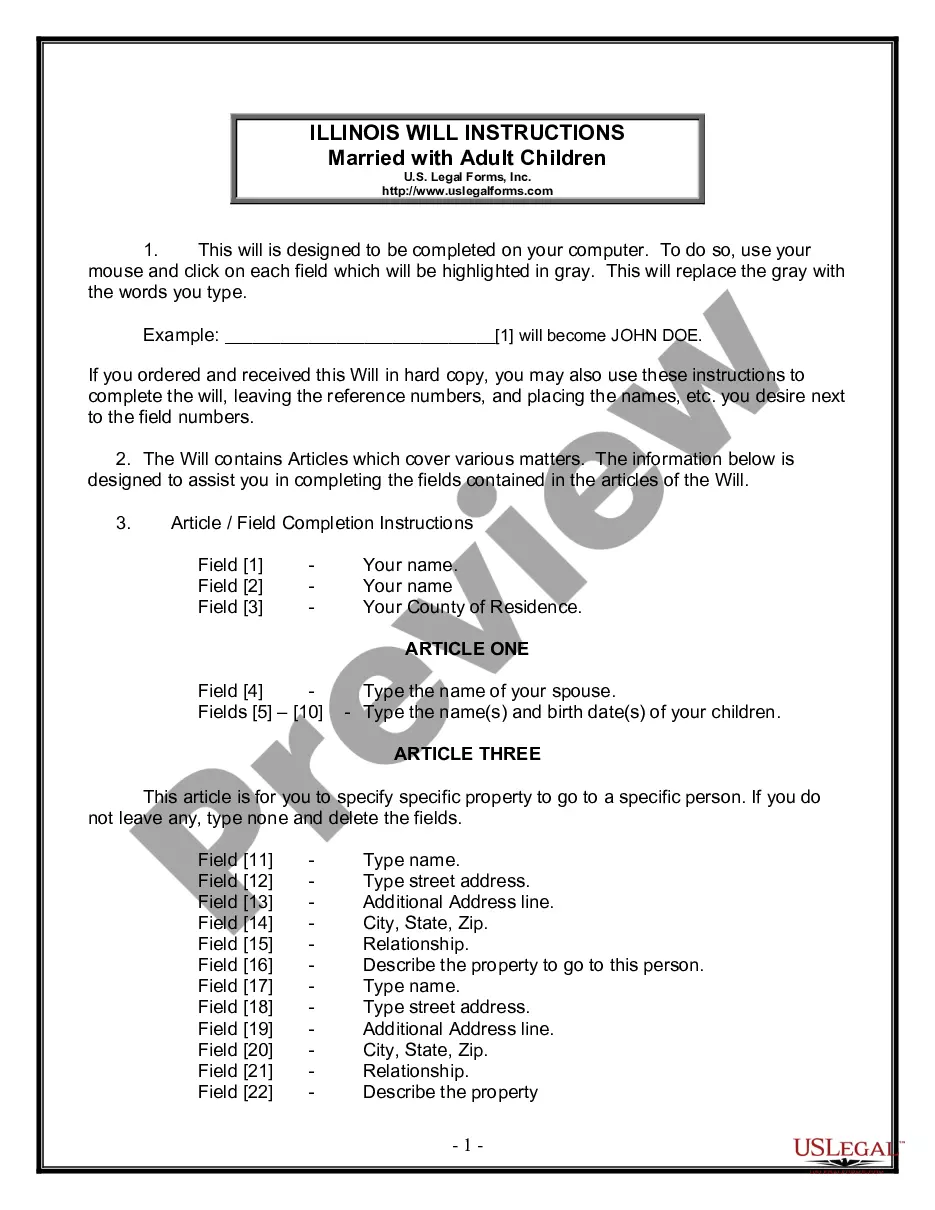

How to fill out South Carolina Qualified Domestic Trust Agreement?

US Legal Forms - one of the most significant libraries of lawful forms in America - provides an array of lawful document layouts you are able to down load or print. Making use of the site, you may get a large number of forms for enterprise and specific reasons, categorized by classes, says, or key phrases.You will find the newest variations of forms just like the South Carolina Qualified Domestic Trust Agreement within minutes.

If you currently have a subscription, log in and down load South Carolina Qualified Domestic Trust Agreement through the US Legal Forms catalogue. The Down load switch can look on every single form you see. You get access to all formerly saved forms within the My Forms tab of your bank account.

If you want to use US Legal Forms the very first time, listed here are simple instructions to help you get began:

- Be sure you have selected the correct form to your metropolis/area. Click the Preview switch to check the form`s information. Read the form information to actually have chosen the right form.

- In the event the form doesn`t satisfy your requirements, take advantage of the Research field at the top of the display screen to obtain the one which does.

- When you are content with the shape, affirm your choice by clicking on the Get now switch. Then, select the rates strategy you want and give your qualifications to register to have an bank account.

- Process the transaction. Make use of Visa or Mastercard or PayPal bank account to perform the transaction.

- Pick the file format and down load the shape on your own product.

- Make modifications. Load, edit and print and signal the saved South Carolina Qualified Domestic Trust Agreement.

Every single template you put into your money lacks an expiry time which is your own property eternally. So, in order to down load or print another backup, just check out the My Forms portion and click about the form you need.

Get access to the South Carolina Qualified Domestic Trust Agreement with US Legal Forms, the most comprehensive catalogue of lawful document layouts. Use a large number of specialist and express-certain layouts that meet up with your small business or specific demands and requirements.