South Carolina Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years

Description

How to fill out Testamentary Provisions For Charitable Remainder Annuity Trust For Term Of Years?

If you wish to finish, download, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Leverage the site’s simple and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

Step 4. Once you have found the form you need, click the Buy now button. Choose the payment plan you prefer and enter your credentials to register for an account.

- Use US Legal Forms to find the South Carolina Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to obtain the South Carolina Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

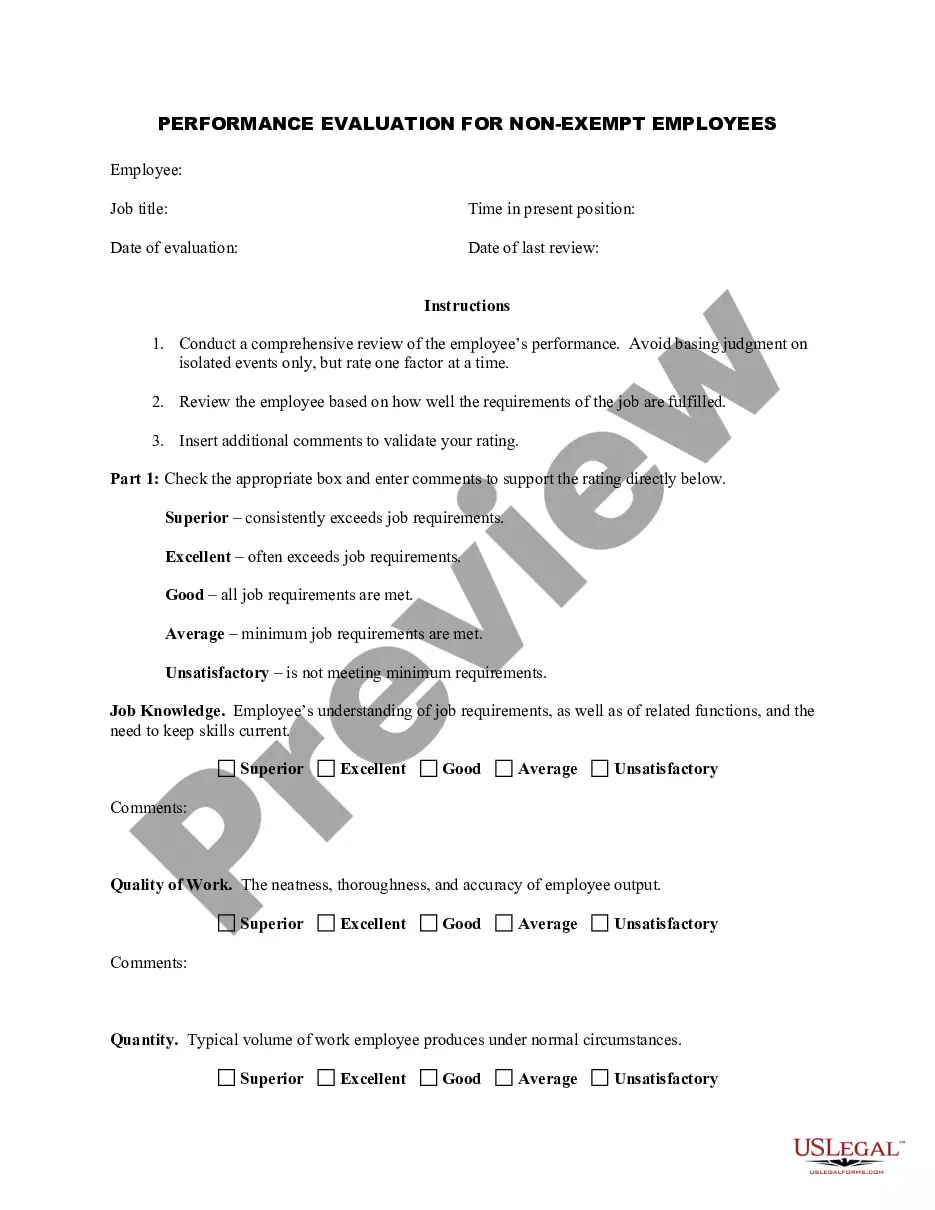

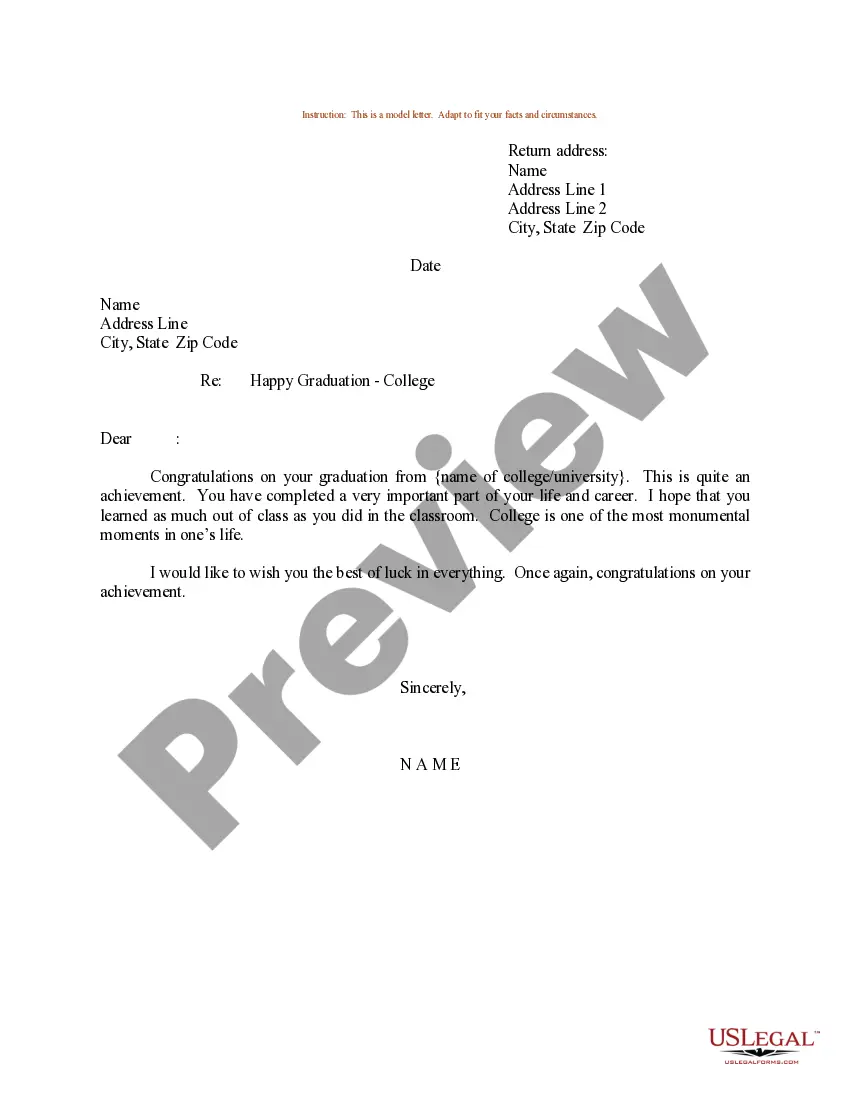

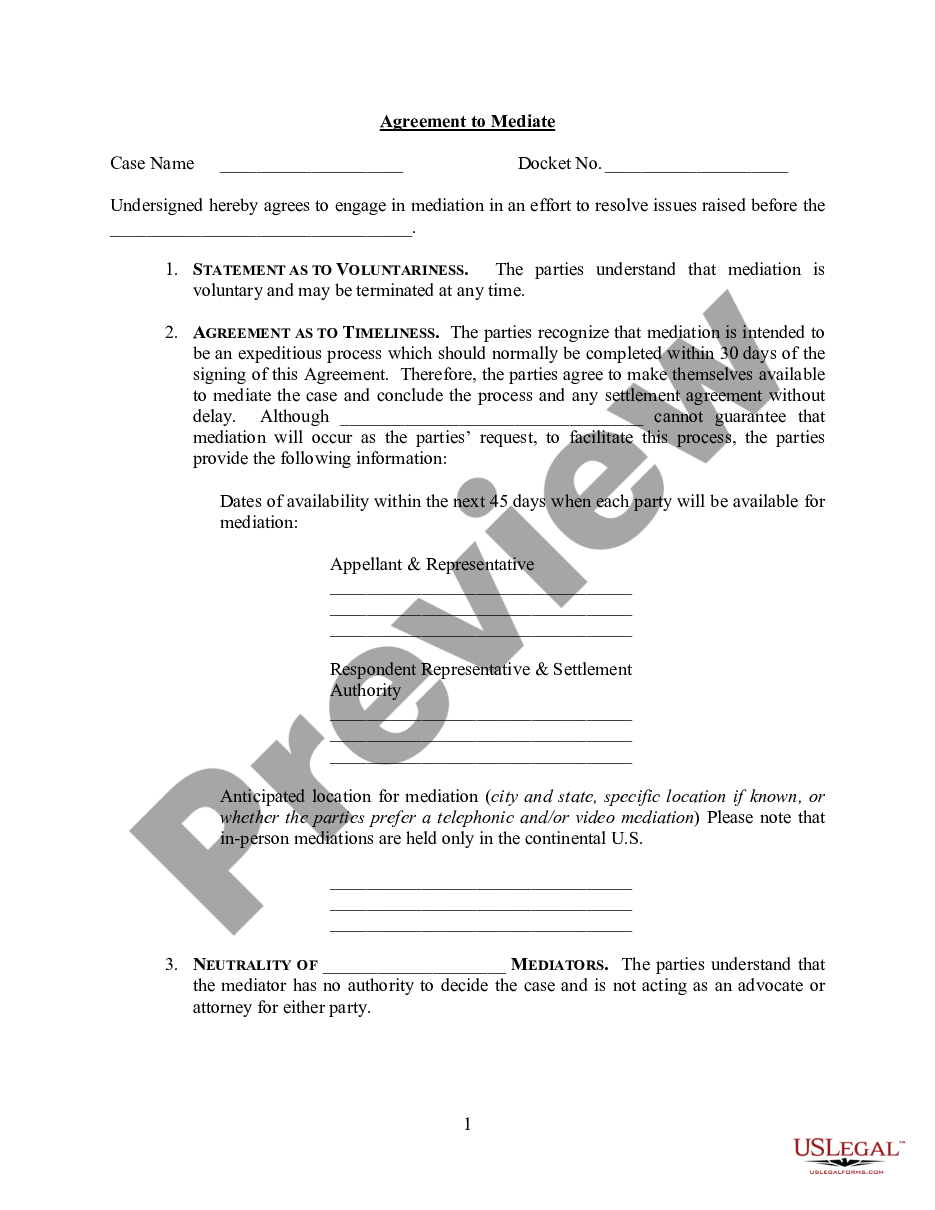

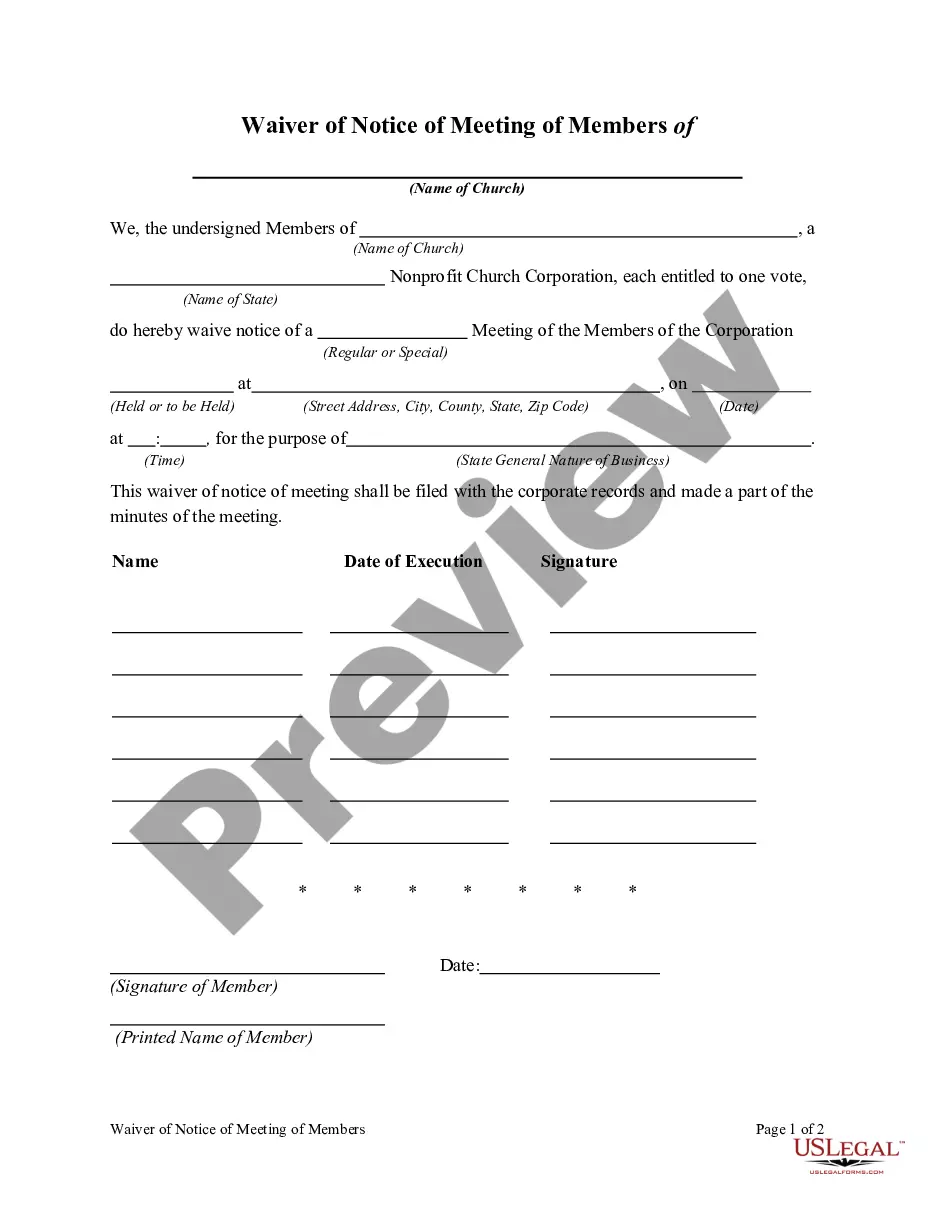

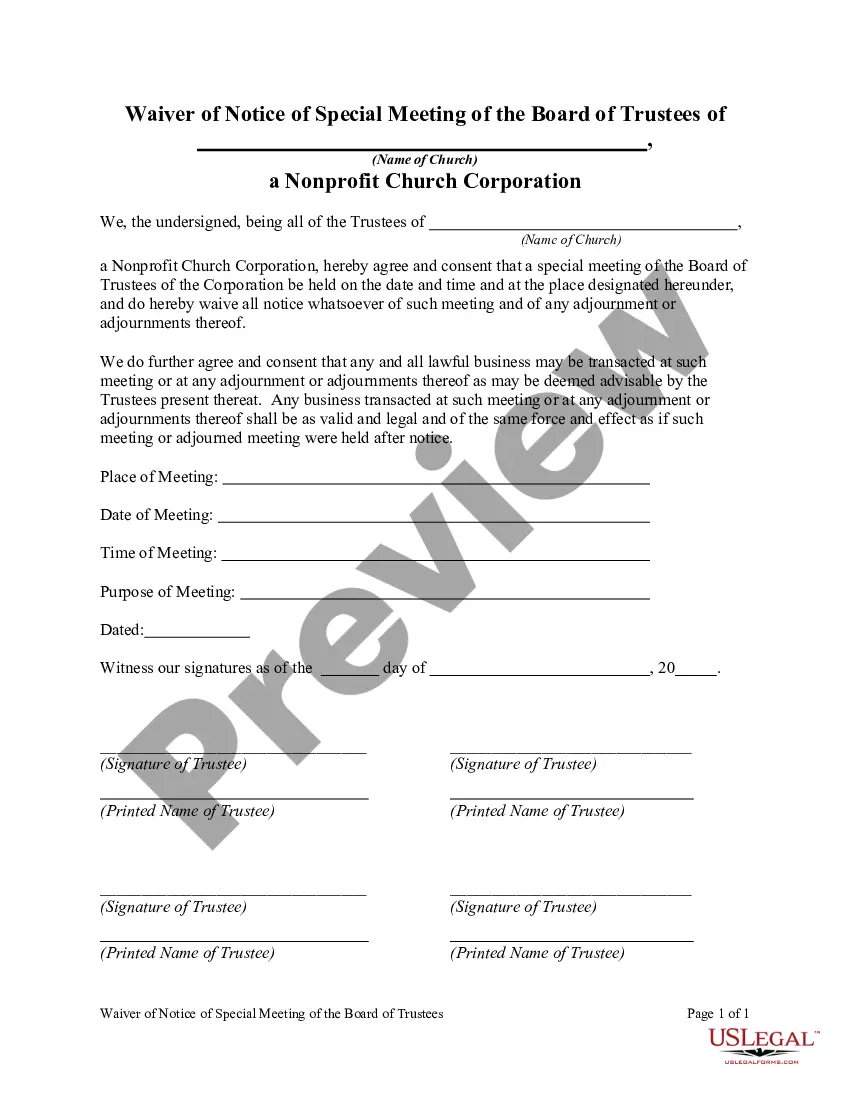

- Step 2. Use the Preview option to review the content of the form. Be sure to read the description.

Form popularity

FAQ

Unitrust payouts are taxable. With a CRT, the donor must pay tax on the income stream, which is categorized into four tiers: (1) Ordinary income and qualified dividends, (2) capital gains (short-term, personal property, depreciation, long-term gain), (3) other tax-exempt income; and (4) return of principal.

A testamentary trust is a trust that is to contain a portion or all of a decedent's assets outlined within a person's last will and testament. A testamentary trust is not established until after the person passes away in which the executor or executrix settles the estate as outlined in the will.

You don't have to name a testamentary trust as a beneficiary in your will because, by definition, it's already a beneficiary. Testamentary trusts differ from inter-vivos or living trusts in that they don't exist until after your death.

A testamentary trust is a trust contained in a last will and testament. It provides for the distribution of all or part of an estate and often proceeds from a life insurance policy held on the person establishing the trust. There may be more than one testamentary trust per will.

To create a testamentary trust, the settlor first must select the trustee and the beneficiary and specify the assets that are to be placed in trust. The settlor also has the ability to specify when and how to disburse the trust to the beneficiary. The last will and testament should detail all of this information.

A will typically contains provision for the distribution of a testator's deceased estate after their death. There are some instances where a testator might choose to create a testamentary trust instead of bequeathing an asset directly to a beneficiary.

Naming Your Testamentary TrustThe name of the trust (this must be listed first);The words created in my last will and Testament' (do not include a date created);The name of the trustee, followed by the word trustee;The trustee's address and phone number.

All trusts are required to contain at least the following elements:Trusts must identify the grantor, trustee and beneficiary. The grantor and trustee must be identified because they are parties to the contract.The trust res must be identified.The trust must contain the signature of both the grantor and the trustee.

If an individual establishes a charitable remainder trust for his or her life only, the trust assets will be included in his or her gross estate under IRC section 2036.

One of the drawbacks of a testamentary trust is the considerable responsibility it puts on the trustee. He must meet regularly with the probate court to demonstrate his safe handling of the trust, and depending on your wishes, his tasks may go on for many years.