Subject: South Carolina Sample Letter for Distribution of Estate to Church Dear [Church Name], I hope this letter finds you in good health and high spirits. I am writing to inform you about the distribution of an estate in South Carolina to your revered institution. In accordance with the last will and testament of [Full Name of the deceased], dated [Date], we hereby notify you that the deceased, a cherished member of our community and a devoted congregant of [Church Name], has generously bequeathed a portion of their estate to support the noble cause of the church's ongoing mission. [Talk about the deceased's affiliation with the church and their devotion to its values, principles, and community involvement.] We deeply appreciate the deceased's benevolent intentions and are committed to fulfilling their wishes. The value of the estate property allocated to [Church Name], as per the will, is [Amount/value of the estate bequeathed]. To ensure a smooth and timely distribution process, we kindly request the church's cooperation in providing the necessary documentation, including an official acceptance letter on your organization's letterhead. This letter should affirm the church's willingness to accept the bequest and thoroughly outline your plans for utilizing the funds. [If applicable, briefly explain any restrictions or conditions attached to the donation by the deceased.] Please provide the following information in the acceptance letter: 1. Official acceptance of the bequest and gratitude for the deceased's generosity. 2. Detailed information about any special funds or programs that will benefit from the bequest. 3. Assurances that the funds will be used exclusively for the designated purpose. 4. The church's tax-exempt status documentation or IRS identification number. 5. Bank account details for the estate transfer, including routing and account numbers. 6. Any further information required for the proper administration and documentation of the bequest. [If there are different types of South Carolina Sample Letters for Distribution of Estate to Church, state them here, if not, skip this part.] At your earliest convenience, please forward the acceptance letter, along with the aforementioned supporting documents, to the below address or email: [Your Name] [Your Title/Position] [Your Church/Organization Name] [Address Line 1] [Address Line 2] [City, State, ZIP Code] [Email Address] Should you have any questions or require further information, please do not hesitate to contact me at [Phone Number] or [Email Address]. Thank you for your prompt attention to this matter, and we look forward to continuing our partnership in fulfilling the deceased's philanthropic vision. Yours sincerely, [Your Name] [Your Title/Position] [Your Church/Organization Name]

South Carolina Sample Letter for Distribution of Estate to Church

Description

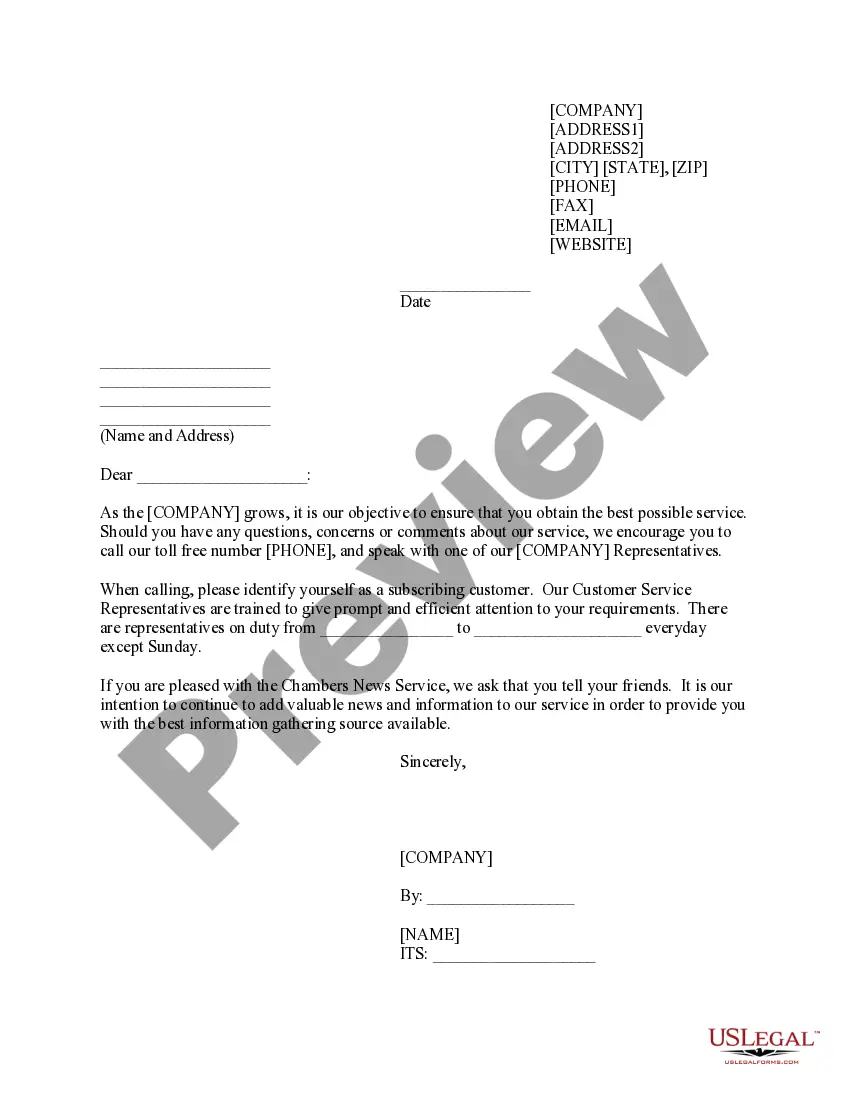

How to fill out South Carolina Sample Letter For Distribution Of Estate To Church?

US Legal Forms - one of many most significant libraries of authorized forms in the States - offers a variety of authorized document web templates you may down load or produce. Utilizing the internet site, you can find thousands of forms for organization and person functions, sorted by classes, says, or search phrases.You will find the newest variations of forms just like the South Carolina Sample Letter for Distribution of Estate to Church in seconds.

If you already have a registration, log in and down load South Carolina Sample Letter for Distribution of Estate to Church from the US Legal Forms catalogue. The Download key will show up on each form you perspective. You have accessibility to all previously delivered electronically forms within the My Forms tab of your respective accounts.

If you wish to use US Legal Forms the very first time, here are simple guidelines to help you started out:

- Be sure to have picked the proper form to your metropolis/region. Select the Preview key to analyze the form`s information. See the form information to actually have chosen the correct form.

- When the form doesn`t suit your demands, use the Research area at the top of the monitor to discover the one who does.

- If you are pleased with the shape, confirm your decision by visiting the Buy now key. Then, select the pricing strategy you want and offer your references to register to have an accounts.

- Method the transaction. Make use of your credit card or PayPal accounts to complete the transaction.

- Choose the formatting and down load the shape on the system.

- Make adjustments. Load, edit and produce and indication the delivered electronically South Carolina Sample Letter for Distribution of Estate to Church.

Each and every template you added to your money lacks an expiration particular date and is the one you have permanently. So, if you would like down load or produce one more duplicate, just check out the My Forms section and click around the form you need.

Gain access to the South Carolina Sample Letter for Distribution of Estate to Church with US Legal Forms, the most extensive catalogue of authorized document web templates. Use thousands of professional and condition-specific web templates that meet up with your company or person needs and demands.

Form popularity

FAQ

While there is no specific deadline for this in South Carolina law, it is generally best to do so within a month to prevent unnecessary delays in the probate process.

The Personal Representative must file a final account, report and petition for final distribution, have the petition set for hearing, give notice of the hearing to interested persons, and obtain a court order approving the final distribution.

This is when courts transfer the ownership of assets to beneficiaries or heirs. The final distribution only occurs when the estate is settled, meaning all creditors and taxes have been paid, all disputes have been resolved, and the judge gives final approval.

Some of the financial assets of the deceased are put within an estate account after they pass away in order to help pay off their debts. Once the account is opened, the Executor, or a court-appointed administrator, is permitted to use the funds held within the account for debts.

The Personal Representative must file a final account, report and petition for final distribution, have the petition set for hearing, give notice of the hearing to interested persons, and obtain a court order approving the final distribution.

The Court Issues a Certificate of Discharge Once all claims have been paid, the will presented and all tasks listed above are completed, the court will close the estate. To confirm this, a Certificate of Discharge is issued.

Divvying up your estate in an equal way between your children often makes sense, especially when their histories and circumstances are similar. Equal distribution can also avoid family conflict over fairness or favoritism.

Individuals can receive inheritance money in different ways including through a trust and from a will, which can come with restrictions, or as a beneficiary on a bank or retirement account.