South Carolina LLC Operating Agreement for Married Couple: A Comprehensive Guide Keywords: South Carolina, LLC Operating Agreement, Married Couple, types Introduction: A South Carolina LLC Operating Agreement is a legally binding document that outlines the rights, responsibilities, and decision-making processes for members of a Limited Liability Company (LLC) in the state of South Carolina. When a married couple decides to start an LLC together, they can enter into a specific type of operating agreement tailored to their unique relationship as a married couple. Types of South Carolina LLC Operating Agreements for Married Couple: 1. Standard Operating Agreement for Married Couple: This type of operating agreement is suitable for most married couples who wish to establish an LLC together. It includes provisions for the distribution of profits and losses, member contributions, management structure, decision-making process, and dispute resolution methods. The agreement also outlines the couple's responsibilities and duties as members of the LLC. 2. Community Property Operating Agreement: In South Carolina, a married couple may choose to create a Community Property Operating Agreement for their LLC. This agreement designates the LLC property as community property, ensuring an equal distribution of assets and liabilities between spouses in case of separation, divorce, or death. It protects the interests of both spouses and provides clarity on property ownership. 3. Separate Property Operating Agreement: Alternatively, a married couple may opt for a Separate Property Operating Agreement, which recognizes and maintains each spouse's separate ownership interest in the LLC. This agreement is especially useful when the couple wishes to keep their personal assets separate from the LLC's assets and liabilities. It ensures that the LLC's property remains independent of the marital estate. 4. Management by Both Spouses Operating Agreement: In some cases, married couples may desire to manage the LLC together, sharing equal responsibility in decision-making and day-to-day operations. This type of operating agreement outlines the roles and responsibilities of each spouse and provides a framework for joint management, while still protecting their individual interests as members. Key Elements of a South Carolina LLC Operating Agreement for Married Couple: Regardless of the type of operating agreement chosen, there are essential components that should be included: 1. Member Information: The agreement should identify the couple's specific names, addresses, and roles within the LLC (managers or members). 2. Capital Contributions: Outline the initial contributions made by each spouse, which may include cash, assets, or services rendered. It also specifies how additional contributions will be handled in the future. 3. Profit and Loss Allocation: Define how profits and losses will be distributed among the spouses, usually based on their ownership percentage. 4. Management and Decision-making: Specify whether the LLC will be managed by both spouses or if one spouse will take on a managerial role. Detail the decision-making process, voting procedures, and any limitations on decision-making powers. 5. Dissolution and Withdrawal: Describe the process for dissolving the LLC or allowing spouses to withdraw from the LLC in case of divorce, separation, or death. This includes addressing the division of assets, liabilities, and fair valuation methods. Conclusion: A South Carolina LLC Operating Agreement for a married couple ensures clarity, accountability, and protection of individual and joint interests. Depending on their needs and preferences, couples can choose from various types of agreements, each tailored to their unique circumstances. It is crucial for couples to seek legal advice to draft an agreement that aligns with their goals and safeguards their rights as married business partners.

South Carolina LLC Operating Agreement for Married Couple

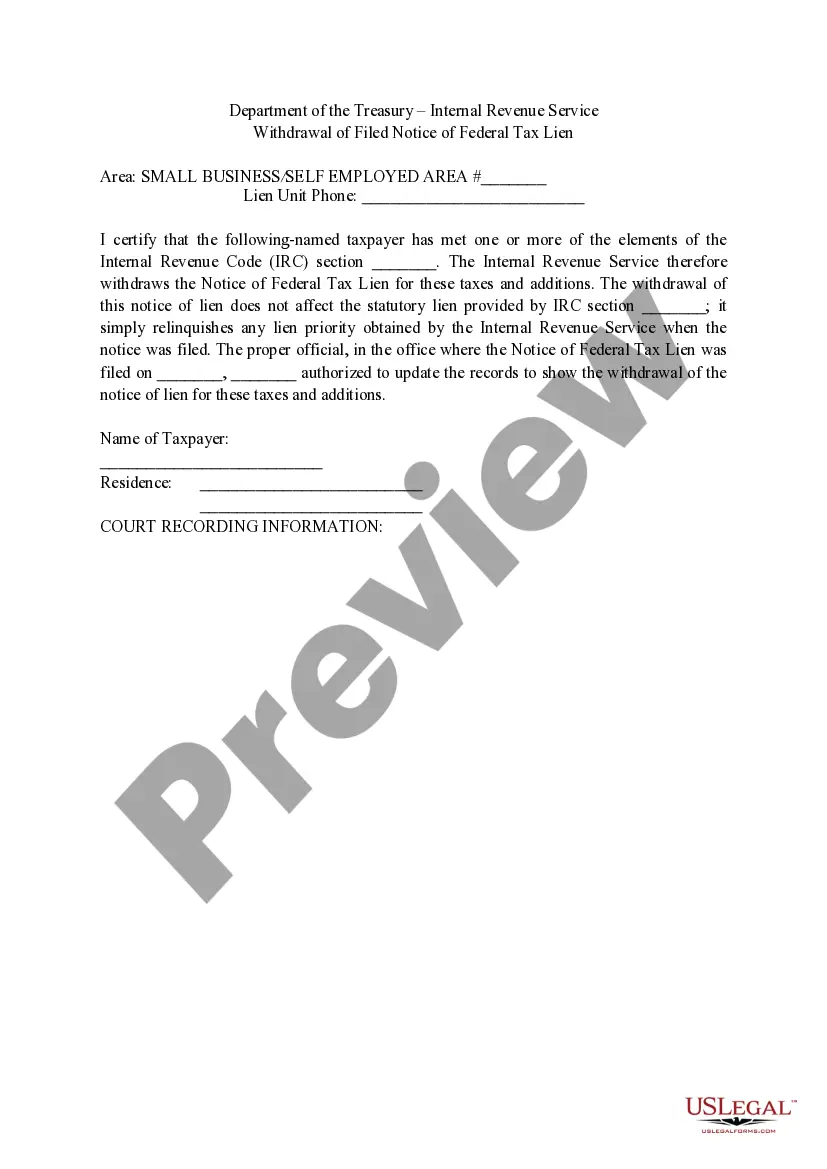

Description

How to fill out South Carolina LLC Operating Agreement For Married Couple?

Have you been in a position the place you need to have files for sometimes organization or individual uses just about every time? There are a variety of legal papers layouts available online, but locating versions you can rely is not straightforward. US Legal Forms provides a huge number of type layouts, like the South Carolina LLC Operating Agreement for Married Couple, which are composed to fulfill federal and state needs.

Should you be presently knowledgeable about US Legal Forms website and get a merchant account, basically log in. Next, it is possible to download the South Carolina LLC Operating Agreement for Married Couple design.

Unless you provide an bank account and want to begin using US Legal Forms, adopt these measures:

- Obtain the type you require and make sure it is for the correct area/region.

- Take advantage of the Preview option to check the form.

- Browse the explanation to ensure that you have selected the right type.

- If the type is not what you are seeking, make use of the Lookup area to obtain the type that fits your needs and needs.

- When you get the correct type, click on Get now.

- Choose the pricing strategy you need, fill out the desired information and facts to make your money, and buy the transaction utilizing your PayPal or credit card.

- Decide on a practical file structure and download your backup.

Locate all of the papers layouts you possess purchased in the My Forms menus. You can obtain a further backup of South Carolina LLC Operating Agreement for Married Couple whenever, if possible. Just click the needed type to download or printing the papers design.

Use US Legal Forms, probably the most substantial collection of legal varieties, to save time as well as stay away from blunders. The services provides skillfully manufactured legal papers layouts that you can use for a range of uses. Make a merchant account on US Legal Forms and initiate producing your way of life a little easier.