South Carolina Sample Letter for Finalization of Accounting

Description

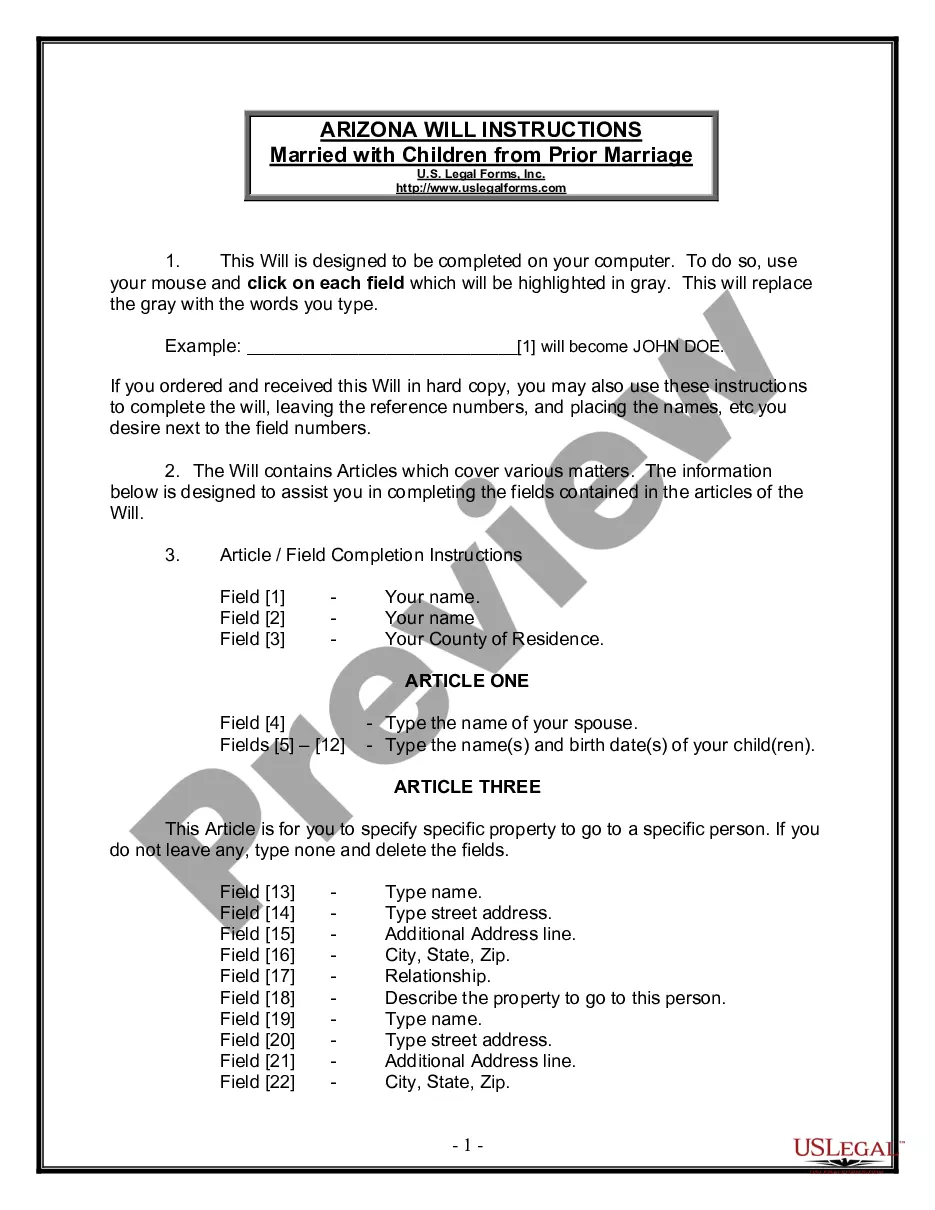

How to fill out Sample Letter For Finalization Of Accounting?

Choosing the best legitimate papers design might be a battle. Of course, there are tons of themes available on the Internet, but how do you obtain the legitimate kind you want? Make use of the US Legal Forms site. The services offers 1000s of themes, for example the South Carolina Sample Letter for Finalization of Accounting, that you can use for organization and private requires. Each of the varieties are checked by specialists and satisfy federal and state requirements.

If you are presently signed up, log in to the account and click on the Download button to get the South Carolina Sample Letter for Finalization of Accounting. Utilize your account to check with the legitimate varieties you possess bought previously. Proceed to the My Forms tab of your own account and get another copy of your papers you want.

If you are a brand new customer of US Legal Forms, here are easy directions so that you can follow:

- Initial, ensure you have selected the correct kind to your area/region. It is possible to look over the shape utilizing the Preview button and browse the shape outline to ensure it will be the best for you.

- In case the kind does not satisfy your needs, utilize the Seach field to discover the proper kind.

- When you are certain that the shape would work, click on the Buy now button to get the kind.

- Opt for the costs plan you want and enter the needed information and facts. Build your account and pay for the transaction utilizing your PayPal account or credit card.

- Pick the data file formatting and acquire the legitimate papers design to the gadget.

- Total, revise and produce and indication the attained South Carolina Sample Letter for Finalization of Accounting.

US Legal Forms is definitely the largest collection of legitimate varieties in which you can find a variety of papers themes. Make use of the service to acquire appropriately-made documents that follow condition requirements.