The South Carolina Authority of Partnership to Open Deposit Account and to Procure Loans refers to the permission granted to partnerships in South Carolina to establish a deposit account, as well as apply for and obtain loans from financial institutions. This authority allows partnerships to carry out their financial transactions efficiently while ensuring compliance with the state's regulations and guidelines. Partnerships are legally recognized business entities consisting of two or more individuals who join forces conducting business activities for profit. In South Carolina, partnerships may be formed as general partnerships, limited partnerships, or limited liability partnerships (Laps). Each type of partnership has different rights, obligations, and liabilities, which may affect their authority to open a deposit account or procure loans. To open a deposit account, partnerships need to demonstrate their legal existence and provide essential documents such as a partnership agreement and identification of the partners. The South Carolina Authority of Partnership ensures that partnerships can open deposit accounts as a collective entity, enabling them to manage their finances effectively and separate personal and business funds. Additionally, partnerships may need to procure loans from financial institutions to support their operations, expand their ventures, or invest in new opportunities. However, the authority to obtain loans may vary depending on the partnership type. General partnerships may have different borrowing and lending capacities compared to limited partnerships or Laps, as their liability structures differ. General partnerships consist of partners who share equal responsibility and liability for the partnership's debts, obligations, and actions. Therefore, these partnerships are typically authorized to open deposit accounts and procure loans with the unanimous consent of all partners. Limited partnerships, on the other hand, have both general and limited partners. General partners are personally liable for the partnership's obligations, while limited partners have limited liability. Limited partnerships must adhere to certain rules and regulations to open deposit accounts and procure loans. These partnerships usually require the consent of the general partners and may have restrictions on the involvement of limited partners in financial transactions. Laps are partnerships that provide partners with limited liability protection but allow them to actively participate in the management and operation of the business. Laps may have broader authority to open deposit accounts and procure loans, as they combine the flexibility of a partnership with the limited liability features of a corporation. However, Laps must still meet specific criteria and provide necessary documentation to financial institutions for these activities. In conclusion, the South Carolina Authority of Partnership to Open Deposit Account and to Procure Loans grants partnerships the legal permission to establish deposit accounts and obtain loans. Understanding the different types of partnerships — general partnerships, limited partnerships, and Laps — is crucial for businesses operating in South Carolina to determine the extent of their authority to engage in financial transactions. By adhering to the state's regulations and guidelines, partnerships can effectively manage their financial affairs and support their growth and success.

South Carolina Authority of Partnership to Open Deposit Account and to Procure Loans

Description

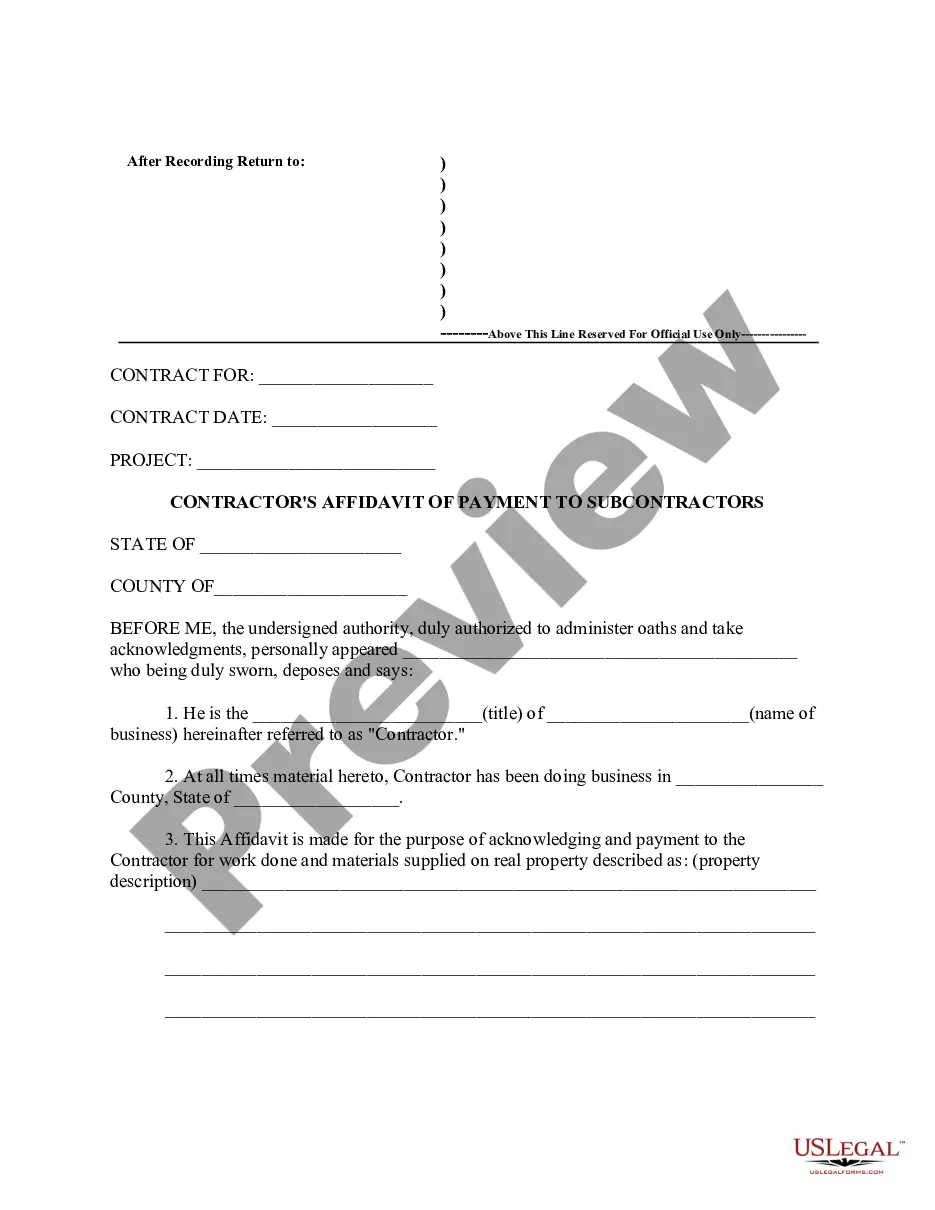

How to fill out Authority Of Partnership To Open Deposit Account And To Procure Loans?

US Legal Forms - one of the biggest libraries of lawful kinds in the United States - delivers a variety of lawful record layouts you may download or printing. Using the internet site, you will get 1000s of kinds for business and individual purposes, sorted by groups, says, or keywords.You can get the newest models of kinds much like the South Carolina Authority of Partnership to Open Deposit Account and to Procure Loans in seconds.

If you already have a subscription, log in and download South Carolina Authority of Partnership to Open Deposit Account and to Procure Loans from your US Legal Forms local library. The Down load option will appear on each and every form you view. You have accessibility to all earlier saved kinds from the My Forms tab of your respective accounts.

If you wish to use US Legal Forms initially, listed below are straightforward instructions to get you started:

- Be sure to have picked the correct form to your metropolis/area. Click on the Preview option to examine the form`s information. Read the form outline to actually have selected the correct form.

- In the event the form does not suit your specifications, use the Search field at the top of the monitor to find the one who does.

- Should you be satisfied with the form, validate your option by clicking on the Get now option. Then, pick the rates program you want and offer your accreditations to register for an accounts.

- Procedure the financial transaction. Make use of charge card or PayPal accounts to complete the financial transaction.

- Pick the formatting and download the form in your system.

- Make alterations. Fill out, revise and printing and indication the saved South Carolina Authority of Partnership to Open Deposit Account and to Procure Loans.

Every single design you included with your bank account lacks an expiry date and it is yours permanently. So, if you want to download or printing an additional duplicate, just go to the My Forms portion and click on the form you need.

Obtain access to the South Carolina Authority of Partnership to Open Deposit Account and to Procure Loans with US Legal Forms, one of the most extensive local library of lawful record layouts. Use 1000s of specialist and state-distinct layouts that meet up with your organization or individual needs and specifications.