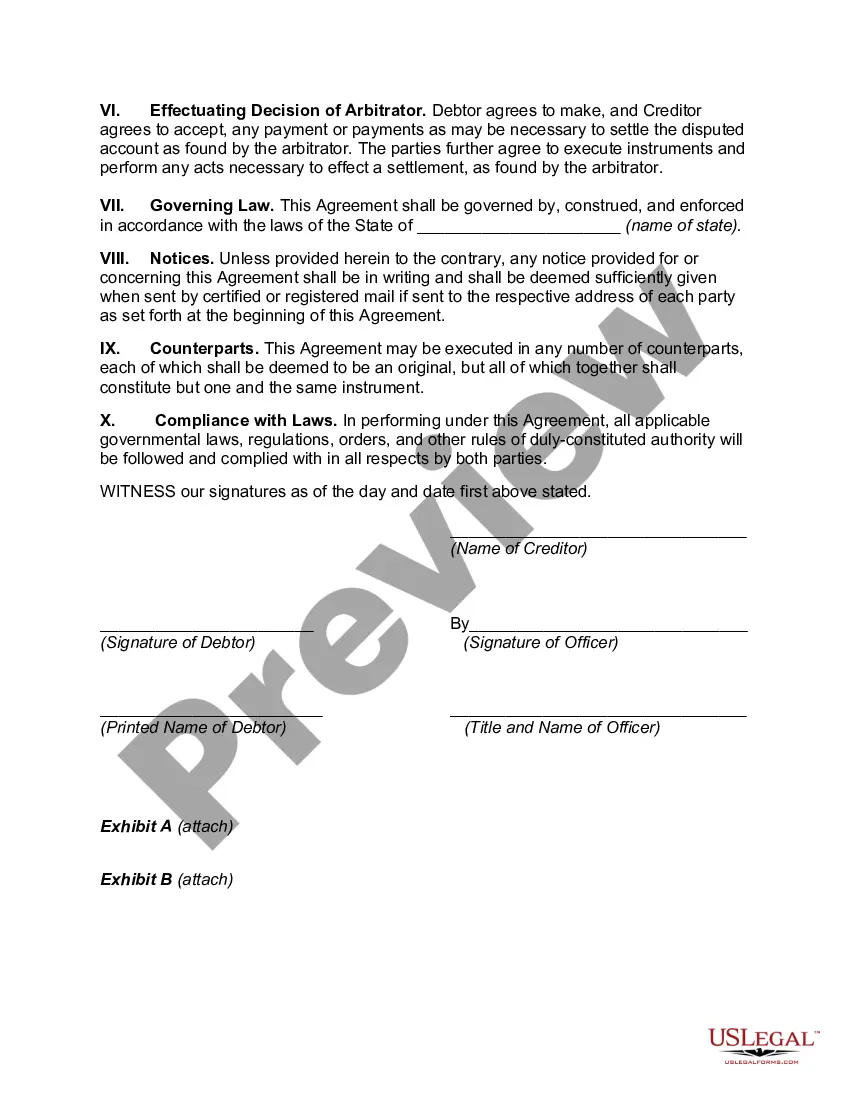

South Carolina Agreement to Arbitrate Disputed Open Account

Description

How to fill out Agreement To Arbitrate Disputed Open Account?

If you need to total, download, or create valid document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the website's user-friendly and efficient search to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Select the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to obtain the South Carolina Agreement to Arbitrate Disputed Open Account with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to acquire the South Carolina Agreement to Arbitrate Disputed Open Account.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to browse through the form’s content. Remember to read the information carefully.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find alternate versions of the legal form template.

Form popularity

FAQ

Takeaway. When there is any dispute as to the validity of an arbitration agreement, parties shall decide whether they should go to the court or the arbitral tribunal by considering whether it is clear on the evidence and the construction of the agreements on the question of jurisdiction.

Meena Vijay Khaitan it was held: - "It will be noticed that under the Act of 1996 the arbitral tribunal is presently invested with power under sub-section (1) of section 16 to rule on its own jurisdiction including ruling on any objection concerning the presence or validity of the arbitration agreement and for that

An arbitration agreement is a legally binding contract that offers an alternate dispute resolution between two parties or more. Arbiration agreements provide an alternative to civil court litigation. Parties sign an arbitration agreement and enter into a process known as arbitration if a dispute arises.

These include: An arbitrator lacked jurisdiction to award, such as when the subject matter of the dispute cannot be arbitrated; The issue or dispute is not covered by a valid arbitration agreement, such as when there is an issue the parties did not agree to arbitrate; The arbitration was tainted by fraud; and/or.

A defendant can waive the arbitration requirement by engaging in a court litigation that the consumer initiates, by refusing to pay arbitration fees or refusing to participate in the arbitration, or (according to some courts) by initiating collection litigation in a public forum against the consumer prior to the

First, any valid arbitration agreement must reflect the conscious, mutual and free will of the parties to resort to arbitration and not to other means of dispute resolution, including State courts. The consent of both parties to submit their dispute to arbitration is the cornerstone of arbitration.

Arbitration can be binding (which means the participants must follow the arbitrator's decision and courts will enforce it) or nonbinding (meaning either party is free to reject the arbitrator's decision and take the dispute to court, as if the arbitration had never taken place). Binding arbitration is more common.

This means that any disputes between customers and banks over account fees, identity theft, or other charges will be decided by an arbitrator that the bank helps choose, rather than an impartial judge.

The arbitration agreement is valid only if signed by parties with full civil act capacity, and such parties must be competent, specifically: (i) A person with full civil act capacity is at least 18 years old and does not lose or limit her/his civil act capacity or difficulties in perception, mastery of acts.

Currently, credit card and bank companies often insert arbitration clauses in their contracts to prevent consumers from banding together to file class-action lawsuits over scams and fraudulent products.