South Carolina Employee Time Sheet

Description

How to fill out Employee Time Sheet?

If you desire to be thorough, download, or print legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site's straightforward and efficient search function to locate the documents you require.

Various templates for business and personal use are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find different versions of the legal form template.

Step 4. Once you have found the form you need, click the Buy now button. Select the payment plan you prefer and enter your details to register for an account.

- Use US Legal Forms to retrieve the South Carolina Employee Time Sheet in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to obtain the South Carolina Employee Time Sheet.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the content of the form. Be sure to check the description.

Form popularity

FAQ

How to Fill Out a TimesheetEnter the Employee's Name. Here you should fill out the employee's full, legal name whose hours you are recording.Provide the Date or the Date Range. Next up you need to add the date.Fill in the Task Details.Add Hours Worked.Calculate Your Total Hours.Approve the Timesheet.

6 Steps to Encourage Employees to Submit Their TimesheetsCommunicate the purpose of time tracking.Set clear policies and guidelines.Let your employees learn how to use the timesheet.Send automatic timesheet reminders.Follow up.Use gamification in time tracking.

How to Fill Out a TimesheetEnter the Employee's Name. Here you should fill out the employee's full, legal name whose hours you are recording.Provide the Date or the Date Range. Next up you need to add the date.Fill in the Task Details.Add Hours Worked.Calculate Your Total Hours.Approve the Timesheet.

How to Fill Out a TimesheetEnter the Employee's Name. Here you should fill out the employee's full, legal name whose hours you are recording.Provide the Date or the Date Range. Next up you need to add the date.Fill in the Task Details.Add Hours Worked.Calculate Your Total Hours.Approve the Timesheet.

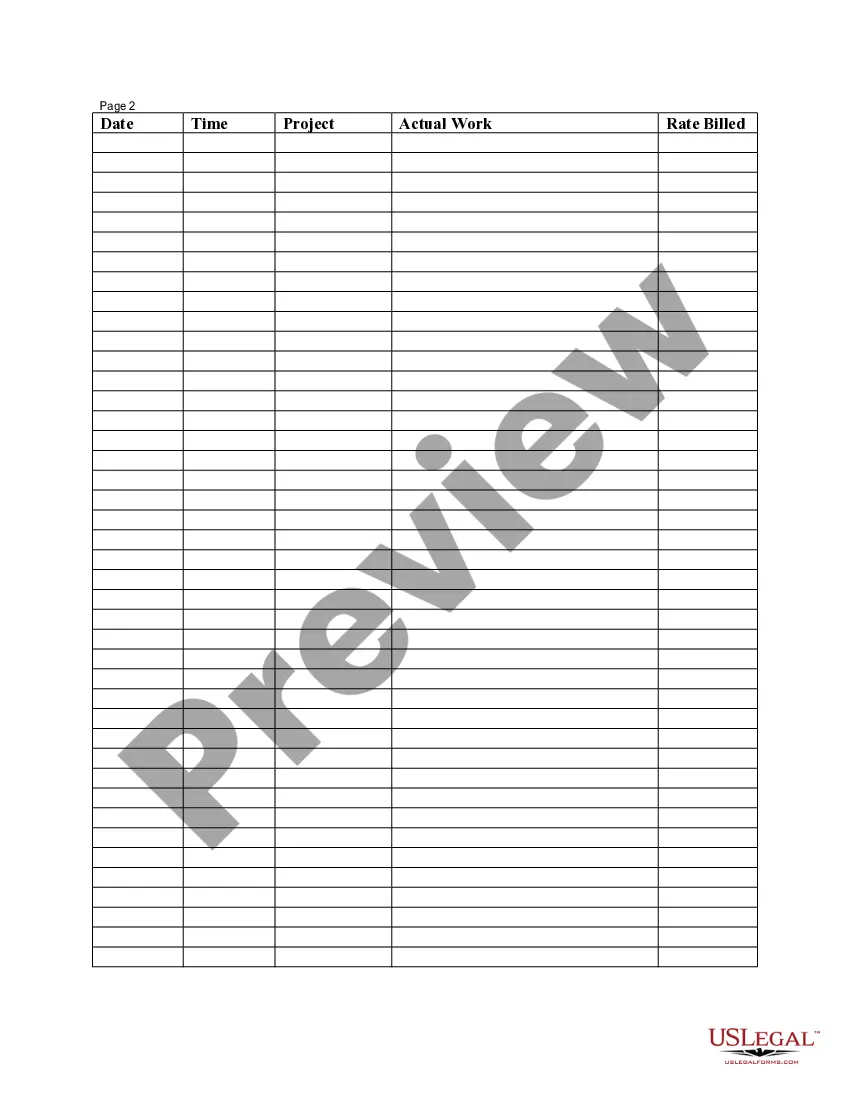

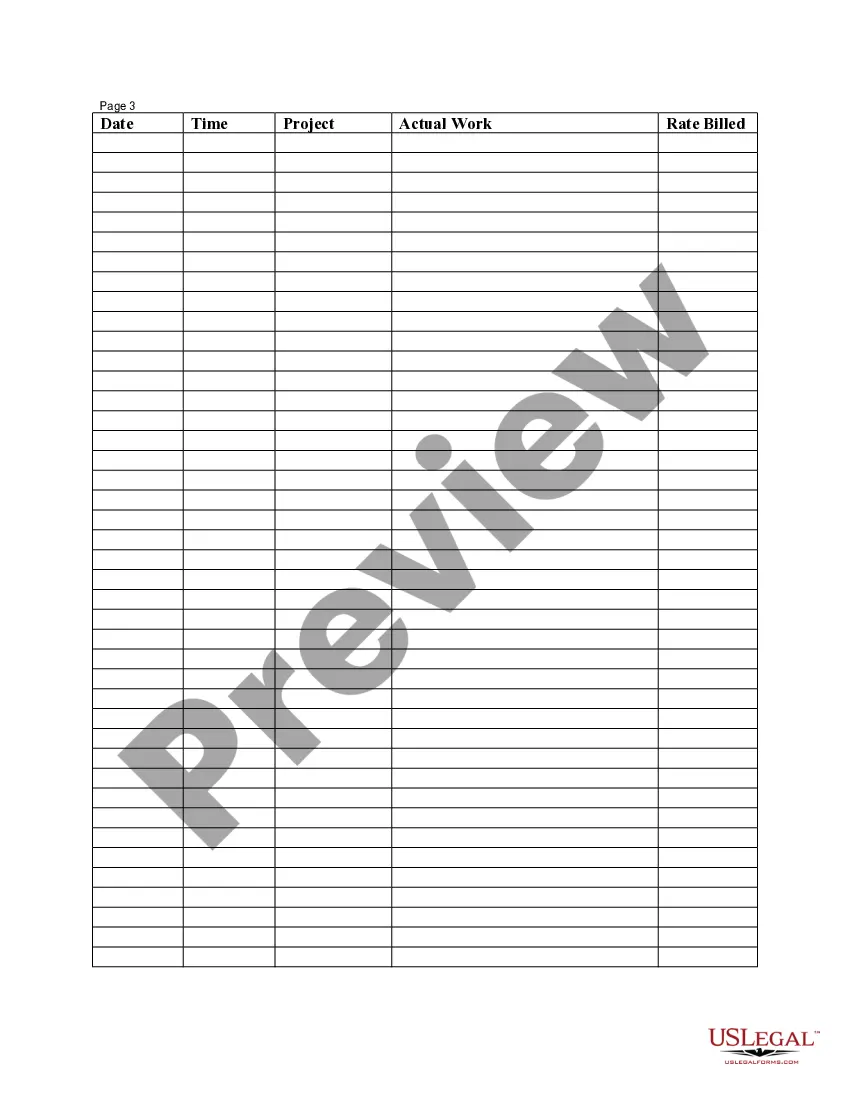

Employee timesheets are used to record the hours worked by employees. Timesheets can be handwritten, punched on cards, typed into a spreadsheet, or automatically filled by a timeclock system.

How To Create a Timesheet in Excel?Step 1: Format your spreadsheet. Open a new Excel file.Step 2: Add timesheet title. Highlight the cell range A1L1.Step 3: Add required labels. Now it's time to add all the labels to your Excel timesheet.Step 4: Add time-related labels.Step 5: Finishing touches.

Information included on timesheetsEmployee's name.Pay period.Date worked.Day worked.Hours worked.Total workweek hours.

How to fill out a timesheet: Step-by-step instructionsStep 1: Enter the employee's name. Enter the person's name whose working hours you are recording.Step 2: Add a date range.Step 3: Add project details.Step 4: Include working hours for work days.Step 5: Determine total hours.Step 6: Get approval from supervisor.

Time and wages records can't be: changed unless the change is to correct an error. false or misleading.