South Carolina Document Organizer and Retention

Description

How to fill out Document Organizer And Retention?

Have you found yourself in a situation where you need documents for business or personal reasons nearly every day.

There are numerous legitimate document templates accessible online, but finding forms you can rely on is not easy.

US Legal Forms provides a vast collection of template forms, including the South Carolina Document Organizer and Retention, which are designed to comply with federal and state regulations.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the South Carolina Document Organizer and Retention at any time if necessary. Just select the form you need to download or print the document template. Utilize US Legal Forms, the most comprehensive selection of legitimate forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are currently familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the South Carolina Document Organizer and Retention template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Find the form you require and ensure it is for your correct city/state.

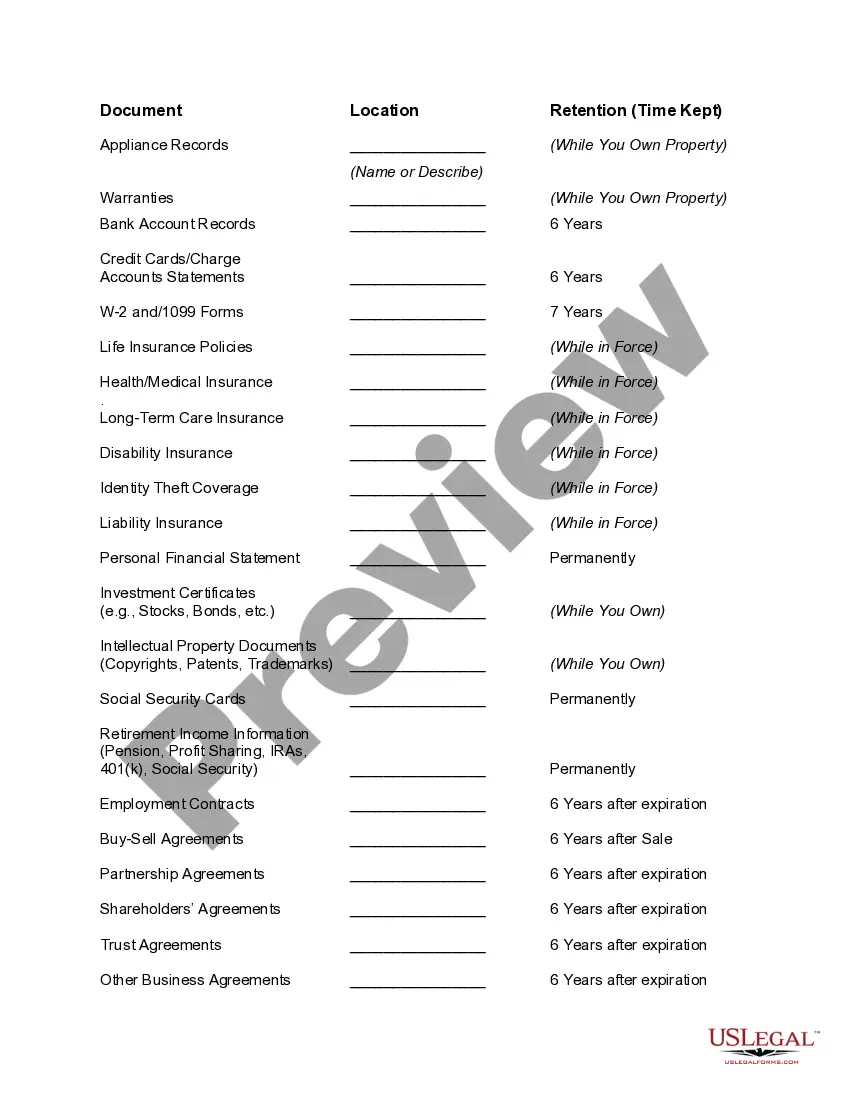

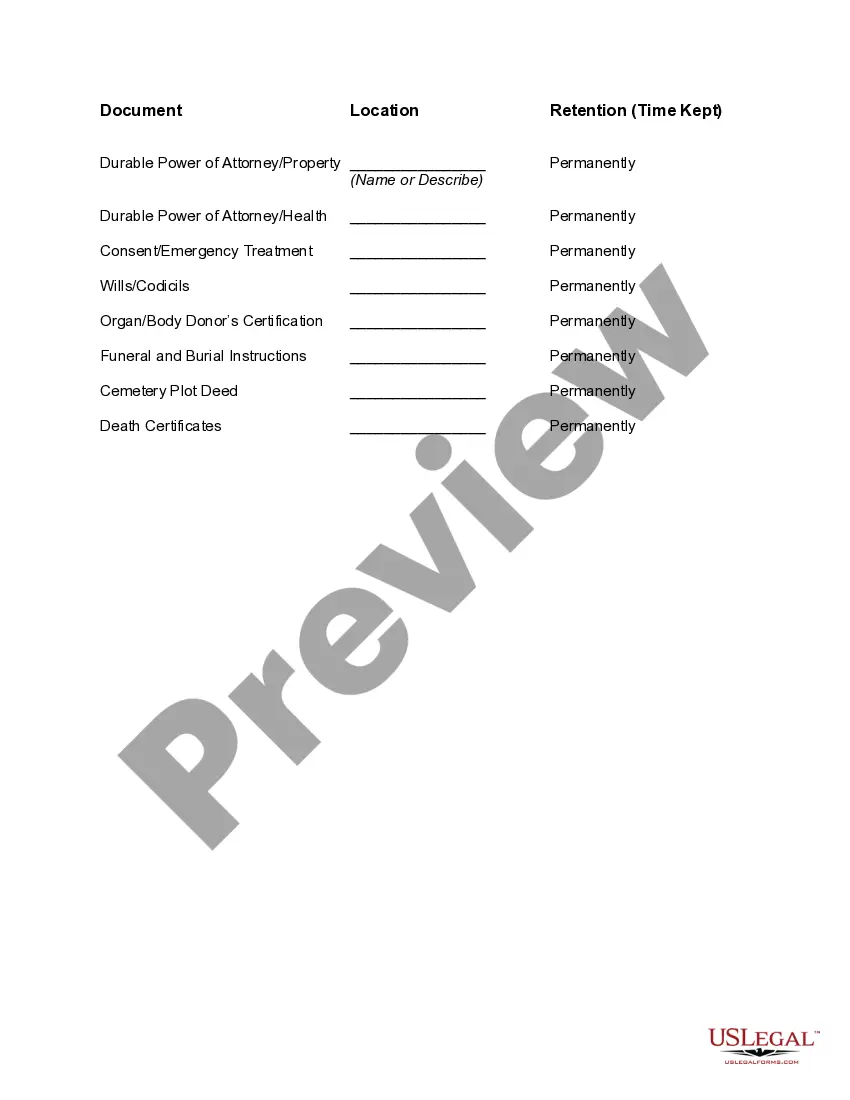

- Use the Preview button to review the form.

- Check the summary to confirm that you have selected the right form.

- If the form is not what you are looking for, utilize the Lookup area to find the form that meets your needs.

- When you find the correct form, click Acquire now.

- Select the pricing plan you need, fill in the required information to create your account, and process your order using PayPal or a credit card.

Form popularity

FAQ

South Carolina Time-Keeping: What you need to know Every employer shall keep records of names and addresses of all employees and of wages paid each payday, and deductions made for 3 years.

A document retention policy identifies confidential information and categorizes it by how and where documents are stored (electronically or in paper) and the required retention period based on federal, state, and other regulatory requirements.

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

Document retention is a system that allows you and your employees to automatically create policies and determine what should be done with particular documents or records at a certain point of time.

South Carolina Time-Keeping: What you need to know Every employer shall keep records of names and addresses of all employees and of wages paid each payday, and deductions made for 3 years.

A DRP will identify documents that need to be maintained, contain guidelines for how long certain documents should be kept, and save your company valuable computer and physical storage space.

How long should I keep employee personnel files? You should keep an employee's personnel files for six years after the employee has left your organisation. The reason for this is that up until six years has passed, the former employee may sue you for breach of contract in the county court.

A document retention policy establishes and describes how a company expects its employees to manage company information (whether in electronic files, emails, hard copies, or other formats) from creation through destruction, according to applicable laws and the company's particular legal and business needs.

A records retention program will identify documents and business records that need to be maintained and contain guidelines for how long certain documents should be kept and how they should be destroyed.

EEOC Regulations require that employers keep all personnel or employment records for one year. If an employee is involuntarily terminated, his/her personnel records must be retained for one year from the date of termination.