The South Carolina Basic Law Partnership Agreement is a legally binding contract that outlines the terms and conditions governing the formation and operation of a partnership in the state of South Carolina. This agreement serves as a vital document for any partnership, as it establishes the rights, responsibilities, and obligations of each partner involved. The South Carolina Basic Law Partnership Agreement typically includes various key provisions, which may vary depending on the specific type of partnership being formed. These provisions often cover important aspects such as the purpose and duration of the partnership, the contributions and capital invested by each partner, the distribution of profits and losses, decision-making processes, and dispute resolution mechanisms. One specific type of South Carolina Basic Law Partnership Agreement is the General Partnership Agreement. In this type of agreement, all partners have equal rights and responsibilities, and they share both profits and liabilities equally. This arrangement is the most common and simplest form of partnership and is often used by small businesses and professional practices. Another type is the Limited Partnership Agreement, which consists of at least one general partner and one or more limited partners. In this arrangement, the general partner(s) are responsible for managing the partnership and have unlimited liability, while the limited partner(s) provide capital but have limited liability and are not involved in the day-to-day operations. Additionally, there is the Limited Liability Partnership Agreement (LLP), which provides limited liability protection to all partners. This form of partnership is prevalent among professionals such as lawyers, accountants, and architects. It is important for partners in South Carolina to have a well-drafted Basic Law Partnership Agreement in order to establish clear guidelines and avoid potential disputes. This agreement helps ensure that all partners are aware of their rights and obligations, promotes transparency, facilitates effective decision-making, and ultimately contributes to the smooth functioning of the partnership.

South Carolina Basic Law Partnership Agreement

Description

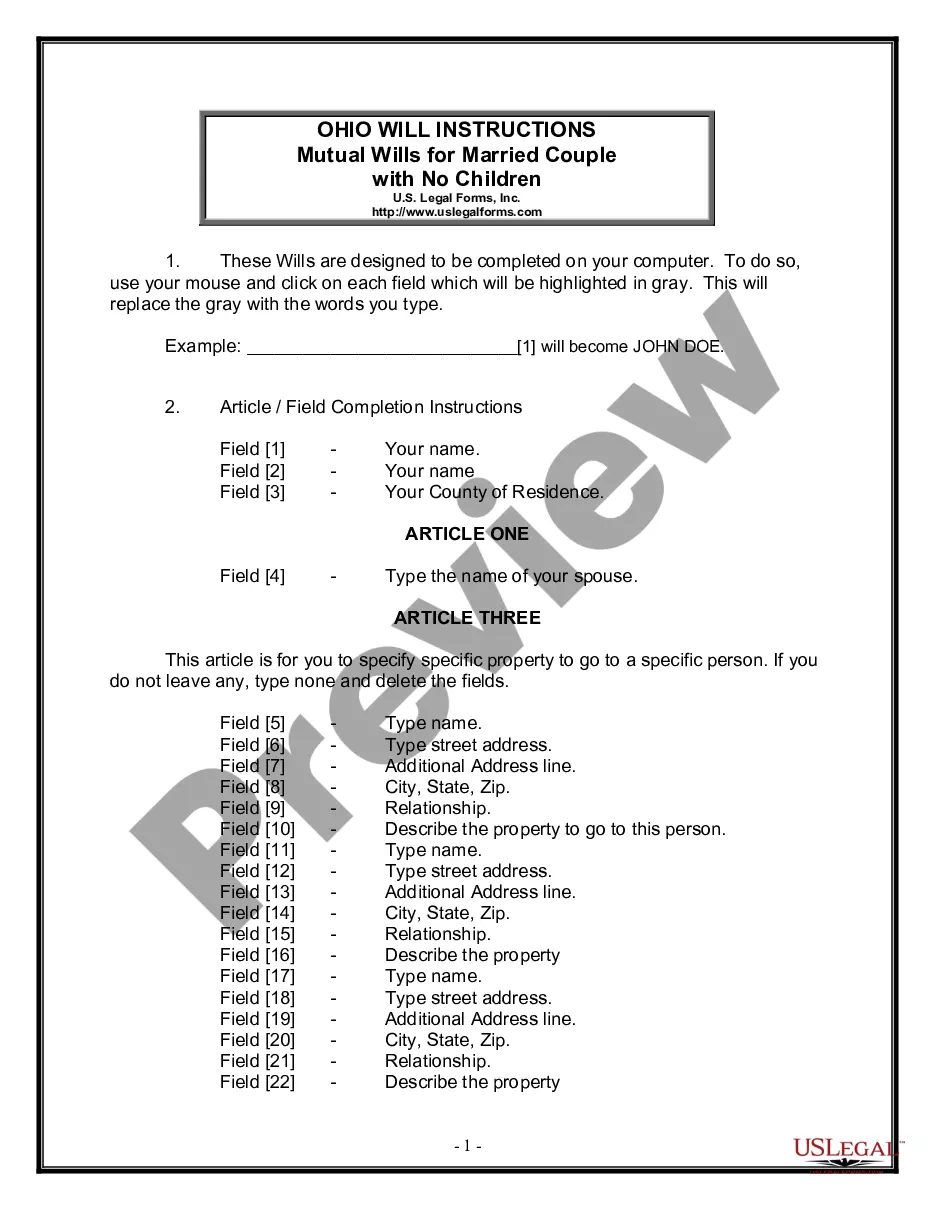

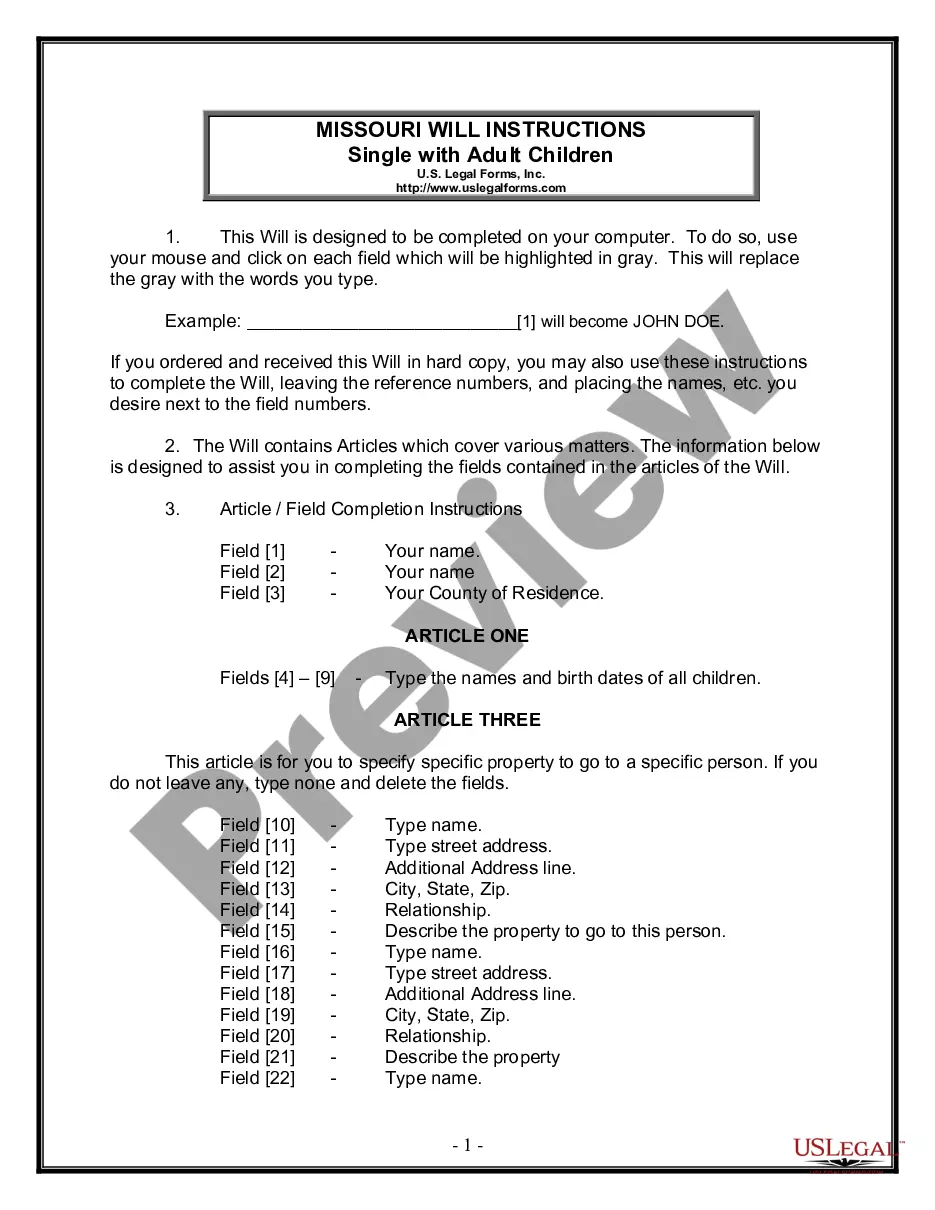

How to fill out South Carolina Basic Law Partnership Agreement?

Choosing the right legal file template can be a have a problem. Naturally, there are tons of templates accessible on the Internet, but how would you find the legal type you require? Use the US Legal Forms site. The assistance gives thousands of templates, like the South Carolina Basic Law Partnership Agreement, which you can use for organization and private requirements. Every one of the kinds are checked out by professionals and meet up with federal and state demands.

In case you are presently registered, log in to the account and then click the Acquire switch to find the South Carolina Basic Law Partnership Agreement. Use your account to look from the legal kinds you might have acquired previously. Visit the My Forms tab of the account and obtain an additional version of your file you require.

In case you are a whole new consumer of US Legal Forms, here are basic directions that you can follow:

- Initial, make certain you have selected the proper type for your metropolis/state. You may look through the shape using the Review switch and read the shape outline to ensure it is the best for you.

- In the event the type is not going to meet up with your needs, take advantage of the Seach field to discover the proper type.

- When you are certain the shape is acceptable, select the Buy now switch to find the type.

- Pick the prices strategy you need and enter the essential information. Create your account and buy the order making use of your PayPal account or charge card.

- Select the file format and acquire the legal file template to the product.

- Complete, edit and print out and signal the obtained South Carolina Basic Law Partnership Agreement.

US Legal Forms is the greatest library of legal kinds where you can see a variety of file templates. Use the company to acquire professionally-made documents that follow condition demands.

Form popularity

FAQ

Written partnership agreements protect the company and each partner's investment in it. If there is no written partnership agreement, partners are not allowed to draw a salary. Instead, they share the profits and losses in the business equally.

A Partnership is defined by the Indian Partnership Act, 1932, as 'the relation between persons who have agreed to share profits of the business carried on by all or any of them acting for all'. Agreement is the essential part of partnership business. It secure the right of both party.

A partnership must have two or more owners who share in the profits and losses of a business. Partnerships can form automatically without the submission of formation documents. All partnerships should have a written partnership agreement that spells out the rules and regulations of the business.

In South Carolina, any two or more people may form a limited liability partnership. Most commonly though, we see professionals like doctors, lawyers and accountants using this type of business structure because it protects each partner from liability for the professional malpractice of another partner.

To ensure your business partnership stays on course, follow these tips.Share the same values.Choose a partner with complementary skills.Have a track record together.Clearly define each partner's role and responsibilities.Select the right business structure.Put it in writing.Be honest with each other.

There are three relatively common partnership types: general partnership (GP), limited partnership (LP) and limited liability partnership (LLP).

200b Partnerships are required to withhold 5% of the South Carolina taxable income of partners who are nonresidents of South Carolina.

Thus as per the above definition, there are 5 elements which constitute of a partnership namely: (1) There must be a contract; (2) between two or more persons; (3) who agree to carry on a business; (4) with the object of sharing profits and (5) the business must be carried on by all or any of them acting for all.

A partnership agreement is a foundational document and is legally binding on all partners. The agreement outlines the business's day-to-day operations and the rights and responsibilities of each partner. In this way, the document is not unlike a set of corporate bylaws.

There are a few important steps to go through once the decision has been made to start a partnership in South Carolina.Step 1: Select a business name.Step 2: Register the business name.Step 3: Complete required paperwork.Step 4: Determine if you need an EIN, additional licenses or tax IDs.More items...