The South Carolina Employee Lending Agreement is a legally binding contract between an employer and an employee outlining the specifics and terms of a loan arrangement. This agreement establishes the conditions under which an employer provides financial assistance to an employee, usually in the form of a loan, for personal or professional purposes. Keywords: South Carolina Employee Lending Agreement, employer, employee, loan arrangement, financial assistance, personal, professional. The South Carolina Employee Lending Agreement can be categorized into different types based on the purpose and nature of the loan: 1. Personal Loan Agreement: This type of South Carolina Employee Lending Agreement is designed to provide financial aid to employees for personal reasons such as emergencies, medical expenses, education, housing, or debt consolidation. The agreement clearly outlines the loan amount, interest rate, repayment terms, and other relevant details. 2. Holiday or Vacation Loan Agreement: Some employers offer their employees the option of taking a loan specifically for funding their vacations or travel expenses during holidays. This type of South Carolina Employee Lending Agreement specifies the loan amount, interest rate, repayment period, and any limitations on the use of funds. 3. Professional Development Loan Agreement: Employers who encourage their employees' professional growth may offer loans to cover expenses related to education, training courses, certification programs, or skill enhancement. This agreement clarifies the loan terms, repayment options, and the anticipated benefits that the employee's enhanced skills will bring to the employer. 4. Relocation Loan Agreement: In situations where an employer requests an employee to relocate for work purposes, they may provide financial assistance through a relocation loan. This agreement delineates the loan amount, conditions for repayment, and any additional terms related to the relocation process. 5. Advance Salary Loan Agreement: Sometimes, employees may face unexpected financial burdens, and employers may offer them a short-term loan against their upcoming salaries. This type of South Carolina Employee Lending Agreement specifies the loan amount, deductions from future paychecks, interest rates, and repayment terms. Regardless of the specific type, a South Carolina Employee Lending Agreement is a valuable tool that protects the interests of both parties involved and ensures transparency in loan transactions. It is crucial for both employers and employees to carefully review and understand the terms laid out in the agreement before signing to avoid any future disputes or misunderstandings.

South Carolina Employee Lending Agreement

Description

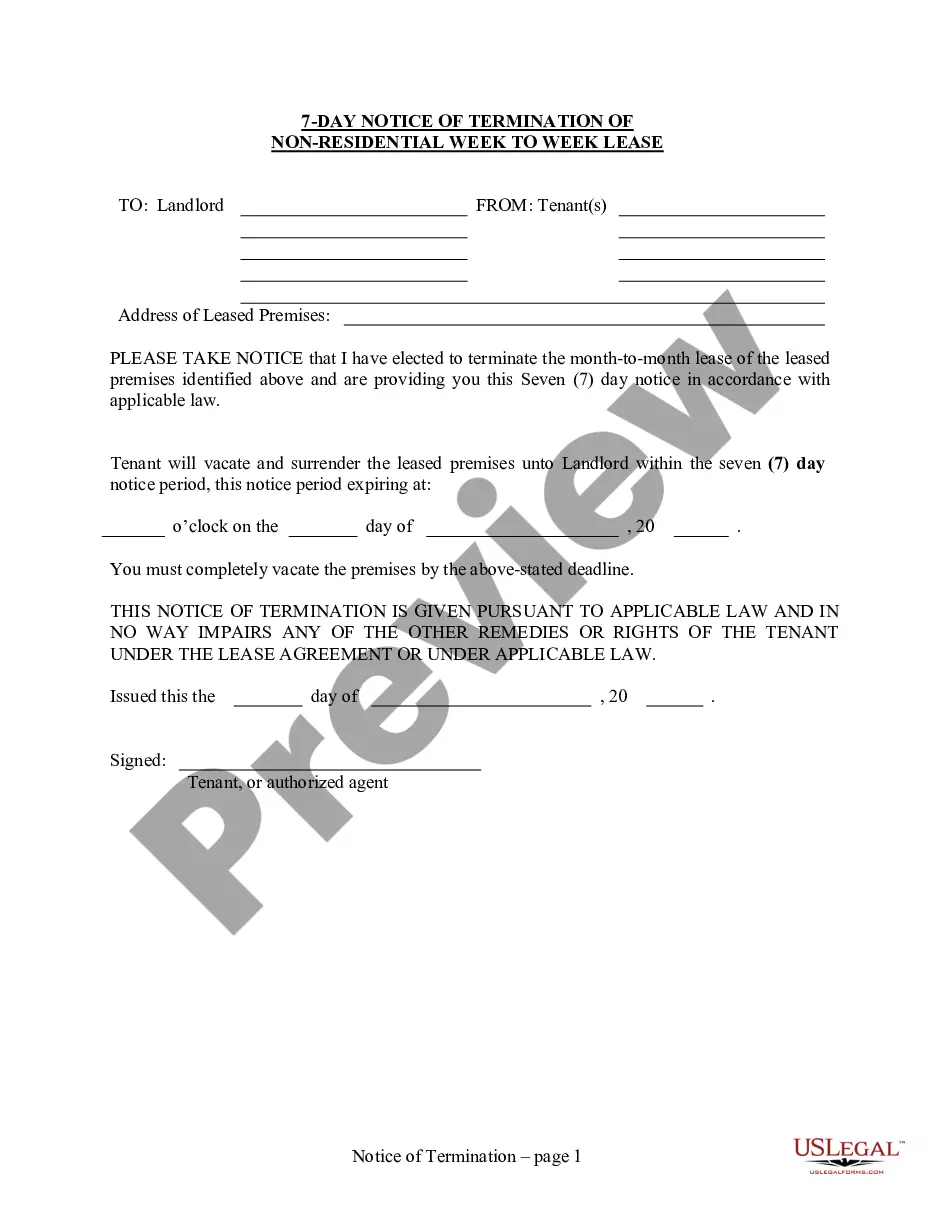

How to fill out South Carolina Employee Lending Agreement?

If you wish to total, download, or print legitimate document layouts, use US Legal Forms, the biggest assortment of legitimate types, that can be found on the web. Make use of the site`s simple and easy hassle-free look for to get the documents you need. Numerous layouts for business and individual uses are sorted by types and states, or search phrases. Use US Legal Forms to get the South Carolina Employee Lending Agreement within a few click throughs.

When you are currently a US Legal Forms consumer, log in in your accounts and click on the Obtain option to get the South Carolina Employee Lending Agreement. You can also entry types you previously delivered electronically within the My Forms tab of the accounts.

Should you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the form for the appropriate area/country.

- Step 2. Take advantage of the Review solution to look over the form`s content material. Do not overlook to learn the outline.

- Step 3. When you are unsatisfied together with the form, take advantage of the Research industry towards the top of the display screen to locate other variations of your legitimate form format.

- Step 4. After you have identified the form you need, click the Get now option. Pick the costs program you favor and add your accreditations to sign up for the accounts.

- Step 5. Approach the financial transaction. You may use your bank card or PayPal accounts to finish the financial transaction.

- Step 6. Choose the format of your legitimate form and download it on the product.

- Step 7. Complete, modify and print or sign the South Carolina Employee Lending Agreement.

Each and every legitimate document format you purchase is the one you have permanently. You may have acces to every form you delivered electronically inside your acccount. Go through the My Forms area and decide on a form to print or download once again.

Compete and download, and print the South Carolina Employee Lending Agreement with US Legal Forms. There are millions of expert and express-certain types you can use to your business or individual requires.

Form popularity

FAQ

Gavin Newsom signed a law on Thursday to cap rates at 36 percent. Assembly Bill 539 ends a decades-long practice of charging borrowers who take out loans between $2,500 and $10,000 with interest that can exceed 200 percent.

All loans consist of three components: The interest rate, security component and term.

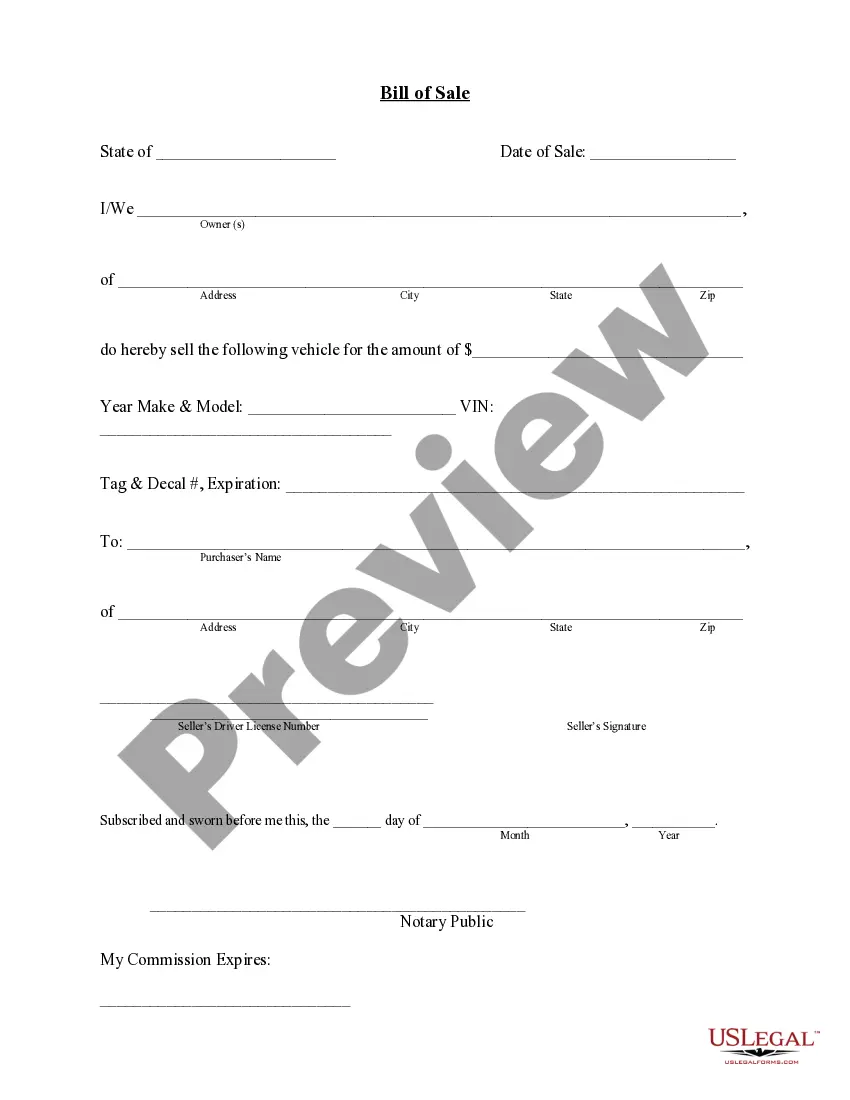

10 Essential Loan Agreement ProvisionsIdentity of the Parties. The names of the lender and borrower need to be stated.Date of the Agreement.Interest Rate.Repayment Terms.Default provisions.Signatures.Choice of Law.Severability.

Mention the relationship between the Lender and Borrower. Write the amount of loan that has been lent to the Borrower. Mention the purpose of the loan like conducting wedding, hospital charges, investing in a business or any other purposes. Give the duration or tenure of the loan and the termination date.

This article will go through eight key terms in a loan agreement and what you should consider about each of them.Interest.Default Interest.Prepayment.Events of Default.Committed or Uncommitted Loan Agreement.Repayment On Demand or Fixed Term.Secured or Unsecured.Bilateral or Syndicated.

Your loan agreement should clearly outline the interest rate that you will pay, allow you to repay the loan early, detail what will occur in the event of default and specify whether the loan is secured or unsecured.

There is no federal regulation on the maximum interest rate that your issuer can charge you, though each state has its own approach to limiting interest rates. There are state usury laws that dictate the highest interest rate on loans but these often don't apply to credit card loans.

Yet Article 15 of the California Constitution declares that no more than 10% a year in interest can be charged for any loan or forbearance of any money, goods or things in action, if the money, goods or things in action are for use primarily for personal, family or household purposes.

Nearly every state has its own interest rate laws that place a cap on the amount of interest creditors can charge their customers. At the moment, the legal maximum for credit debt in South Carolina is 8.75%.

The Truth in Lending Act (TILA) protects you against inaccurate and unfair credit billing and credit card practices. It requires lenders to provide you with loan cost information so that you can comparison shop for certain types of loans.