The South Carolina Expense Reimbursement Form for an Employee is a document designed to facilitate and track the reimbursement process for work-related expenses incurred by employees in South Carolina. This form ensures that employees are reimbursed for eligible expenses promptly and accurately, which helps to maintain employee morale and productivity. The form collects detailed information about the expenses incurred, including the date, description, and amount of each expense. This information allows employers to verify the legitimacy of the expenses and allocate appropriate funds for reimbursement. It also helps in the reconciliation of accounts and ensures compliance with company policies, state laws, and tax regulations. Keywords: South Carolina, expense reimbursement form, employee, work-related expenses, reimbursement process, eligible expenses, maintain employee morale, productivity, detailed information, expenses incurred, date, description, amount, verify legitimacy, allocate funds, reconciliation of accounts, compliance, company policies, state laws, tax regulations. There might be various types of South Carolina expense reimbursement forms for employees, including: 1. Travel Expense Reimbursement Form: This form is used when an employee incurs expenses related to business travel, such as accommodation, transportation, meals, and other travel-related expenses. 2. Business Expense Reimbursement Form: This form covers general work-related expenses, like office supplies, equipment, training, certifications, professional memberships, and other necessary work-related expenses. 3. Mileage Reimbursement Form: This form is used when employees use their personal vehicles for work-related travel. It calculates the mileage traveled and reimburses employees based on the standard mileage rate set by the Internal Revenue Service (IRS). 4. Meal and Entertainment Expense Reimbursement Form: This form is specifically focused on employees' expenses related to business meals and entertainment activities. It includes details about the purpose of the meal/entertainment, attendees, and total expenses incurred. 5. Miscellaneous Expense Reimbursement Form: Sometimes, additional expenses may arise that don't fit into a specific category. This form is used for miscellaneous expenses that are covered by the employer but require prior approval or supporting documentation. It's important for employers and employees to understand and comply with the specific reimbursement policies and procedures set forth by their organization and South Carolina state laws. Using the appropriate reimbursement form helps streamline the process and ensures accuracy and transparency when reimbursing employees for work-related expenses in South Carolina.

South Carolina Mileage Reimbursement Law

Description

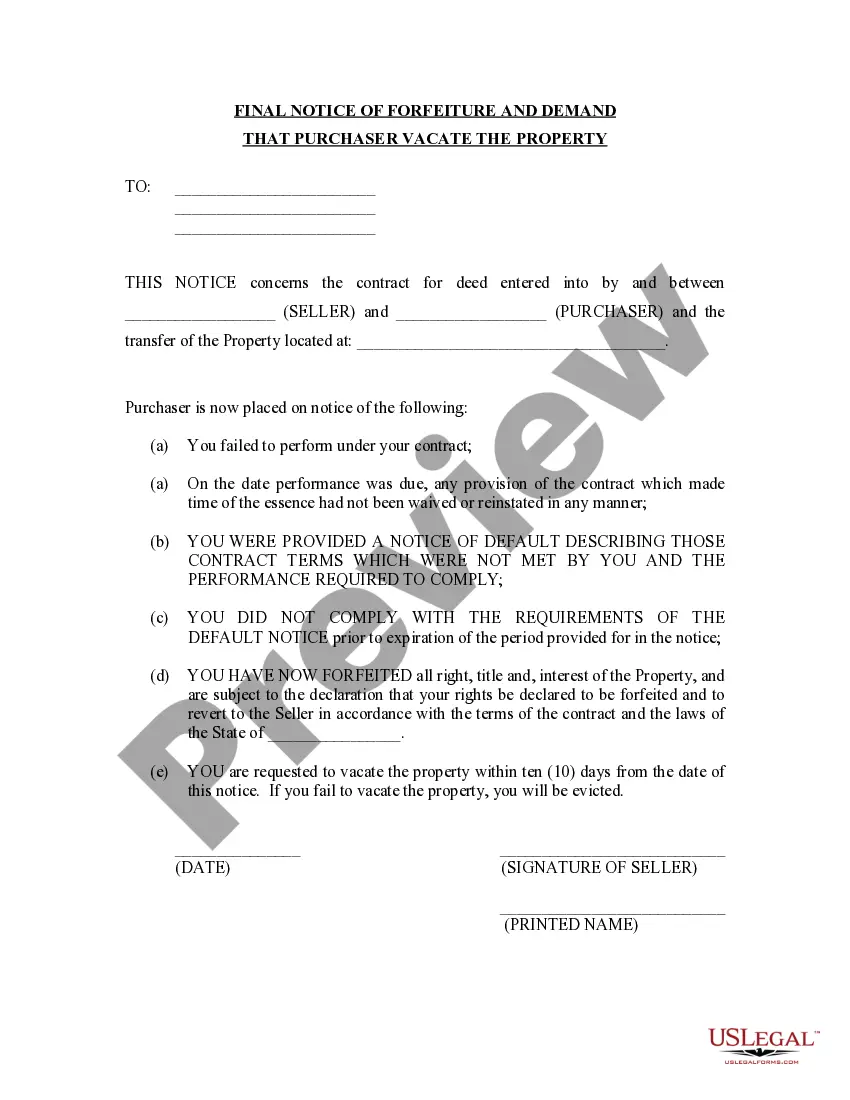

How to fill out South Carolina Expense Reimbursement Form For An Employee?

US Legal Forms - among the most significant libraries of legal varieties in America - offers a wide array of legal papers layouts you can down load or printing. Making use of the website, you can find a huge number of varieties for company and personal uses, categorized by classes, states, or key phrases.You will discover the most recent versions of varieties such as the South Carolina Expense Reimbursement Form for an Employee within minutes.

If you already possess a subscription, log in and down load South Carolina Expense Reimbursement Form for an Employee in the US Legal Forms collection. The Down load button will show up on each and every kind you view. You get access to all formerly saved varieties in the My Forms tab of the account.

If you would like use US Legal Forms initially, listed here are easy recommendations to help you started:

- Be sure to have picked the best kind for your area/state. Select the Preview button to review the form`s content. Read the kind description to actually have chosen the appropriate kind.

- In the event the kind does not fit your specifications, take advantage of the Look for field at the top of the display to get the one who does.

- If you are pleased with the form, validate your selection by visiting the Buy now button. Then, opt for the prices strategy you prefer and give your credentials to sign up to have an account.

- Process the purchase. Utilize your Visa or Mastercard or PayPal account to accomplish the purchase.

- Select the formatting and down load the form on the device.

- Make adjustments. Load, modify and printing and sign the saved South Carolina Expense Reimbursement Form for an Employee.

Every template you included with your account does not have an expiry particular date and is also your own property eternally. So, if you wish to down load or printing an additional duplicate, just visit the My Forms section and then click in the kind you need.

Obtain access to the South Carolina Expense Reimbursement Form for an Employee with US Legal Forms, probably the most comprehensive collection of legal papers layouts. Use a huge number of specialist and express-specific layouts that satisfy your business or personal needs and specifications.