South Carolina Agreement Replacing Joint Interest with Annuity

Description

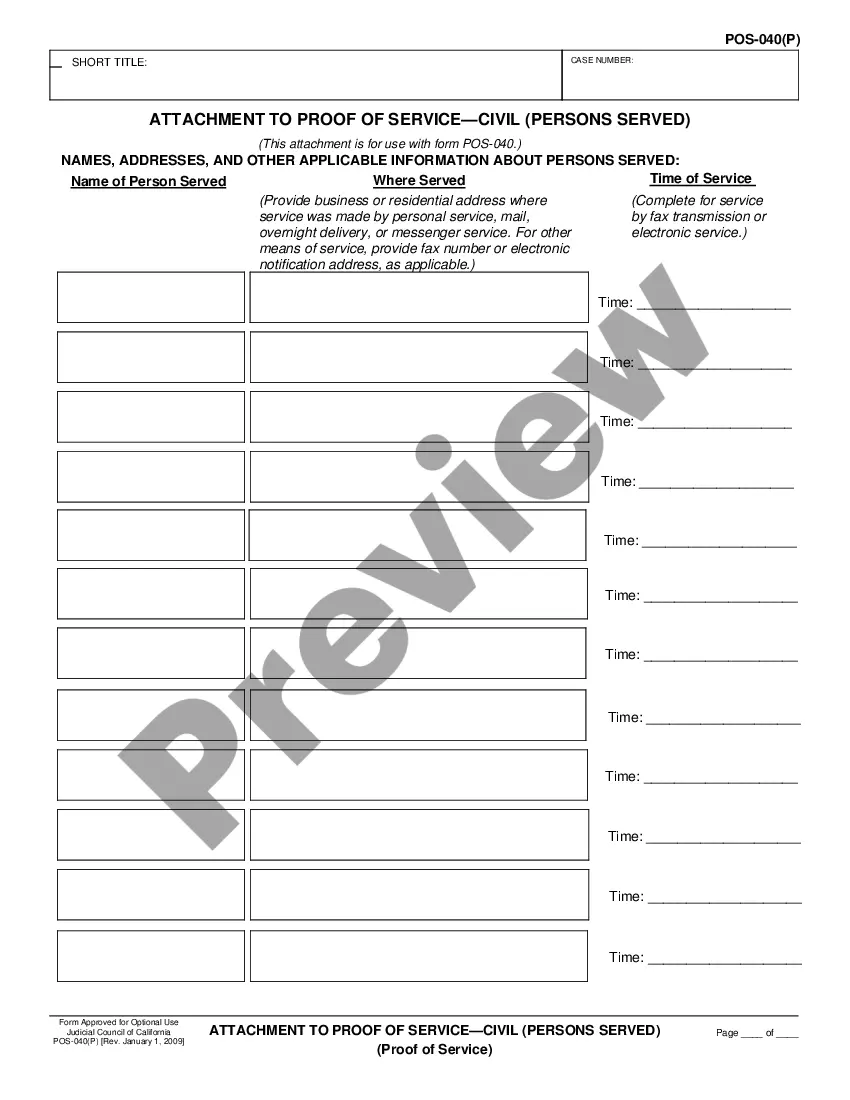

How to fill out Agreement Replacing Joint Interest With Annuity?

If you wish to finalize, obtain, or print official document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site's straightforward and user-friendly search function to find the documents you require.

Different templates for business and personal purposes are categorized by type and titles, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose your preferred payment plan and enter your credentials to register for an account.

Step 5. Complete the transaction. You can utilize your Visa or MasterCard or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the South Carolina Agreement Replacing Joint Interest with Annuity in just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and click the Acquire button to find the South Carolina Agreement Replacing Joint Interest with Annuity.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's details. Remember to check the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

Exchanging an annuity policy can be a good idea under certain circumstances, especially if it means transitioning into a more beneficial plan. However, you should carefully evaluate the new terms and any associated fees involved in the exchange. For those considering a South Carolina Agreement Replacing Joint Interest with Annuity, consulting with a financial adviser can provide clarity and help you make a well-informed decision.

Replacing insurers must receive a list of the applicant's life insurance policies to be replaced, inform their field representative about replacement regulations, and send the existing insurer a written notice advising of the proposed replacement.

Which ultimately determines the interest rates paid to the owner of a fixed annuity? Insurer's guaranteed minimum rate of interest.

(1) A statement signed by the applicant as to whether replacement of existing life insurance or annuity is involved in the transaction. (2) A signed statement as to whether or not the agent knows replacement is or may be involved in the transaction.

If a Market Value Adjusted Annuity owner surrenders his/her policy prematurely, a penalty is imposed, the amount of which depends directly upon the current interest rates at the time of surrender.

Definition: Replacement is any transaction where, in connection with the purchase of New Insurance or a New Annuity, you lapse, surrender, convert to Paid-up Insurance, Place on Extended Term, or borrow all or part of the policy loan values on an existing insurance policy or an annuity.

Overview of South Carolina Retirement Tax FriendlinessSouth Carolina does not tax Social Security retirement benefits. It also provides a $15,000 taxable income deduction for seniors receiving any other type of retirement income. The state has some of the lowest property taxes in the country.

A deferred annuity is an annuity in which the income payments begin sometime after one year from the date of purchase. The purpose of the surrender charge is to help compensate the company for loss of the investment value due to an early surrender of a deferred annuity.

The insurer shall notify any existing insurer that may be affected by the proposed replacement within five business days after the receipt of a completed application indicating replacement or, if not indicated on the application, when the replacement is identified, and send a copy of the available illustration or

How are surrender charges deducted in a life policy with a rear-end loaded provision? "Deducted when the policy is discontinued". In a policy with a rear-end loaded provision, surrender charges are deducted when the policy is discontinued.