A South Carolina Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse is a specific type of trust established in accordance with South Carolina laws. It is designed to provide financial protection and support for the surviving spouse after the death of the trust or (person establishing the trust). This trust structure allows the trust or to transfer their assets into the trust while maintaining control and providing income for their spouse's lifetime. The trust or designates their spouse as the beneficiary of the trust, ensuring that they receive regular income from the trust assets to support their financial needs. One key feature of this trust is the power of appointment given to the beneficiary spouse. This power allows them to designate how the trust assets will be distributed after their passing. This provides flexibility and allows the beneficiary spouse to allocate the remaining trust assets to their chosen beneficiaries, such as children or other family members. There may be different variations or subclasses of the South Carolina Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse, which can be customized to better suit individual needs and circumstances. Some of these potential variations include: 1. Irrevocable South Carolina Marital-deduction Residuary Trust: This type of trust cannot be altered or revoked once it is established, providing a higher level of asset protection and tax benefits. 2. Testamentary South Carolina Marital-deduction Residuary Trust: Created upon the death of the trust or, this type of trust ensures that assets pass through probate while still benefiting from the marital deduction and offering the lifetime income provision. 3. Revocable South Carolina Marital-deduction Residuary Trust: This trust remains flexible, allowing the trust or to modify or revoke the trust during their lifetime. It becomes irrevocable upon the trust or's death. 4. Charitable South Carolina Marital-deduction Residuary Trust: This trust includes charitable organizations as beneficiaries, providing potential tax advantages while still offering income and power of appointment to the surviving spouse. 5. Special Needs South Carolina Marital-deduction Residuary Trust: Designed specifically for beneficiaries with special needs, this trust ensures that the spouse receives income and protects the beneficiary's eligibility for government benefits. In summary, a South Carolina Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse is a trust arrangement that allows the trust or to transfer assets to provide income for the surviving spouse's lifetime, while also giving the spouse the power to decide how the remaining assets are distributed. Different variations of this trust exist to cater to different needs and circumstances.

South Carolina Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

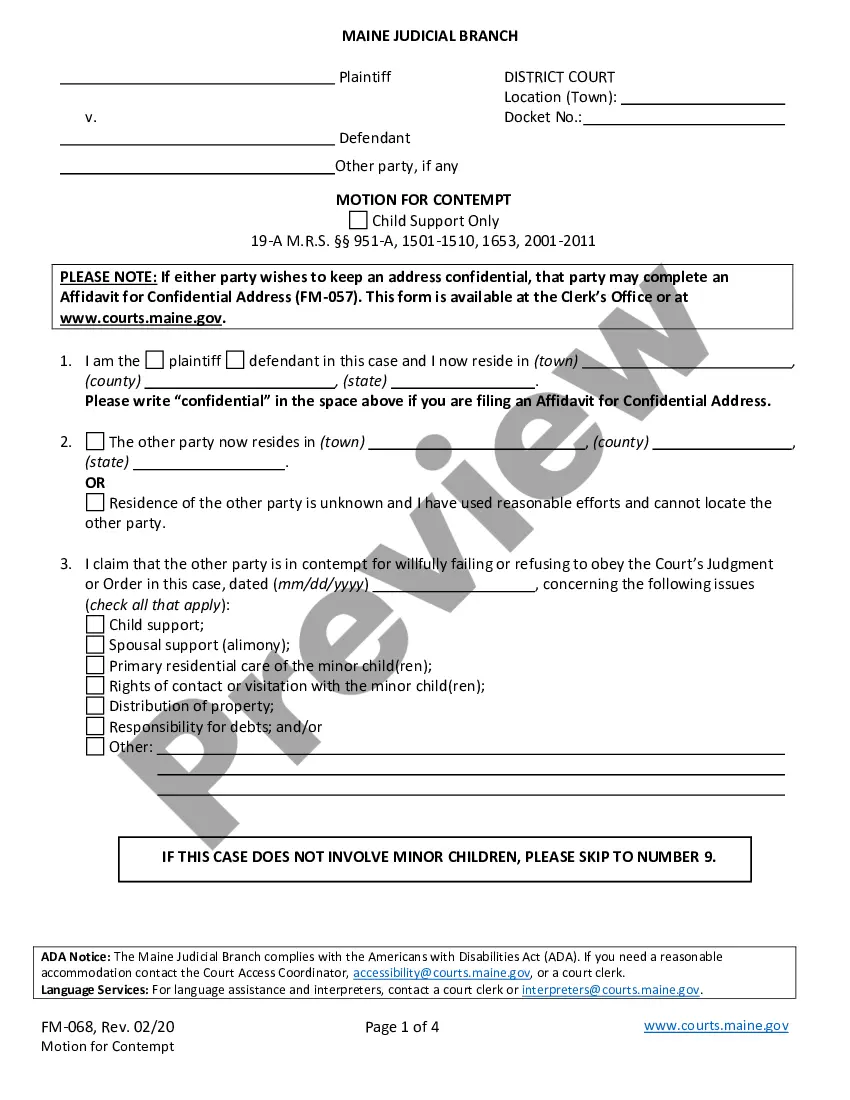

How to fill out South Carolina Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

Choosing the best legal file design could be a have difficulties. Naturally, there are a lot of web templates accessible on the Internet, but how can you get the legal form you need? Take advantage of the US Legal Forms website. The assistance delivers a large number of web templates, including the South Carolina Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, which you can use for enterprise and private requires. Every one of the types are inspected by experts and meet state and federal requirements.

When you are already signed up, log in to your accounts and then click the Download option to find the South Carolina Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse. Use your accounts to look from the legal types you possess acquired in the past. Go to the My Forms tab of the accounts and acquire another version of the file you need.

When you are a new end user of US Legal Forms, allow me to share straightforward guidelines that you can stick to:

- First, ensure you have selected the appropriate form for your personal city/area. It is possible to examine the shape while using Preview option and look at the shape description to ensure this is basically the best for you.

- If the form is not going to meet your expectations, make use of the Seach discipline to discover the proper form.

- When you are sure that the shape is acceptable, select the Acquire now option to find the form.

- Select the prices prepare you would like and type in the needed information and facts. Design your accounts and purchase the transaction utilizing your PayPal accounts or Visa or Mastercard.

- Select the document file format and down load the legal file design to your product.

- Complete, revise and print out and signal the received South Carolina Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse.

US Legal Forms may be the greatest library of legal types in which you can discover numerous file web templates. Take advantage of the company to down load expertly-created files that stick to express requirements.

Form popularity

FAQ

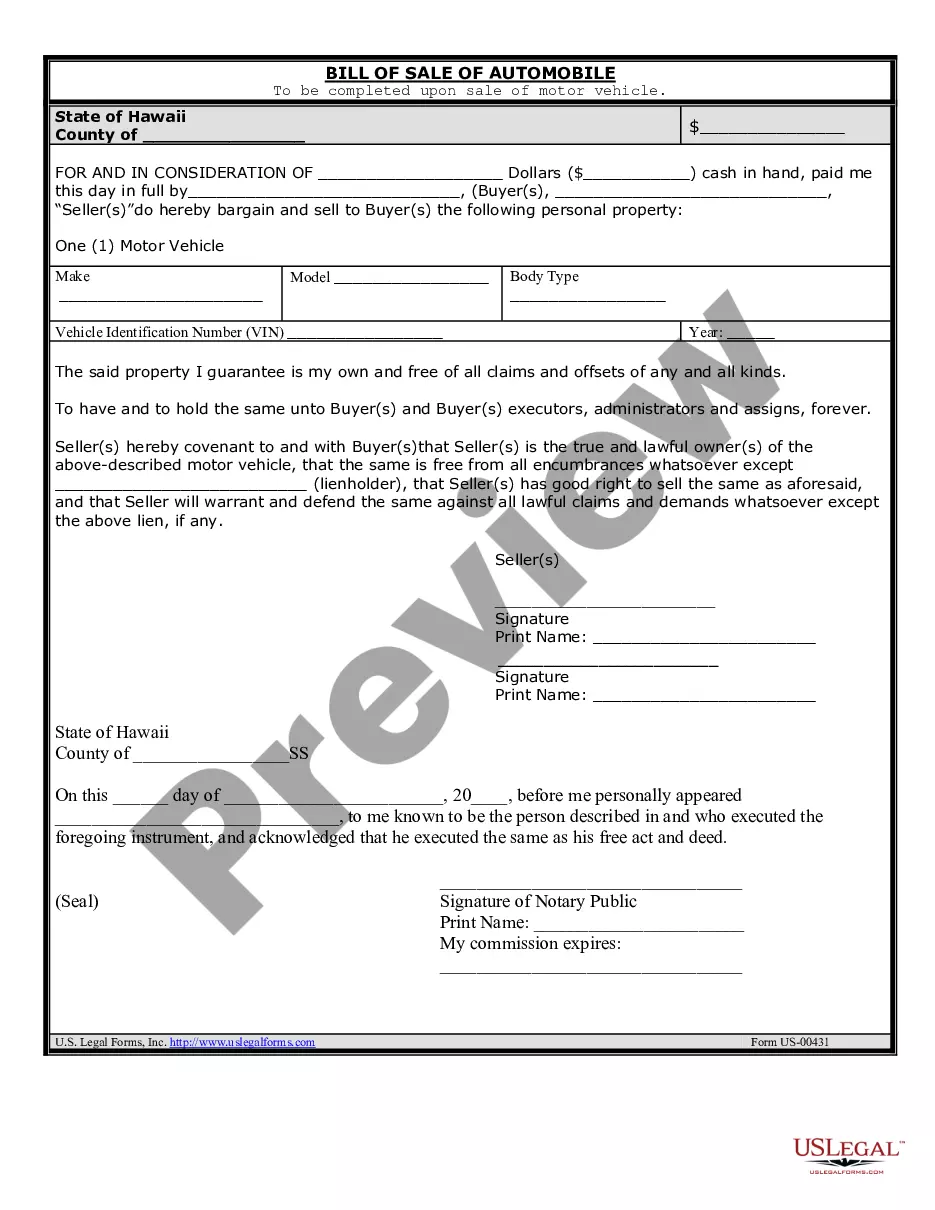

Hear this out loud PauseThe certificate must be acknowledged by the acting trustees and witnesses in the presence of a Notary Public before it is recorded in the county where the subject real property is situated. Consult a lawyer with questions regarding certifications of trust in South Carolina.

Among the disadvantages are the following: As irrevocable trusts, once formed, they are exceedingly difficult to dissolve or amend. Only provides an estate tax exemption of up to $24.12 million in 2022 (or $25.84 million in 2023) Requires the transfer of assets into the trust, which can be a time-consuming procedure. Marital Trust | Definition, How It Works, Advantages ... Carbon Collective Investment ? sustainable-investing Carbon Collective Investment ? sustainable-investing

RESIDUARY TRUST. Unlike the Marital Trust, the Residuary Trust can provide for substantial flexibility and give broader discretion to the Trustee. This trust may be structured as a single trust for the benefit of all your descendants or separate trusts for each of your children (and such child's descendants). Estate Planning - HRBK Law hrbklaw.com ? hrbk_publications ? estate-planning hrbklaw.com ? hrbk_publications ? estate-planning

Hear this out loud PauseThe first trust (the ?marital? trust) is for the surviving spouse, and the second trust (the ?bypass? or ?residual? trust) is typically for the couple's heirs. The surviving spouse can access the residual trust or receive income from it during their lifetime, but it does not belong to them.

Hear this out loud PauseIf you have a spouse and no children, your spouse will inherit your entire estate. If you have a spouse and children, your spouse gets half and the remaining estate is split equally amongst the children.

To make a living trust in South Carolina, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

While various types of trusts can be labeled as ?residuary,? broadly speaking, a residuary trust is a trust that contains the remaining property that is not specifically left to a beneficiary in pour-over will, in the trust, or through another trust. What Is a Residuary or Residual Trust? - RMO LLP rmolawyers.com ? Blog rmolawyers.com ? Blog

Also called an "A" trust, a marital trust goes into effect when the first spouse dies. Assets are moved into the trust upon death and the income that these assets generate go to the surviving spouse?under some arrangements, the surviving spouse can also receive principal payments. What Is a Marital Trust? Benefits, How It Works, and Types Investopedia ? terms ? marital-trust Investopedia ? terms ? marital-trust