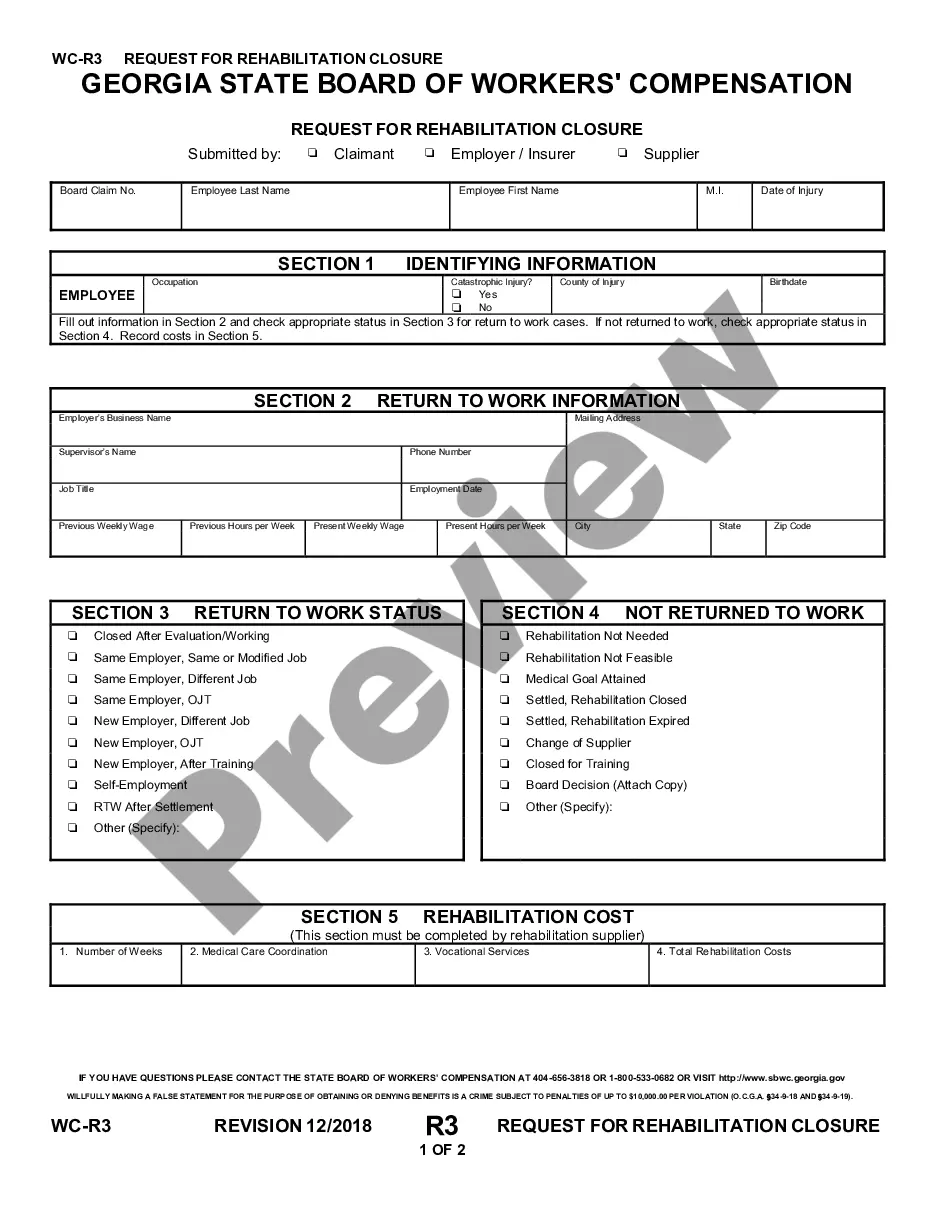

The South Carolina Compensation Administration Checklist is a comprehensive document that outlines the necessary steps and guidelines for managing compensation and benefits within an organization operating in South Carolina. This checklist is designed to ensure compliance with relevant state laws and regulations and to facilitate fair and equitable compensation practices. It assists employers in properly administering compensation programs and maintaining accurate records. Keywords: South Carolina, compensation administration, checklist, organization, compliance, compensation practices, benefits, state laws, regulations, fair, equitable, programs, accurate records. Types of South Carolina Compensation Administration Checklists: 1. Employee Compensation Checklist: This checklist focuses on the various components of employee compensation, including base salary, bonuses, incentives, and benefits. It provides guidance on determining fair and competitive compensation levels and outlines the steps for administering and communicating compensation programs to employees. 2. Wage and Hour Compliance Checklist: This specific checklist concentrates on compliance with South Carolina's wage and hour laws, such as minimum wage, overtime regulations, and record-keeping requirements. It ensures that employers are correctly categorizing employees, calculating wages, and maintaining accurate records of hours worked. 3. Benefits Administration Checklist: This checklist centers around the management of employee benefits in accordance with South Carolina regulations. It covers areas such as health insurance, retirement plans, leave policies, and other related benefits. This checklist ensures that employers are administering benefits programs consistently and in line with legal requirements. 4. Payroll Administration Checklist: This checklist emphasizes the accurate and timely processing of payroll in compliance with South Carolina's laws and regulations. It includes verifying employee data, calculating deductions, submitting accurate payroll tax filings, and maintaining records. 5. Workers' Compensation Checklist: This checklist focuses on compliance with South Carolina's workers' compensation laws, which require employers to provide benefits to employees for work-related injuries or illnesses. It outlines the steps for reporting incidents, managing claims, and ensuring appropriate insurance coverage. By following the relevant South Carolina Compensation Administration Checklists, organizations can effectively manage their compensation programs, maintain compliance with state laws, and foster a positive work environment for their employees.

The South Carolina Compensation Administration Checklist is a comprehensive document that outlines the necessary steps and guidelines for managing compensation and benefits within an organization operating in South Carolina. This checklist is designed to ensure compliance with relevant state laws and regulations and to facilitate fair and equitable compensation practices. It assists employers in properly administering compensation programs and maintaining accurate records. Keywords: South Carolina, compensation administration, checklist, organization, compliance, compensation practices, benefits, state laws, regulations, fair, equitable, programs, accurate records. Types of South Carolina Compensation Administration Checklists: 1. Employee Compensation Checklist: This checklist focuses on the various components of employee compensation, including base salary, bonuses, incentives, and benefits. It provides guidance on determining fair and competitive compensation levels and outlines the steps for administering and communicating compensation programs to employees. 2. Wage and Hour Compliance Checklist: This specific checklist concentrates on compliance with South Carolina's wage and hour laws, such as minimum wage, overtime regulations, and record-keeping requirements. It ensures that employers are correctly categorizing employees, calculating wages, and maintaining accurate records of hours worked. 3. Benefits Administration Checklist: This checklist centers around the management of employee benefits in accordance with South Carolina regulations. It covers areas such as health insurance, retirement plans, leave policies, and other related benefits. This checklist ensures that employers are administering benefits programs consistently and in line with legal requirements. 4. Payroll Administration Checklist: This checklist emphasizes the accurate and timely processing of payroll in compliance with South Carolina's laws and regulations. It includes verifying employee data, calculating deductions, submitting accurate payroll tax filings, and maintaining records. 5. Workers' Compensation Checklist: This checklist focuses on compliance with South Carolina's workers' compensation laws, which require employers to provide benefits to employees for work-related injuries or illnesses. It outlines the steps for reporting incidents, managing claims, and ensuring appropriate insurance coverage. By following the relevant South Carolina Compensation Administration Checklists, organizations can effectively manage their compensation programs, maintain compliance with state laws, and foster a positive work environment for their employees.