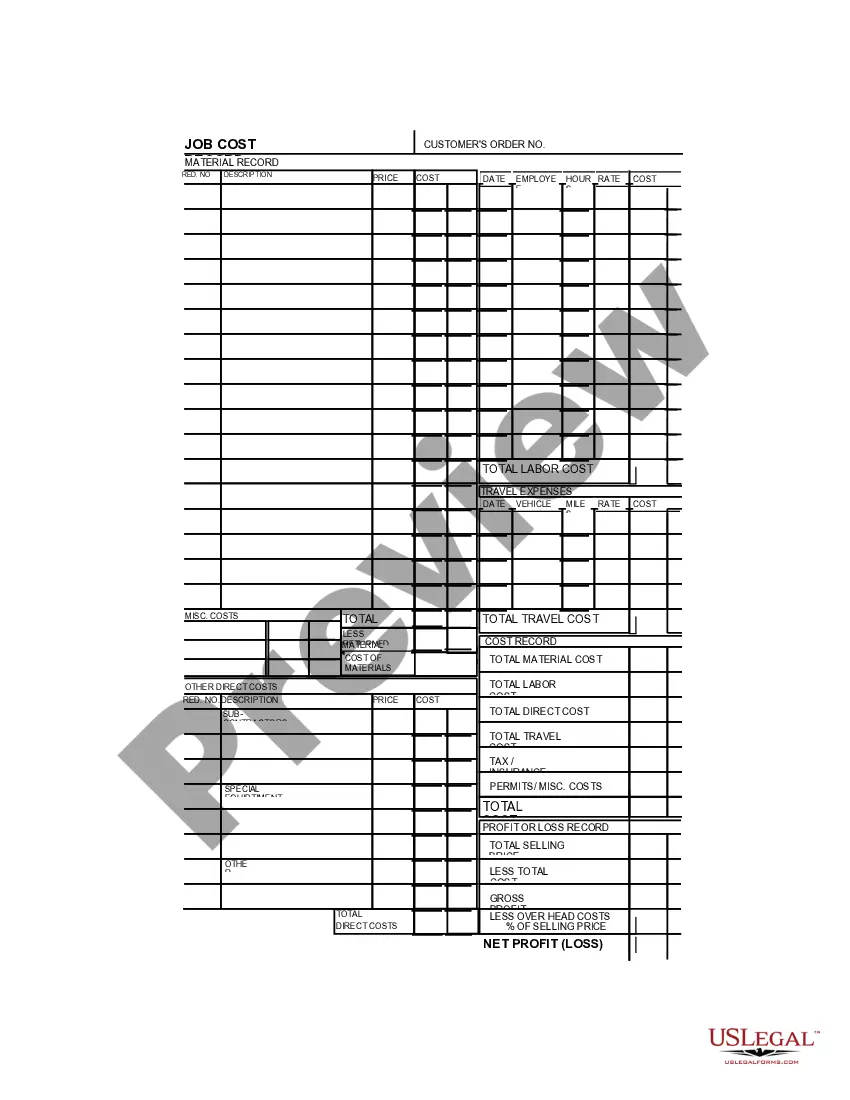

South Carolina Job Invoice - Long

Description

How to fill out Job Invoice - Long?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a broad selection of legal document templates that you can download or print.

By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms like the South Carolina Job Invoice - Long within minutes.

If you have an active monthly subscription, Log In and download the South Carolina Job Invoice - Long from your US Legal Forms library. The Download button will be displayed on every form you view. You can access all previously downloaded forms in the My documents tab of your account.

Proceed with the transaction. Use your credit card or PayPal account to complete the purchase.

Select the format and download the form to your device. Make modifications. Complete, edit, print, and sign the downloaded South Carolina Job Invoice - Long. Every template you added to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, just go to the My documents section and click on the form you need. Access the South Carolina Job Invoice - Long with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your region/state.

- Click the Review button to check the form's details.

- Read the form summary to confirm you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to locate one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, choose the pricing plan you prefer and provide your details to sign up for an account.

Form popularity

FAQ

Guarantee's on workmanship vary between companies, Some don't offer any and others can offer 10 years. Guarantee's on materials are different and come in to play if the materials are defective. normally material guarantee's are 10 years.

In South Carolina, the general rule is that you have 8 years from the last date on which work was performed on your home.

(2) When an invoice is determined to be improper, the agency shall return the invoice to the vendor as soon as practicable after receipt, but no later than 7 days after receipt (refer also to paragraph (g)(4) of this section regarding vendor notification and determining the payment due date.)

Congress has imposed on agencies an obligation to pay every "proper invoice" within 30 days after its receipt. Under the Prompt Payment Act, an agency that fails to pay within the required time will be liable for interest on the delinquent payment.

North Carolina has a three-year statute of limitations period on actions for breach of contract and negligence. This means that claims based on a contract with the builder must be brought within this period, or they are barred.

Where a defect amounts to a breach of contract (which will usually be the case), the default limitation period for bringing a claim against the contractor is 6 years from the date of practical completion. However, if the contract is executed as a deed, that period is extended to 12 years.

A labor warranty provides you with coverage against improper installation and generally lasts for a year. By comparison, a manufacturer product warranty usually covers failures or defects, and coverage can range from 10 to 30 years.

In South Carolina, pay-when-paid clauses are generally enforceable. This means that the contractor can postpone payment to his subcontractors but only for a reasonable time to afford the contractor an opportunity to receive payment from the owner.

The general rule is 30 days from the invoice date. However, you can discuss this with your customer and either make it shorter or longer than 30 days. Regardless of what you agree upon, the payment terms and the due date should be clearly stated on the invoice.

How long should you wait for an invoice to be paid? As a business owner, you can set your payment terms, and the most common are either 30 days, 60 days, or 90 days.